NVIDIA implied growth rate is assuming new forms with the investor expectations, asset productivity and AI-driven growth nvidia to redefine the framework of valuation of the company. Explore the market-implied price of NVDA, indicators of intrinsic values, and the issue of whether the company is still a convincing buy in 2026, after Q3.

Overview

NVIDIA Corporation (NVDA) is the revolution in the worldwide AI infrastructure in the entire mega-cap industry. The company has scale computing sites that execute the training, inference, and deployment of nearly all top AI models – encompassing generative transformers and autonomous systems on an enterprise scale. Therefore, NVIDIA is no longer regarded as a high-performance producer of GPUs and has become the calculation foundation of present-day artificial intelligence. This unique positioning has already added a new level of excitement to the market with rallies caused by headlines and unprecedented multiples of valuation.

To what extent has the future development already been built into the NVIDIA share, and, at present, does that future outlook give enough leeway to error on the part of the entrants after the Q3 of 2026? In other words, the main concern of investors today is not the probability of NVIDIA’s growth but the amount of growth and the rate of growth that NVIDIA will achieve, and whether it will grow at the pace that the market is implicitly predicting.

In order to fulfil this, the analysis does not provide a comparison of the conventional forecasts of revenues but, instead, the implied growth based on the rate of growth embedded in the current valuation of NVIDIA based on its internal operating performance. NVDA Implied growth expectations are in contrast to the analyst’s projections that reflect what the market must believe the future of NVIDIA stock growth forecast. This highly lies on internal motivation that comprises:

- Net Operating Assets (NOA): How NVIDIA is increasing its operating asset base to handle AI demand Operation:

- Operating Liability Leverage (OLLEV): The effectiveness of the company to utilise the use of supplier financing and customer advances to expand.

- Return on Net Operating Assets (RNOA): What proportion of profit NVIDIA receives on every dollar of operating investment – an obligatory component of economic profitability.

- Residual Earnings: The abnormal earnings, which ultimately grow into the intrinsic value.

NVIDIA Implied Growth Rate

NVIDIA implied growth rate when we discuss the implied growth rate of NVDA is the rate the market will think the company can continue to maintain, with its current profitability, asset base, and reinvestment rate, to support the current price. Otherwise stated: to what extent will the current valuation be reconciled by growth in residual operating income? This is connected to Nvidia implied valuation, Nvidia implied growth expectations, and finally the perception of the market of the future of NVDA (Seeking Alpha, 2025).

In the case of firms that produce high returns on operating assets (RNOA) and can invest efficiently, the implied growth rate can be more rapid, since every dollar reinvested will be created to have high incremental returns. In case of RNOA falls or the reinvestment is inefficient, the implied growth expectation is forced to decrease (or valuation drops) (Reuters, 2025). The NVIDIA valuation frontier, then, cannot merely be the top-line growth: it needs to be profit margin, asset-turnover, or return on assets: the fundamental inputs to NVDA fundamental analysis.

Operational Drivers Behind the Implied Growth

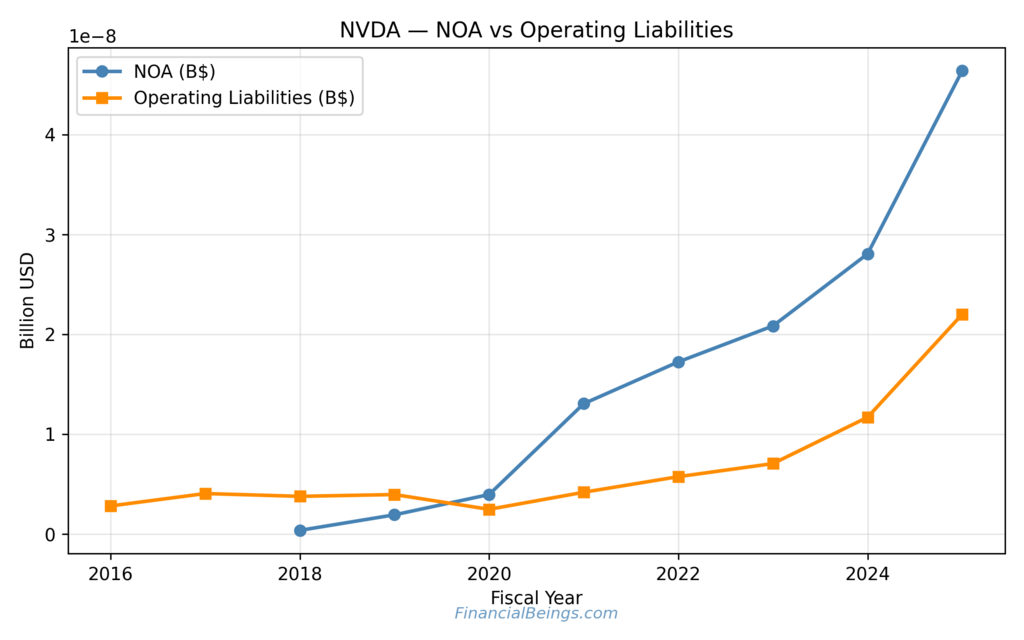

Net Operating Assets (NOA) and Scale

Figure 1 shows that the rate of change of the NOAs of NVDA is sudden. Scale is indicated by the use of a large NOA base; however, it only becomes value-creative in instances where the returns are high. As per the chart below, NVDA is growing at a faster pace in terms of capital. Because the market expects NVDA to utilise the capital effectively, the implication of such growth incorporates the expectations of asset efficiency, which drives the Nvidia long-term valuation outlook.

Figure 1. NVIDIA’s Net Operating Assets (NOA) vs Operating Liabilities (2016–2025).

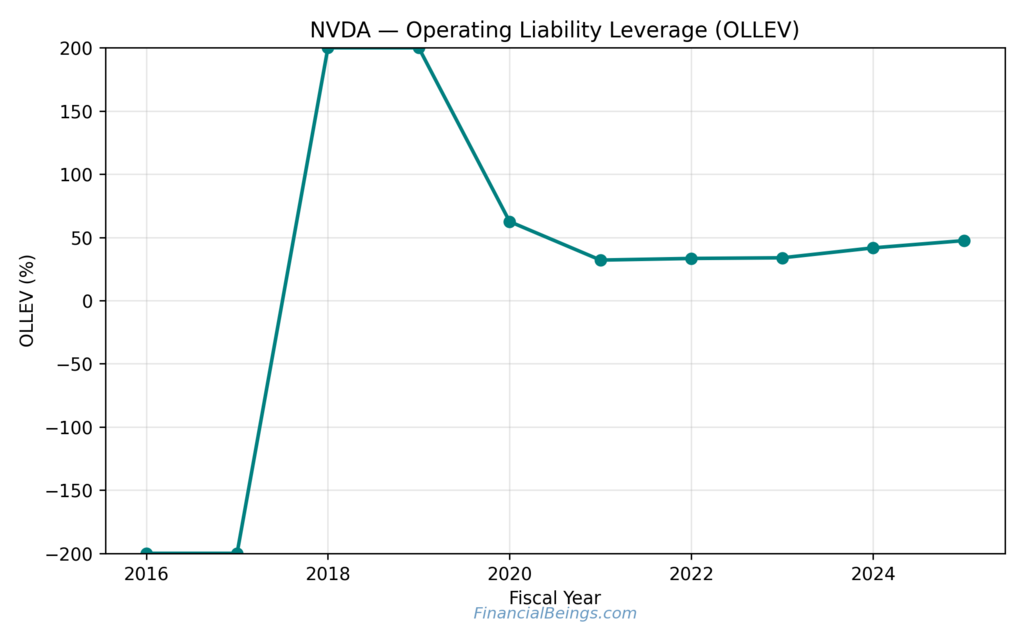

Operating Liability Leverage (OLLEV)

The dynamics of NVDA-OLLEV are presented in Figure 2. At high OLLEV, NVDA is effectively using the non-interest-bearing liabilities (e.g., trade payables, customer advances), but it is using the return on equity without the presence of debt. The leverage is favourable to the profitability and the foundation of the expansion that is Nvidia by the use of AI (Reuters, 2025).

Figure 2. Operating Liability Leverage (OLLEV), 2016–2025.

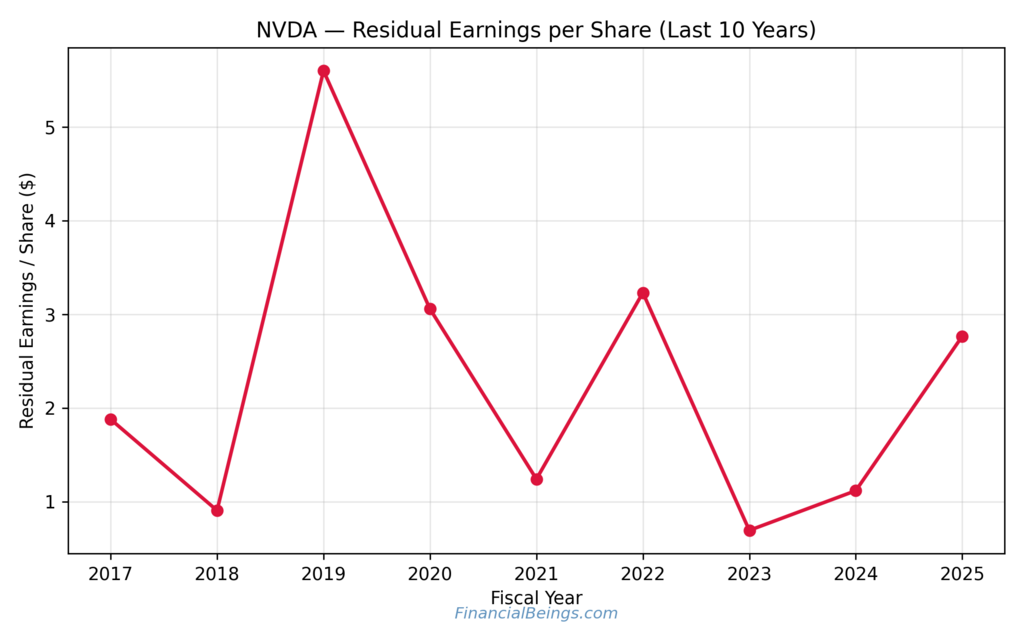

Residual Earnings per Share

The surplus in the amount of operating assets required is represented as the residual earnings. Figure 3 confirms the fact that NVDA has produced positive residual earnings per share over a number of years. That implies a value creation of a scale nature that is driven by Nvidia intrinsic value signals– essential when the market prices growth in (Business Insider, 2025).

Figure 3. Residual Earnings per Share, 2017–2025.

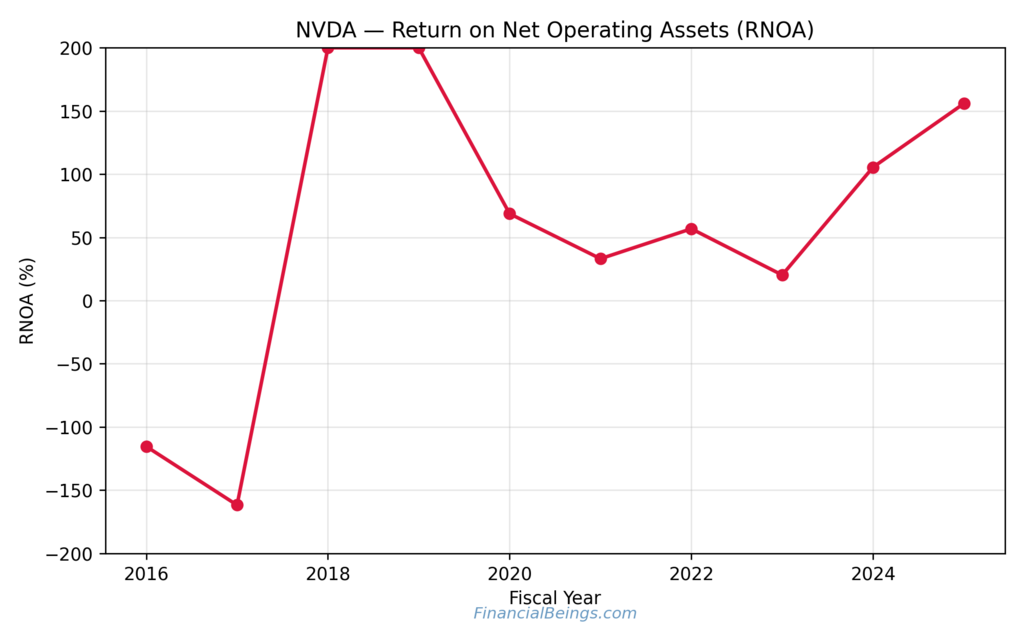

Return on Net Operating Assets (RNOA)

Figure 4 also indicates that the RNOA of NVDA has risen drastically, which is an indication that it has a strong pricing force and operational efficiency. The high RNOA also allows a firm to make more profits by paying out the dollar value of assets, and consequently, smaller growth is necessary to meet implied value thresholds. It is among the drivers of the Nvidia market-implied pricing methodology (Marketwatch, 2024).

Figure 4. Return on Net Operating Assets (RNOA), 2016–2025.

Market-Implied Growth Above 8% Creates a Narrow Margin for Error

Based on the above internal measures, the implied growth rate of NVDA is greater than 8 per cent per annum. Why is this significant? A big company never runs at such rates, except when there is extraordinary performance, and there are minimal headwinds.

In cases of any setback or decline in the margin whenever the investors have taken money to expand, it is punished disproportionately. This is the concern of a nvidia growth premium. NVDA also does not have much margin for error because it has a high implied growth. This means that the valuation will fall at a high rate, and worse than a firm with less implied growth, in case the company fails to meet margins or asset efficiencies (Reuters, 2025).

This force also strengthens the perception of a growth premium and presents why the issue of investor psychology is substantial, as fundamentals.

Implied Revenue Expectations

Table 1: Implied Revenue Bands and Efficiency Assumptions

| Scenario | 2026 Revenue (B$) | 2027 Revenue (B$) | Assumption |

| High PM + High ATO | 175–182 | 225–228 | Strong margins, high asset turnover |

| Low PM + Low ATO | 195–207 | 265–284 | Margins compress; asset efficiency weakens |

This is indicative of the external information that the valuation of NVIDIA could only be supportive in terms of the level of implied revenues that are conceivable when the company is operating on margin and efficiency (MarketWatch, 2024). During periods of margin compression, the company will have no option but to increase revenues by a significantly larger margin to restore its valuation to track.

So, the implied forecast is not a projection; however, this is a market-implied demand, and it is correlated to the Nvidia market-implied pricing theme and Nvidia AI revenue expansion theme.

Investor Psychology & Implied Pricing

The investor mentality is another suitable element in defining NVIDIA market-implied valuation, especially at a time when the firm is associated with the AI megatrend. What makes the stocks of NVIDIA create exaggerated reactions is the mixture of the behavioural biases, narrative-based expectations, along with the idea that there is a shortage of technology. A report by Business Insider (2025) reveals that the AI bubble has turned into a subject of discussion among investors that is constantly ongoing, not because they are no longer afraid of it, but because their valuations have likely become the main risk to the fundamentals that they could lose.

AI Scarcity Premium

NVIDIA is beginning to be perceived by investors as the sole supplier of state-of-the-art AI compute hardware, particularly data-centre GPUs, which will be utilised to train large language models (Reuters, 2025). This kind of perception will lead to a scarcity premium where investors will be paying a premium on a high multiple, not on the existing performance, but on the belief that no other alternative exists or will exist in the near future.

FOMO-Driven Buying Pressure

NVIDIA is a firm whose flow of information preceding an announcement of earnings, investor day, or another news of AI products and services is regular. This serves as a sign of an investment bias that traders feel threatened by being left behind in the next wave of AI-based significant rise. Such a purchasing pressure of FOMO increased the pre-earnings volatility of NVIDIA and pushed implied expectations higher as they projected the present results in future pricing scenarios.

Narrative Momentum

Narrative momentum is a term used to denote the force behind the power of compelling narratives (e.g. NVIDIA is the engine of the AI revolution) to drive valuation more than the temporary financial performance (MarketWatch, 2024). Investors tend to base the perception on the reality that NVIDIA is not just a semiconductor enterprise, but a significant contributor to the process of infrastructural transformation of the digital world worldwide. This supposition fills in expansion desires as the story encourages hope in the long run. The valuation of premiums extends as long as the investors are holding the story, and it will keep on providing us with the NVDA risk-adjusted returns when the revenue or margin changes.

Together, these forces of psychology cause the investor to insist on the high valuation even when it is high and seal the status of NVIDIA as a high expectation high growth stock.

Further Reading : Nvidia Valuation and Implied Growth Rate: Is NVDA Still Worth Its Sky-High Premium in 2025?

Further Reading : Nvidia vs AMD AI Dominance 2025: Which Chipmaker Will Lead the AI Revolution?

Is Nvidia stock a good buy now

The inner signals are consistent with the outside ones, which explain that the growth trajectory of AI at NVIDIA is structurally healthy (Seeking Alpha, 2025). In implied valuation, the efficacy of the company comes in handy to justify the High PM + High ATO scenario, where moderate revenues will be adequate to meet the anticipation of the market.

Why NVIDIA Still Screens as a Buy

The market does not require higher growth in revenues to sustain implied valuation since NVIDIA induces reinvested capital in high abnormal returns. This performance can be seen through RNOA and remaining earnings graphs and it decreases downside risk as long as margins and asset turnover are high. This efficiency is repeatedly applied in the discussion of finances as one of the basic reasons why NVDA has the competitive edge in the long term (MarketWatch, 2024).

The Catch: High Implied Growth = Low Margin for Error

That implied a growth of over 8%; NVIDIA can never risk ceasing operational excellence. There is an opportunity to squeeze the valuation immediately in case of any drop in profitability, supply chain performance, pricing power or data-centre momentum. It is indeed what Reuters (2025) pointed to as the weakness since the high-expectation shares can be corrected drastically every time they experience a minor setback.

By so doing, the investment case is conditional:

- If NVIDIA maintains strong margins + asset efficiency → the stock remains a buy.

- If margins weaken or asset turnover declines → the valuation becomes significantly riskier.

According to the history of the company, as well as our research, NVIDIA is a company with a higher probability to keep doing well. However, Q3 2026 will be the most important milestone since the expectations are too high.

Conclusion

NVIDIA implied growth rate is an indicator of an extraordinary investor trust in the company to take up the AI infrastructure market in the long run. The market is not valuing NVIDIA as a semiconductor company, but the technology that is facilitating the whole technological transformation in the world, and that is consistently reflected in the financial analysis (MarketWatch, 2024; Reuters, 2025). The fact that NVIDIA continues to grow in terms of NOA, stabilization of OLLEV, extraordinary RNOA and persistent residual earnings continuously is all support that NVIDIA is still adding economic value well beyond industry standards.

The best thing is that NVIDIA does not have to see the radical rise in revenue to support its valuation as long as it continues working in its High PM + High ATO operating environment. Operating efficiency of the company gives it a leeway: even in the case of moderate growth of sales, it will be possible to meet the requirements of valuation. However, the market is reporting an implied growth rate of over 8 per cent and this implies that NVIDIA has to continue playing to perfection. The slightest significant weakening of demand in data-centres, or in the competitiveness or margin reductions of accelerators, would cause radical changes in revaluations.

All calculations and valuation estimates are FinancialBeings’ own, based on data sourced from SEC filings (10K and 10Q), use or reproduction before prior approval is prohibited.

Frequently Asked Questions (FAQs)

What is NVIDIA’s projected growth rate?

NVIDIA remains among the most long-term AI-consistent investments, despite having such high expectations that the normal running of the business cannot be compromised in the next Q3 2026. Investors who are willing to bear volatility. The market is implicitly overvaluing NVIDIA to appreciate more than 8 per cent annually. This is not a forecast; it is the minimum growth rate NVIDIA will require to maintain its current valuation.

Is NVIDIA a buy, hold, or sell?

Implied-metrically, NVIDIA is a purchase provided it keeps enjoying good profit margins, high returns of net operating assets, and good turnover of its assets. These guarantee that the company will not have to go way out of the box to generate the market-implied residual income demands. But in case margins become weaker or efficiency is lowered, the stock will be more risky because it is highly sensitive to valuation.

Does NVIDIA have long-term growth?

Yes, internal measures of NVIDIA show that there is the prospect of an advantageous long-term growth, particularly the growth of its base of NOA, high RNOA, and unchanged positive earnings. These signs mean that the company is generating economic long-term profit and is making good investments, and this makes the value of the long-term.

Usama Ali

Usama Ali is the founder of Financial Beings and a self-taught investor who blends classic valuation study with insights from psychology. Inspired by works from Benjamin Graham, Aswath Damodaran, Stephen Penman, Daniel Kahneman, and Morgan Housel, he shares independent, data-driven research to help readers connect money, mind, and happiness.

Disclaimer

The content provided herein is for informational purposes only and should not be construed as financial, investment, or other professional advice. It does not constitute a recommendation or an offer to buy or sell any financial instruments. The company accepts no responsibility for any loss or damage incurred as a result of reliance on the information provided. We strongly encourage consulting with a qualified financial advisor before making any investment decisions.