Introduction

During market volatility, it’s crucial to analyze best dividend stocks to buy now to create a balanced portfolio. Investing in these stocks allows investors to identify sectors with steady income and potential for long-term growth, thereby enhancing their portfolio.

Dividend-paying companies offer stability and income generation due to the unpredictable nature of market conditions. Growth stocks do not meet all portfolio requirements, as investors demand stable companies to provide dividends, especially during economic downturns. Companies offering top dividend stocks should also provide reliable payouts. This analysis examines five companies: Realty Income (REIT), BYDDF (Automobile), Kraft Heinz (Consumer Defensive), Nvidia (Technology), and Occidental Petroleum (Energy). These companies are considered wise investment choices due to their durability, financial stability, and dividend safety, making them suitable for building a portfolio in 2025.

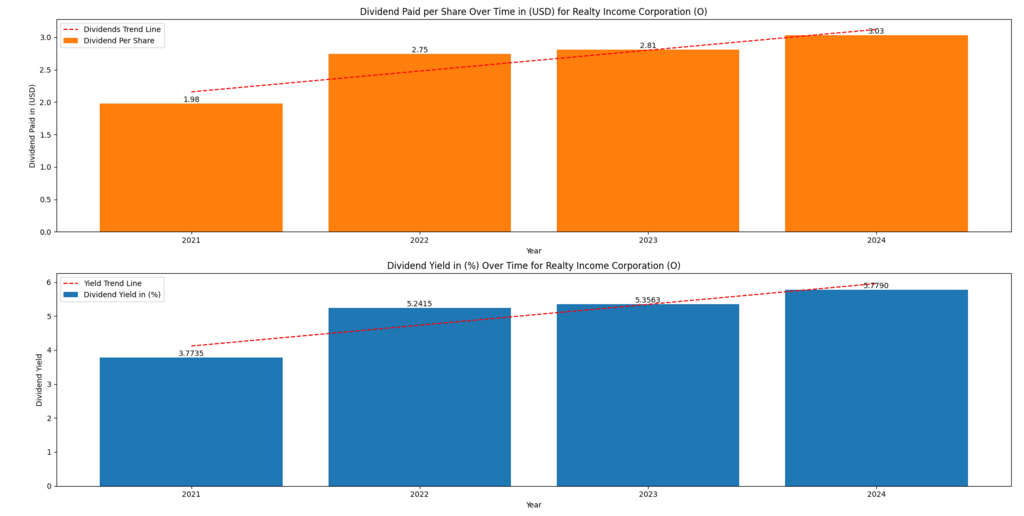

Realty Income (O)

Realty Income, a prominent real estate investment trust, has been recognized as a Monthly Dividend Company due to its consistent dividend distribution. Despite the challenging economic environment, the company’s dividend performance has not been affected by interest rate fluctuations. In 2024, the dividend yield increased from 3.77% to 5.78%, and payouts per share rose from $1.98 to $3.03. The company’s stable revenue flow is attributed to its consistent relationships with service providers who maintain long-term net lease agreements. This makes Realty Income an excellent defensive asset for investors, offering stability in monthly income and safe investments amidst market fluctuations. [1]

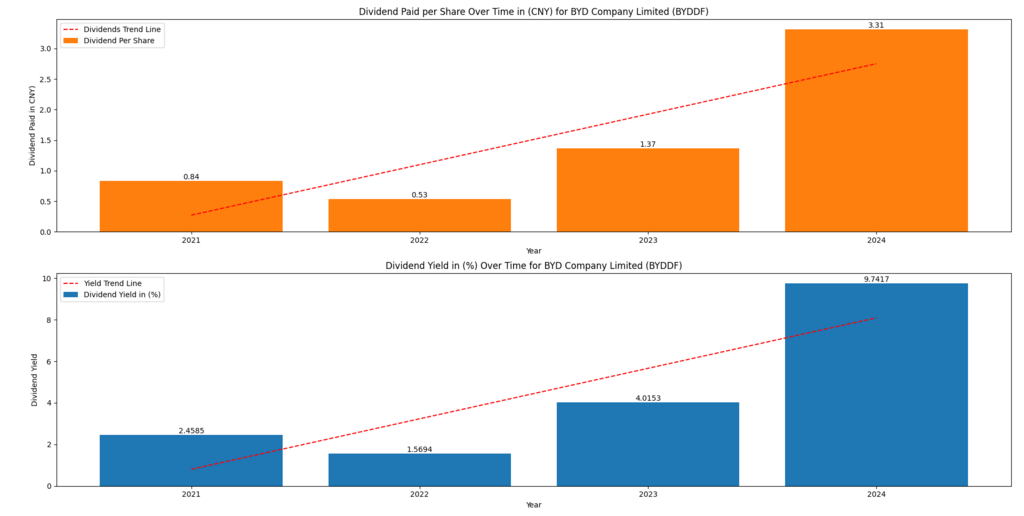

BYDDF (BYD)

Chinese electric vehicle company BYDDF is a unique investment opportunity due to its strong share price growth and increasing dividend structure. The company’s dividend increases are expected to rise from $0.84 in 2021 to $3.31 in 2024, with a projected yield of 9.74% in 2024. BYDDF’s strength is maintained through its diverse product range, global market activities, and local supply chain controls. The company stands out in the electric vehicle market due to its continued dividend increases and expansion of manufacturing scale, making it a premium option for investors. The company’s efforts to expand its market share and profit margins make it a valuable asset. [2]

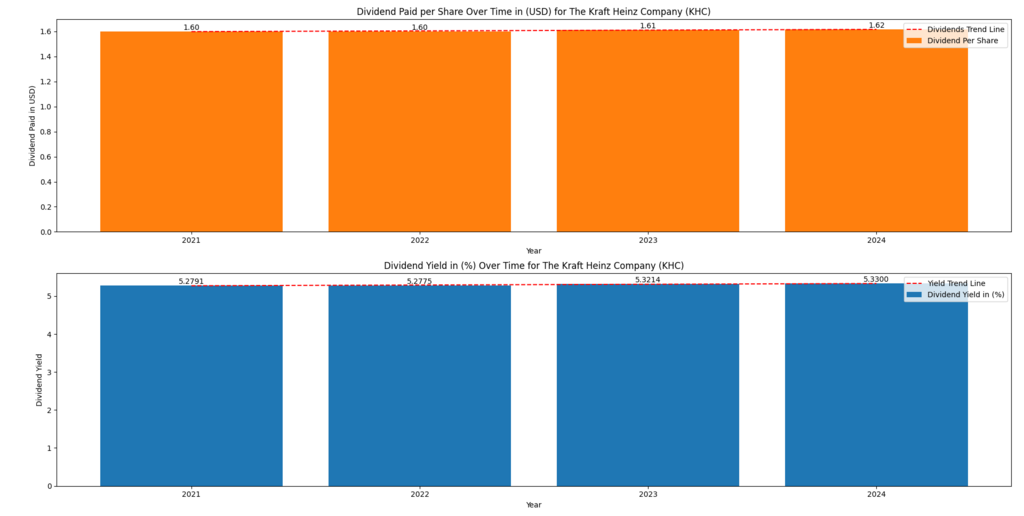

Kraft Heinz (KHC)

Kraft Heinz is a core product in the consumer defensive sector due to its dependable cash flow management and commitment to shareholder dividends. It has maintained a stable dividend yield of over 5.3% from 2021 to 2024, increasing dividends from $1.60 to $1.62 per share. Despite changing customer preferences and inflationary conditions, Kraft Heinz has managed to make profits through increased brand loyalty and cost-control measures. As a result, it is an excellent choice for conservative investors who prioritize income and stability in their portfolios. Here’s another list of high dividend paying stocks!

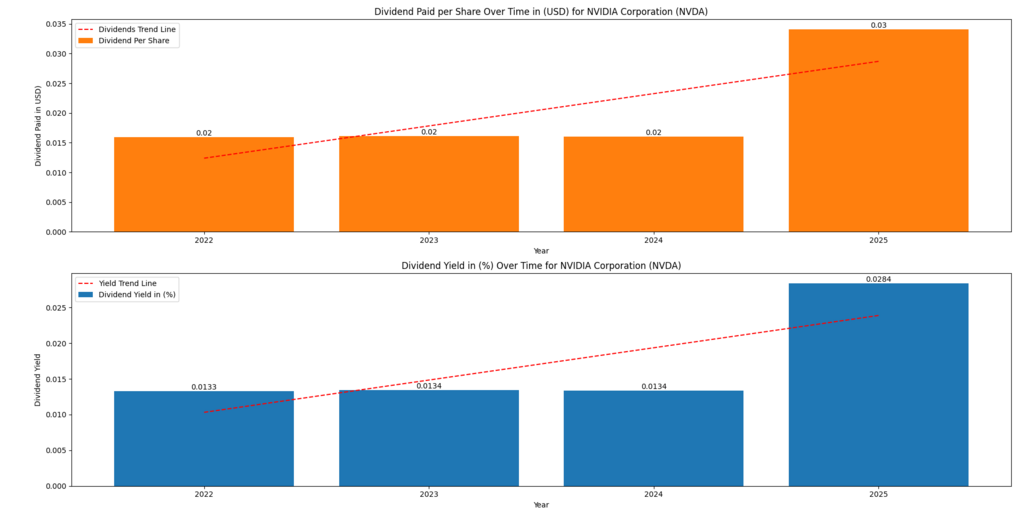

Nvidia Corp (NVDA)

Nvidia is a promising investment option due to its high-growth technology engagements and moderate conditional dividends. In 2022, Nvidia increased its dividends from $0.02 to $0.03 per share, despite a 0.0286% yield. The company’s robust earnings and cash flow make it an excellent dividend stock for investors. The rising share price due to the demand for artificial intelligence and semiconductors demonstrates Nvidia’s value as a great dividend company. Nvidia’s net dividend payments align with funding innovation, promoting growth and protecting shareholders during economic instability. [3]

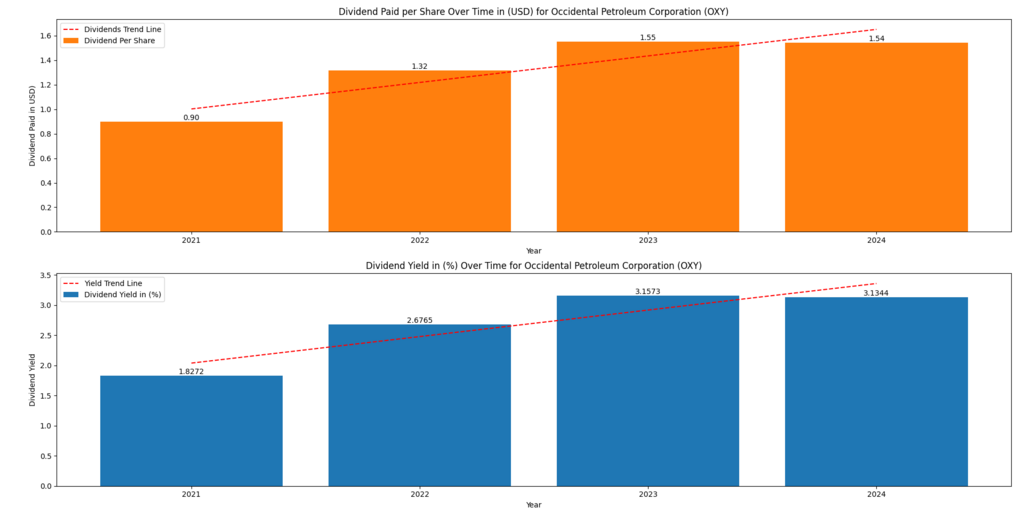

Occidental Petroleum (OXY)

Occidental Petroleum Company has experienced significant growth in its distribution from $0.90 per share in 2021 to $1.54 per share by 2024, despite reducing dividends in 2020 due to petroleum price drops. The company’s yield increased from 1.82% to 3.13% due to increased oil prices and controlled capital utilization. Occidental has become a more powerful energy firm, committed to active carbon dioxide storage through strategic investments in carbon capture and debt reduction. This recovery demonstrates the company’s commitment to exceeding shareholders’ expectations and achieving operational excellence, making it a dividend-paying energy stock with dual advantages against inflation. The company’s recovery demonstrates its commitment to exceeding shareholders’ expectations and operational excellence. [4]

Recent Successful and Unsuccessful Projects by Company

| Company | Successful Project | Year | Unsuccessful Project | Year |

| Realty Income | Acquisition of Spirit Realty Capital | 2023 | Delayed diversification in European retail | 2022 |

| BYDDF | Launch of Yangwang U8 EV luxury SUV | 2024 | Stalled North American expansion | 2023 |

| Kraft Heinz | Successful launch of Kraft Mac & Cheese Deluxe | 2023 | Failed Planters snack brand relaunch | 2022 |

| Nvidia | Release of Blackwell AI Chips | 2024 | Delays in RTX 40 Super GPU rollout | 2023 |

| Occidental | Investment in Direct Air Capture (DAC) technology | 2023 | Underperformance in Ghana offshore project | 2022 |

5-Year Stock Price Growth and Total Return (2020–2025)

| Company | Sector | 5-Year Stock Price Growth (%) | 5-Year Total Return (%) |

| Realty Income (O) | REIT | +12% | +40% |

| BYD Company (BYDDF) | Auto | +150% | +180% |

| Kraft Heinz (KHC) | Consumer Defensive | +10% | +38% |

| Nvidia Corp (NVDA) | Tech | +560% | +580% |

| Occidental Petroleum (OXY) | Energy | +105% | +125% |

Note: Total Return = Stock Price Growth + Dividends Reinvested. Figures are approximate based on historical performance trends up to early 2025.

Why Dividend Stocks Matter During Market Crashes

Investment portfolios that combine growth and income are in high demand, especially during periods of risk uncertainty. Five exceptional dividend stocks, Realty Income, BYDDF, Kraft Heinz, Nvidia, and Occidental, offer diverse combinations across various industries and high-growth potential in electric vehicles and artificial intelligence. Each new stock adds diversity, increasing portfolio strength and asset growth over time. These stocks provide a solid foundation for investing strategies geared towards 2025 and beyond, supporting income generation, consistency, and capital appreciation. They also provide a solid foundation for any investing strategy geared towards the years 2025 and beyond.

Conclusion

Investment portfolios that combine growth and income are in high demand, especially during periods of risk uncertainty. Five exceptional dividend stocks, Realty Income, BYDDF, Kraft Heinz, Nvidia, and Occidental, offer diverse combinations across various industries and high-growth potential in electric vehicles and artificial intelligence. Each new stock adds diversity, increasing portfolio strength and asset growth over time. These stocks provide a solid foundation for investing strategies geared towards 2025 and beyond, supporting income generation, consistency, and capital appreciation. They also provide a solid foundation for any investing strategy geared towards the years 2025 and beyond.

Disclaimer:

The content provided herein is for informational purposes only and should not be construed as financial, investment, or other professional advice. It does not constitute a recommendation or an offer to buy or sell any financial instruments. The company accepts no responsibility for any loss or damage incurred as a result of reliance on the information provided. We strongly encourage consulting with a qualified financial advisor before making any investment decisions.