AMD vs Broadcom semiconductor stocks comparison to investors interested in investing in the AI chips demand in 2026. AVGO vs AMD investment analysis comparing the data in order to include the margins, cash flow, balance sheets and long-term prospects.

Overview

Artificial intelligence, cloud computing and modern computing are centred on semiconductors. Every information centre, artificial intelligence, and digital platform will ultimately be based on trusted and effective chips. The issue of the relevance of semiconductors becoming less relevant is no longer an issue of concern in the debate over the next stage of AI use; more about how every company can be better able to enjoy the fruits of the long-term is even more important. This has rekindled a hype surrounding the AMD vs Broadcom semiconductor stocks, which are two companies that have made significant investments in the data centre ecosystem, but with very dissimilar business models.

AMD is closely associated with processors and AI compute workloads that are the primary drivers of servers and high-performance systems. Its products are most often evaluated based on performance improvements, performance and competitiveness in the demanding computing environments. Broadcom, in its turn, operates more behind the scenes, by offering networking, connectivity and infrastructure silicon, with the help of which data centres transfer and handle massive amounts of data in an efficient fashion. Processors are not given this level of attention, and yet they are also essential in the smooth running of large-scale AI systems.

Both companies are regularly listed under the section of the best semiconductor stock to buy 2026; however, their financial ratios, exposure to risk, and growth bases differ materially. However, even though the trend in the demand for computing is directly related to the performance of AMD, infrastructure expenditures and long-term enterprise relations are sensitive to the performance of Broadcom. These distinctions are essential to any investor who tries to assess the place of every stock in a long-term portfolio that is fixed on the ever-changing semiconductor and AI environment.

Business Models and Market Roles

Advanced Micro Devices (AMD)

AMD is a company that deals with superfast processors, graphics cards and customised chips that are used in PCs, game consoles, and data centres. Over the last couple of years, AI-oriented accelerators and server processors led to the expansion of its operations by AMD, thereby getting it closer to the core of AI compute demand (AMD, 2024).

AMD has been viewed in terms of investor-wise as a direct AI and high-performance computing play, which puts it at the same level to discuss the AMD semiconductor outlook 2026.

Broadcom Inc. (AVGO)

Broadcom has a more infrastructure-based portfolio. Its semiconductor products are in support of networking, storage, connectivity, and custom silicon for the application of large cloud providers. These components do not do AI workloads specifically, but they are required to efficiently perform data transfer within AI systems (Broadcom, 2024).

This puts Broadcom in the vortex of data centre semiconductor leaders, but not so visible in the headlines about AI chips.

Revenue Growth and Business Scale

The growth in revenues indicates how far the companies have grown in their presence.

Revenue Trends (2021–2024)

| Year | AMD Revenue ($ Mil) | Broadcom Revenue ($ Mil) |

| 2021 | 16,434 | 27,450 |

| 2022 | 23,601 | 33,203 |

| 2023 | 22,680 | 35,819 |

| 2024 | 25,785 | 51,574 |

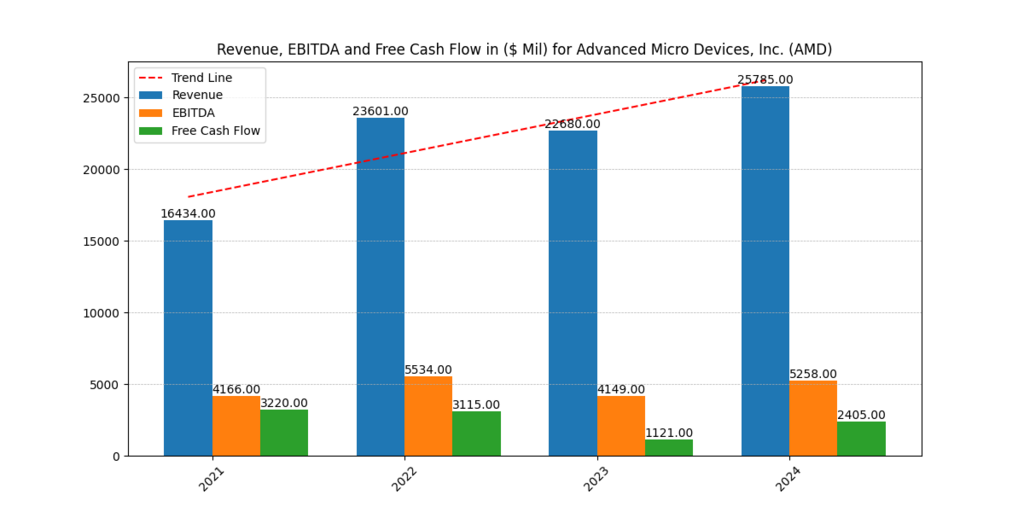

Figure 1. AMD revenue, EBITDA, and free cash flow trends from 2021 to 2024.

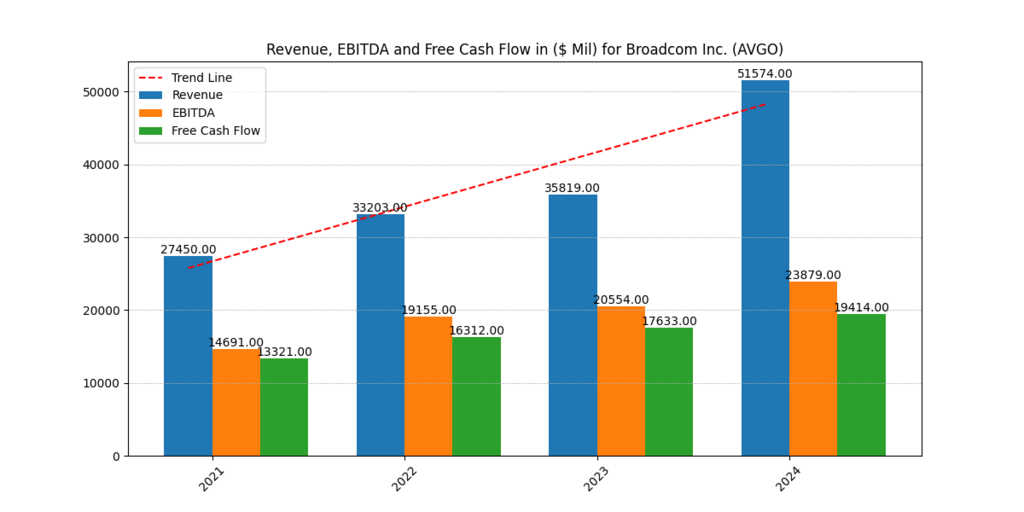

Figure 2. Broadcom revenue, EBITDA, and free cash flow trends from 2021 to 2024.

Broadcom was growing its revenue annually to around $51.6 billion in 2024, nearly two times that of AMD. AMD also grew substantially between 2021 and 2024, with a slight decrease in 2023 and an upswing.

Semiconductors have a problem with scale. Higher revenue bases will come in handy to offset downturns and fund long-term R&D. This stability will be generated by the size of Broadcom, but the expansion of AMD demonstrates the increase in the scope of applicability within the area of compute-intensive markets (AMD, 2024; Broadcom, 2024).

EBITDA and Free Cash Flow Strength

This is not the end of where revenue goes. The financial innovation and the financial crisis stability are achieved by generating cash.

EBITDA and Free Cash Flow (2024)

| Company | EBITDA ($ Mil) | Free Cash Flow ($ Mil) |

| AMD | 5,258 | 2,405 |

| Broadcom | 23,879 | 19,414 |

Broadcom has consistently generated a higher amount of free cash flow compared to AMD in the past. This indicates that the variability of earnings at AMD has risen since its free cash flow has reduced significantly in 2023 and risen in 2024.

The cash flow of Broadcom is sufficient to pay the dividends, acquisitions and continuous investment without relying on external debt financing. The 2024 recovery of AMD is satisfactory, and the cash flows are at a greater exposure to product cycles (Broadcom, 2024).

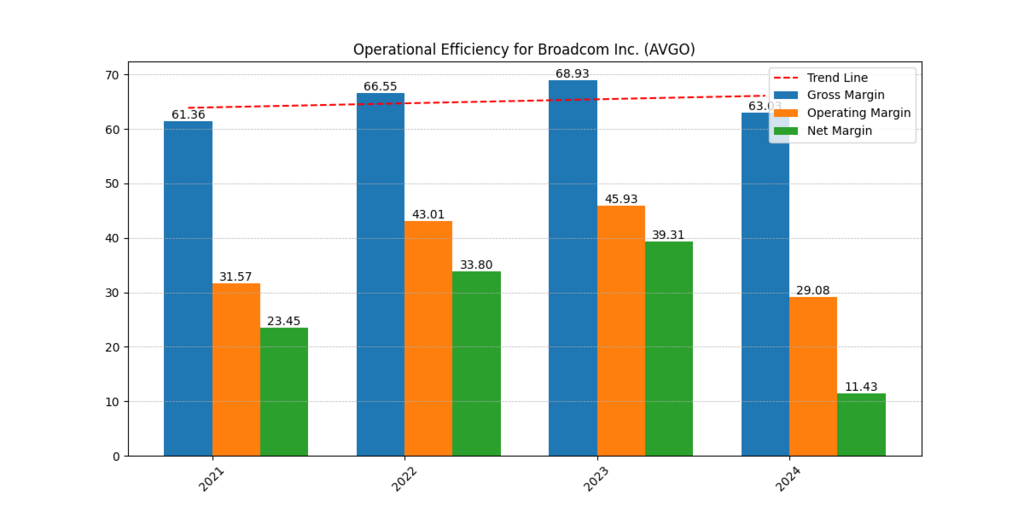

Operational Efficiency and Margins

Margins show how the companies are efficient in transforming revenue into profit.

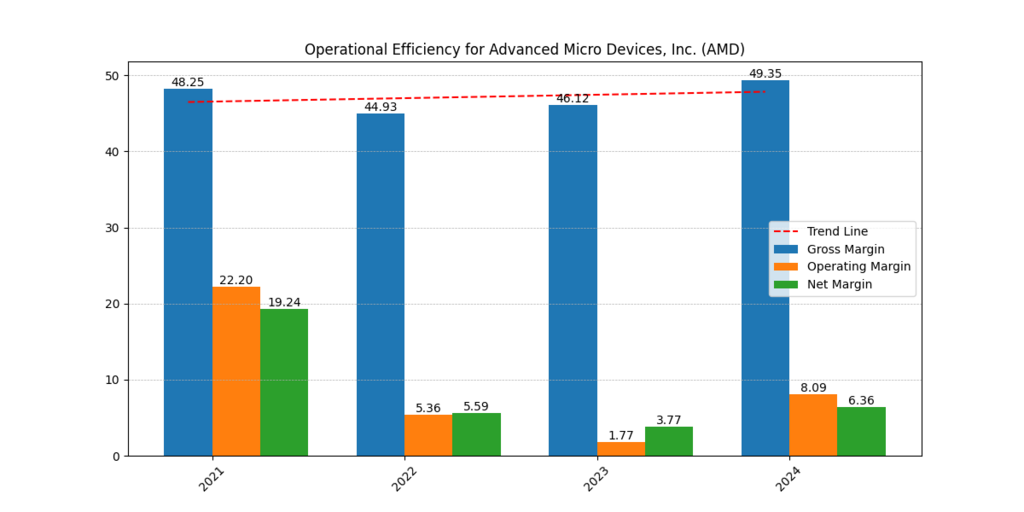

Gross Margin Trends

- AMD: It ranges between 48 per cent in 2021 and 49 per cent in 2024.

- Broadcom: It is projected to be at approximately 61 per cent in 2021, and 63 per cent in 2024.

Operating and Net Margins (2024)

| Metric | AMD | Broadcom |

| Operating Margin | ~8% | ~29% |

| Net Margin | ~6% | ~11% |

Figure 3. AMD gross, operating, and net margin trends from 2021 to 2024.

Figure 4. Broadcom gross, operating, and net margin trends from 2021 to 2024.

Broadcom was ahead of AMD in terms of margin all the time. It’s an AMD vs AVGO competitive landscape. The operating margin of AMD fell significantly against that of the last year (2020- 2024), with Broadcom recording high profitability despite a slight decrease in 2024.

Higher margins normally signify the strength of prices and diversification of revenues. Broadcom’s margin profile reflects the customer and infrastructure focus relations in the long term. The competitive environment and overindulgent expenditures on future products cause the reduced margins of AMD (AMD, 2024).

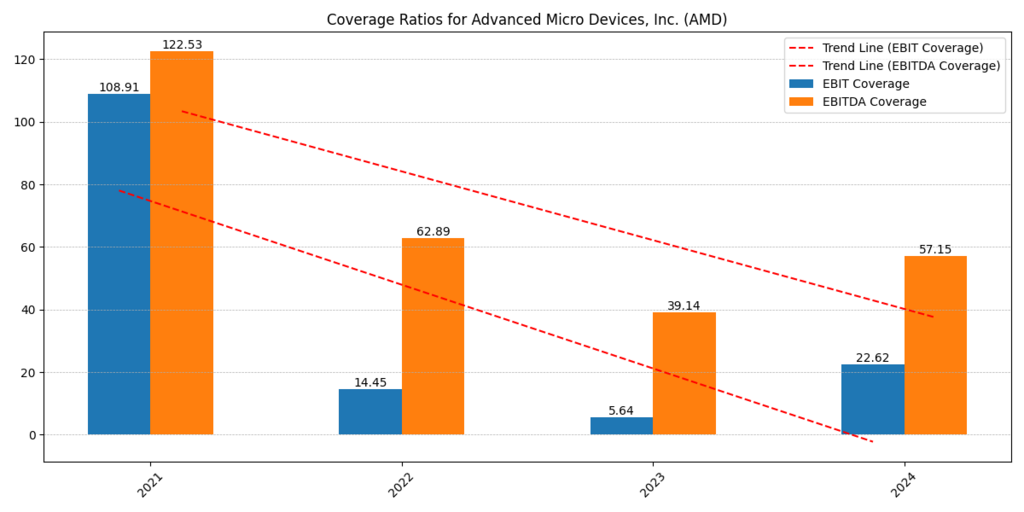

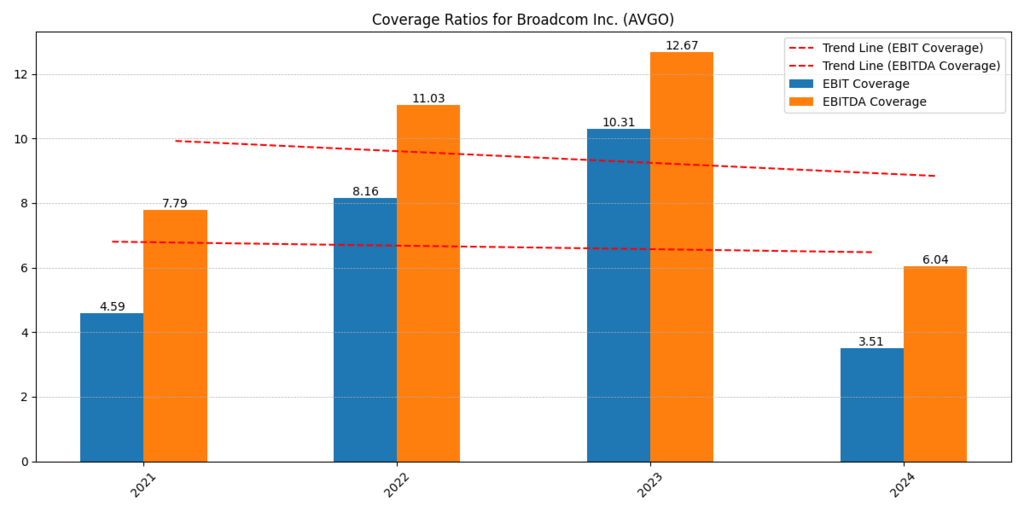

Coverage Ratios and Earnings Protection

Coverage ratios are used to determine the degree of comfort of the earnings in fulfilling the financial obligations.

Coverage Ratios (2024)

| Company | EBIT Coverage | EBITDA Coverage |

| AMD | ~22.6 | ~57.1 |

| Broadcom | ~3.5 | ~6.0 |

Figure 5. AMD EBIT and EBITDA coverage ratios from 2021 to 2024.

Figure 6. Broadcom EBIT and EBITDA coverage ratios from 2021 to 2024.

The coverage ratios of the AMH are much higher when compared to the situation of the good earnings of AMH. The reduced ratios of Broadcom indicate that it is leveraged but at manageable rates in view of the fact that it is cash-generating.

Earnings volatility is represented by a buffer in the coverage of AMD. Compared to high coverage multiples, Broadcom is also more reliant on stable cash flows, and this also aligns with the fact that it has a mature business structure (Broadcom, 2024).

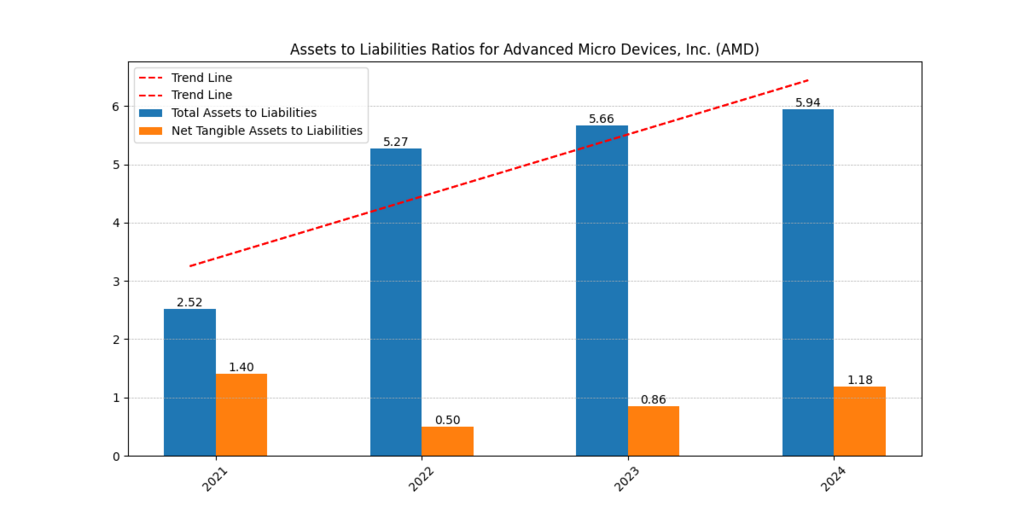

Balance Sheet and Asset Strength

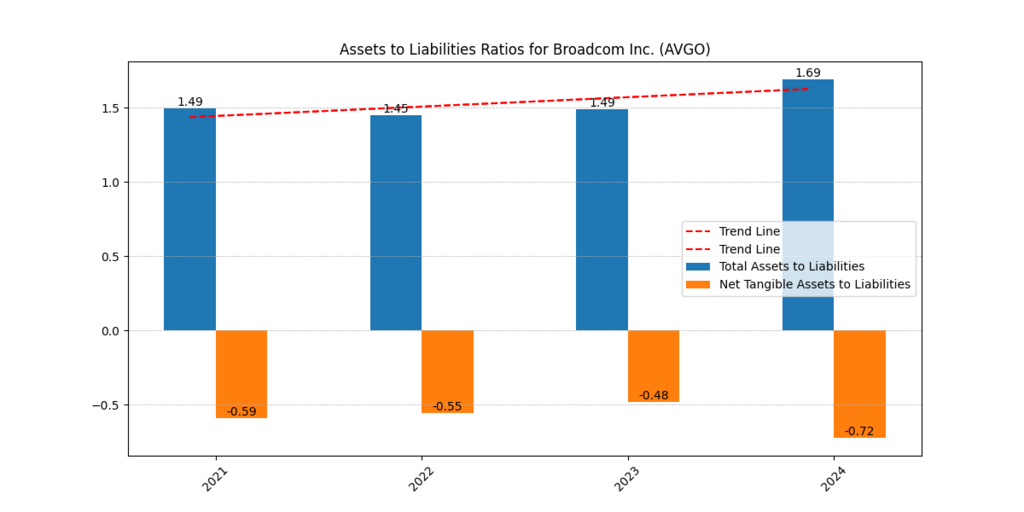

Assets to Liabilities (2024)

| Metric | AMD | Broadcom |

| Total Assets / Liabilities | ~5.9 | ~1.7 |

| Net Tangible Assets / Liabilities | ~1.2 | ~-0.7 |

Figure 7. AMD total assets and liabilities, including net tangible assets, from 2021 to 2024.

Figure 8. Broadcom’s total assets and liabilities, including net tangible assets, from 2021 to 2024.

AMD has a more favourable support of tangible assets in its balance sheet. The level of acquisitions and goodwill is reflected in the balance sheet of Broadcom, in that the net tangible assets are negative.

In times of recession, it will be adaptable to increase the tangible asset buffer. Such a form of organisation is characteristic of the purchase of technology firms, but the more conservative investors prefer the balance sheet profile of AMD (AMD, 2024).

Further Reading : Best Stocks to Buy for Long Term Growth Before 2025 Ends, Not Just Tech Stocks!

AI Exposure and Strategic Positioning

AMD Semiconductor Outlook 2026

The applicability of AMD to the demand of artificial intelligence largely owes to its processors and accelerators that are utilised in data centres. They are directly related products, such as machine learning, inference, and high-performance computing, that put AMD at the core of the AI system implementation. Powerful and massive AI models are becoming more in demand, and the line of products provided by AMD is designed to satisfy this demand ( Advanced Micro Devices, 2024).

Tactically, the greater data centre coverage of AMD will make it more vulnerable to the long-term AI implementation. According to the 2024 revenue data, it can be said that the year is a better year compared to the previous year, and this means that the demand has receded after several years of moderation. However, such high attachment to the computer demand is associated with increased exposure to the state of the market. The profit margins at AMD have been spreading with time, due to competition pricing and affordability of the high research and development costs.

Broadcom AI accelerator market positioning

Another and equally critical contribution that the AI ecosystem makes by Broadcom is different, nevertheless. Broadcom provides no processors to execute AI workloads, but rather, it provides networking, connectivity, and storage associated silicon, enabling an AI system to execute at high performance at scale. The mentioned elements are employed to communicate the information between servers, accelerators, and storage systems reliably and quickly, which is required during the implementation of the AI chip demand growth 2026 (Broadcom Inc., 2024).

The products of Broadcom are embedded in the data centre semiconductor leader, and therefore, its exposure to AI demand would not be as dependent on the specific processor or accelerator deployed. This gives Broadcom a less unstable demand curve, and sustainability of enterprise relationships and repetitive infrastructure refurbishment. This stability is also improved with good cash generation. However, the Broadcom sensitivity to AI is less direct, and it is influenced by bigger infrastructure investment cycles as compared to rapid changes in the demand for computing alone (Broadcom Inc., 2024).

Investor Comparison

The AMD vs Broadcom long-term potential debate, as a neutral investor, is consequently reduced to the kind of exposure an investor would like to have with the semiconductor sector investment trends. AMD is also associated with purposeful AI compute development, i.e. the performance is predetermined by the performance-based demand of processors and accelerators. It will be able to provide more growth opportunities in case of high AI adoption, and can also offer more variability in the earnings in case of a slower growth rate.

Broadcom, in its turn, is much nearer to the very stability of infrastructure and long-term cash flows. The fact that it can scale its data centres in a steady manner, rather than the temporary changes in compute intensity, can be employed to enhance its networking and connectivity business profile. Finally, both firms are viable but different, viable deals to venture into the new semiconductor environment, and the decision will be based on personal risk-prone and investment forecasts.

| Category | AMD (2024) | Broadcom (2024) |

| Revenue | $25.8B | $51.6B |

| EBITDA | $5.3B | $23.9B |

| Free Cash Flow | $2.4B | $19.4B |

| Gross Margin | ~49% | ~63% |

| Net Margin | ~6% | ~11% |

| Asset Strength | Strong | Moderate |

Conclusion

The comparison of AMD vs Broadcom semiconductor stocks attracts attention to the two alternative ways of the involvement of the investor in the AI cycle of semiconductor. The direct exposure of AMD to AI compute demand is higher as it has both processors and accelerators, which is supported by a comparatively good balance sheet and assets. At the same time, it has more fluctuating profitability and profit margins, a phenomenon that is representative of the cyclical and competitive nature of the semiconductor performance-based market. This puts AMD at the mercy of the fluctuations in the product demand and the trend of adoption of technology.

Broadcom provides another type of exposure. Its data centre infrastructure capabilities, networking and connectivity capabilities make it a background provider, and not an edge computer provider. Extremely high margins, consistent cash flow and size of the business offer Broadcom a certain level of financial stability that could be appealing to investors who are sensitive to predictability and long cash flows.

The two shares do not possess the objective superiority of all investors. This is finally decided using personal priorities, risk tolerance and portfolio strategy. AI-based investors may be more appropriate in AMD, and a more infrastructure stability, margins strength, and cash flow durability-focused investor may be more appropriate in Broadcom. Dispassionately, numbers-wise, the two companies are still on the list of the best semiconductor stocks to buy 2026, and they also have their own and essential place in the semiconductor space.

All calculations and valuation estimates are FinancialBeings’ own, based on data sourced from SEC filings AMD (10K and 10Q) and AVGO (10K and 10Q), use or reproduction before prior approval is prohibited.

Usama Ali

Usama Ali is the founder of Financial Beings and a self-taught investor who blends classic valuation study with insights from psychology. Inspired by works from Benjamin Graham, Aswath Damodaran, Stephen Penman, Daniel Kahneman, and Morgan Housel, he shares independent, data-driven research to help readers connect money, mind, and happiness.

Disclaimer

The content provided herein is for informational purposes only and should not be construed as financial, investment, or other professional advice. It does not constitute a recommendation or an offer to buy or sell any financial instruments. The company accepts no responsibility for any loss or damage incurred as a result of reliance on the information provided. We strongly encourage consulting with a qualified financial advisor before making any investment decisions.