Introduction

Adobe stock price forecast 2030: Discover how AI inventions contribute to Adobe’s growth, detailed fair value estimates under the growth scenarios, and other financial characteristics. Will the price of Adobe stock increase or decrease? Find out possible facts and estimated figures about Adobe for the year 2025.

During the last few years, Adobe Inc. has become not only a leading developer of creative applications for design and multimedia sector but also a key player in the field of artificial intelligence (AI) that contributes to the company’s further development and growing impact on various production sectors. The products of Adobe Inc., such as Photoshop, Illustrator, and Adobe Experience Cloud have been steadily incorporating AI as a way to augment both ease of use and productivity.

These products not only distinguished Adobe in the landscape of the creative software from its competitors but also made the company a leader in artificial intelligence-augmented productivity tools. In this article, we will discuss about Adobe’s financial predictions and fair value estimates for the stock while examining how its AI strategies may affect its valuation in 2025. Despite the fact that we shall not give direct buy or sell signals, investors can learn from this post the significant factors to consider when investing in Adobe Inc. through showing key financial indicators and possible growth trend scenarios.

What is Adobe?

Adobe Inc. is a software company, which has specialized in digital media, marketing and document solutions. Adobe was started in the year 1982 and revolutionized the graphic designing world with photo editing tools like Photoshop, illustrator film editing tool premiere etcetera shaping the designs of the present day photographers, graphic designers, and filmmakers. Adobe basic capabilities include digital media creation where Adobe is an indispensable tool for graphic designers, and digital marketing where Adobe Experience Cloud offers customer management and their experiences across the organization.

Adobe’s business model is mainly dependent on services selling creative cloud products that are inclusive of design, video, and web development tools. This shift to subscription has proved to be beneficial for Adobe to gain fixed consistent revenue stream making it as one of the most successful technological companies.

Research on Adobe in AI

Adobe has successfully incorporated AI into all its products using its AI technology known as Adobe Sensei. Sensei provides the basis for a number of intelligent functions in Adobe products and services for creative and marketing, making work faster, more efficient and of higher quality with less intervention. In creative software like Photoshop, it provides and runs the content-aware fill, recognize objects, and create neural filters to let the users edit an image in a more creative way with less effort.

In Adobe Experience Cloud, Sensei employs machine learning in data analysis as well as customer experience management through relevancy as well as journey orchestration wherein businesses acquire valuable intelligence for interaction enhancement. Presently, Adobe is continuously exploring and integrating AI to make challenging processes more manageable and enrich experience and performance of each product. [1]

In addition to improving current solutions, Adobe’s work in AI also covers new areas that can create the next generation of creativity and marketing. Hence, the Organization is currently developing specific AI applications in areas of real-time teamwork, content generation, and predictions that enable users to generate customized content in volume. Adobe has also adopted machine learning and Artificial intelligence as key research areas in a bid to keep up with the market trends and the growing internal development of digital business. It also helps to enrich Adobe’s product portfolio that in turn strengthens Adobe’s competitive advantage and positions Adobe at the forefront of the converging technologies revolution in the creative and marketing industries.

Products of Adobe in AI

Adobe Company has embraced artificial intelligence across the organization, and this has boosted efficacy and usability across products. AI enhanced elements available in Photoshop, including Neural Filters, which refer to AI-enabled functionality that enables one to change facial expression or age of the people captured in the picture as well as content aware fill where Adobe Sensei intelligently erases a part of an image or transfers it to another position. Similarly, video editing in Adobe Premiere Pro has integrated AI, for instance Auto Reframe, which crop and adjusts the footage to other dimensions, very useful for social media content.

Adobe Illustrator employs AI to integrate new design features that help to make the work of an illustrator faster, for instance, the color theme extraction instrument allows the user to redecorate artwork on the basis of sketched-up themes or references. More AI plays of the future Best AI Stock to Buy Now in 2024!

Adobe Experience Cloud, for example, uses artificial intelligence to enable advanced data analysis and related personalization functions that can help businesses to achieve the necessary level of control over their engagements with customers. The targeted real-time predictions assist the businesses to offer customers timely solutions for their needs and thereby increasing engagement and conversion ratios.

AI is also integrated into Adobe Sign and helps to streamline the document’s sending and processing and to improve the security level. These AI enhanced products of Adobe are enabling the people and corporate houses to work more creatively, smartly and efficiently by innovatively integrating the artificial intelligence in their content creation tools, proving Adobe as one the leading technology companies that are spearheading the technology convergence of AI and content generation.

Shareholder‘s Metrics for Adobe

| Metric | Value |

| PE Ratio (TTM) | 45.14 |

| PB Ratio (TTM) | 15.5 |

| Market Cap (USD) | $225,300 million |

| Revenue Growth (2021-2024) | |

| 2021 | $15,785 million |

| 2022 | $17,606 million |

| 2023 | $19,409 million |

| TTM (Trailing Twelve Months) | $20,429 million |

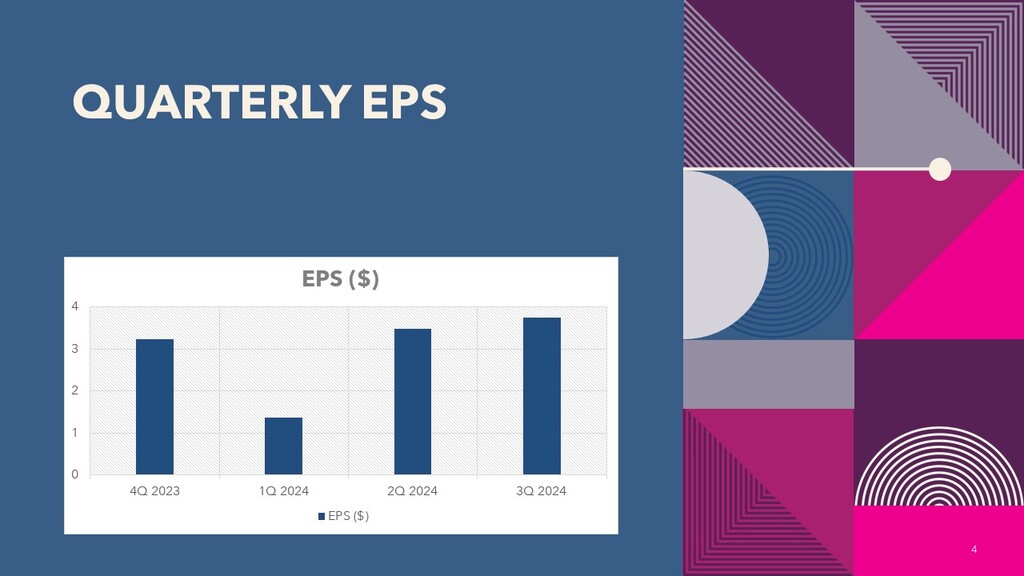

| EPS (TTM) | $11.79 |

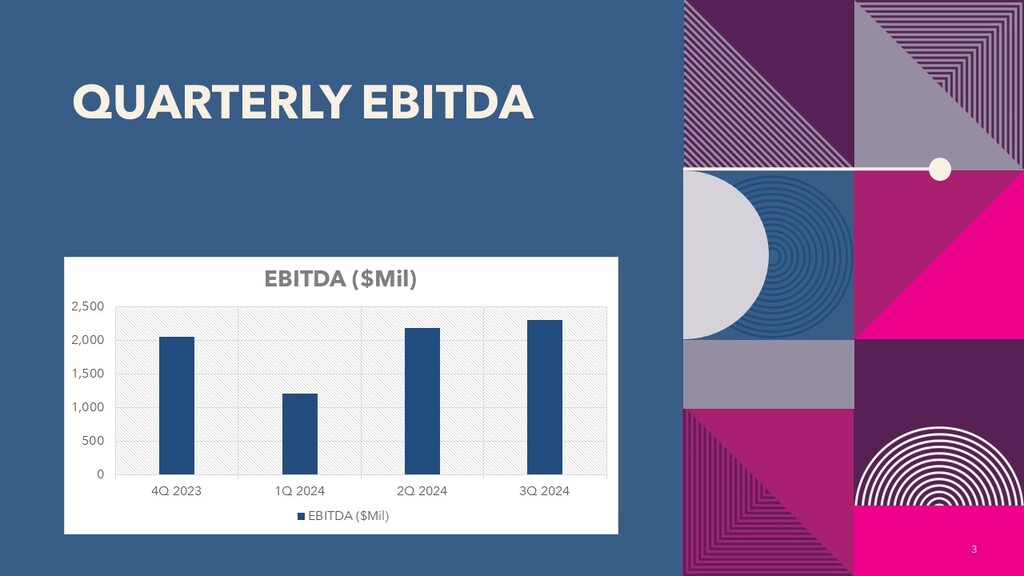

| EBITDA (TTM) | $7.76 billion |

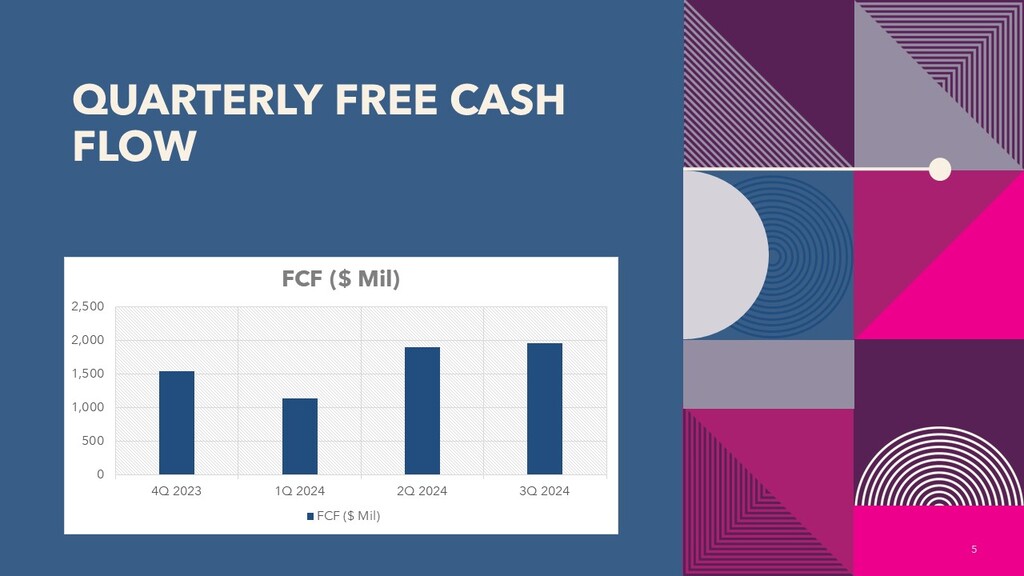

| Free Cash Flow (FCF) | |

| 2021 | $6,882 million |

| 2022 | $7,396 million |

| 2023 | $6,942 million |

| TTM | $6,368 million |

Analysis of Adobe’s Growth

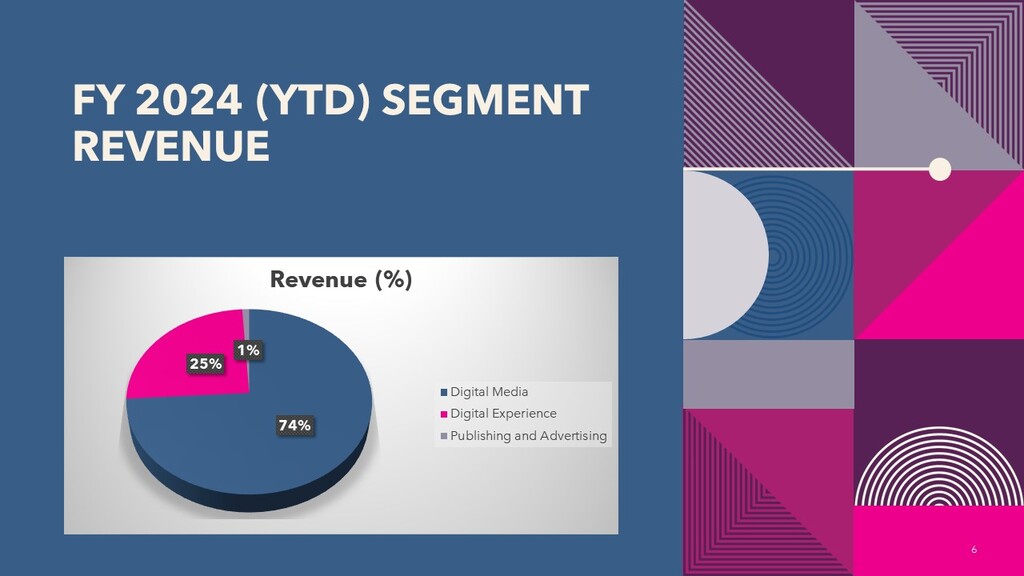

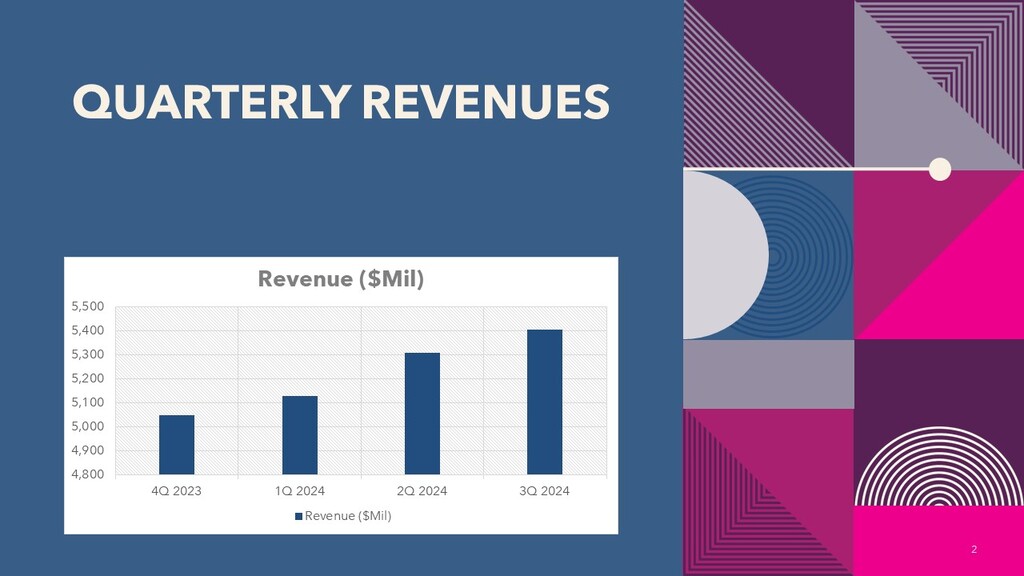

Adobe’s trends of revenue in the past few years demonstrate its transformation from being a creative suite provider to an AI-based digital media and marketing solutions provider. Total revenue has continuously grown from $15.8 in 2021 to $20.4 billion TTM for 2024 suggesting that it enjoys constant demand for all its products.

This growth is contributed by shift in strategic direction with the company shifting to a subscription model for Creative Cloud. Further, Adobe has with time introduced new segments to cater for digital marketing and document management that include Adobe Experience Cloud and Adobe Sign hence expanding the market and reducing the market dependency on a single product. [2]

Adobe’s AI focus appears to be a significant driver of future growth and its tool, AI, is called Adobe Sensei. Innovative deliveries of AI features ultimately support more proficient and deeper operations which in return, create value for consumers and provides products with more appeal. Current customers’ needs in both consumer and enterprise markets are met by Adobe’s continuing strategic AI development in areas like automated design, predictive analytics, and data-driven real-time personalization. It could maintain this growth as applications of Artificial Intelligence are poised to become increasingly core to business and creative industries. If Adobe will persist on creating new solutions and leveraging these trends, it remains prepared to experience solid revenue increases in the next years. [3]

Price Prediction for Adobe

| Growth Scenario | Estimated Price per Share |

| Low Growth | $474 |

| Medium Growth | $585 |

| High Growth | $731 |

Analysis of Fair Value

To determine Adobe’s stock, three growth models are used to estimate the fair value of Adobe’s shares. When the company is in Low Growth and its growth rate is slow, the stock has the price of $474 per share. According to the Medium Growth which depicts fair and consistent growth, the stock is valued at $585 per share. Lastly, under high growth scenario where AI and market penetration expand at a faster rate, the valuation of the stock stands at $731 per share. These forecasts are contingent upon Adobe’s future performance and market conditions, however, these numbers provide the possible range.

Conclusion

In conclusion, Adobe has really been growing its revenues significantly over several years and its change to subscription model coupled with hefty investment into AI makes it more poised for future success. It has diversified its product base to artistic tools, digital marketing, and document services to customers, thus allowing the company to capture various markets and mitigate its risks on a particular product. The future success of the company will rest heavily with its ability to invest in AI technologies as the key to innovation and customer demands.

The fair value analysis gives a number of the stock prices based on the specified growth rates. These estimates consider Adobe’s possibility to sustain or even build on its advance toward growth, depending on how the company utilizes independent developments and strengthens its market position. All these development should be taken into consideration when investors are looking forward to investing in Adobe’s stock in their investment plan.

**Please be informed that the content is informational and by no means serve as a buy or sell signal. The company is not responsible for the loss of capital.