Meta Stock Forecast 2025 — Discover whether Meta Platforms (META) is an after-Q3 earnings buy. Find out the AI investments, monetisation, and valuation data that help to see through the clutter of the market to see the long-term potential of META.

Introduction

Meta started a new era of sustainable profitability and incorporated AI. This makes the Meta Platforms stock prediction 2025 discussion a necessity for the analysts, long-term shareholders, and portfolio managers who wish to be exposed to the high-growth digital ecosystems. The reasons why the interest in the Meta Stock Forecast 2025 is on the increase are threefold. The most considerable one is the renewed focus of Meta on AI through its Llama line of models, its recommender systems and its integration into Reels, Instagram Discovery, WhatsApp Business and Feed ranking systems.

The second element of importance is the recovery of advertising revenues, which has demonstrated a good recovery when companies turn advertising budgets back to performance-based engines during the normalisation of the macroeconomic environment.

The third force is the inner reorganisation strategy of Meta that reduced the operational overheads and increased the ratio of cost to revenue, which ultimately increased the degree of investor confidence in the financial discipline and competitiveness of the business in the long run. It is these reasons that the Meta Stock Forecast 2025 is particularly vital since risk, opportunity, and structural advantage are some of the factors that are being considered by investors.

Understanding Meta Through Clean Accounting Fundamentals

The Article determines the essence of Meta as presented by the measures of Net Operating Assets (NOA), Operating Liability Leverage (OLLEV), Residual Earnings, and Return on Net Operating Assets (RNOA) instead of making predictions based on market sentiments. These financial measures are a correct, and hypothetically founded view of value creation, which is consistent with the residual-income valuation theory. These long-term patterns may help investors filter out the short time events that happen as a result of geopolitical friction, regulatory news and market sentiment troughs and concentrate on how intrinsic values are formed. It is a more accurate and orderly method of establishing a practical Meta stock valuation outlook (Koller et al., 2020).

Net Operating Assets (NOA): Meta’s Structural Engine of Growth

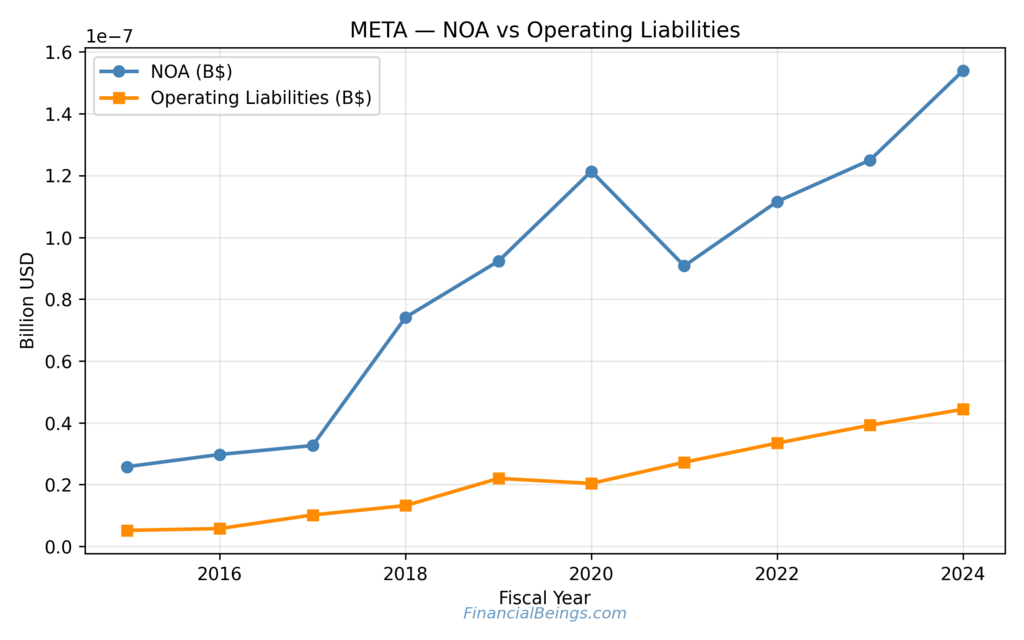

NOA increasing by 0.3B in 2015 to a stable growth of 1.5B in 2024. The latter expansion may be justified by the fact that Meta spent on AI data centres, cloud computing, content protection platforms, and even machine-learning clusters in the long term. The emergence of NOA also indicates the present efforts by Meta to create more powerful computational power and the ability to scale up its operation on a general basis.

The investments of this type provide it with a foundation to introduce advanced AI-based ranking systems and be able to provide billions of interactions on content every day, which, in turn, add to the accumulated competitive advantage of the business. This steady growth proves the assumption of the Meta Platforms stock prediction 2025, as NOA is a good predictor of the potential profitability and operating leverage in the future (Meta, 2024).

Figure 1: META — Net Operating Assets (NOA) vs Operating Liabilities (2015–2024)

Operating Liability Leverage (OLLEV): A Quiet but Powerful Advantage

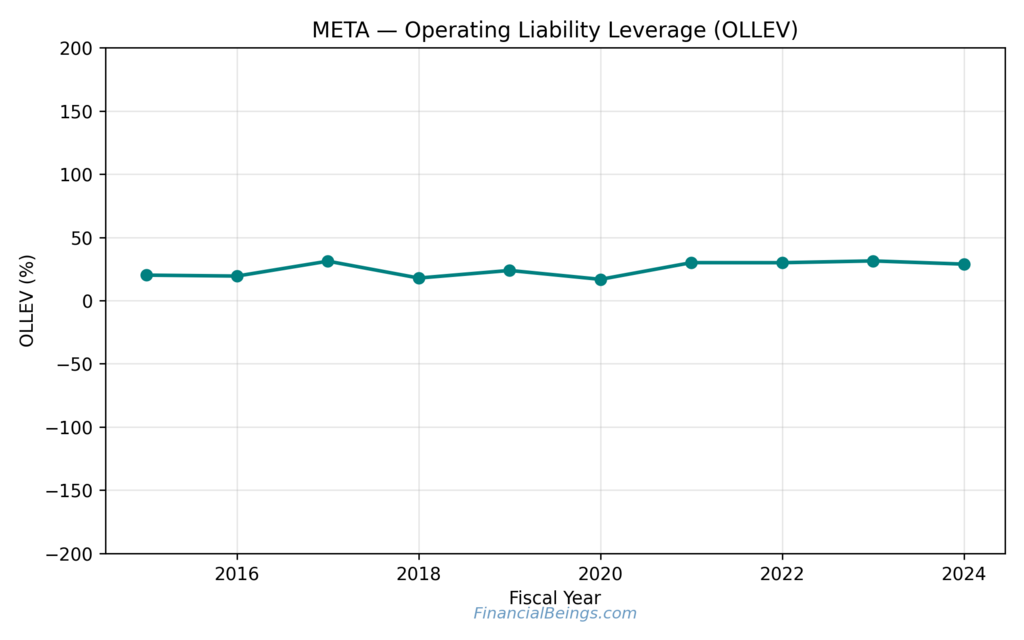

OLLEV has been really consistent in the range of 20%-33% and this indicates that Meta is actually using the operating liabilities wisely and it is not on the verge of an over-exposure. This indicates a well-functioning working-capital structure that has a stable supplier relationship, optimisation of the payables and minimum exposure to interest-bearing debt. Such stability of OLLEV makes Meta resilient, in spite of any economic crisis, due to operating liabilities which provide a form of implicit financing at very low cost. This directly impacts the stability of incomes and has been a silent but a powerful competitive advantage when analyzed to determine the outlook for Meta stock.

Figure 2: META — Operating Liability Leverage (OLLEV), 2015–2024

Residual Earnings: Meta’s Strongest Indicator of Intrinsic Value

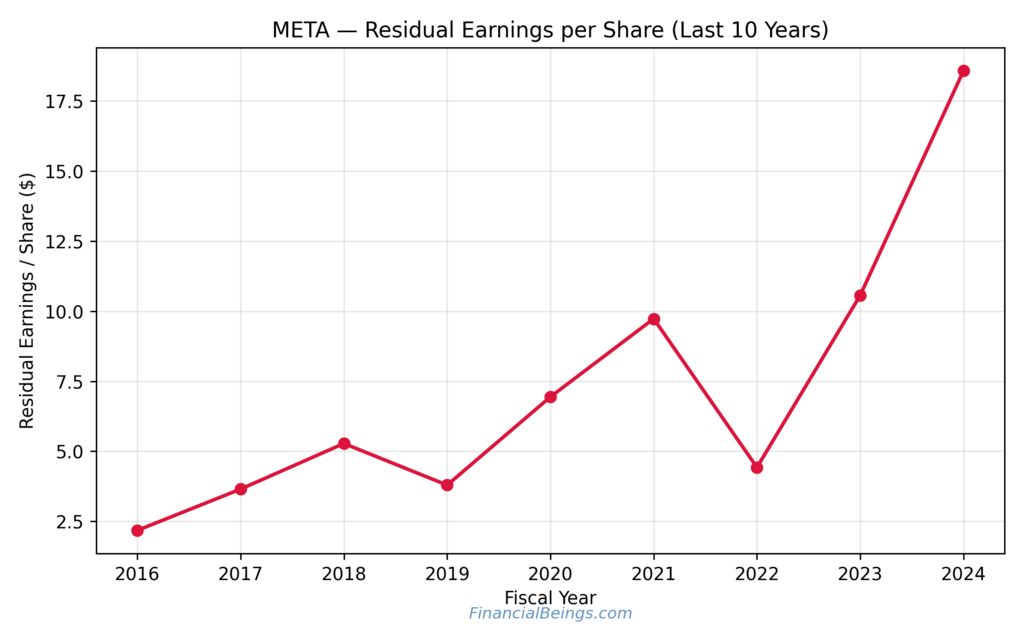

This growth in residual earnings, which has increased from $2.1 to $18.6 in 2016 and 2024, respectively, reflects the good quality of the company, the potential of Meta to generate returns more than the cost of capital. This nearly 9-fold growth is evidence of the consistent generation of value by Meta, irrespective of the changes in the economy in the short-term. In academic finance, the actual economic profit is indicated by the residual earnings and, therefore, is one of the best indicators of whether a stock is undervalued or overvalued. The indicator aids the health of the Meta stock valuation outlook, and big and increasing residual earnings tend to correlate with long-term enhancing intrinsic value (Koller et al., 2020).

Figure 3: META — Residual Earnings per Share (2016–2024)

RNOA: Meta’s Operating Profitability Powerhouse

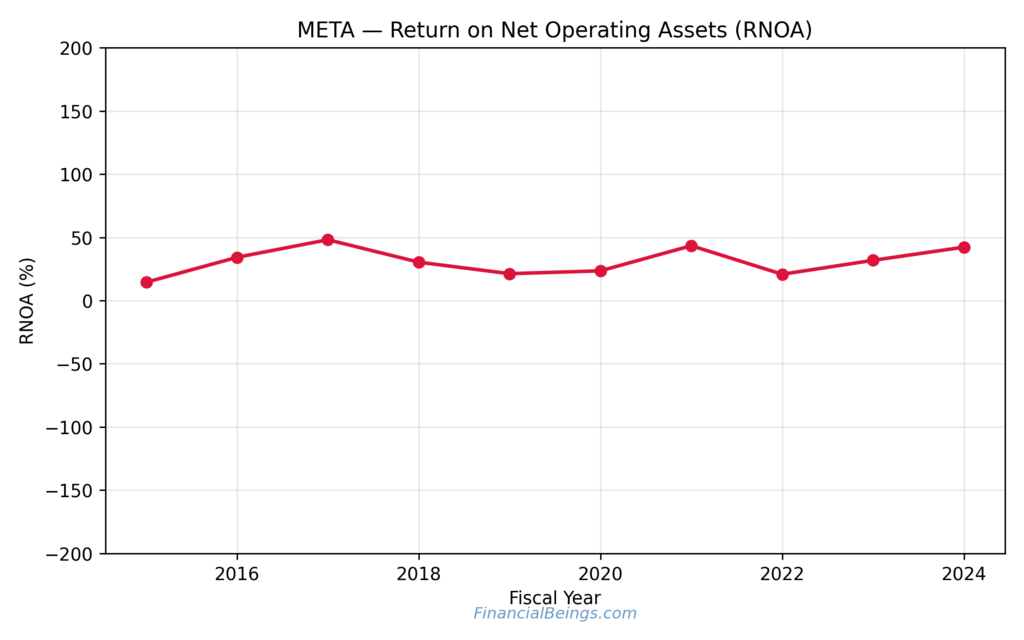

RNOA was maintained at varying levels between 20 per cent and 47 per cent, and this put Meta among the top operating technology companies of its size. This is a terrific profitability ratio, which means the ability of the Meta to convert all the net operating assets to important economic disbursements.

The thesis that the core business of this company not only stagnates, but also improves with the efficiency of the core business of this company can be confirmed by the fact that in 2024, the core business of this company began to recover to the higher part of this range. This reinforces the integrity of the Meta Stock Forecast 2025 since a high RNOA will reduce the chances of profitability shock happening in the future and make the business model more sustainable by Meta (Meta, 2024).

Figure 4: META — Return on Net Operating Assets (RNOA), 2015–2024

META Q3 2025 Earnings Analysis

The fact that the Q3 performance shows that the company is able to spend substantial amounts of money on AI and attain high revenues is informative strategically of the fact that Meta has a very narrow profitability margin, as it tries to expand its technological base. This dynamic is very crucial in predicting the Meta Platforms stock 2025, in that it demonstrates the possibility of Meta to absorb the cost of innovation without affecting its core financial standing.

The results of Q3 can be used by a company that examines the future perspective of the investment in Meta to realise that the implementation of AI does not appear to be a burden of costs, but the potential to enable the monetisation of the ecosystem. Combined with the operational efficiencies obtained in the Year of Efficiency, Q3 figures are another indication to believe that Meta is financially disciplined in the future (Meta, 2024).

Meta Valuation Outlook

The valuation interpretation model can be used to interpret the valuation by participating in the structured and academically consistent interpretation of the intrinsic value of Meta. The bear case of 1.0T presupposes that the stock can be perceived as quite over-valued in the event of the slowdown of the momentum of Meta or in the occurrence of the more stringent pressure of the regulators.

The situation that market connotes at 1.5T denotes the current balance of investor expectations and basic success. The 2024 efficiency-based case at 1.6T shows the way in which an enhanced cost structure, as well as an increment in residual earnings, is used to justify a slight undervaluation. Finally, the bull scenario of 2.1T illustrates a high in-built upside in case where Meta manages to sustain a robust cycle and high efficiency, as well as trends in RNOA.

| Scenario | Intrinsic Value ($T) | Intrinsic Value/ Market Cap (%) | View |

| Bear | 1.0 | 65 | Overvalued if growth momentum weakens |

| Market-Implied | 1.5 | 97 | Fairly valued based on current expectations |

| 2024 Efficiency Case | 1.6 | 105 | Slight undervaluation due to high efficiency cycle |

| Bull | 2.1 | 137 | Deeply undervalued if efficiency persists + higher RNOA sustainability |

Table 1: META Valuation Interpretation

Why Meta Gets Mispriced Frequently?

A significant variable in the valuation of Meta is the investor psychology since the market tends to react emotionally rather than rationally to the happenings in the company. This loss aversion can result in the overreaction of the investors to the short-term regulatory problems or variations in the spending of Reality Labs. Recency bias may overrate the impact of a down quarter that masks the excellence of the long-term performance indicators of Meta. Similarly, the narrative-driven sentiment is prone to overemphasising the concept of metaverse investments and ignoring more lucrative areas of advertising and AI (Koller et al., 2020).

Further Reading : Meta Stock for Long-Term Portfolio: How AI and Metaverse Bets Could Redefine Growth Through 2030!

AI-Driven Growth in Meta Platforms

The growth of AI is now one of the largest competitive advantages of Meta that altered nearly every domain of its ecosystem. The AI can help to make the advertisements placement more relevant, engage the users more by using sophisticated ranking algorithms and enable Meta to offer a more refined targeting to advertisers. This advanced integration is based on the global patterns according to which the AI potential is playing an increasing role in the technology companies as part of the long-term value. It also helps Meta to be more robust in the digital advertising market and makes sure that the company will have continuous revenue growth even during the periods of macroeconomic instability (Meta, 2024).

Will Meta Platforms Stock Go Up?

Evidence suggests that the intrinsic value support of Meta is high. A higher residual earnings level means that Meta can earn profit on a regular basis, which is above its cost of equity. These large values of RNOA attest to the position of its monetisation engine. Expansion of NOA confirms prudent growth that contributes to the long-term value creation. The advertising need is also great with the help of the AI-based optimisation that helps to promote campaign improvement and keep advertisers on board. Meta has also improved its cost structure, and stable OLLEV can forecast financial results.

Long-Term META Stock Analysis: Why 2025 May Be a Turning Point

Under the long-term investment, the diversified revenue ecosystem, international expansion and operational upgrades through the application of AI place Meta in a long-term competitive advantage. Revenue resiliency is further provided by the growing WhatsApp Business monetisation potential, Reels, and marketplace ecosystems. The core of the reinforcement of these ecosystems is AI, which improves the interests of users, increases the delivery of ads, and provides ad creators with better platforms to generate revenues (Meta, 2024).

Final Verdict

Many financial statements, intrinsic value data, and trends of 2016-2024 and psychological market dynamics, which have resulted in a conclusion that Meta is fundamentally sound, operationally efficient and structurally positioned to create long-term value in 2025. These elements of rising residual earnings, high RNOA, discipline in the management of liabilities, rising NOA and monetisation gains driven by AI enhance the legitimacy of the data-based Meta advertising revenue forecast. The presence of these strengths means that the value creation engine of Meta is robust despite noise in the market and sentiment changes.

By this fact, investors who are asking the question of whether to meta stock buy or sell 2025 can be confident in the fact that the firm has been able to generate high economic returns, has a high level of technical infrastructure, and is a market leader. The performance trends which are evident in the NOA, OLLEV, RNOA and residual earnings show that the intrinsic valuation of Meta has good operational fundamentals. This is what makes the future of Meta stock price target 2025, not a hype matter, but that of measurable economic outcomes.

All calculations and valuation estimates are FinancialBeings’ own, based on data sourced from SEC filings (10K and 10Q), use or reproduction before prior approval is prohibited.

Frequently Asked Questions (FAQs)

Is Meta a strong buy?

Meta possesses a good core, including rising residual earnings, high RNOA, and a sensible operating efficiency (Meta, 2024). This is a good indication of the intrinsic-value profile. It is a robust purchase depending on the risk level of an individual who is assuming an investment goal, but the statistics behind it show that Meta is inherently robust.

Will Meta stock hit $800?

No model can assure that Meta can reach a price level of $800. The prices of markets, the mood and external economic factors are the factors that affect the prices of stocks. The aim should be at the intrinsic worth and financial foundation of Meta rather than a certain future price. However, The fundamentals indicate that META can reach $800 or above that based upon 2024 efficiency.

Usama Ali

Usama Ali is the founder of Financial Beings and a self-taught investor who blends classic valuation study with insights from psychology. Inspired by works from Benjamin Graham, Aswath Damodaran, Stephen Penman, Daniel Kahneman, and Morgan Housel, he shares independent, data-driven research to help readers connect money, mind, and happiness.

Disclaimer

The content provided herein is for informational purposes only and should not be construed as financial, investment, or other professional advice. It does not constitute a recommendation or an offer to buy or sell any financial instruments. The company accepts no responsibility for any loss or damage incurred as a result of reliance on the information provided. We strongly encourage consulting with a qualified financial advisor before making any investment decisions.