AVGO vs MSFT Stock Analysis 2026: Compare on AI exposure, growth, drivers, valuation and risk of Microsoft and Broadcom to ascertain which stock is better to buy at the current prices.

Overview

The comparison of which is better AVGO or MSFT stock, according to AI headlines or short-term market hype. It is about how each firm converts AVGO vs MSFT long-term investment shareholder value through discipline, size and management of the balance sheet. The enterprises are at the core of technology investments into both businesses, and their directions are absolutely different. Broadcom is a cash-based semiconductor and infrastructure computer software company, as compared to Microsoft, which is a platform-based cloud and enterprise software company. Such differences also have Broadcom VMware integration impact on the utilisation of capital, the efficacy in utilising assets, and the sensitivity of each stock to valuation suppositions.

This is done by a Broadcom vs Microsoft stock comparison in an alternative manner, and not a narrative manner, but on an operating and valuation basis in 2026. It will be reviewed on net operating assets, operating liabilities, net operating assets return, as well as the sensitivity of intrinsic value on the basis of the past financial statements. By looking at how the Broadcom AI semiconductor exposure and Microsoft AI cloud growth will become quantifiable operating returns, investors can have a better idea of the profile of stock that suits their risk profile.

In this strategy, the forecasts and price targets are not applied and instead evaluated to determine whether the AVGO or MSFT stock forecast 2026 is more resilient or more growth-dependent at current market prices, with the help of the available financial data only (Broadcom Inc., 2024; Microsoft Corporation, 2024).

Business Model Differences

Broadcom has a capital-disciplined approach to doing business, which consists of the efficiency of its operations, cash generation, and shareholder returns. Its core business activities are semiconductors, networking solutions and infrastructure software, and the demand in this field is associated with long-term enterprise contracts and with constant consumption. This structure enables Broadcom to limit its capital expenditure against product establishment, and it is the reason AVGO stock buy and sell is likely to exhibit a greater change in operational efficiency than a steady rise in asset growth. This model will favour the stability of cash flows and rise in dividends over one that is sustained to investors who would compare AVGO and MSFT best tech stocks for 2026.

Microsoft Azure AI revenue outlook, in its turn, is cloud-based, enterprise software-based, and AI-driven workloads. Azure, Microsoft 365, and enterprise AI solutions require long-term investment into data centres, software creation and connection of the ecosystem. This implies that the expansion of the operating assets of Microsoft has been smooth and not an indication of an abrupt shift in its efficiency.

This helps explain why the Microsoft AI cloud expansion encourages the uniform scale but also makes MSFT share vulnerable to assumptions of the long-run expansion and application. These structural differences are the most significant point in the Broadcom vs Microsoft stocks comparison since they define the profitability of either of the companies in terms of turning revenue into operating returns over time (Broadcom Inc., 2024; Microsoft Corporation, 2024).

Operating Assets and Liabilities Comparison

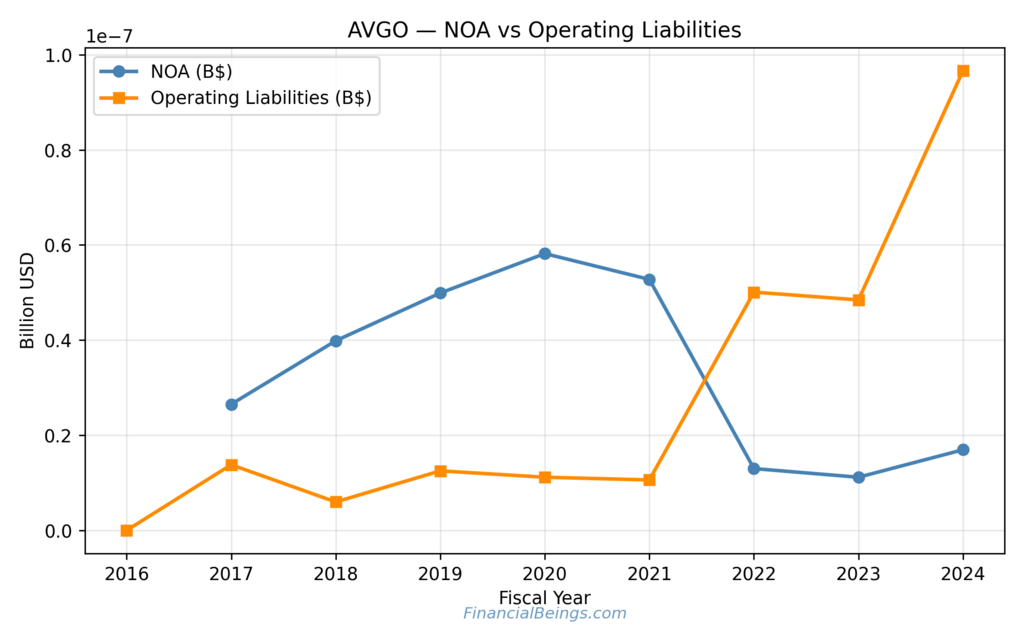

Broadcom NOA vs Operating Liabilities

Broadcom continues to increase its net operating assets steadily until 2021 because of the investments it has been making in the semiconductor capacity and semiconductor infrastructure software platforms over the years. After 2021, NOA has decreased considerably, and operating liabilities have grown considerably after 2022. This trend denotes the transformation in the pattern of financing the operations of Broadcom. As an alternative to acquiring more operating assets from the company, the reliance on supplier payables, deferred revenue and other operating liabilities increased to sustain the activities.

Such a change is applicable to investors who compare AVGO vs MSFT stocks, as the operations, which are supported by liabilities, are likely to represent a more developed business stage. At the point when revenue and margins are stable, the higher operating liabilities would have the capability of reducing the size of the capital held in the day-to-day operations with the objective of improving efficiencies per dollar invested.

This is among the factors why the increase in the net operating assets of Broadcom in 2022 was great, although there was no vigorous growth in the assets. Comparing the stocks of Broadcom and Microsoft, such action of a balance sheet may be linked to the focus of the company on the discipline of cash flows and the Broadcom dividend growth stock maintenance with the decrease in the sustained increase of the asset base ( Broadcom Inc., 2024).

Table 1. Broadcom NOA and Operating Liabilities

| Fiscal Year | NOA (USD bn) | Operating Liabilities (USD bn) |

| 2017 | 27.0 | 14.0 |

| 2018 | 40.0 | 6.0 |

| 2019 | 50.0 | 12.0 |

| 2020 | 58.0 | 11.0 |

| 2021 | 53.0 | 10.0 |

| 2022 | 13.0 | 50.0 |

| 2023 | 11.0 | 49.0 |

| 2024 | 17.0 | 96.0 |

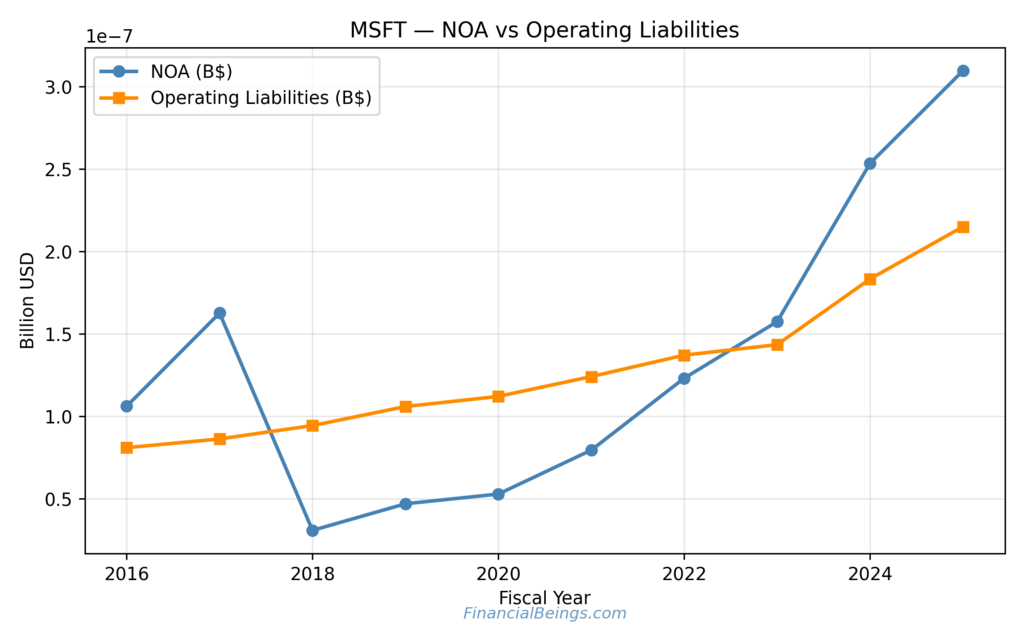

Microsoft NOA vs Operating Liabilities

There has been a gradual increase in the net operating assets of Microsoft, and they have surpassed USD 300 billion, suggesting further investment in cloud systems, enterprise software platforms, and AI-related services. Although operating liabilities also increased, it increased at a lower and slower rate indicating that Microsoft continues to finance expansion of growth by expanding assets rather than optimising liabilities. It is a format of a Balance sheet that allows the platform to be scaled in the long term, but leads to excessive capital intensity compared with Broadcom.

To an investor thinking about MSFT stock as a Broadcom vs Microsoft stock, the dependence of Microsoft on further development of utilisation to maintain operating efficiency would be a pointer to this strategy. As a result, the growth of Microsoft AI clouds improves size and market share and makes the MSFT stock buy at current price more sensitive to long-term growth projections in the valuation (Microsoft Corporation, 2024).

Table 2. Microsoft NOA and Operating Liabilities

| Fiscal Year | NOA (USD bn) | Operating Liabilities (USD bn) |

| 2017 | 106.0 | 81.0 |

| 2018 | 31.0 | 95.0 |

| 2019 | 47.0 | 106.0 |

| 2020 | 53.0 | 112.0 |

| 2021 | 80.0 | 124.0 |

| 2022 | 122.0 | 137.0 |

| 2023 | 158.0 | 144.0 |

| 2024 | 253.0 | 183.0 |

| 2025 | 310.0 | 215.0 |

Return on Net Operating Assets (RNOA)

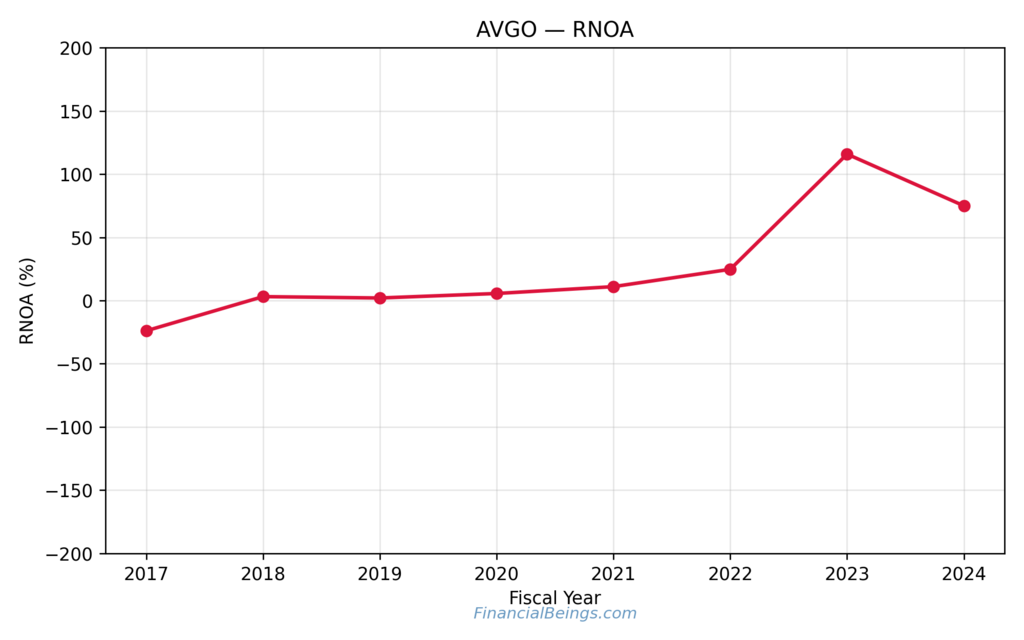

Broadcom RNOA

Broadcom RNOA has been slowly, until 2021, and sharply after 2022. This peak was followed by a declining operating asset base and operating income, i.e. a significantly higher efficiency ratio on every dollar of invested capital, and not an abrupt increase in profits (Broadcom Inc., 2024). The transition can be viewed as a transition by Broadcom to greater capital discipline and reliance on recurring revenues of infrastructure software and long-term contracts in the semiconductor industry.

This trend shows that investors who consider Broadcom a stock comparable to Microsoft show that the current performance is more of a balance sheet optimisation trend and not a cyclical demand trend. These motivated returns that are inspired by efficiency are less prone to slower growth or even tighter financial conditions.

Table 3. Broadcom RNOA (%)

| Fiscal Year | RNOA |

| 2017 | -25.0 |

| 2018 | 4.0 |

| 2019 | 3.0 |

| 2020 | 6.0 |

| 2021 | 11.0 |

| 2022 | 25.0 |

| 2023 | 116.0 |

| 2024 | 75.0 |

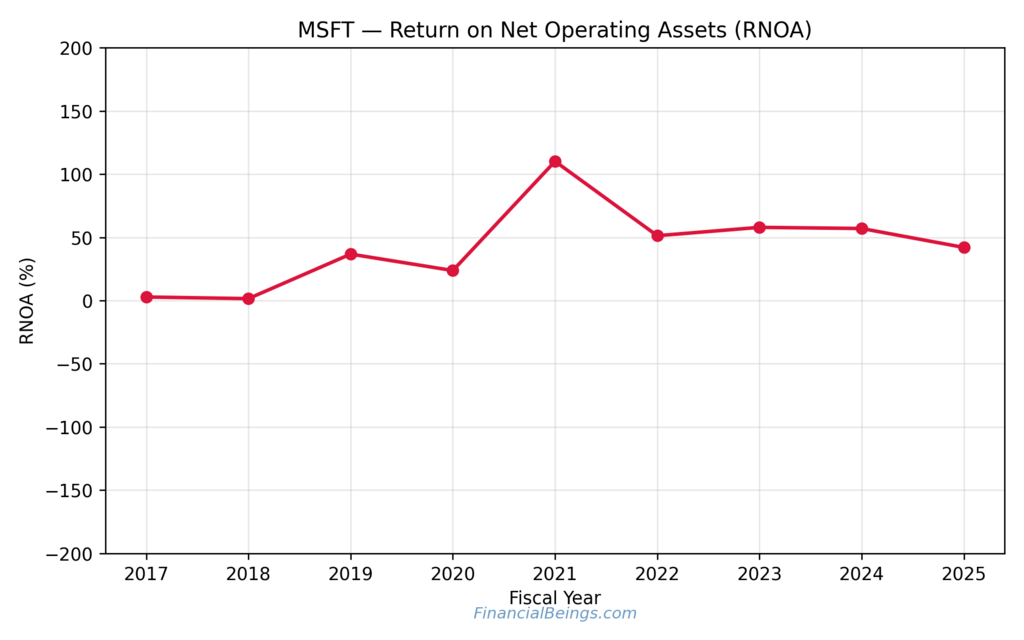

Microsoft RNOA

In 2021, the RNOA of Microsoft was the highest, and thereafter it was lower yet decisive. The trend resembles consistent reinvestment into the operating assets, where returns are initially large but stabilise with an increase in the intensity of capital (Microsoft Corporation, 2024). Further outlay on cloud infrastructure, data centre and enterprise platform augments the asset base faster than the operating revenue in the short run. To investors who would compare MSFT stock to AVGO stock forecast 2026, this may indicate that the operating effectiveness of Microsoft is very sensitive to the further growth of cloud utilisation and platform adoption as opposed to the optimisation of balance sheets.

Table 4. Microsoft RNOA (%)

| Fiscal Year | RNOA |

| 2017 | 3.0 |

| 2018 | 2.0 |

| 2019 | 37.0 |

| 2020 | 24.0 |

| 2021 | 110.0 |

| 2022 | 52.0 |

| 2023 | 59.0 |

| 2024 | 58.0 |

| 2025 | 43.0 |

AVGO vs MSFT Valuation Analysis- Which One is a Buy?

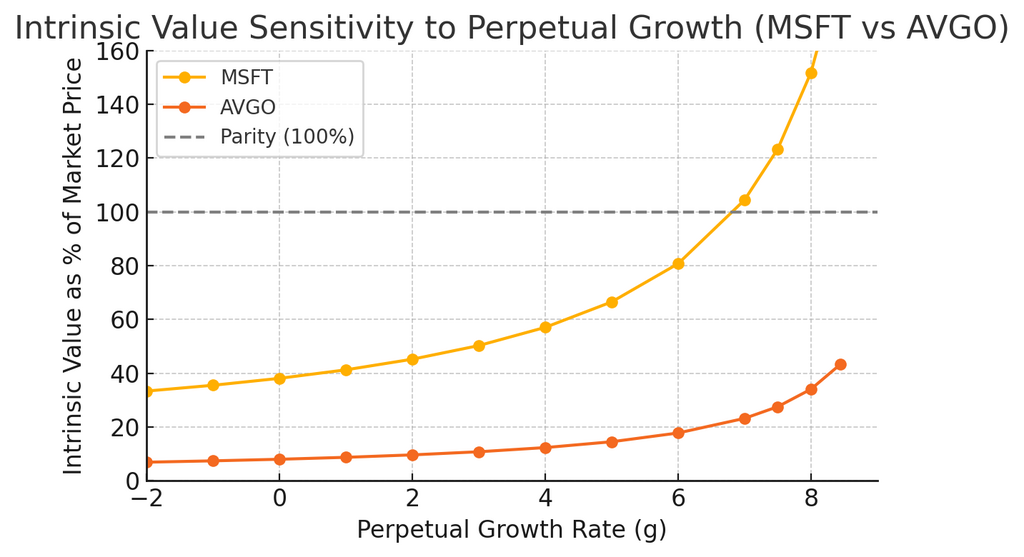

Intrinsic value sensitivity shows that the Microsoft valuation is very sensitive to minor changes in the perpetual growth assumptions, and at higher growth rates above 6.5%, only the parity is reached. Broadcom’s valuation is still significantly under that of parity across the same range of growth, i.e. its market price is more speculative and the intrinsic value does not converge to 100% market price even at higher growth rates. The comparison shows that Microsoft Corp (MSFT) is a adequate choice for long-term stable and growth portfolios while Broadcom Inc (AVGO) is a volatile choice and only suitable for high risk investors.

Table 5. Intrinsic Value as % of Market Price

| Growth Rate | MSFT (Intrinsic Value as % of Market Price) | AVGO (Intrinsic Value as % of Market Price) |

| 0% | 38.0 | 8.0 |

| 2% | 45.0 | 10.0 |

| 4% | 57.0 | 13.0 |

| 6% | 80.0 | 18.0 |

| 8% | 152.0 | 34.0 |

Further Reading : AMD vs Broadcom Semiconductor Stocks: Which One Should Investors Pick for 2026’s AI Boom?

Further Reading : MSFT vs CRM Stock: Which Tech Giant Offers Safer Growth in 2026?

Further Reading : Best Tech Stocks to Buy Now: The AI-Driven Leaders Set to Shape 2025 to 2030!

Investor Perspective

Broadcom and other businesses have been observed to do well in the market during previous market cycles when investors are highly interested in cash discipline, balance sheet quality and downside coverage. When interest rates or liquidity become constrained, markets usually appreciate predictable cash flows and effective utilisation of capital as opposed to expansion. These are conditions which are aligned with the operating model at Broadcom, which emphasises cash generation and effective utilisation of capital.

On the other hand, in the case of businesses like Microsoft, it is usually healthy when investors possess a high degree of confidence regarding growth in the long term and when the lack of capital phobia is not a concern. This disparity can be presented to explain how AVGO and MSFT can exchange leadership positions with several market cycles; both firms are essentially strong but Broadcom Inc (AVGO) is a high risk stock (Broadcom Inc., 2024; Microsoft Corporation, 2024).

Conclusion

This analysis of AVGO vs MSFT stock 2026 demonstrates that Microsoft is an embodiment of scale and strength of reinvestment, and Broadcom is an embodiment of operating efficiency and capital discipline. Neither stock is necessarily the best at all times since they are sensitive to new market situations and the cost of capital environment. The more suitable one is based on the fact that an investor prefers cash stability over long-term growth exposure at existing market values.

Broadcom could be more attractive in periods when valuation discipline and cash returns have the greatest importance, and Microsoft could be more attractive to investors who are at ease with recurrent reinvestment and responsive to long-term growth prospects. It is usually more important to comprehend these structural differences instead of responding to short-term narratives in the market.

Frequently Asked Questions (FAQs)

Is AVGO a strong buy?

AVGO has shown positive revenue growth and margin growth, which is a good execution in its semiconductor and infrastructure software departments. However, the existing market price already reflects an aggressive implied long-term growth rate of about 9.5%, which is highly valuation risky.

Even under the assumption that the growth is up to 7 per cent, the intrinsic value only explains a small proportion of the current market capitalization. In contrast, the growth rates are optimistic, and even the expected returns are also squashed. This implies that the stock valuation is highly dependent on how the execution and the growth sustenance perform.

As a result, AVGO is currently a high-risk and volatile investment. Selective exposure can be offered to investors with a large risk-taking tolerance; nevertheless, towards long-term investors, AVGO is not a good investment at the prevailing market prices due to a lack of upside and an unhealthy ratio of reward to risk.

Is MSFT or AVGO a better buy?

In the current market prices, Microsoft (MSFT) is making a superior purchase than the other. Due to the long-term cash flow, a platform benefit, and a diversified method of AI monetisation in the cloud and enterprise software and productivity ecosystems, MSFT offers a medium-risk, attractive reward profile.

Microsoft has a higher valuation as compared to AVGO in relation to bold growth expectations; this provides higher execution variance. This makes MSFT a good selection for a long-term investor and is also appealing to growth-based investors who would like to own AI but with a comparatively lower level of volatility. Overall, MSFT is a more balanced and well-structured risk-reward company, and AVGO is a risky investment that requires an almost-perfect performance to be able to justify its current price value.

All calculations and valuation estimates are FinancialBeings’ own, based on data sourced from SEC filings MSFT (10K and 10Q) and AVGO (10K and 10Q), use or reproduction before prior approval is prohibited.

Usama Ali

Usama Ali is the founder of Financial Beings and a self-taught investor who blends classic valuation study with insights from psychology. Inspired by works from Benjamin Graham, Aswath Damodaran, Stephen Penman, Daniel Kahneman, and Morgan Housel, he shares independent, data-driven research to help readers connect money, mind, and happiness.

Disclaimer

The content provided herein is for informational purposes only and should not be construed as financial, investment, or other professional advice. It does not constitute a recommendation or an offer to buy or sell any financial instruments. The company accepts no responsibility for any loss or damage incurred as a result of reliance on the information provided. We strongly encourage consulting with a qualified financial advisor before making any investment decisions.