Introduction

Discover the best AI stocks with strong dividend payouts and exceptional growth potential. Explore detailed financial analysis of Nvidia, TSMC, Google (Alphabet), Microsoft, and ASML to identify the best dividend-paying AI investments in 2025.

Artificial intelligence drives technological advancement, transforming industries like healthcare, finance, transportation, and entertainment. Investors are drawn to this emerging sector as AI adoption accelerates. Five prominent technology companies consistently combine their leadership in AI innovation with dividend payments to shareholders, despite most AI-focused companies growing by reinvesting revenues. These companies are attracting investors to capitalize on this emerging sector.

This article discusses five prominent AI companies: NVidia, TSMC, Alphabet (Google), Microsoft, and ASML. These companies offer substantial dividends and have high potential for growth. Their strong financial results and critical AI value chain positions make them attractive investments for investors seeking long-term value and reliable income.

The following section provides detailed financial data and performance appraisals to explain why these stocks are considered top AI dividend choices for portfolio decisions in 2025.

Nvidia (NVDA)

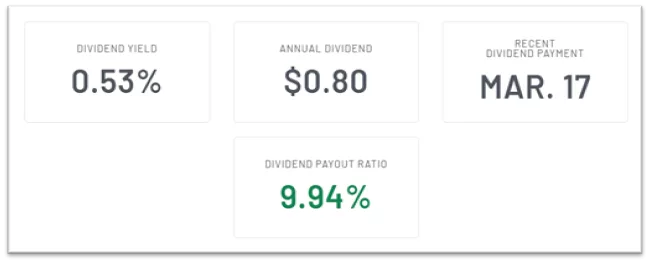

Nvidia, a global leader in artificial intelligence computing, has consistently demonstrated profitability through its advanced graphics processing units (GPUs). The company has achieved high levels of return on equity and capital, indicating efficient use of operating assets and shareholder contributions. Nvidia maintains a high rate of dividend growth while offering small cash payouts to shareholders. The company’s focus on new technologies and large investments in research and development gives it a competitive advantage.

Nvidia’s ability to control its cash flow through lower investments and payouts to shareholders makes it an exceptional artificial intelligence stock with strong growth potential and income improvements. Investors interested in the rapidly growing artificial intelligence field and potential dividend benefits should consider Nvidia as their preferred alternative.

Taiwan Semiconductor Manufacturing Company (TSMC)

TSMC, a key semiconductor supplier to major artificial intelligence hardware manufacturers like Apple and Nvidia, is a key player in the industry due to its financial success and consistent profitability. The company’s efficiency in generating revenue from invested cash makes it a reliable source of income for investors. TSMC’s effective dividend policy and substantial cash flow support its dividend policy, making it an attractive investment option for years to come.

The company’s technical superiority and large client base make it a stable investment option. The company’s prudent financial management, high profit margins, and significant capital expansions make it an attractive investment option for long-term dividend payments. As the global foundry leader, TSMC’s financial expansion and stable dividend payouts make it an ideal investment opportunity for passive income generation through AI technology.

Alphabet Inc. (GOOGL)

Alphabet, the parent company of Google, established the dividend service based on its strong financial position. The company sustains high profitability through digital advertising and cloud services, financing its artificial intelligence programs like Google DeepMind and Gemini. Alphabet’s outstanding management system and expansion capabilities have led to significant financial growth. The company’s new dividend policy is based on robust cash reserves and reliable free cash flow, indicating its commitment to shareholders.

Despite a low payout ratio, Alphabet’s low dividend yield allows for significant dividend growth. Strategic investments in artificial intelligence infrastructure not only achieve growth milestones but also increase shareholder value. Alphabet’s exceptional artificial intelligence stock is attributed to its expanded research and development investments and enhanced dividend distributions. The company promises to increase its income streams in the future and Do not miss out on these Top 5 AI Stocks for Best Returns.

Microsoft (MSFT)

Microsoft’s financial performance is superior to its competitors due to its dominant corporate software business, Azure’s artificial intelligence capabilities, and OpenAI’s efforts. The company’s growth in revenue and earnings is attributed to its efforts to improve its products. High operational margins and capital use contribute to strong returns.

Microsoft’s exceptional financial position allows for a substantial dividend program, which has continued to expand. The company is committed to communicating with shareholders through dividend payments and investments in artificial intelligence infrastructure development. As a financially stable company, Microsoft is considered one of the best dividend stocks in the AI market and it has also taken a place in our 2026 list of Best Dividend High Yield Stocks 2026 Edition. It is an excellent investment option for shareholders seeking dividend increases consistent with the expansion of AI-related businesses.

Recent AI Projects

| Company | Project Name | Date | Description |

| Nvidia | NIMs (NVIDIA Inference Microservices) | March 2024 | A new software platform to simplify AI model deployment, helping enterprises use AI more efficiently via APIs. |

| DGX Cloud Expansion | February 2024 | Expansion of cloud-based AI supercomputing services to more partners, allowing scalable training of large language models. | |

| NVIDIA Omniverse Cloud APIs | January 2024 | Released APIs for Omniverse Cloud to support industrial digital twin development and AI-powered simulation. | |

| TSMC | AI Chiplet Integration R&D | March 2024 | Advanced R&D project focused on AI-optimized chiplet packaging to increase performance and power efficiency. |

| 6nm AI Accelerator Production | February 2024 | Began volume production of a new 6nm process node tailored for AI accelerators used in data centers. | |

| Collaboration with Synopsys for AI Design Tools | January 2024 | Teamed up with Synopsys to enhance AI-based design automation for next-gen semiconductor manufacturing. | |

| Alphabet (Google) | Gemini 1.5 Multimodal AI Model | February 2024 | Launched a powerful AI model capable of text, image, and audio comprehension with large context windows. |

| AI-Powered Search Experience (SGE) | March 2024 | Rolled out AI summaries and interactive responses in Google Search to enhance user query experiences. | |

| AI Studio for Developers | January 2024 | Introduced an AI development platform to build, deploy, and fine-tune AI agents using Google’s large models. | |

| Microsoft | Copilot for Microsoft 365 Enhancements | March 2024 | Updated AI features across Office products like Word and Excel for smarter writing, editing, and analysis. |

| Azure OpenAI Integration for Enterprises | February 2024 | Expanded enterprise tools by integrating OpenAI models more deeply into Azure cloud services. | |

| Copilot in Windows 11 | January 2024 | Embedded AI assistant across Windows 11 to provide contextual help, summarize content, and boost productivity. | |

| ASML | AI-Based Predictive Maintenance | March 2024 | Deployed AI systems to predict equipment failures and optimize uptime across lithography machines. |

| AI-Driven Defect Detection System | February 2024 | Rolled out AI software that enhances semiconductor wafer inspection using deep learning for real-time feedback. | |

| AI Simulation for EUV Tool Calibration | January 2024 | Implemented AI-powered simulations to improve the precision and efficiency of EUV machine calibration. |

Conclusion

Five AI-driven companies, Nvidia, TSMC, Alphabet, Microsoft, and ASML, offer exceptional dividend potential and robust growth, making them attractive investments for dependable earnings and AI sector access.

Usama Ali

Usama Ali is the founder of Financial Beings and a self-taught investor who blends classic valuation study with insights from psychology. Inspired by works from Benjamin Graham, Aswath Damodaran, Stephen Penman, Daniel Kahneman, and Morgan Housel, he shares independent, data-driven research to help readers connect money, mind, and happiness.

Disclaimer

The content provided herein is for informational purposes only and should not be construed as financial, investment, or other professional advice. It does not constitute a recommendation or an offer to buy or sell any financial instruments. The company accepts no responsibility for any loss or damage incurred as a result of reliance on the information provided. We strongly encourage consulting with a qualified financial advisor before making any investment decisions.