Introduction

Learn about Apple stock price prediction for 2030 such as fair value, financial and growth characteristics. Find out about the Apple’s involvement in AI, its revenue growth, and its dividend products.

One of the largest players in the global technology market, Apple Inc. (AAPL), does not stop expanding its presence in the tech sphere, leading to new achievements in terms of hardware, software, and tech services. Apple continues to sustain its competitiveness by owning the development of AI, AR and focusing primarily on sustainable technology. Products like the M-series chips display Apple as an organization that transforms its brand into feats of utility performance and efficiency. Moving into the augmented reality and mixed-reality devices means growth outside mobile phones, which put Apple among major market players.

Understanding the projection of the Apple’s stock by 2030 is useful to investors who want to get an insight into Apple’s growth rates and company value. In this blog, we will analyze the current and potential fair value of Apple and how the recent events can affect this technology giant’s market course. However, we will not advise you to buy or sell the stocks, doing so can cause legal issues for the company.

What is Apple Doing in Technology Sector?

Apple has continued to be an outstanding player in the technology market continuing to set pace in the development of new technologies in consumer electronics, software, and services. Popular for gadgets such as the Apple iPhone, iPad, Macintosh computers, and the Apple Watch, Apple now looks to developing new technologies with every new product. In recent years it has most heavily focused on artificial intelligence (AI), augmented reality (AR), and custom silicon utilizing that this company is a pioneer in these industries. The latest iPhone models are equipped with deep learning capabilities, providing the user with real-time photo and video processing, and making the picture and videos more smart and intelligent.

Apart from the hardware, there is a growing diversification in services such as iCloud, Apple Music, Apple TV+, and the App Store where it is has people paying for renewal, thereby giving Apple extended customer stickiness. Samsung and Apple’s developments in AR are to change the way user-interaction and gamification is to immerse the digital realm with physical reality, the impending launching of the AR/VR headset is predicted. Also, Apple is investing in innovation to increase the use of recycled materials and aims for its entire supply chain to be carbon neutral. Innovation and sustainability, ecosystem, and industry stand out as ways Apple pursues its work in the tech industry to become stronger and address the consumers’ needs.

Products and Research of Apple.

Every available product and every potential research project that is currently under development by Apple emphasize innovation and user experience. Four key products of the company are iPhone, iPad, Mac, Apple Watch and AirPods, which are recognized for combining great technologies with elegant, simple looks. The iPhone is Apple’s all-time flagship product and it has been upgraded with innovative features, such as powerful A-series and M-series chips, which are designed in-house by Apple to enhance its other products. On the other hand, Mac devices especially those with the new M series chips that has been recently unveiled are arguably some of the company’s most powerful machines. [1]

The company’s research interests cover artificial intelligence (AI), augmented reality (AR), and health tech. AI has become a crucial part of almost all Apple products, from improving picture quality to the voice assistant program for the iPhone. AR is another important field, and Apple is expanding AR capabilities to iPhones and iPads with the help of developing ARKit, a framework for building AR experiences. Health technology is also considered core to Apple’s research, the Apple Watch now has features like ECG and blood oxygen levels, to which Apple has to remain faithful to its mission of personal health. Apple continues the research in these areas to deliver daily experiences and develop potential future technology interventions that are inseparable from users’ lives.

AI Features in New Phones

Apple’s newest iPhones come equipped with numerous advanced Artificial Intelligence features intended to improve the interaction with a device. Some of the newest models are used to enhance the employment of artificial intelligence in photographing, for instance, identifying the subject, the light distribution, and the blurring of the background during the photography process. For example, the AI-powered Photonic Engine optimizes picture quality by improving brightness, detail, and color of an image even at night, offering vibrate, high-resolution images with less interference from the user. Don’t miss out on the latest of Chipmakers, Arm stock price prediction: Fair Review in 2024.

Also, the iPhone has an A-series chip that adds ML feature of Siri which assists in enhancing Siri’s performance in recognizing speech more accurately, in addition to the more customized help. AI also drives on-device text operations that include Live Text, which enhances the capability of capturing a text on a picture and giving room for users to click, translate, or perform a search on them at once. Apple focuses on optimization of assistants’ work with limited use of the cloud and localizations of the majority of data processing, which preserves users’ privacy. Such AI trends that are performed in the latest iPhone iOS versions show how Apple challenges the iPhone as a multipurpose tool as photography, with voice-interaction technology that is tailored to improve usability across numerous applications. [1]

Invertor’s Metrics for Apple Inc. (AAPL)

| Metric | Value |

| PE Ratio (TTM) | 36.70 |

| PB Ratio (TTM) | 58.96 |

| Market Cap (USD) | $3.379 Trillion |

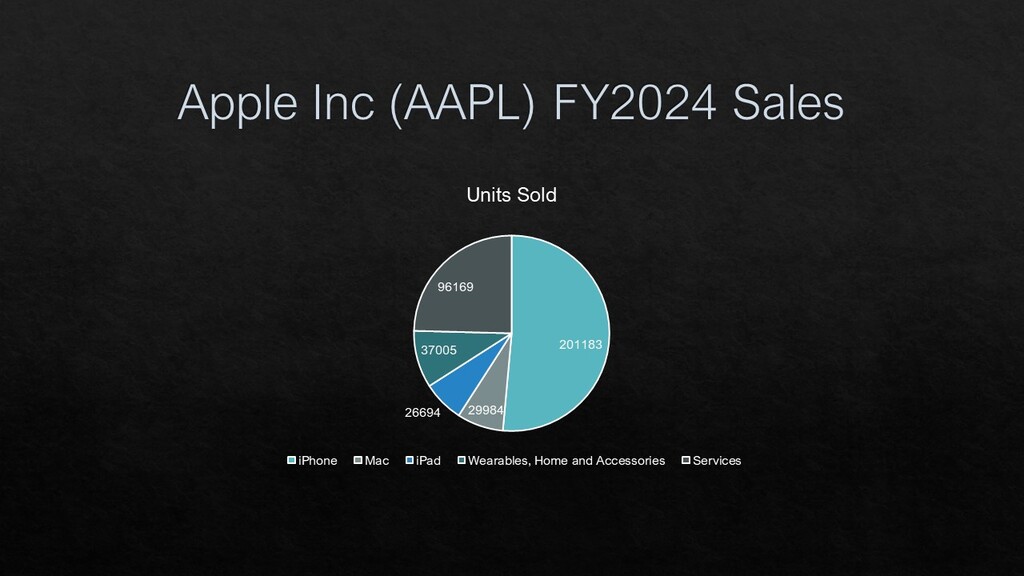

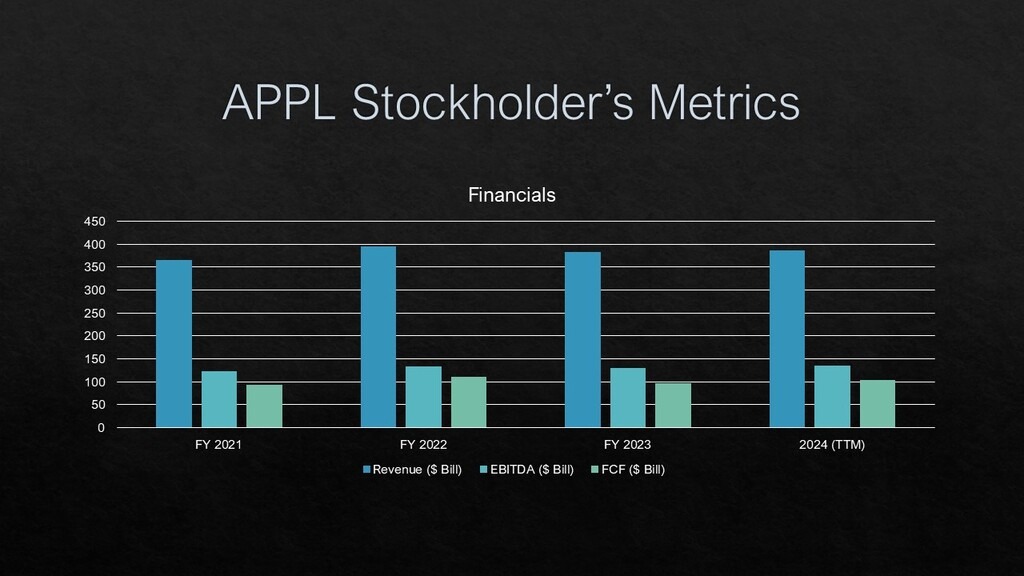

| Revenue Growth (2021-2024) | 2021: $365,817,000 2022: $394,328,000 2023: $383,285,000 2024: $391,035,000 TTM: $391,035,000 |

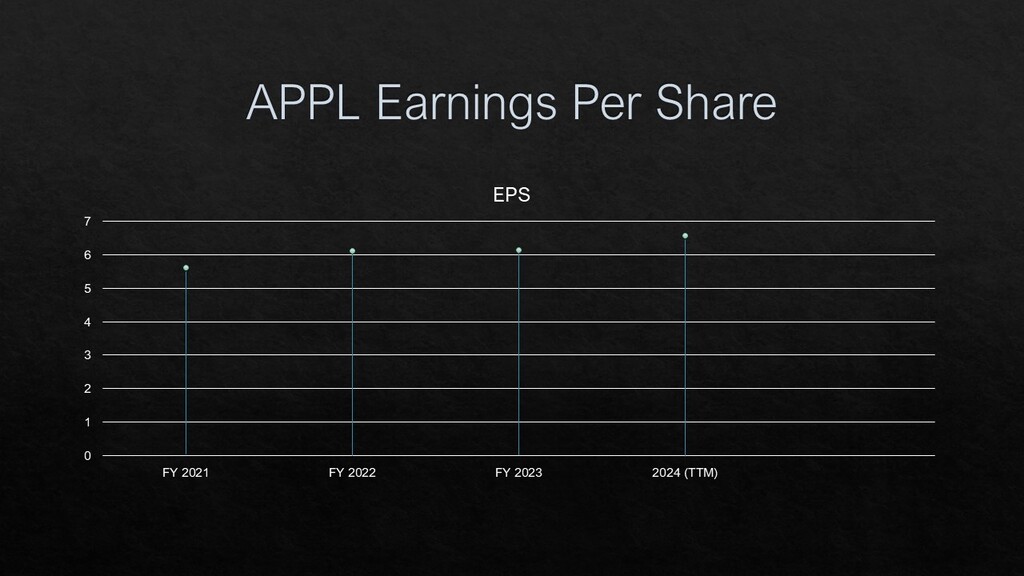

| EPS (TTM) | $6.09 |

| EBITDA (TTM) | $134,661,000 |

| Free Cash Flow (FCF) $Mil | 2021: $93 2022: $111.4 2023: $99.6 2024: $108.8 |

Price Prediction for Apple Inc. (AAPL)

| Medium Growth | Price per share $195 (Downside 14%) |

| Low Growth | Price per share $161 (Downside 29%) |

| High Growth | Price per share $212 (Downside 6%) |

Analysis of Apple’s Financials

Apple’s Price-to-Earnings (P/E)

Apple’s Price-to-Earnings (P/E) ratio is influential with a comparatively higher ratio that is high, which show a strong belief that the company can earn and grow in the market. A high P/E ratio may reflect that the stock is overvalued, however, it always contains information about future growth in the stock.

Apple has been pointed out to be profitable from the Earnings per Share (EPS) of $6.09 to show the capacity of the firm in delivering returns to the shareholders. Favorable investor perceptions due to consistent EPS and high-grossing phone sales are also responsible for Apple high valuation ratios.

P/B Ratio

Apple has fairly high P/B ratio, it points to a gap in which investors are willing to pay for the company’s stock relative to its book value. This high ratio is common in information technology (IT) companies that probably command high brand recognition and immense goodwill.

Apple’s Market Capitalization

Apple’s market capitalization gives the company a position among world’s largest ranked by steady technological advancement, ecosystem dominance, and consumers worldwide. Yet, it is not easy to make high growth percentages when the company has a high market capitalization.

Apple’s Revenue Growth

Over this period, Apple’s revenue has grown by 6.9%. Apple was relatively down in 2023, but it strengthened in 2024 and proving its ability to diversify the revenue streams. The change contrasts the PC hardware market pressures with the growing customer adoption of services in various countries and conditions in the global economy. [2]

Apple’s EBITDA

Apple’s EBITDA is high and reveals its financial success as well as its well-organized approach to managing and controlling costs, which it sustainably achieves high operating margins in the IT industry. This strong EBITDA is consistent with the company’s capacity to fund its research and development and grow its range of connected hardware devices.

Apple’s Free Cash Flow

Analyzing Apple’s FCF for the last three years, we have observed that though it is expected to grow in 2022, it is expected to dip slightly in 2023 before rising again in 2024. This trend testifies to the fact that Apple possesses strong cash revenue conversion skills with a 2021-2024 relative boost of about 17%. Healthy FCF makes it possible for Apple to finance the dividend program and reinvestment in the future technologies. [3]

The fair value estimates indicate the limited potential for the price to rise above the current price level, but with different measures of downside risk in each of them. Whereas high price to sales and price to book value for Apple means that investors have a lot of confidence in the company’s potential, it also means that the company’s P/S and P/BV ratios offer little scope for expansion, unless the company experiences significant growth.

Apple’s Dividends

Apple has paid dividends ever since, offering a small yield of 0.44% in addition to growth characteristics. This dividend history shows that cash continues to be strong and company is still focusing on shareholders returns and the same time investing in the innovation and expansion.

Conclusion

Apple remains a market leader with high earnings and significant cash flows, and but has higher valuation ratios and might be overvalued in short term. Apple is still a good stock to have with steady revenues and predictable dividends; however, its additional price appreciation can only be seen if the company is going to grow at a sustainable rate with increased market expectations.

**Please be informed that the content is informational and by no means serve as a buy or sell signal. The company is not responsible for the loss of capital.