Introduction

Learn about ASML Stock Forecast from 2025 to 2035 with an estimated fair value based upon different growth rates. Discuss on how technological advantage of ASML and trend analysis affects ASML stock price in future.

ASML is one of the biggest companies in the semiconductor industry which provides photolithography tools that are relevant for the chips manufacturing. Hence, ASML has a significant responsibility in handling technology direction as the leading supplier to the world, particularly with growth in the utilization of enhanced chips in artificial intelligence, machine learning, and the cloud. In this article, we present reasonable estimates of ASML without issuing bullish or bearish recommendations and guidelines on when to buy or sell the stock to protest against legal consequences while discussing about the future predicted values of the ASML stock and its possible performance. This discussion will entail ASML’s products, research in Artificial Intelligence and company outlook.

What is ASML?

ASML is a Dutch company that has become the primary photolithography systems producer for the semiconductor manufacturers. Since it has the advanced extreme ultraviolet (EUV) lithography systems, it supports the development of even the latest microchips improving the powers of various microchips making it a key company in the world of technology. The growth is due to more demand for ASML’s technology such as artificial intelligence (AI) and the 5G industry among others. [1]

Research of ASML in AI

Currently, ASML continues investing on the research front into delivering the most advanced semiconductor chips such as those used in artificial intelligence and machine learning applications. The key of ASML technological advancement is the Extreme Ultraviolet (EUV) lithography, an ability that enables production of smaller and more advanced chips with better energy efficiency. This is important for manufacturers as it would allow the world’s current and upcoming machines that run with the help of artificial intelligence to meet the computational power they require as the density of transistors would be increased.

These advanced chips are central in enhancing AI in different fields such as, data processing, auto control systems, and enhanced computer processing. Living up to its reputation, ASML has been investing strongly in new product development, guaranteeing that the prototypical lithography systems to be launched in the future will follow the bar set by Moore’s Law and help semiconductor manufacturers win the race to develop hardware capable of handling AI algorithms. [2]

ASML is not trying to push artificial intelligence forward itself; however, its role is pivotal for the advancement of AI. In fact, by providing leading chip producers such as Taiwan’s TSMC, America’s Intel and Samsung from South Korea with its most sophisticated lithography machines, ASML unwittingly contributes to the development of AI across the globe. Find out Best AI Stocks of the Future!

The chips manufactured with ASML’s EUV technology are used by most data centers, Artificial Intelligence devices and edge devices because they are capable of processing very large volumes of data. Thus, the need for ever-more effective and energy-efficient chips, as an artificial intelligence technology progresses, places ASML right at the center of this development. As the enabler of production of semiconductors that enable AI, its importance cannot be overemphasized in the future of AI.

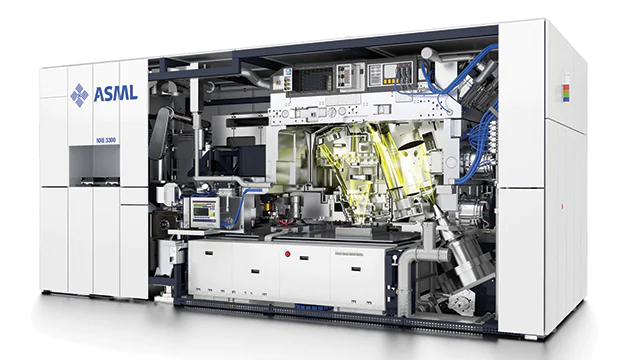

Products of ASML

ASML’s product portfolio mainly revolves around lithography systems:

- EUV (Extreme Ultraviolet Lithography): A technology that is uniquely tied with ASML and the one used for manufacturing the most complex chips on the market.

- DUV (Deep Ultraviolet Lithography): This technique serves for the production of chips with slightly lower computational ability but still at a very high level.

- Metrology and Inspection Systems: It assists manufacturers in comparing chips to their specifications and in identifying and correcting for imperfections. [3]

Price Prediction for ASML

| Metric | Value |

| PE Ratio | 41.4 |

| Current Stock Price | $710 (Changes Frequently) |

| Fair Value (18% growth) | $1,193.87 per share |

| Fair Value (16% growth) | $1,008.90 per share |

| Fair Value (12.2% growth) | $720.67 per share |

| Fair Value (11.3% growth) | $664.47 per share |

Analysis of Price Prediction for ASML

The pro forma adjustments are fair value of ASML stock growth rate scenarios, where the possible future stock price levels are determined. Here’s how each growth scenario impacts the stock’s valuation:

Price Prediction at 18% Growth

If ASML can grow at a rate of 18% CAGR, this means that the revenue growth would be even stronger due to the firm’s dominance in the market or future advancements in AI and semiconductor technology, the price of the stock could reach $1,193.87. This may be valued at a 45% premium to the current levels from its current price. This scenario assumes that ASML will successfully build on it technological advantage and increasing demand for its products in AI, the new generation network 5G and the development of advanced chips.

Price Prediction at 16% Growth

This projection is made based on the expectation that ASML will maintain a compounded average growth rate of sales revenue of 16% CAGR, a figure marginally below its estimated historic growth rate of 20%. This growth rate signifies moderate growth, maybe because of the high demand of semiconductor equipment and ASML’s EUV lithography technology. Therefore, projecting forward this growth curve after 10 years, the fair stock price of $1,008.90 suggest a 20.9% increase from today’s stock price of $723.26.

Price Prediction at 12.2% Growth

This projection assumes a growth rate to be at 12.2% CAGR which is lower than the previous analysis and is based on the average growth that the company has seen over the last 10 years. The fair value under this consideration of the stock is $720.67 while the current price is $723.26 revealing -0.36% downside. This outlook is characterized by steady growth of ASML, but with a moderate increase in the speed of this process.

Price Prediction at 11.3% Growth

If performance is even worse and ASML faces intensified competition or if the market for semiconductors gradually stagnates, the fair value would be $664.47, the downside of 22.7% compared to the current price. This CAGR of 11.3% shows that it might still be vulnerable to factors like competitive threats, geo-political activities or lower rate of technology upgrade in the development of the chips.

Investor Metrics for ASML

| Metric | Value |

| PE Ratio | 37.89 |

| Market Cap | $317,695 Million |

| Free Cash Flow ($ Mil) | 2021: 10,762.87 2022: 7,788.03 2023: 3,527.87 TTM: 3,174.75 |

| Revenue ($ Mil) | 2021: 20,220.85 2022: 23,004.46 2023: 29,942.85 TTM: 27,643.82 |

| EPS (Earnings Per Share) | $19.09 |

| EBITDA | $8,870 Billion |

| Dividend Yield | 0.94% [3] |

Is ASML Stock a Good Buy?

ASML is a principal equipment supplier for the semiconductor industry, and its growth path over the course of the next ten years appears to be quite favorable considering the increasing application of sophisticated chips in areas such as artificial intelligence, fifth generation (5G), and so on. Certainly, one cannot accurately forecast the respective stock prices in the long run, however, given ASML’s dominance in photolithography technology and its improvement in free cash flow and earnings, buying shares of ASML is a wise investment for those who are familiar with the indefinite growth of the semiconductor industry.

However, as with everything that has to do with investment, there are always risks associated with it, more so given that the AI industry may not appear as rosy as it has been painted in the future, or competition might heat up.

Where Will ASML Stock Be in 10 Years?

According to the current and future requirements for advanced semiconductor manufacturing tools all over the world, it is projected that there is huge upside opportunity in ASML’s stock. If it can stay in the technology growth company range of 16% to 18% growth per year, then the stock price could easily go as high as $1000 to $1200 per share. Nevertheless, if the growth rate decreases, it may even be below $700, under the assumption of the conservative scenario.

Conclusion

We believe that the further development of ASML has a direct dependency on such fields as Artificial Intelligence, fifth generation mobile networks, and semiconductors. Photolithography is expected to remain the key source of revenues since the company is already a leader in this field. Yet, declining in the share price could be influenced by a market situation, technological competition, and macro-economic conditions of the world market in which ASML operates. Such variables were important for ASML and investors should factor the following when evaluating the company as an investment for the long-term.