Are consumer staples a good investment in 2026? Analyse safety, valuation, growth constraints whether US defensive stocks are still worthwhile for investors.

Introduction

With 2026 in the rear-view mirror, many investors are reconsidering portfolio defense and a very basic question: are consumer staples a good investment when growth stocks have remained in the headlines? The best US consumer staples stocks 2026 are the ones that provide daily needs, food, beverages, home care and simple retail needs, and thus the demand is more uniformly distributed across the economic cycles. This would include Costco (COST) and Walmart (WMT) as super-sized retailers, PepsiCo (PEP) and Coca-Cola (KO) as the beverage and snacks market leaders, Procter and Gamble (PG) and Kimberly-Clark (KMB) as the market leaders in household and personal-care and Mondelez (MDLZ) as a global snacks company.

These companies are optimised, according to the official positioning, on critical consumption, global brand reputation, and common price (Costco Wholesale, n.d.; Walmart, n.d.; PepsiCo, n.d.). Coca-Cola Company, n.d.; Procter and Gamble, n.d.; Kimberly-Clark, n.d.; Mondelez International, n.d.). However, defensive reputation is not a quality of investment in itself. The question for safe US stocks for long-term investors is whether economic profit and not accounting profit is made by such firms.

This is the reason that the companies have been ranked in this article using Forecast Residual Earnings Per Share (REPS). This residual-income view throws light on what companies are engines of value generation and what companies are mainly capital-preservation machines, which offers a superior platform, on which a disciplined defensive investing strategy US and an informed consumer staples portfolio allocation choice could be determined.

Residual Earnings, Not Popularity

The residual earnings per share are profit measures after deduction of the cost of equity capital. This, in practice, means that REPS are used to identify whether the management decisions are returns which are above the risk expectations of the investors. This paradigm is best applicable to the case of the analysis of defensive stocks to buy in 2026, where the growth in revenues is frequently constant, but the distribution of capital efficiency is quite fragmented.

The profit driven by good accounting by most consumer staples companies is the result of scale and brand strength, but economic profit can be low when the capital bases are large, or the returns are absorbed by leverage. That is why high returns cannot always be compared with the growth of intrinsic values. This distinction is essential to put into consideration the comparison between consumer staples vs growth stocks 2026 since staples must work on the premise of efficiency and durability, but not growth stories.

Balance-Sheet Safety and Valuation Context

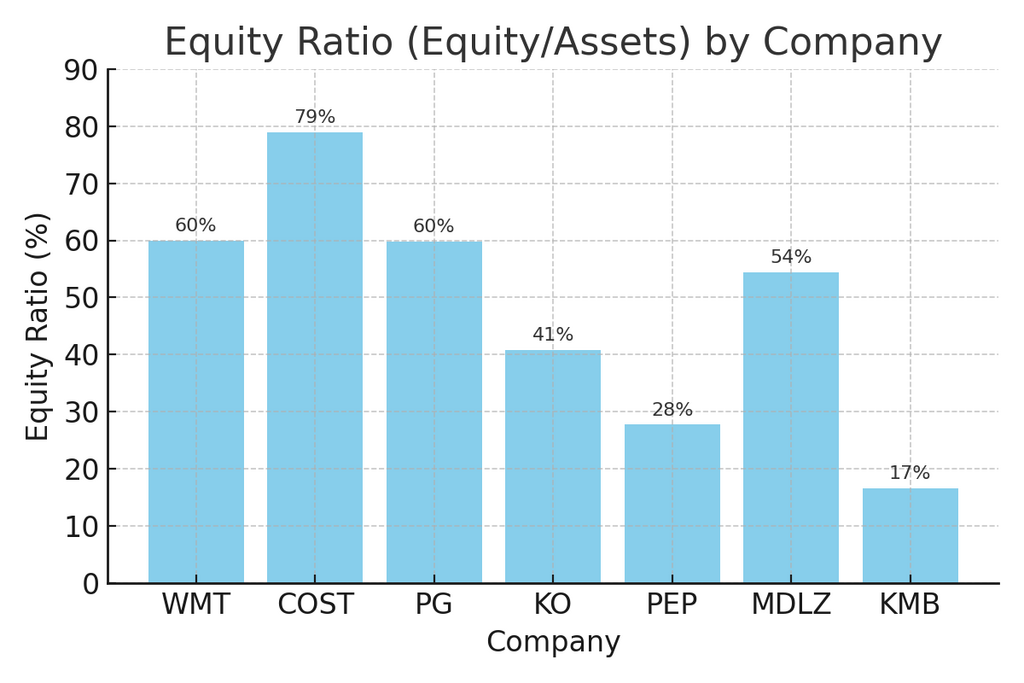

A) Balance-sheet positioning (Equity Ratio)

The defensive portfolios are very sensitive to the balance sheet structure. A company that has a high equity ratio will be more flexible during economic stress, but a low ratio could enhance returns and risk.

Figure 1. Equity/assets ratio by companies. This compares the balance-sheet conservatism among the group of peers. Costco has the highest equity ratio, which means that the equity cushion is highest, whereas Kimberly-Clark has the least, which means that it is more exposed to leverage. Walmart and Procter & Gamble are located on the high end, implying a rather higher capitalisation compared to a number of other peers.

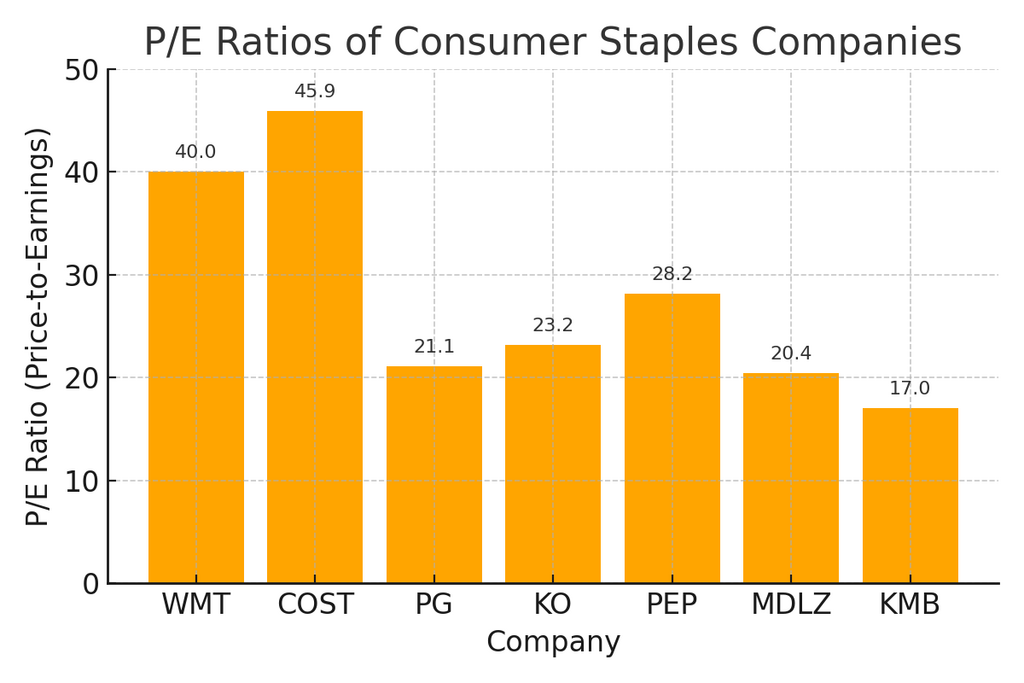

B) Valuation snapshot (P/E ratios)

The ratios of the prices to earnings show what the market expects, but do not show whether the expectations are realistic in terms of the economy. The higher P/E may signify the generation of the values in the future, and the lower P/E may be a sign of the structural limitations, rather than undervaluation.

Figure 2. PE Ratios of Consumer Staples Companies. This represents changes in valuation expectations in the group. Multiples of Costco and Walmart are more, and that of Kimberly-Clark is on the lower side. These ratios are implemented to provide insight; however, they cannot be applied individually; they must be applied in conjunction with residual earnings.

| Rank (Forecast REPS) | Company | Equity Ratio (%) | P/E Ratio | Forecast REPS (~) | Residual-Income Class |

| 1 | COST | 79 | 45.9 | 15.4 | Value Creation Engine |

| 2 | KMB | 17 | 17.0 | 7.2 | Value Creation Engine (leverage-influenced) |

| 3 | PEP | 28 | 28.2 | 7.1 | Value Creation Engine |

| 4 | PG | 60 | 21.1 | 5.1 | Capital Preserver |

| 5 | KO | 41 | 23.2 | 2.5 | Capital Preserver |

| 6 | WMT | 60 | 40.0 | 1.8 | Turnaround Economics |

| 7 | MDLZ | 54 | 20.4 | 1.1 | Value at Risk |

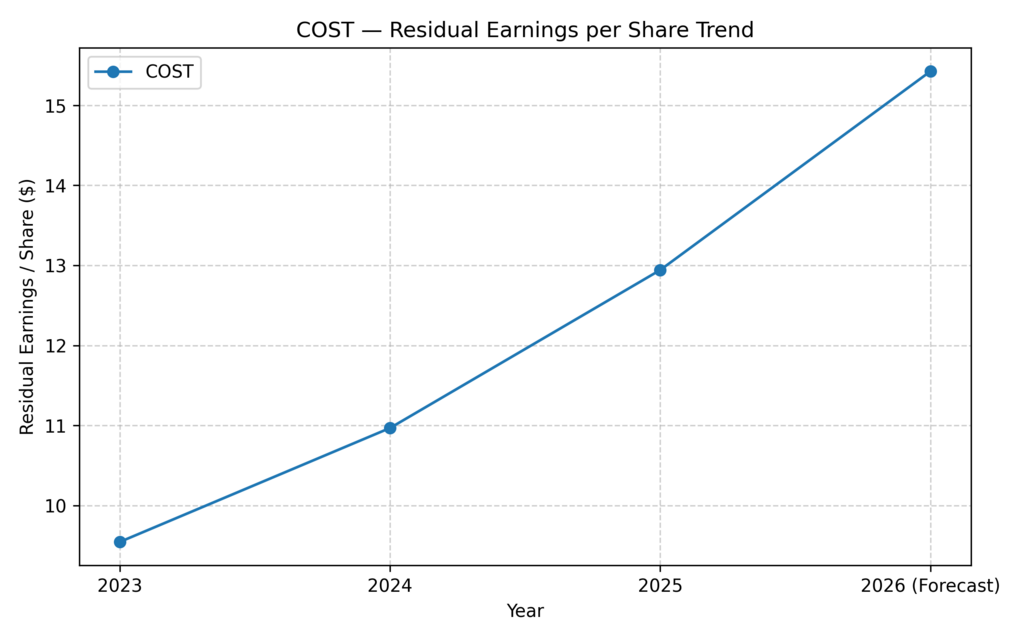

Costco (COST)

Costco leads the list of the predicted residual earnings per share of approximately 15.4. The tendency of the REPS shows a high rate of acceleration with a high base that implies high economic profit per share and the value creation that is sustainable. The formal business model of Costco is centred around the membership-based warehouse format targeted at offering equal value to customers and low prices (Costco Wholesale, n.d.). The strategy assists in maintaining the repetitive buying tendency and efficiency in running it, which, in fact, is near the high residual earnings tendency.

Strategically, Costco demonstrates that are consumer staples a good investment may be the solution to when the economy can be held at a steady level or even increased.

Kimberly-Clark (KMB)

Kimberly-Clark comes second with forecast REPS of approximately 7.2, which is a splendid recovery in the economic generation of profits. The company targets the most important consumer and professional hygienic products and concentrates on the reputed brands and global coverage (Kimberly-Clark, n.d.). All these factors support a steady demand that is reflected in the improved trend of REPS.

The comparatively low equity ratio, however, means that it is more affected by leverage. This means that there is a possibility of some of the residual earnings power being decided by the balance-sheet framework and not necessarily by operations-based economics, and more sensitive to low-risk stock investments 2026.

Figure 4. KMB Residual Earnings per Share Trend. KMB depicts the seeming recuperation of the residual earnings, but the leverage in the balance sheet renders KMB more financially apprehensive than its peers, which enjoy larger equity cushions.

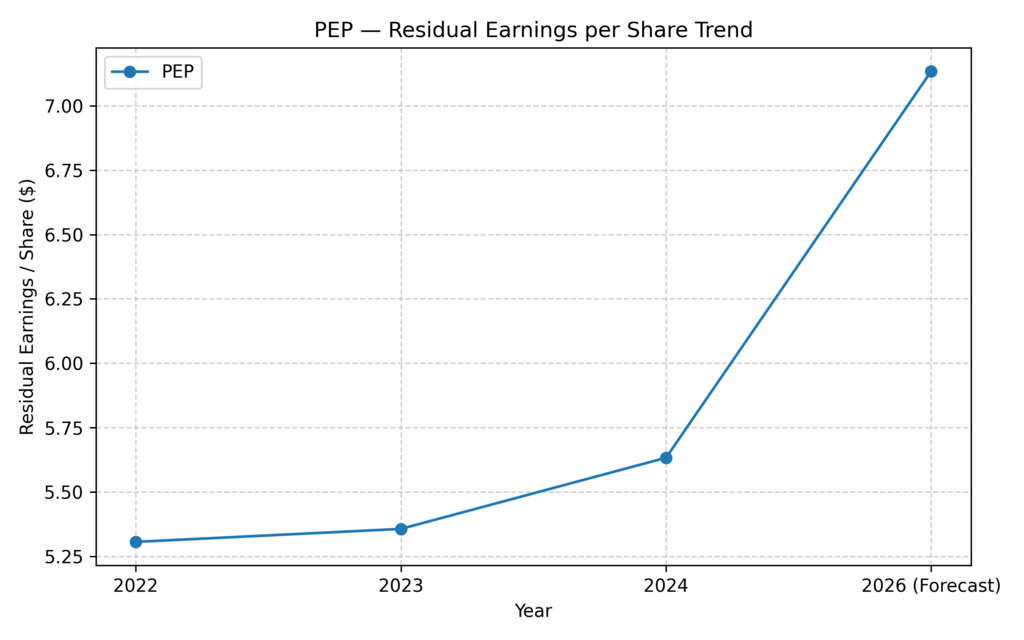

PepsiCo (PEP)

PepsiCo is ranked third with forecast REPS of approximately 7.1. The trend of residual earnings is not very high and is stable. PepsiCo claims that it takes the form of delivering convenient food and drinks through a broad spectrum of world branding (PepsiCo, n.d.). This diversification eases the pricing power and strong demand as it is in line with the steady residual earnings scenario.

PepsiCo gives a tradeoff to investors who are interested in reaping dividends on dividend-paying consumer staples stocks with a long history of stability.

Figure 5. PEP -Trend of Residual Earnings per Share. PepsiCo has a steady and stable growth of residual earnings, which qualifies it to meet the definition of a high-quality value creation engine.

Procter and Gamble (PG)

Procter and Gamble ranks fourth, and forecast REPS are between 5.1. The company specialises in the daily needs of consumers who have a high brand portfolio as they support hygiene, health and home care (Procter & Gamble, n.d.). This strategy enables a smooth demand level but fails to enable the company to fast-track residual earnings, considering that it is fully grown.

PG would therefore be appropriate in a consumer staple portfolio allocation planning where consistency and retention of capital are more essential than aggressive value development.

Figure 6. PG — Trend Residual Earnings per share. PG has shown low and slow growth in the residual earnings, and this has the trait of a defensive compounder.

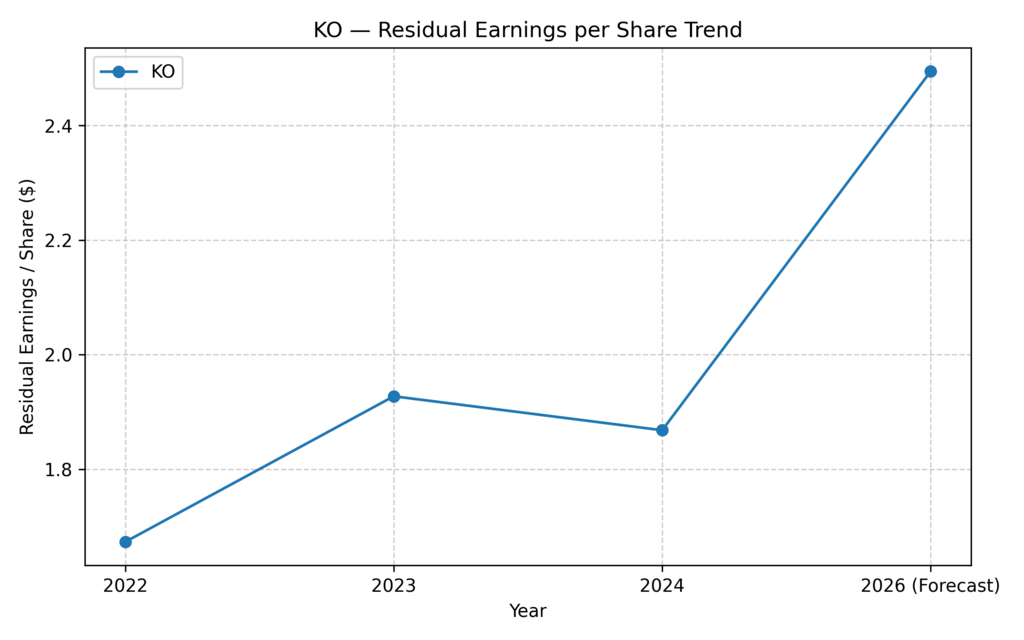

Coca-Cola (KO)

Coca-Cola is ranked in position five, and it has a forecast REPS of approximately 2.5. The company also presents itself as a total drinks distributor with an extensive array of beverage options in the markets (The Coca-Cola Company, n.d.). Though this is a positive move towards good international presence and cash flow, the trend in the residual earnings indicates low economic growth in profits.

Coca-Cola may be a safe stock for the investor who is examining the safe US stocks as a long-term investor, but preservation will be rewarded by the residual income more than economic growth.

Figure 7. KO -Earnings Trend per Share. KO has stable but low residual profits, which proves its label of the capital preserver.

Walmart (WMT)

Walmart maintains a sixth place regarding forecast REPS of approximately 1.8. The business mission of Walmart is to help its customers save money and improve their everyday living through scale and efficacy (Walmart, n.d.). Despite the high operational performance that this strategy has resulted in, low levels of margins continue to pose a threat to the economic profit per share due to the trend of residual earnings.

This makes Walmart more relevant as an operationally-enhancement-story rather than a residual-earnings-leader-in-consumer staples sector outlook 2026 comparisons.

Figure 8. WMT Trend in Earnings per Share Residual. WMT is a low starting firm with low residual earnings when compared to its peers.

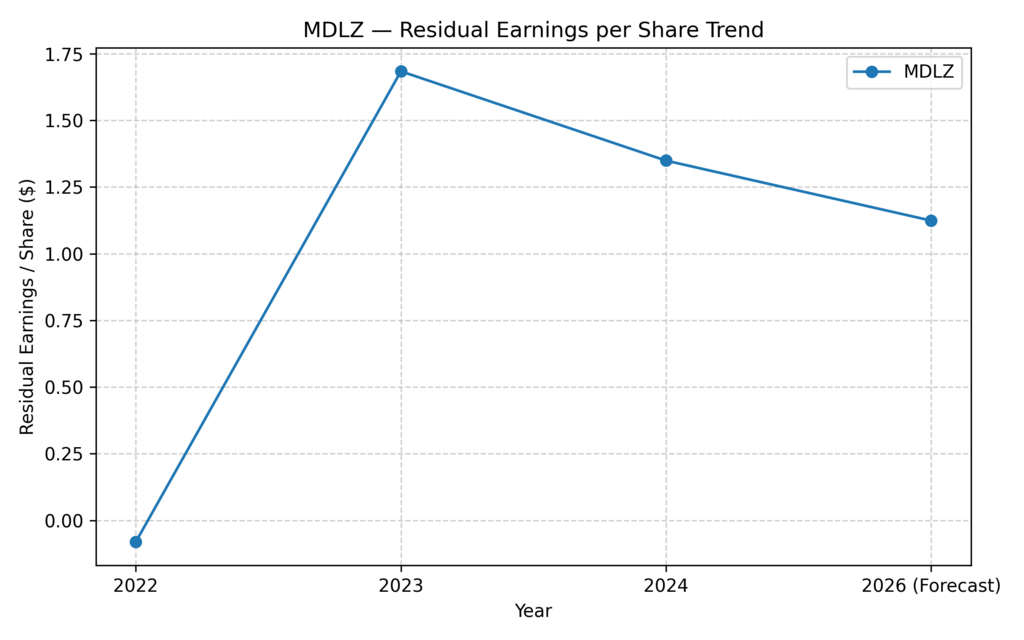

Mondelez (MDLZ)

The final competitor is Mondelez, whose forecast REPS is approximately 1.1. The company describes itself as a snack global player that targets brand building in the long term (Mondelēz International, n.d.). However, given the brand strength, the tendency of the residual earnings is horizontal and possibly it is decreasing, which is an indicator of economic pressure on profit generation.

This underlines the need not to restrict the consumer staples valuation analysis to brand recognition when it comes to the establishment of the long-term value creation.

Figure 9. MDLZ -Trend in Residual Earnings per Share. The profile of residual earnings of MDLZ is the most deplorable of the peers, which attests to the value at risk.

The Best Stocks to Buy : The Real Economic Value Creators

The residual-income group employs consumer staple firms on the rationale of their effectiveness in generating economic gain in the face of bearing the expense of equity rather than either volume, income, or brand image.

Value Creation Engines: COST, PEP, KMB

The Value Creation Engines firms will always record high and/or increasing residual earnings per share, i.e. the returns earned by such companies exceed the amount of the required return by the shareholders. Leader in this category is Costco (COST) as its residual earnings are at a high level and growing at an accelerated rate, which also means that it has high operating efficiency and sustained competitive advantages (Costco Wholesale, n.d.).

The growth of the residual earnings by PepsiCo (PEP) is steady and predictable, which means that there is a steady flow of economic profits production with a relatively low degree of volatility (PepsiCo, n.d.). The case of Kimberly-Clark (KMB) also performs well in regard to residual earnings, but this performance is moderately influenced by leverage that enhances the possibility of returns coupled with financial sensitivity (Kimberly-Clark, n.d.).

Capital Preservers: PG, KO

Capital Preservers continue to generate positive residual earnings but at a lower and more constant level, and with minor acceleration. Procter and Gamble (PG) and Coca-Cola (KO) are no exception, as their immense equity and sophisticated business structure consume much of their surplus economies. Even though these companies remain very profitable in accounting terms and they offer stability during challenging economic times, their residual-income structures show that they are not well-positioned to add the level of value creation, but they are better suited to aid in the protection of invested capital (The Coca-Cola Company, n.d.). The companies provide predictability and stability to defensive investors and not high growth in the intrinsic values.

Turnaround Economics: WMT

Walmart (WMT) is a Turnaround economics enterprise because its residual earnings show that it has definitely improved with a low base; however, when compared to the industry leaders, it’s very small. The implication of this trend is strategic progress and an increase in profits, but not the ultimate in terms of economic profitability that will turn Walmart into a value creation engine. Operational implementation is the foundation of Walmart’s investment argument on the basis of residual income as opposed to the existing economic hegemony (Walmart, n.d.). It is thus a business in transition, although the value addition in the future can be developed, but is not well defined.

Value at Risk: MDLZ

Mondelez (MDLZ) falls under Value at Risk due to the downward trend in its residual earnings profile, which means that it is struggling to generate economic profits. Despite the strong brands and the global company, the residual-income analysis shows that the returns are close to the level, or even less than the cost of equity. This puts in question the ability of the firm to create shareholder value in an incremental fashion (Mondelēz International, n.d).

Why This Classification Matters?

Such categorisation of residual income confirms that not all consumer staples are a defensive investment or even a highly attractive investment. It is not the stability of the revenue or dividends to generates economic value. In this system, investors will consider it simpler to align their portfolios with their objectives, which could be the value compounding of long-term, capital protection or the selective turnaround exposure instead of merely following the traditional sector names assigned.

Conclusion

Then, are consumer staples a good investment in 2026? The answer is yes – but selectively. The residual earnings analysis shows that economic generation of value is concentrated among a small number of companies. Costco stands the best as a residual-income compounder, followed by PepsiCo and Kimberly-Clark. Mainly, Procter and Gamble and Coca-Cola are capital maintainers, and Walmart and Mondelez have lesser economic upward chances.

The fact that exposure to the sector is insufficient is the most significant consideration for the investor who is developing a defensive investing strategy US. It is the preference of those corporations that do generate residual earnings frequently that consumer staples may be some sort of defensive, long-term investment.

All calculations and valuation estimates are FinancialBeings’ own, based on data sourced from SEC filings COST (10K and 10Q), KMB (10K and 10Q), PEP (10K and 10Q), PG (10K and 10Q), KO (10K and 10Q), WMT (10K and 10Q) and MDLZ (10K and 10Q), use or reproduction before prior approval is prohibited.

Usama Ali

Usama Ali is the founder of Financial Beings and a self-taught investor who blends classic valuation study with insights from psychology. Inspired by works from Benjamin Graham, Aswath Damodaran, Stephen Penman, Daniel Kahneman, and Morgan Housel, he shares independent, data-driven research to help readers connect money, mind, and happiness.

Disclaimer

The content provided herein is for informational purposes only and should not be construed as financial, investment, or other professional advice. It does not constitute a recommendation or an offer to buy or sell any financial instruments. The company accepts no responsibility for any loss or damage incurred as a result of reliance on the information provided. We strongly encourage consulting with a qualified financial advisor before making any investment decisions.