Introduction

What are the best dividend and growth stocks choices for the year 2025? Investors seeking dividends and growth prospects should consider the three top picks of BYDDF, Occidental Petroleum (OXY), and Alphabet Inc. (GOOGL).

Stock investors seek equity investments that offer dividend payments and can increase their assets. Three leading companies in the list are BYDDF, Occidental Petroleum (OXY), and Alphabet Inc. (GOOGL). These companies are recognized for their robust financial performance and control over dominating marketplaces.

This blogpost reviews financial outcomes and dividend records of the above-mentioned stocks to determine why they present ideal investment solutions for yield-based market valuation. The market dominance of stocks enables them to achieve outstanding financial outcomes.

Profitability and Dividends: BYDDF (BYD)

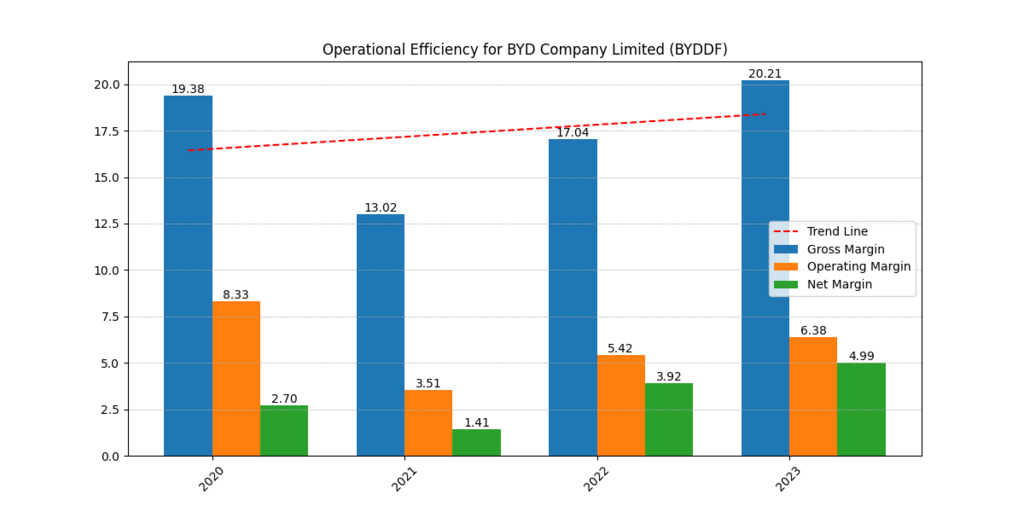

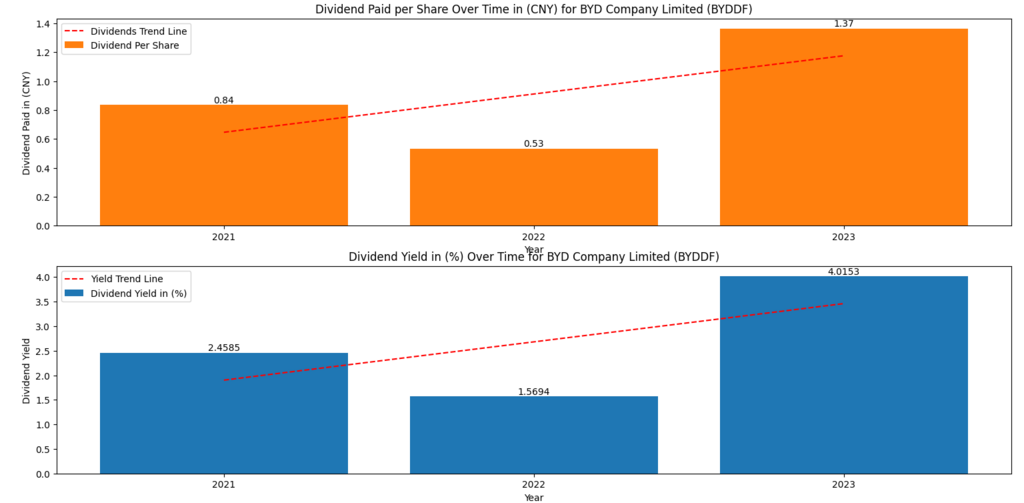

BYD Company Limited stands as a leading electric vehicle and battery industry company which maintains steady growth in its revenue and earnings performance. BYD achieves consistent profit growth by maintaining manufacturing efficiency along with increased market power because of its pricing strategies. Operating and net margins decreased in 2022 for BYDDF but the company showed strong cost management in subsequent years as margins and profits improved. [1]

The dividend payout rate of the company has increased between 2022 and 2023 which has drawn substantial attention from investors. The growing global electric vehicle market creates strong dividend payment and capital appreciation potential for BYDDF which draws investors who want to acquire both stock and dividend payments. The company has become a preferred investment destination for shareholders because of its efficient cost management system and enhanced dividend distribution policies.

Profitability and Dividends: Occidental Petroleum (OXY)

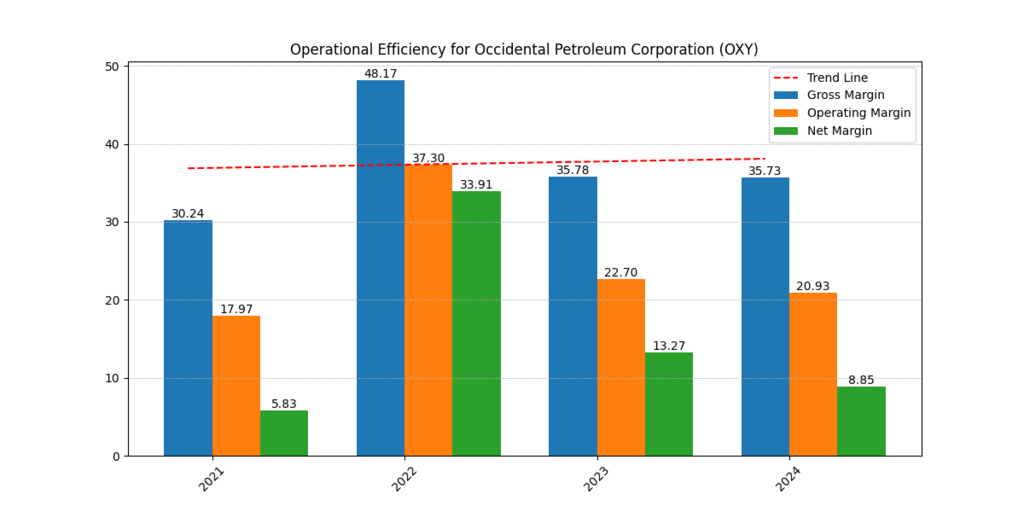

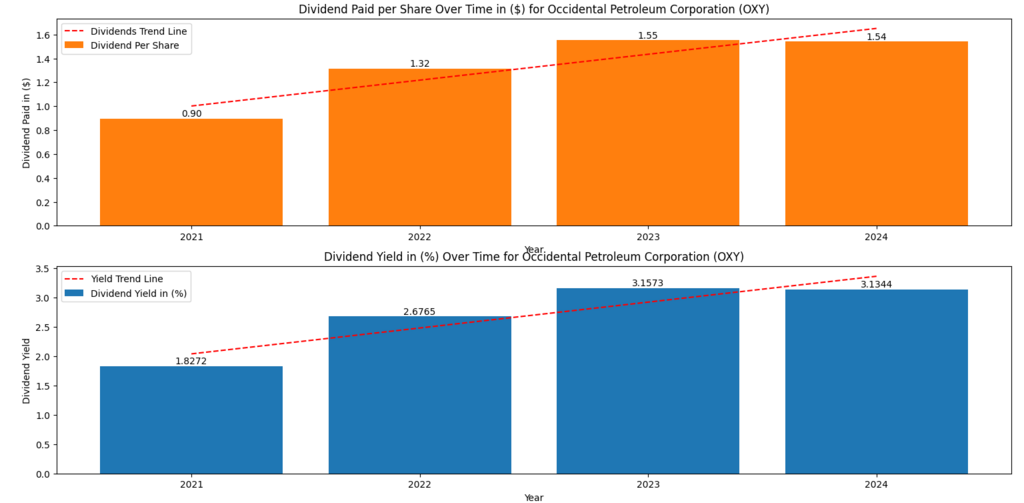

Occidental Petroleum, a major US oil and gas producer, has managed to maintain stability due to its resilience against market changes. Despite market swings in 2022 due to increased oil prices, the company maintained strong gross margin figures. Occidental’s cost management and production optimization techniques have allowed it to maintain consistent margins in 2023 and 2024, with slight variations. Operating and net margins have shown a similar trajectory in 2022, stabilizing within the company’s reach in 2023 and 2024. [2]

Occidental’s dividend per share has seen a significant increase between 2021 and 2023, offering investors a steady remuneration. The company’s ability to maintain steady dividends and even increase them is attributed to its investments in sustainable energy and anticipated strong energy demand projections in the coming years. Our another list of The Top 5 High Dividend Stocks for Boosting Your Income amid Tariffs.

Profitability and Dividends: Alphabet Inc. (GOOGL)

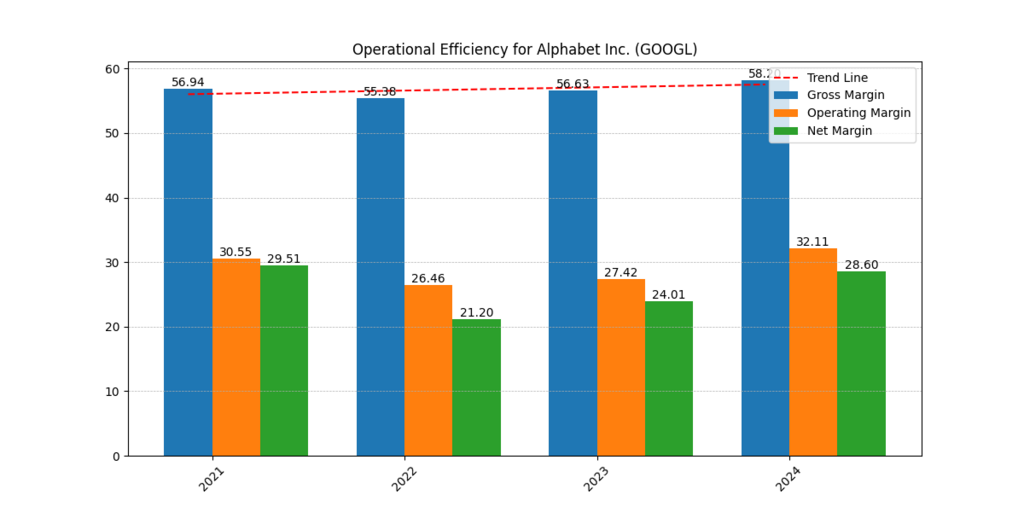

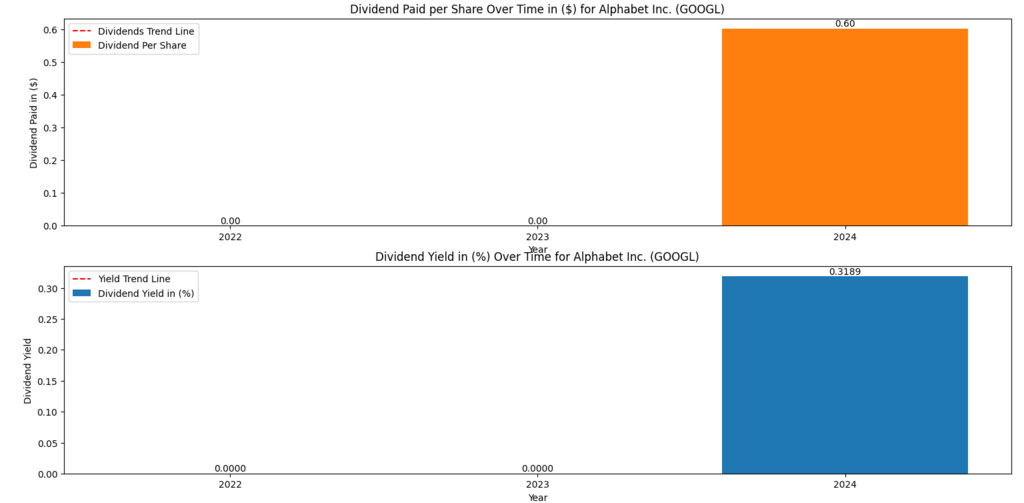

Alphabet Inc., the leading company in digital advertising, cloud computing, and artificial intelligence services, has announced its historic primary dividend distribution for 2024. The company has maintained its growth stock status, delivering growth alongside income while modifying its approach for shareholder rewards. Alphabet is a successful and profitable company, demonstrating strong pricing tactics and efficient cost management techniques. The company has maintained a consistent gross margin, resulting in a recovery in operating and net margins.

Alphabet has added a dividend yield to its existing capital distribution method, but the yield is lower than traditional dividend equities. Alphabet is an attractive investment opportunity for those seeking stability and high-growth opportunities due to its strong financial foundation, commanding position in the technological industry, and the establishment of dividends. [3]

AI Projects by BYDDF, OXY, and GOOGL

| Company | AI Project | Description | Year |

| BYDDF (BYD) | Smart EV Battery Management | AI-driven optimization of battery life, efficiency, and safety in electric vehicles. | 2023 |

| BYDDF (BYD) | Autonomous Driving System | AI-based driver-assistance and self-driving technology for BYD’s electric vehicles. | 2024 |

| OXY | AI-Powered Carbon Capture | AI-enhanced monitoring and optimization of carbon capture technology to reduce emissions. | 2023 |

| OXY | Predictive Maintenance | Machine learning models to predict and prevent equipment failures in oil production. | 2024 |

| GOOGL | Gemini AI | Next-generation AI model designed for text, image, and multimodal processing. | 2023 |

| GOOGL | AI-Powered Search Engine | Integration of generative AI into Google Search for improved query understanding and response generation. | 2024 |

Strengths of BYDDF, OXY, and GOOGL as Dividend and Growth Stocks

| Factor | BYDDF (BYD) | Occidental Petroleum (OXY) | Alphabet Inc. (GOOGL) |

| Industry | Electric Vehicles (EV) & Batteries | Energy (Oil & Gas, Carbon Capture) | Technology (AI, Cloud, Digital Ads) |

| Growth Drivers | Expansion in global EV markets, battery innovation, and government EV subsidies | Rising oil demand, carbon capture initiatives, and energy sector stability | AI-driven expansion, cloud computing, and digital advertising dominance |

| Dividend Potential | Increasing dividends with stronger profitability | Consistently growing dividends, supported by stable cash flow | Recently introduced dividends, strong financial reserves |

| Competitive Advantage | Advanced battery technology, strong market presence in China | Strong position in energy transition with carbon capture investments | Leadership in AI and cloud services, global brand recognition |

| Risk Factors | Competition in the EV sector, battery supply chain issues | Oil price volatility, geopolitical risks | Regulatory scrutiny, advertising market fluctuations |

Conclusion

Investors are seeking companies that offer both dividends and growth opportunities in the ever-changing market. Three top 2025 stock selections include BYDDF, Occidental Petroleum (OXY), and Alphabet Inc. These companies have excellent financials, industry leadership, and a commitment to increased shareholder returns. OXY provides stability in the energy industry, while Alphabet’s new dividend policy boosts growth. These stocks offer promising income and capital appreciation opportunities.

**Please be informed that the content is informational and by no means serve as a buy or sell signal. The company is not responsible for the loss of capital.