Introduction

Learn about the 5 quantum computing stocks in 2025: IBM, Microsoft, Google, D-Wave, Quantum Computing Inc. Explore their quantum projects, TTM revenues, EBITDA, EPS, and free cash flow.

One of the century’s most groundbreaking breakthroughs, quantum computing has the potential to become an influential force in the future. Unlike traditional computers, which use two states to code data, quantum computers use quanta to solve problems that are either impossible or would take a long time for classical systems to handle. In addition to financial services, the healthcare, artificial intelligence, and logistics industries leverage quantum technologies to outperform their rivals.

The field of quantum computing offers investors the chance to foresee the future of a potential industry and make investments in it. Companies like IBM, Microsoft, Google, D-Wave Quantum Inc., and Quantum Computing Inc. are at the forefront of innovation, each contributing to the development and application of quantum technologies. The article examines the five businesses, their quantum computing initiatives, and the relevant financial measures to determine whether investors should consider them in 2025 or not.

Financial Metrics

| Metric (TTM) | IBM | Microsoft | D-Wave | Quantum Computing | |

| Revenue ($000) | 62,580,000 | 251,190,000 | 339,859,000 | 9,424 | 386.05 |

| EBITDA ($000) | 12,649,000 | 139,513,000 | 126,690,000 | -70,319 | -22,717.03 |

| EPS ($) | 6.88 | 12.11 | 7.54 | -0.41 | -0.24 |

| FCF ($000) | 11,889,000 | 72,662,000 | 55,823,000 | -61,285 | -22,154.51 |

IBM (International Business Machines Corporation)

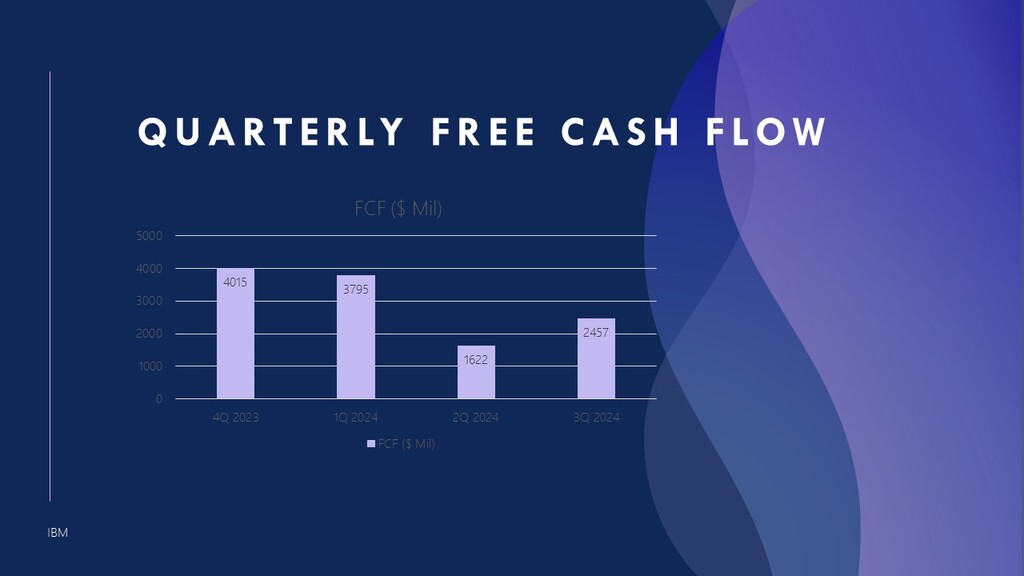

IBM is leading the way in the development of quantum computing by offering exclusive services through the IBM Quantum. Additionally, IBM Quantum combines these innovations with its cloud-accessible IBM Quantum System One and its 127-qubit processor, known as Eagle. According to financial analysis, a company with a high EBITDA of $12.65, a strong EPS of $6.88, and good sales per TTM of $62.58, has good profitability. Detailed analysis for IBM can be found in the link: IBM Stock Forecast 2025.

It may continue to improve quantum technology by investing more in research and development, as seen by its $11.89 billion actual free cash flow (FCF). IBM is therefore proud of its strong commercial relationships in quantum computing as well as its open and flexible architectural quantum system designs. Although the company’s overall revenues are higher than the revenue generated by the quantum division, the company’s strong top line and ongoing investments in quantum scalability make it an attractive investment vehicle for players interested in quantum technology. [2]

Microsoft Corporation

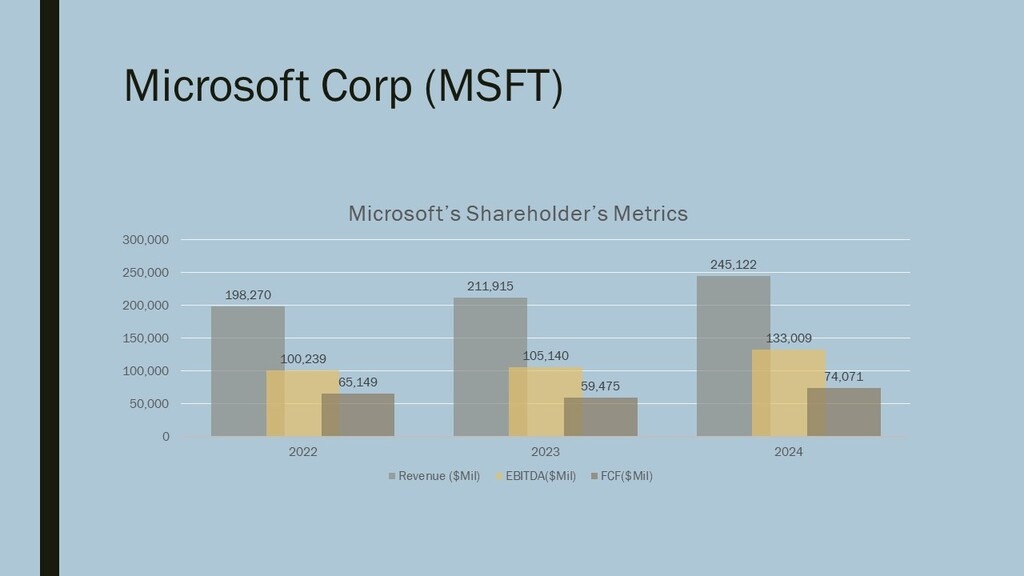

A service that adapts quantum computing to the Microsoft Azure platform, Microsoft Azure Quantum enables customers to create quantum solutions with standard interfaces. The business’s strategy of utilizing both quantum and classical computing demonstrates its realistic goal of advancing the application of quantum computing. Microsoft’s dominance in technological industries is demonstrated by its operational metrics, which include a TTM revenue of $251.19 billion, EBITDA of $139.51 billion, and EPS of $12.11. Are you interested in the performance of biggest 7 companies of the world? Magnificent 7 Stocks Performance in 2024.

With $72.66 billion in free cash flows, Microsoft has the resources to invest in quantum research and development. Collaborations with quantum hardware designers and quantum research initiatives help the company differentiate itself from the competitors. Microsoft is one of the top firms in quantum computing and a great place to invest because of its parent company ecosystem and cloud-based services, which only help to increase the application and growth of quantum technology. [3]

Google (Alphabet Inc.)

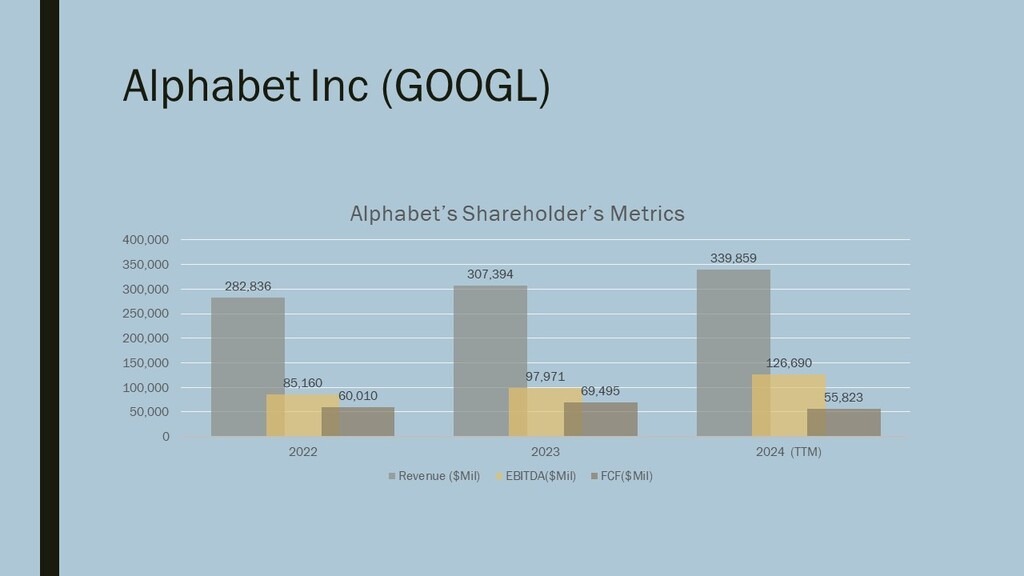

Google’s efforts to achieve quantum dominance with its quantum division are demonstrated by its Sycamore processor and its most recent addition, the Willow chip. These milestones show the potential for solving problems that traditional computers couldn’t.

TTM revenue for Google is $339.86 billion, EBITDA is $126.69 billion, and the company’s EPS ratio is 7.54. With a free cash flow of $55.82 billion, this indicates that the company has the kind of funds it can use for research and development of quantum breakthroughs. Given Al and machine learning’s connection to quantum computing, Google is competitive in this field, thus strategists may want to take it into account. Although quantum computing is still a specialized field, Google is rightfully considered a leading quantum computing stock because of its importance and prospective applications throughout Alphabet’s goods and services. [4]

D-Wave Quantum Inc.

With a focus on quantum annealing technology, D-Wave offers distinctive solutions for optimization issues in sectors including banking and logistics. High-profile companies like NASA and Volkswagen use its quantum technology, despite it being a relatively small player. Due to its low TTM revenue of $9.42 million and negative EBITDA of -$70.32 million, D-Wave is having financial difficulties. The company’s negative free cash flow of -$61.29 million and EPS of -$0.41 underscore the considerable risk of investing in startups in quantum technology.

D-Wave’s revolutionary potential is highlighted by their Advantage quantum devices, which include more than 5,000 qubits, and its emphasis on real-world quantum applications. Investors seeking early-stage exposure to the quantum computing revolution find D-Wave appealing, despite the fact that it is not a financially secure investment. [5]

Quantum Computing Inc. (QCI)

The primary goal of Quantum Computing Inc. is to bring quantum computing from the realm of sci-fi fantasies closer to people’s daily lives by developing user-friendly software tools. In terms of finances, QCI is a very new company, with a TTM of $386,050 in revenue and a net loss and EBITDA of -$22.72 million, respectively. Its low free cash flow of -$22.15 million and EPS of -$0.24, which are typical of a company in its developing stage, serve as an indication of this. Nevertheless, these difficulties can be overcome with the aid of QCI’s revolutionary software solutions.

In addition, QCI is expanding access to quantum solutions by targeting businesses that might not have internal quantum expertise. While it continues to be a pure play and wager on the future, QCI is a significant participant in the quantum computing space due to its capacity to expand its business and gain market share. [1]

Bottom Line

Quantum computing is a technology that is swiftly advancing and is poised to revolutionize industries such as finance and healthcare. IBM, Microsoft, Google, D-Wave, and Quantum Computing Inc. are all investing in this technology as a result of their distinctive financial performance, products, and services. IBM is recognized for its secure, long-term investments, whereas Microsoft implements a hybrid model of the quantum method and a massive cloud. Google is a pioneer in the field of quantum supremacy and has received significant funding to advance its technology.

D-Wave is currently in the early phases of development, but it is focused on QAS businesses and attracts high-performing investors. Quantum is made accessible to the public through the use of user-friendly software. Investors who are interested in investing in this swiftly expanding industry should evaluate these companies according to their long-term outlook on advancements. Quantum computing’s commercial applications will expand swiftly as individuals become more at ease with it.

**Please be informed that the content is informational and by no means serve as a buy or sell signal. The company is not responsible for the loss of capital.