Introduction

This study investigates the financial data of Alphabet Inc. (GOOGL) stock for a comprehensive analysis and identifies 2025 investment strategies and estimated fair value assessment.

Among the world’s leading tech companies is Google, a subsidiary of Alphabet Inc. (GOOGL). When Google first launched its search engine platform in 1998, it revolutionized web search and established several key business divisions including cloud services, artificial intelligence, digital advertising, and mobile technology development.

In addition to owning YouTube and Google Cloud, Alphabet Inc. also owns other AI-based initiatives that it has developed, like Waymo, which helps the business maintain its dominant position in international technology marketplaces. Despite consistently attaining financial success, Alphabet continues to maintain its trillion-dollar market value, which is present in both the S&P 500 and the Nasdaq. Investors can make better stock evaluation decisions for the 2025 period by analyzing Alphabet’s financial statistics and margins along with its anticipated growth.

Since Alphabet’s entire investment in the development of cloud services and AI foundation has no effect on the stability of its revenue, a pricing analysis of Alphabet is required. Projected stock values will be obtained by moving forward with market development research and financial metric analysis of recent and present university earnings results. For investors who intend to participate or just keep an eye on Alphabet’s current investments, the analysis provides crucial information about the company’s future strategy.

Alphabet Inc.: A Tech Giant with Strong Fundamentals

Alphabet Inc., the parent company of Google, stands as a dominant force in the global technology sector. Digital advertising plus cloud computing and artificial intelligence services with consumer electronics products allow Alphabet Inc to maintain its financial strength through stable fundamental business operations. The three main operating units of Google consisting of Search together with YouTube and Google Cloud generate sizeable revenue streams that drive continuous growth of company profits.

The market leadership of Alphabet appears through its robust fundamental structure and its steady sales business and thick operating profit margins. Google Cloud with its AI software solutions and strategic acquisitions and innovative solutions from the company secures lasting economic achievement. Alphabet maintains robust financial stability through its small debt levels and robust cash reserves along with a solid market positioning. The assessment performed on the financial aspects and fair market valuation positions Alphabet as either a buy-sell or hold asset for the year 2025.

Recent Developments in Alphabet Inc. (Google) – 2024

| Date | Development | Impact on Financials |

| Q1 2024 | Google Cloud reported 28% YoY revenue growth. | Increased revenue and improved margins. |

| Q2 2024 | Launched Gemini AI, a next-gen AI model. | Boosted AI adoption, higher R&D costs. |

| Q2 2024 | Regulatory fines in the EU for antitrust. | One-time legal expense, minimal long-term impact. |

| Q3 2024 | YouTube ad revenue surged 15% YoY. | Strengthened digital ad business, higher EPS. |

| Q4 2024 | $70B share buyback program announced. | Increased shareholder value, reduced share count. |

Financial Analysis

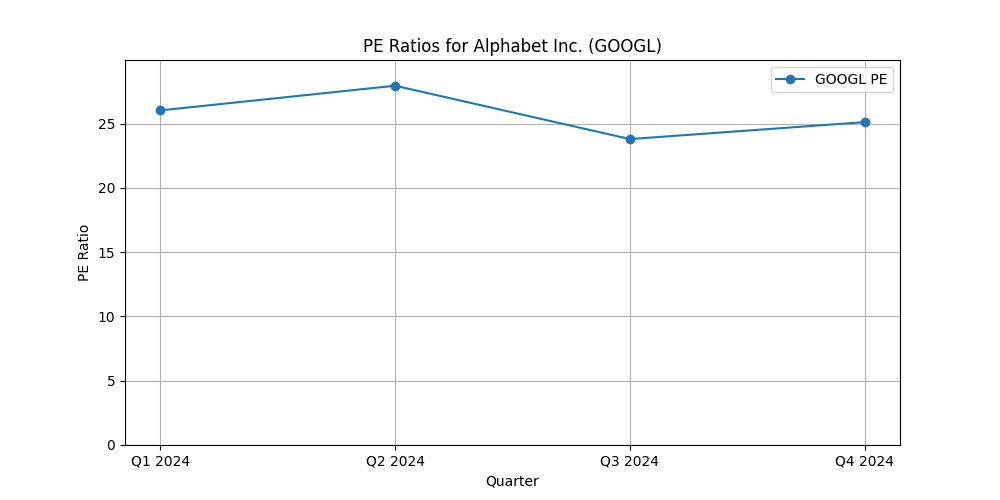

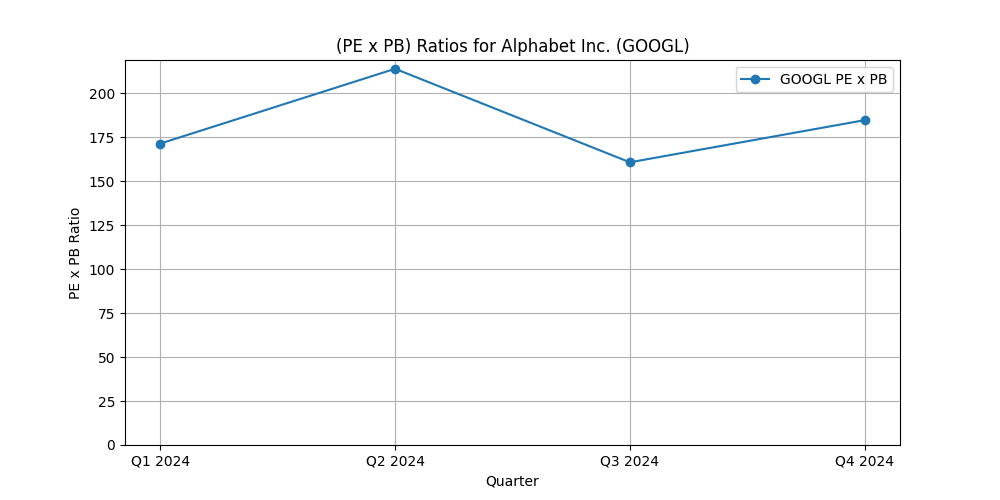

Price-to-Earnings (P/E) Ratio

The P/E ratio of Alphabet stood at 23.02 during Q4 2024 yet slightly fell from earlier values. The P/E ratio showed a change because the company recorded better earnings alongside investors becoming more realistic about growth expectations. The company demonstrates strong financial health through its demonstrated earnings growth of 31% which enhanced periodic earnings per share performance. A slight decrease in P/E ratio indicates earnings growth yet market expectations have diminished probably due to AI industry intensifying competition.

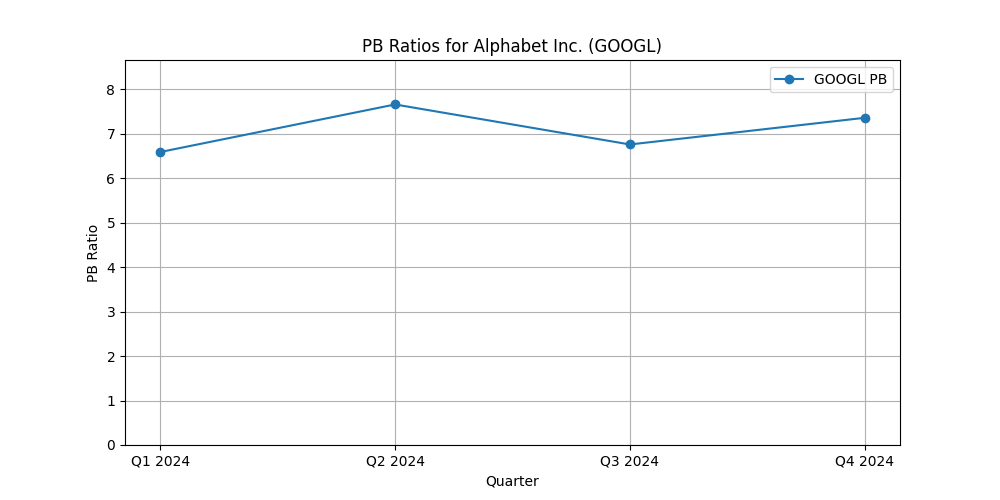

Price-to-Book (P/B) Ratio

The P/B ratio of Alphabet maintained high levels during 2024 because investors demonstrated substantial confidence in the company. In a company like Alphabet with substantial intangible assets consisting of patents and proprietary algorithms and brand strength the P/B ratio is expected to be high. Stock price changes during Q4 led to fluctuations in the P/B ratio even though book value alterations remained minimal compared to figures reported in Q1. Market investors show elevated valuation of Alphabet by assigning it values significantly higher than its tangible asset base making it a powerful technology firm with considerable market impact and future expansion potential.

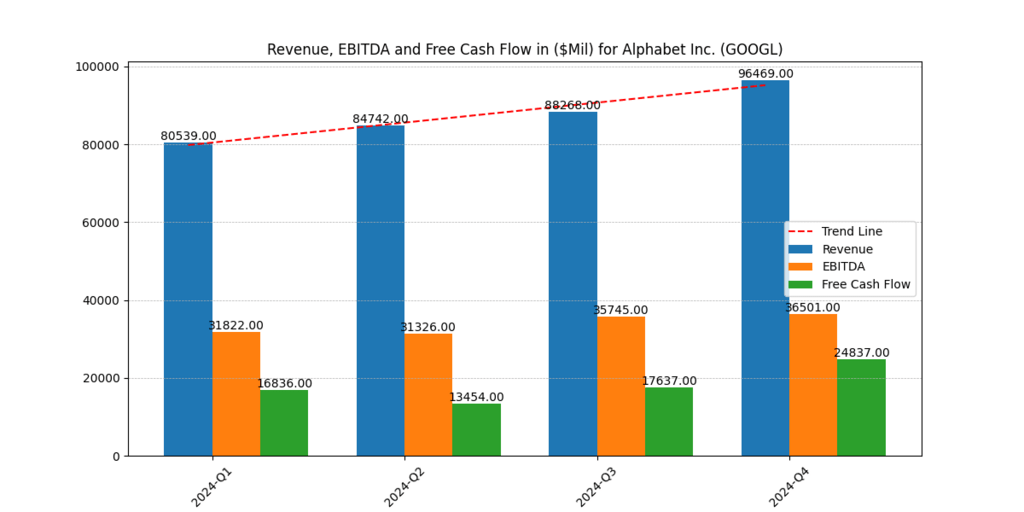

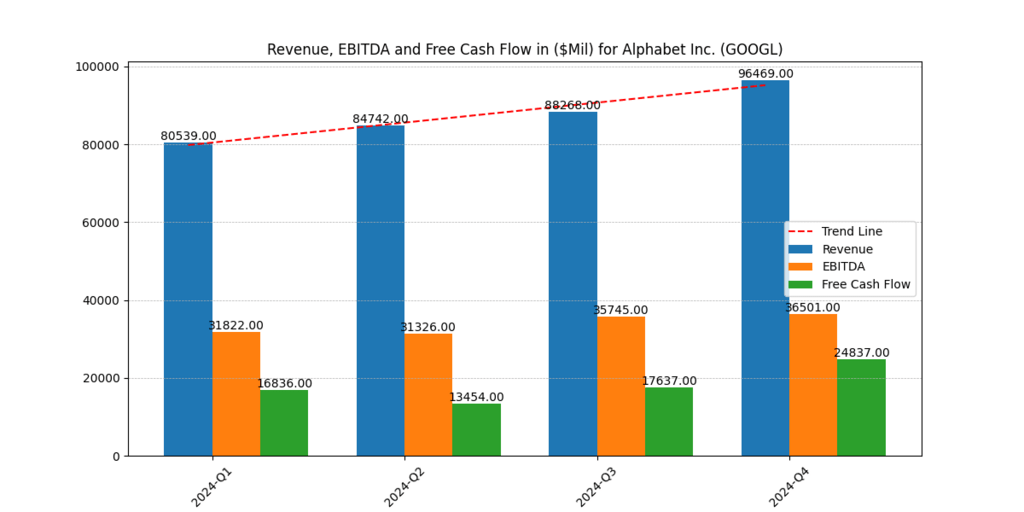

Revenue Growth

The revenue of Alphabet increased by 19.8% from $80.5 billion during Q1 to $96.5 billion during Q4 2024. The business expansion derived from growing advertising revenue and keep dominance of search engine functions plus rising Google Cloud product revenues. Google received the highest quarterly revenue during Q4 through increased holiday season ad spending. The company demonstrates resilience because it experienced double-digit revenue growth in challenging macroeconomic times. Alphabet maintains its dominance in the market and demonstrates adaptability to digital trends because of its sustainable upward revenue growth.

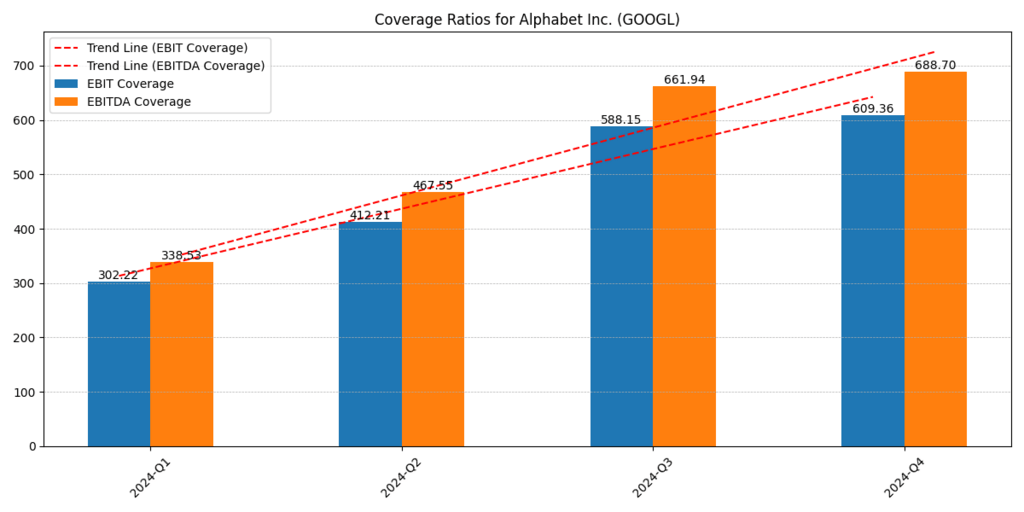

Earnings before Interest, Taxes, Depreciation, and Amortization (EBITDA)

Alphabet’s net growth in EBITDA value increased by 14.7% from $31.8 billion in Q1 to $36.5 billion in Q4. The business used cost savings to boost profitability and increase advertising investment for those market prospects inside the growing cloud computing industry. Alphabet had the operational advantage of size throughout this time, and it was still able to control costs efficiently even as they increased. Alphabet’s remarkable financial health and ability to generate substantial operational cash that is invested in AI solutions, cloud computing platforms, and other hardware initiatives, as well as its ability to generate more than enough money, are demonstrated by the fact that it has been able to increase EBITDA over a number of quarters.

Free Cash Flow (FCF)

Alphabet’s businesses generated $16.8 billion in free cash flow in Q1, which rose steadily to $24.8 billion by Q4. The financial results for the fourth quarter showed improved capital spending practices and higher revenue collection, while cost control techniques remained effective. Alphabet’s ability to finance its revolutionary ideas, buy back stock, and acquire new businesses is bolstered by a strong free cash flow (FCF). The reason behind this is that Alphabet generates enormous cash flows, which help to give the business operational flexibility. The company’s enormous cash reserves, which it uses to keep developing AI technologies, cloud infrastructure, and digital advertising campaigns, guarantee its financial security.

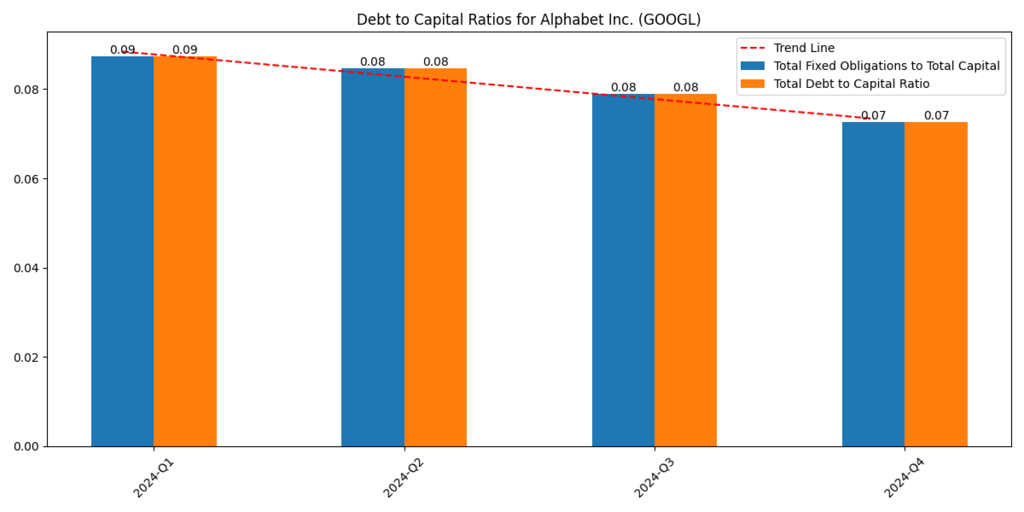

Debt-to-Capital Ratio

Alphabet’s debt-to-capital ratio dropped from 0.09 in Q1 to 0.07 in Q4 despite starting at 0.09 in Q1. Alphabet’s debt management approach demonstrates that the business can grow without taking on a significant amount of external debt. Alphabet’s robust cash reserves enable capital investments and protect the company from external borrowing risks, resulting in financial stability. Alphabet’s financial soundness lessens the impact of interest rate changes on its counterparts in the industry because of its low leverage position. Alphabet may leverage economic cycles of a low debt-to-equity ratio to employ sustained growth strategies that protect wealth for owners.

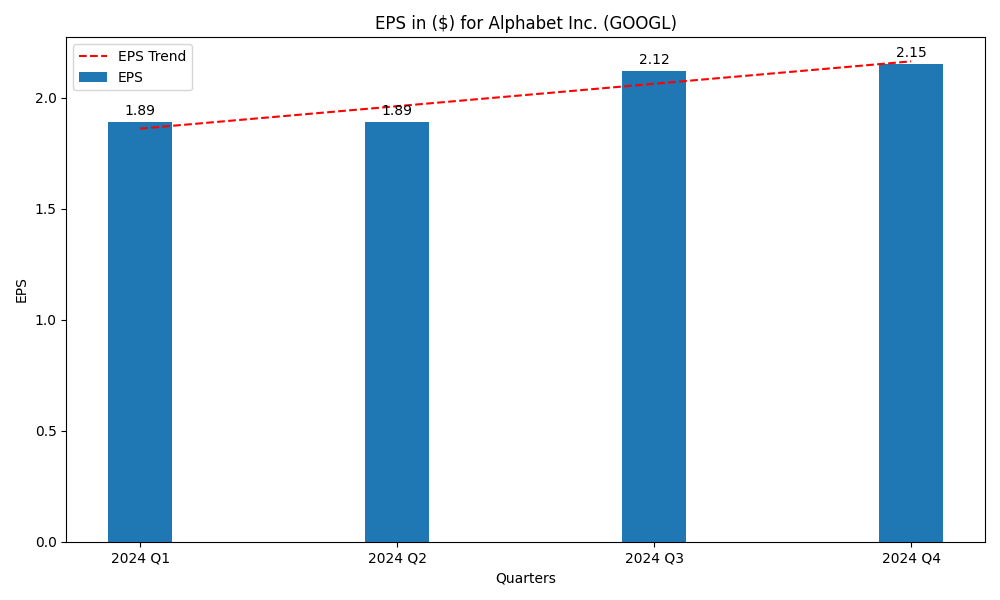

Earnings per Share (EPS)

Earnings per share at Alphabet increased from $1.89 to $2.15 during the first and fourth quarters of 2024 which reflects both strong profitability along with expanded revenue levels. Shareholder value grows effectively at Alphabet because the company maintains persistent growth in earnings per share. Higher EPS trends generate investor confidence that results in market valuation increases through higher stock prices. The company boosted earnings per share through revenue expansion into Google Cloud while optimizing costs along with the development of AI-driven products. The rising EPS figures of Alphabet show its dedication to implementing its strategic market leadership approach alongside financial growth.

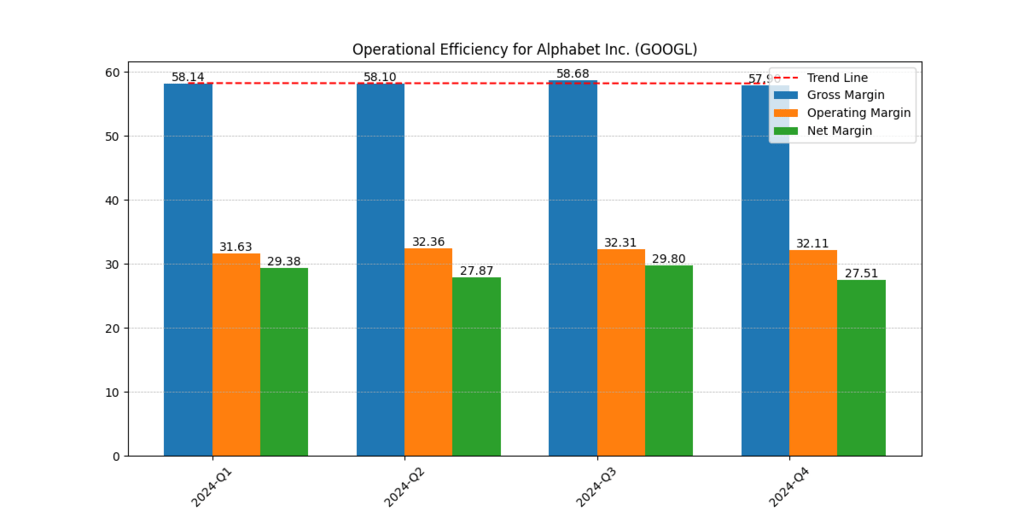

Profit Margins

The gross margin of Alphabet maintained 58% during Q4 2024 with operating margin settling at 32.1% and net margin remaining stable at 28%. Operational efficiency at Alphabet remains strong because the company successfully keeps its financial margins stable. Profitable financial margins stem from the AI-based operating efficiency systems of the company which establishes its strong business position and competitive market strength. All strategic business decisions made by Alphabet produced positive financial results after allocating new capital funds and operating effectively.

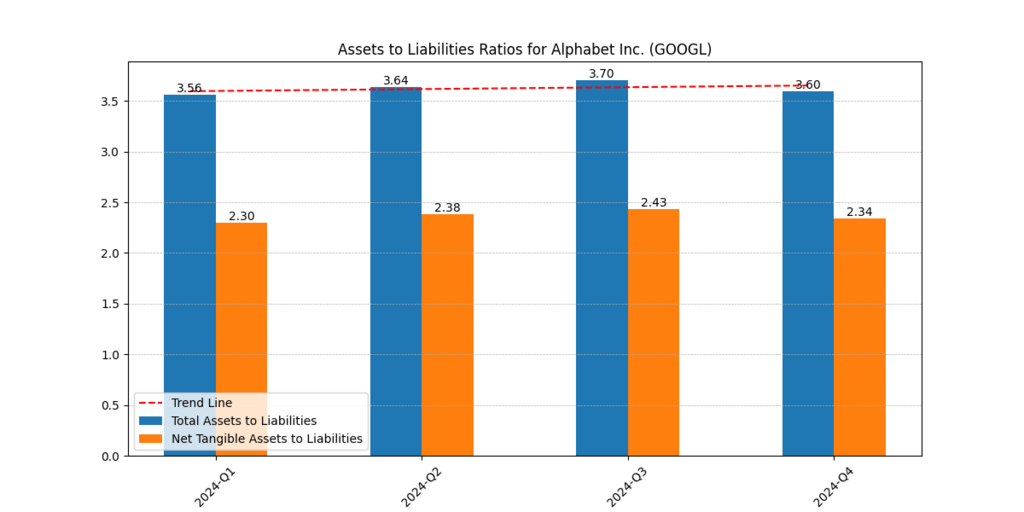

Balance Sheet Strength

The balance sheet performance of Alphabet continued being robust during the full year of 2024 because its assets-to-liabilities ratio remained above 3.5. The company utilizes large cash reserves together with low debt for strategic acquisitions and important investment opportunities. The strong financial status of Alphabet lets the company maintain operational stability across tough economic conditions and accomplish its growth objectives. The business future of Alphabet remains secure because its research and development funding runs independently from heavy borrowings. Alphabet has proven itself as one of the most financially secure technology companies active in markets today.

Fair Value Estimates for Alphabet (GOOGL)

| Growth Scenario | Fair Value per Share |

| High Growth (Increasing Revenues and Margins) | $272 |

| Medium Growth (Slight Revenue Increase, Sustained Margins) | $245 |

| Low Growth (Declining Revenues and Margins) | $181 |

Alphabet Inc Valuation analysis focuses on the projections of several growth estimates based on the expected changes in the company’s revenue and margin earnings. On the basis of substantial revenue growth and improved margins, we expect the company share price to be $272 per share on high growth conditions. For medium growth conditions of steady margins with moderate revenue growth the fair value is $245 per share.

When revenues fall while keeping poorer margins, the projected fair value drops down to $181 per share. The assessment makes an evaluation of the future earnings performance of Alphabet as a company as well as its Artificial Intelligence market position and economic factors that influence the digital advertising, cloud service professions. Here is our Comparison of Google Parent Alphabet Inc. (GOOGL)with other Magnificent 7 Stocks.

Additional Key Developments in Alphabet Inc. (Google) – 2024

| Date | Development | Impact/Significance |

| Q1 2024 | Expanded Google Fiber to 10 new cities. | Strengthened internet services division, increasing market share. |

| Q2 2024 | Android 15 launched with advanced AI integration. | Enhanced ecosystem stickiness, driving device sales and user engagement. |

| Q2 2024 | Announced partnership with OpenAI for AI research. | Improved AI capabilities, potential competitive advantage over rivals. |

| Q3 2024 | Google Search introduced generative AI-powered results. | Higher ad efficiency and potential revenue growth. |

| Q4 2024 | Acquired a major cybersecurity firm for $5B. | Strengthened Google Cloud security offerings, enhancing enterprise appeal. |

Conclusion

Alphabet Inc.’s 2024 financial results indicate that investing in the strategy was evolving to adapt to the market changes and growing revenue and improving the margins. The company’s fair value assessment is strong given macroeconomic and regulatory challenges that the company faces. Investors should include earnings pattern, market condition, AI and cloud computing

**Please be informed that the content is informational and by no means serve as a buy or sell signal. The company is not responsible for the loss of capital.