Introduction

Is Advanced Micro Devices (AMD) stock overvalued going into 2025? This financial study covers the evaluation of AMD’s revenue expansion together with profitability analysis and valuation assessment. Discover key insights before investing.

Advanced Micro Devices (AMD) stands as a leading semiconductor company that produces high-performance processors combined with graphics cards. The company began operations in 1969 and has since become one of the top players in both computing and gaming sectors through its direct competition against Intel and NVIDIA. The company offers Ryzen CPUs along with Radeon GPUs together with EPYC data center processors while continuing to expand their market presence in important sectors. AMD has adopted a rapid expansion strategy in AI combined with data center and customized silicon initiatives which pursue opportunities within high-performance computing markets.

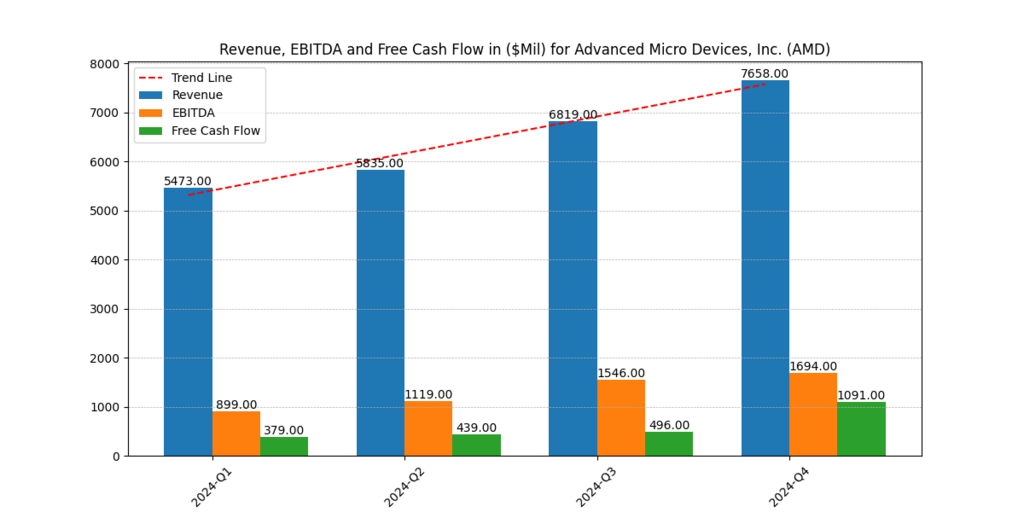

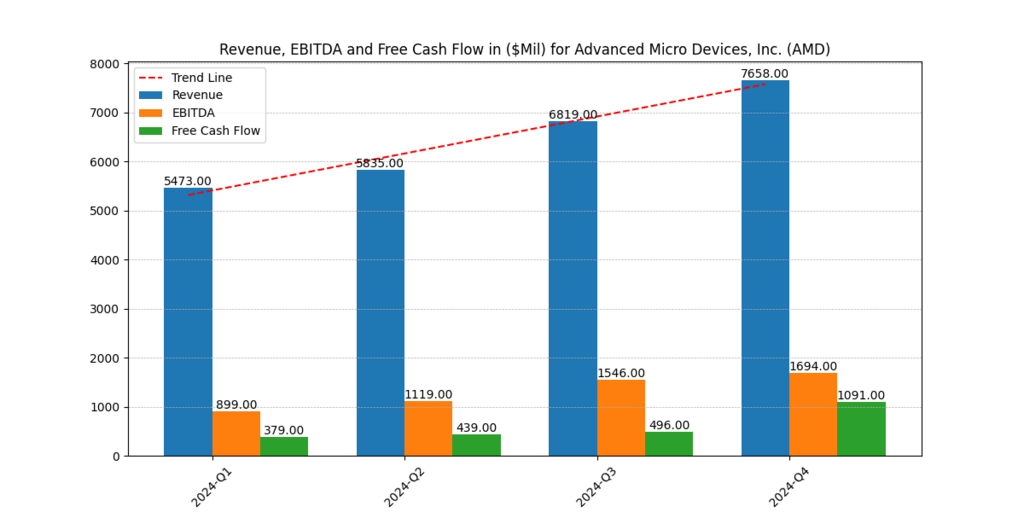

The company’s dominant technology performance encounters problems related to aggressive sector competition and fluctuating semiconductor market demand together with macroeconomic market volatility. AMD showed consistent revenue advancement in 2024 as their first quarter revenue started at $5.47 billion and reached $7.66 billion in the fourth quarter. CEO Lisa Su indicated that AMD’s Q1 2025 revenue will decrease by 7% sequentially which causes market concerns over future growth rates.

This blogpost carried out a thorough examination of AMD stock through an evaluation of revenue performance and profitability margins and earnings per share results and free cash flow generation and market valuation factors. Potential investors need to evaluate the growth possibilities of AMD in addition to its competitive space and financial health when they plan future purchases for the semiconductor market. [1]

Key takeaways

1. Reliable figures demonstrate that AMD achieved revenue growth during 2024 yet the organization forecasts a Q1 2025 financial period with a 7% sequential decline.

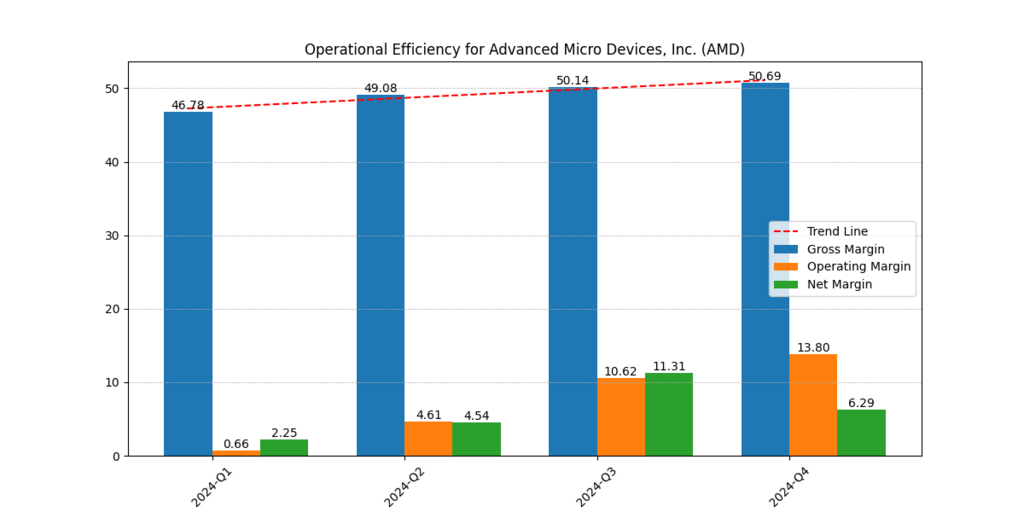

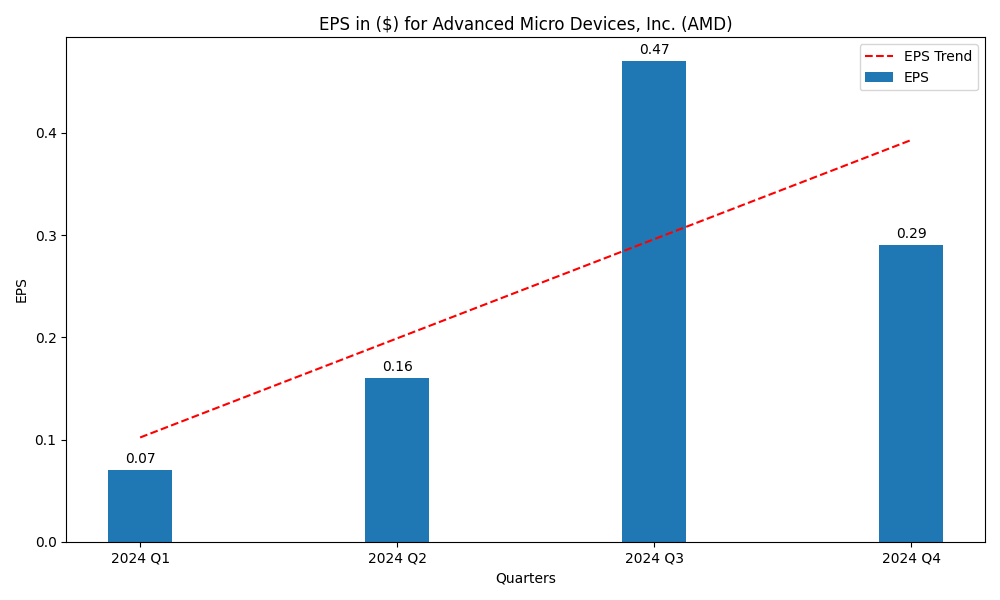

2. The company experienced expanding gross margin levels across 2024 even while Q4 earnings per share diminished.

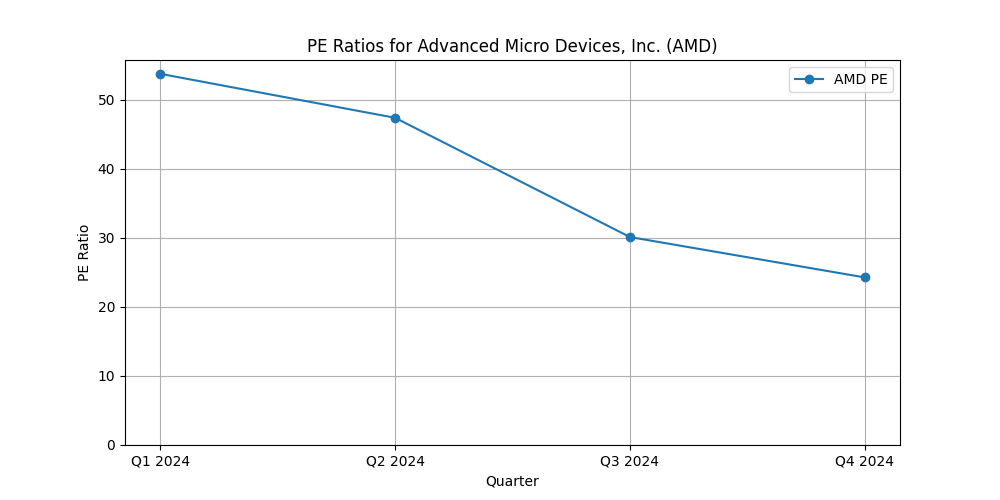

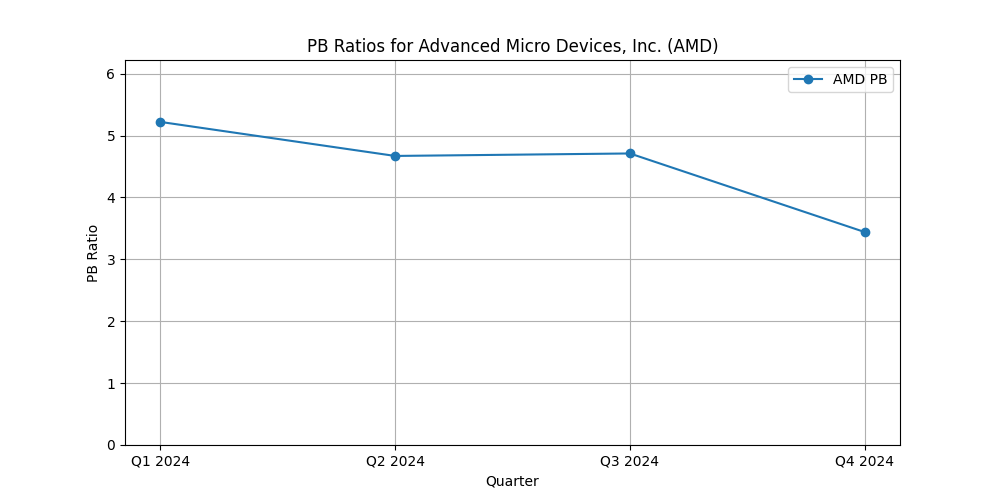

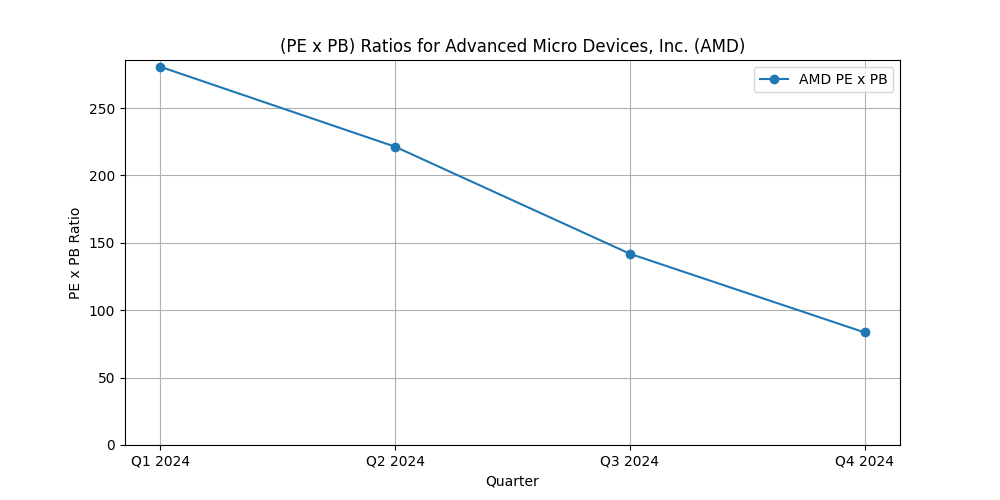

3. Market sentiment towards the stock appears unfavorable when considering current PE and PB ratios.

4. Investors need to monitor possible market forces that could impact AMD’s revenue divisions.

Financial Analysis for AMD Stock

Revenue Trends: Growth and Decline

AMD achieved a continuous revenue rise between Q1 and Q4 of 2024 as their earnings amounted to $7.66 billion in Q4 from $5.47 billion in Q1. CEO Lisa Su predicted Q1 2025 revenue will fall 7% from the previous quarter because specific market segments show reduced demand. The company maintains steady growth from gaming and data center business units although insufficient demand within the client segment holds back complete revenue expansion.

The company pushes forward with expansions into AI alongside high-performance computing positions as it seeks long-term market success. Investors should track revenue patterns with caution because of macroeconomic challenges and industry transition factors which affect semiconductor market sales. The biggest competitor of AMD is NVIDIA, read our in-depth anaysis on NVIDIA Stock Analysis 2025.

Gross, Operating, and Net Margins for AMD

AMD achieved gross margin expansion between Q1 and Q4 where gross margin rose from 46.78% to 50.69% because premium product pricing combined with shifts in profit-making consumer bases. Operating margin showed significant growth during the fourth quarter so it reached 13.80% from its initial 0.66% start in the first quarter indicating improved cost control and operational effectiveness.

The net margin reached its highest point at 11.31% during Q3 but then fell to 6.29% in Q4 possibly because of increased costs or exceptional expenses. The fluctuating business performance demonstrates that AMD generates sustainable profits from its main operations yet outside market forces alongside investment expenses continue to affect earnings growth. Investors need to evaluate cost trends together with overall market patterns in their analysis.

Earnings per Share (EPS) Analysis

Earnings per share (EPS) figures at AMD jumped from an initial $0.07 during Q1 2023 to peak at $0.47 in Q3 before settling at $0.29 in Q4. The company delivered robust earnings expansion during the mid-year period yet Q4 results indicate potential profitability problems. The decrease in EPS shows signs of increasing operational expenses and lower than forecasted net margins even though revenues expanded. The potential revenue decrease in Q1 2025 discussed by the CEO requires investors to prepare for possible earnings fluctuation. The future EPS growth of AMD depends on their success in controlling operating expenses and expanding AI-based revenue streams and handling competition within the semiconductor market. [2]

Free Cash Flow and Liquidity Strength

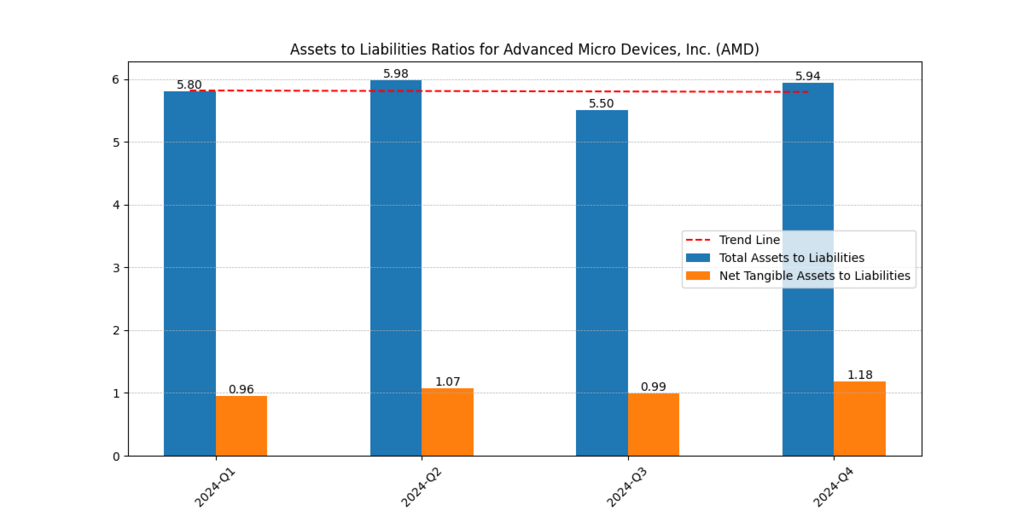

The free cash flow (FCF) at AMD rose considerably from Q1 2024 when it was at $379 million up to Q4 where it reached $1.09 billion. The company demonstrates its ability to generate extra cash funds through its strong FCF growth despite changes in profitability. The assets-to-liabilities ratio maintained a stable position at 5.80 across the whole year which demonstrates AMD has a secure financial foundation and protects its obligations.

AMD maintains strong liquidity that gives it flexibility to undertake investments in AI technology AI research development as well as potential acquisitions using surplus cash flow. Investors need to monitor how AMD distributes its cash reserves because they should analyze whether these funds support innovation activities and semiconductor market penetration in growing segments. [3]

Valuation Concerns: Is AMD Stock Expensive?

Investors need to evaluate AMD’s fair value against its projected earnings because the CEO projects decreasing revenue during Q1 2025. The decline in EPS generates doubts about the long-term ability of the company to maintain consistent profit levels even though revenue and margins show positive signs.

The potential upside growth of AMD could be constrained because of competition it faces from both Intel and NVIDIA in the AI and data center sectors. Investors should carefully evaluate risks because AMD maintains its position as a durable long-term player even though its premium market assessment warrants caution before investing at present prices.

AMD’s AI-Related Projects and Initiatives

| Project/Initiative | Description | Target Market | Launch Year |

| MI300X AI Accelerator | High-performance AI GPU designed to compete with NVIDIA’s H100, optimized for large language models (LLMs) and AI workloads. | Data centers, AI training, cloud computing | 2024 |

| Xilinx AI Engine (AIE) | AI-powered adaptive computing solution acquired from Xilinx, enhancing AMD’s AI and edge computing capabilities. | Edge AI, IoT, Automotive, Aerospace | 2023-2024 |

| Ryzen AI Processors | Integration of AI accelerators into Ryzen CPUs, enabling AI-driven features for PCs and laptops. | Consumer PCs, Enterprise AI applications | 2024 |

| EPYC AI Chips | AI-optimized server CPUs for cloud and data center applications, enhancing AI inference and processing power. | Cloud providers, Enterprise AI, Data Centers | 2024 |

| Acquisition of Nod.ai | Strengthening AI software capabilities by acquiring Nod.ai to improve AI frameworks and developer tools. | AI model deployment, Enterprise AI software | 2023 |

| Partnership with Microsoft & Meta | Collaborating with major tech firms to enhance AI hardware acceleration for cloud AI workloads. | Cloud AI, Enterprise AI, Generative AI | 2024 |

AMD is aggressively expanding its AI portfolio, focusing on data centers, AI accelerators, and adaptive computing to compete with NVIDIA and Intel in the rapidly growing AI market.

AMD’s Competitive Position in the AI Market

AMD speeds up its market positioning as a dominant AI industry player while challenging competencies of NVIDIA and Intel. AMD launches the MI300X AI accelerator to obtain substantial market share in the AI data center sector where NVIDIA enjoys overwhelming control through H100 GPUs. The recent acquisition of Nod.ai by AMD provides the company with enhanced AI software tools to help developers improve AI model performance on AMD hardware platforms.

The EPYC AI chips from AMD provide cloud providers and enterprises with AI-optimized CPUs that enable them to use fewer NVIDIA GPUs during inference. AMD shows its full commitment to AI technologies by embedding AI engines into Ryzen chips which serve consumer and enterprise PCs. The company continues to tackle ongoing hurdles despite its remarkable achievements. The extensive adoption of NVIDIA’s CUDA platform presents an insurmountable barrier which hinders developers from making transitions to different systems.

Through its business agreements with Microsoft Meta and other cloud firms, AMD continues to build stronger market presence. AMD’s AI success in the upcoming years will be determined by how their hardware performs along with the level of software support and customer market acceptance. AMD can increase its AI-related revenue at scale while delivering competitive AI accelerators to become more attractive to investors over the long term.

AMD’s Strengths vs. Challenges

| Strengths | Challenges |

| Strong presence in the gaming, data center, and AI markets | Intense competition from NVIDIA and Intel in AI and GPU sectors |

| MI300X AI chips gaining traction in enterprise AI workloads | Dependence on TSMC for chip manufacturing, limiting supply chain control |

| Consistent improvement in gross margins and profitability | Stock valuation concerns, as high PE and PB ratios indicate overvaluation |

| Expansion in embedded and automotive segments, diversifying revenue streams | Slowing demand for consumer PC processors, affecting overall revenue growth |

| Strong strategic partnerships with Microsoft, Google, and Tesla for AI projects | Macroeconomic risks such as interest rates and global demand fluctuations |

| Focus on energy-efficient chips, meeting sustainability demands | Software ecosystem needs improvement to compete with NVIDIA’s CUDA dominance |

Conclusion

The semiconductor industry leader AMD continues to establish itself through outstanding business growth throughout the years. The company maintains its strategic growth through key markets such as gaming and data centers and artificial intelligence yet its recent financial reports show both positive and negative signs. The recent financial results of AMD revealed sequential revenue growth for data centers and embedded segments which led to a 7% predicted revenue decrease in the first quarter of 2025 according to CEO Lisa Su.

AMD achieved a significant increase in gross profit margin to 50.69% during Q4 2024 because of its strong pricing systems and cost management capabilities. EPS is predicted to decrease by $0.18 from $0.47 to $0.29 within Q4 2024 which signals potential profitability issues. Free cash flow experienced significant growth in Q4 but investors need to examine all valuation ratios carefully before making an investment decision due to the stock’s seemingly overvalued position. AMD demonstrates direct competition with NVIDIA because of its planned AI innovation and MI300X accelerator chips development.

The growth prospects for AMD depend on its ability to properly expand its AI operations while addressing software system hurdles. Macroeconomic market forces along with competitive challenges persist as key risks for the company. Investors should consider AMD stock because of its highly potent growth capabilities although its market fluctuations can be intense. Assessments regarding AMD’s future business path must focus on next-generation financial reports and Artificial Intelligence development alongside market environment observations.

**Please be informed that the content is informational and by no means serve as a buy or sell signal. The company is not responsible for the loss of capital.