Introduction

The future drivers of growth, risks, and valuation information for predicting Apple’s stock price prediction 2030 are explained, targeting long-term investors seeking to achieve long-term returns. Apple Inc. (AAPL) has, over the years, been an icon of the intersection of technology innovation and faith among investors. This company remains a pearl in the world’s equity markets, with a market capitalization of $3.67 trillion, and its shares are currently priced at $239.95 as of 2025. It poses one great question to the investors: What will Apple be like in 2030? The Apple stock price prediction for 2030 is not just a financial analysis; it is a psychological narrative, examining the company’s performance, future expectations, and market sentiment.

This valuation is based on Value-Added Earnings (VAE), which are analyzed to discuss the valuation of Apple by 2030. Besides the financial indicators, the long-term stock forecast of AAPL is also based on investor behavior, risk perception, and Apple’s ability to maintain its innovative advantage. If you are planning to buy Apple stock in 2026, please read our latest short term valuation and risks of AAPL here, “Is Apple Stock Worth Buying in 2026 After AI and Services Growth—Or Is It a Trap?”

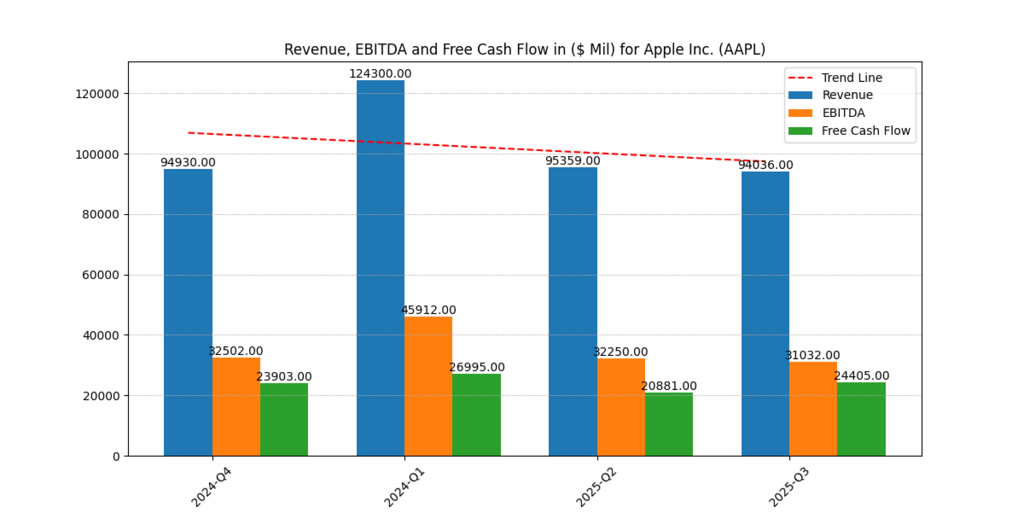

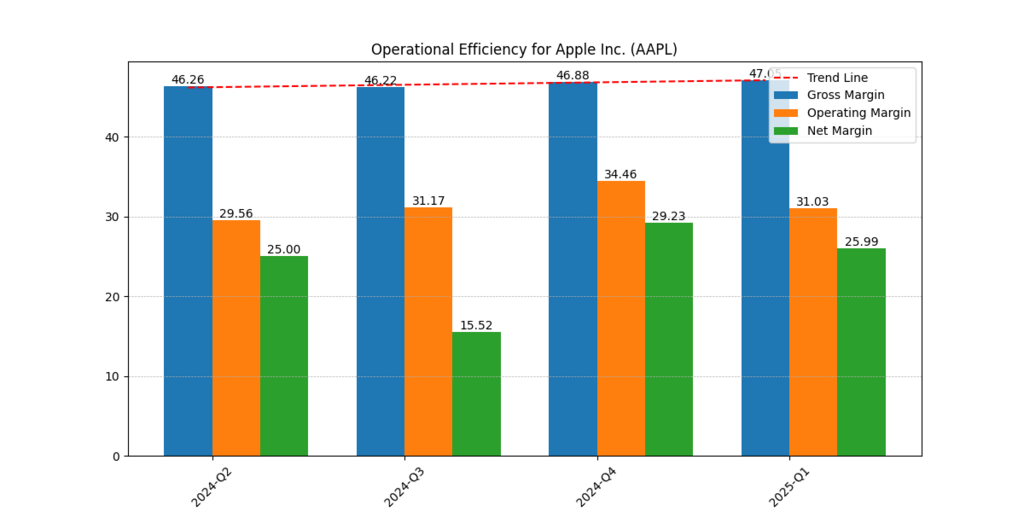

Apple’s Financial Foundation

Discipline and leverage are reflected in Apple’s balance sheet. Equity reached $41.7 billion as of 2025, representing a decrease from the exact figure recorded the previous year, which was $62.1 billion. Net operating assets totaled $122.9 billion, and net debt was in the range of $60.8 billion, comprising $106.6 billion of current-year debt.

Regardless of these numbers, Apple maintains enviable profitability levels, with a projected ROE of 1.85% in 2026. It is projected that the company will have its value-added earnings of $7 in 2025 and $7.54 in 2026, with a growth in the residual earnings of 7.66%. The figures demonstrate that the company is capable of maintaining shareholder value despite the presence of competition (Liu & Zhang, 2022).

Apple Services Revenue Growth: A Core Driver

The change in Apple from a hardware-based company to a services-based revenue source has transformed its financial direction. The App Store, Apple Pay, iCloud, and Apple Music are among the services that have continued to grow, generating better margins than the company’s hardware products. Statista (2023) notes that Apple’s service revenue growth has experienced double-digit revenue growth over the past decade, a trend expected to continue into the 2030s.

Such a shift will be crucial to Apple’s growth outlook for 2030, with recurring revenues making the divergence somewhat less unstable than before iPhone upgrade cycles. To investors, the stability of subscriptions increases confidence in Apple’s future, making the company less sensitive to macroeconomic shocks.

Historical Investor Scenarios: Lessons for 2030

To AAPL’s long-term stock prediction, it is necessary to revisit how investors behaved over the last several decades:

2007 iPhone Launch

The investors underestimated the disruptive power of the iPhone. The responses were largely skeptical at first, yet shareholders significantly increased the value of Apple with the smartphone’s global market dominance.

2015–2019 Services Expansion

When Apple focused on services, investors did not believe the firm could diversify effectively. Nevertheless, the strategy was proven correct by recurring revenue growth by Apple Music and iCloud, which generated a new premium on the stock.

2020 Pandemic Resilience

Apple surpassed expectations during the COVID-19 pandemic by capitalizing on the trends of remote work and consumer demand for connectivity. The company’s stock demonstrated impressive resilience, which highlights it as a safe-haven investment in the tech sector (Shiller, 2021).

These instances suggest that nihilism is often a precursor to breakthroughs by Apple. In the case of 2030, investors may again underestimate the potential of spatial computing, AI-based gadgets, and bundled services. It is essential to recognize this trend in order to put the Apple stock price prediction for 2030 into perspective.

Scenario-Based Valuation Using Value-Added Earnings

Depending on the growth trend of Apple, the VAE model offers explicit valuation dynamics:

Table 1 – Apple Price Prediction Scenarios (VAE Model)

| Scenario | Growth Rate (%) | Growth Price per Share (USD) | Market Implied Growth Rate (%) | Value-Adding Growth Rate (%) |

| No Growth | 0.0 | $55.65 | 6.59 | 7.58 |

| Moderate Growth | 6.5 | $158.64 | 6.59 | 7.58 |

| Strong Growth | 7.0 | $184.40 | 6.59 | 7.58 |

| Optimistic Growth | 7.5 | $220.04 | 6.59 | 7.58 |

These results underscore Apple’s sensitivity to growth assumptions. The stock will have a value of only $55.65 without growth. However, with the 7-7.5% growth, the valuation increases to $184-$ 220, which is in line with Apple’s 2030 optimism forecast.

Apple 2030 Forecast: Fundamentals and Psychology

Apple’s growth outlook for 2030 is a combination of complex numbers and investor psychology. The 6.59% probability of increase is the implied growth rate that the market has in its expected market. Nonetheless, if Apple maintains a value-adding growth rate of more than 7%, the stock may rightfully be valued above $ 220 per share by 2030.

Rational expectations are, however, often distorted by investor psychology. Anchoring bias keeps investors fixated on the current price of $239.95, whereas the optimism bias prompts others to anticipate substantial returns. The volatility is increased by the fear of missing out (FOMO), with retail investors piling in when the market reaches its highs, thereby building reinforcing loops (Kahneman, 2011).

Risks to the Long-Term Outlook

Despite the company’s power, even the strongest one is not without risks, and Apple is no exception. Long-term investors need to consider not only financial results but also external factors that may disrupt expansion forecasts.

- Competition: Although Apple has traditionally had a high brand and ecosystem moat, its competitors, including Samsung, Google, and the new Chinese companies, like Huawei and Xiaomi, are making progress in terms of AI-driven devices and innovative ecosystems.

- Regulation: The App Store, which is one of the primary sources of revenue related to services, is regularly subjected to antitrust investigation in the U.S. and EU by Apple.

- Hardware Dependency: Apple has been diversifying, but a significant portion of its revenue continues to rely on iPhone sales.

- Macroeconomic Risks: Apple, as a consumer-facing company, is prone to the global macroeconomic environment. Recessionary cycles, interest rate increases, and inflation may hamper consumer spending power.

According to behavioral finance, such risks increase the likelihood of loss aversion, where investors are more concerned about possible losses than the gains of the same magnitude (Tversky & Kahneman, 1992). Practically, this suggests that any regulatory penalty, loss of revenue, or market share will have a disproportionate impact on Apple’s stock price, as investors will respond defensively to any perceived threat.

Further Reading : Unveiling the Future: Apple Stock Price Prediction 2030 for Intelligent Investors

Opportunities Beyond 2025–2030

On the opportunity dimension, Apple finds itself in a position to open up new markets that may transform its long-term path:

- Spatial Computing: Vision Pro headset is the first spatial computing device that Apple launched. In its mass adoption, the platform would build a brand-new ecosystem of applications, much like the iPhone in 2007.

- AI Implementation: Predictive services, Photos, and Siri are already being improved by artificial intelligence in iOS. Incorporating AI further into its devices, whether as a personalized health device, productivity application, or generative application, Apple can enhance user engagement while reinforcing ecosystem lock-in. This not only strengthens consumer loyalty but also increases the company’s revenue by offering its services.

- Sustainability: Apple has made a significant focus on its ESG endeavors, where it has promised to be a fully carbon-neutral company along its supply chain. These sustainability practices ensure that Apple not only addresses regulatory and societal expectations but also becomes more appealing to institutional investors who consider ESG portfolios.

All these innovations are in favor of AAPL’s long-term stock description, ensuring that, in addition to being a growth story, it is also a resilience play.

Investor Sentiment and Behavioral Drivers

Behavioral finance also explains why Apple continues to maintain a premium valuation in the market.

Herding Behavior

Massive institutional investors tend to be at the forefront when it comes to building an Apple holding that sends a message to the retail investors.

FOMO (Fear of Missing Out)

It is a world-famous company with a history of innovation, and so the stock itself is a psychological anomaly.

Long-term Patience

Apple has turned into a synonym of stability and steady returns, and it goes to sleep well at night in portfolios.

A combination of these sentimental behavioral patterns suggests that Apple’s valuation in 2030 will not rely solely on the company’s financial performance, but also on how investors collectively perceive the Apple story. According to Shiller 2021, stories have the same power as the figures used to determine stock market performance.

Conclusion

Apple stock price prediction 2030 shows the convergence of financial performance and human psychology. According to VAE modeling, the per-share value of Apple ranges between $158 and $220 under moderate growth and optimistic growth scenarios, respectively. This supports the Apple growth outlook 2030 and the bigger AAPL long-term stock Prediction.

The history of Apple illustrates that a lack of trust is a probable precursor to triumph, both in iPhones and in services, as well as pandemic readiness. As long as the company continues to innovate by leveraging spatial computing, AI, or bundling subscriptions, the future of Apple shares looks bright.

To the intelligent investor, Apple is not merely a share; it is also a financial anchor and an emotional investment in technology. To predict the future of 2030, Apple is among the few companies that can continue to grow in the long term and retain the loyalty of its investors.

Usama Ali

Usama Ali is the founder of Financial Beings and a self-taught investor who blends classic valuation study with insights from psychology. Inspired by works from Benjamin Graham, Aswath Damodaran, Stephen Penman, Daniel Kahneman, and Morgan Housel, he shares independent, data-driven research to help readers connect money, mind, and happiness.

Disclaimer

The content provided herein is for informational purposes only and should not be construed as financial, investment, or other professional advice. It does not constitute a recommendation or an offer to buy or sell any financial instruments. The company accepts no responsibility for any loss or damage incurred as a result of reliance on the information provided. We strongly encourage consulting with a qualified financial advisor before making any investment decisions.