Let’s look into ASML stock intrinsic value as it continues to dominate the global lithography process of extreme ultraviolet (EUV), which is essential to sophisticated semiconductor production. Nevertheless, using the company’s Q2 2025 release of earnings release will show positives and areas of concern that would influence the intrinsic value of the company. Nevertheless, although financial results were strong, the attitude shifted towards the market due to fears of growth in 2026 and geopolitical risks, which directly affect the ASML valuation scenarios.

Q2 2025 Earnings Performance

ASML made net sales of €7.7 billion in Q2 2025 and got to the higher end of guidance, and gross margins reached 53.7 per cent, touching higher than the consensus estimates (ASML, 2025).

Although ASML has such strong results, its stock price decreased by about 6-10 per cent when the earnings were published. This was based on analysts citing lower-than-expected Q3 guidance, indicating its forecasted sales to be between €7.4 and 7.9 billion with a gross margin of 50-52 per cent and managerial warning over revenue growth in 2026 as a factor (Financial Times, 2025).

Operational and Financial Metrics

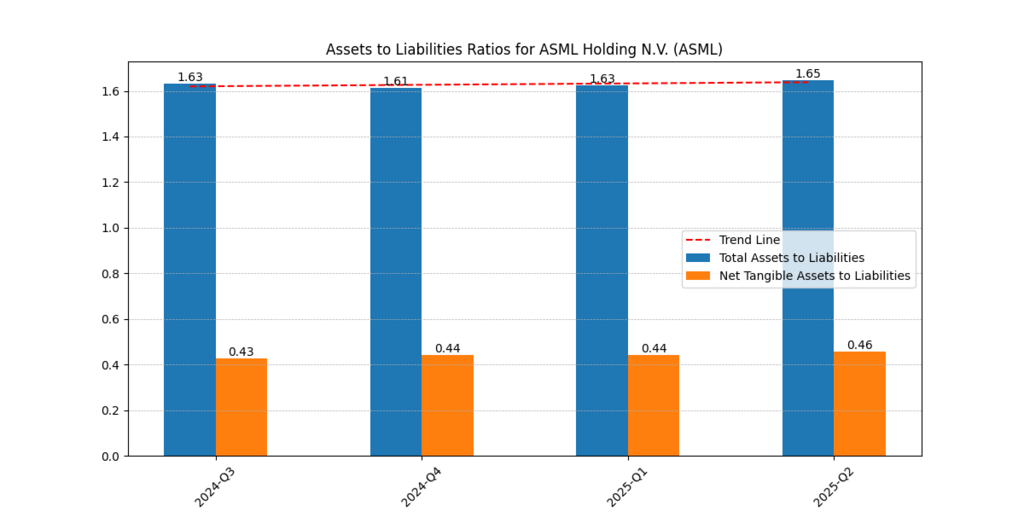

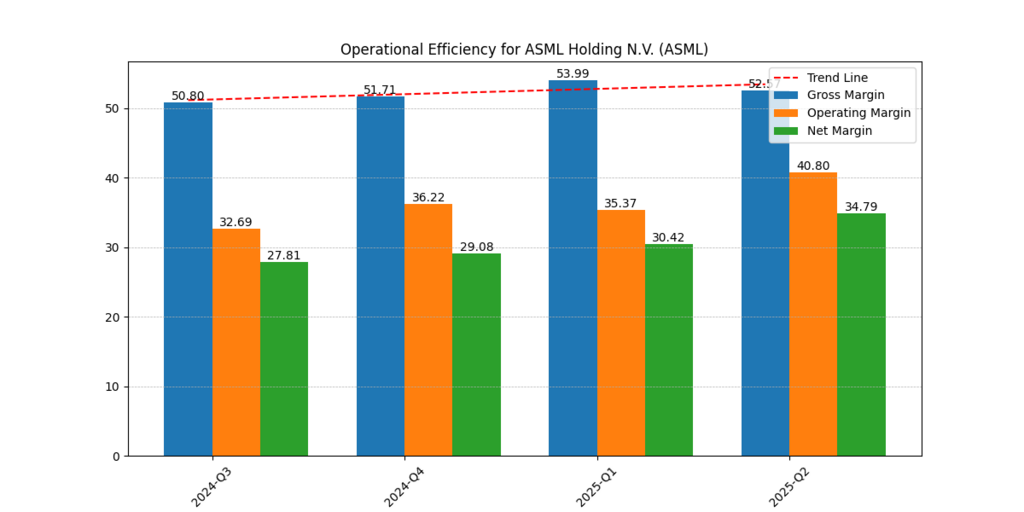

The efficiency with which ASML is operating continues to be strong, with increasing margins. Since 2024, the gross margin of the company has been maintained at more than 50%, and the operational and net margins have been increasing (see Figure 1).

Figure 1: Assets-to-Liabilities Ratios for ASML Holding N.V. (Q3 2024 – Q2 2025), which display the total assets to liabilities trend and net tangible assets.

Figure 2: Key performance indicators of Operational Efficiency Gross, Operating, and Net Margins of ASML 03 2024 to Q2 2025.

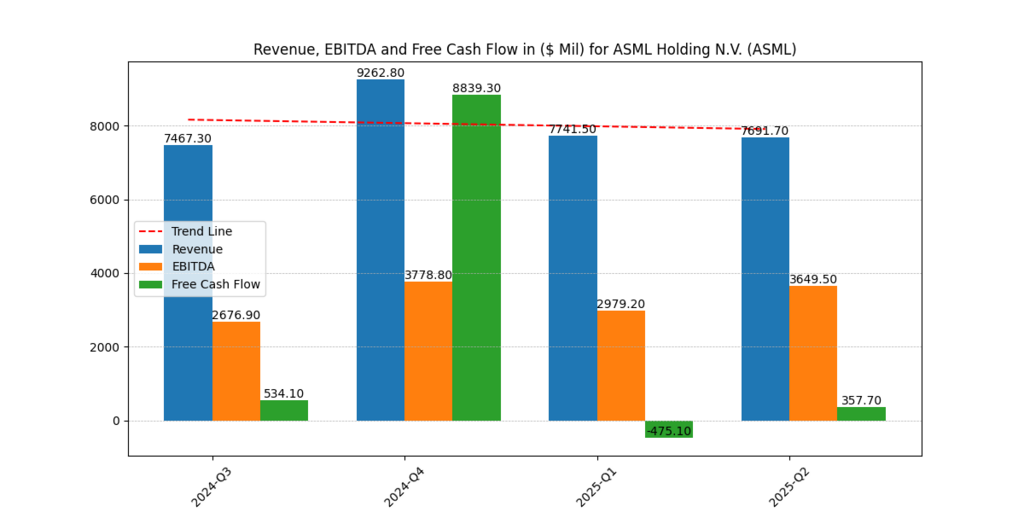

The revenue, EBITDA, and free cash flow of ASML are also quarterly volatile, where the revenue experienced a high of €9.26 billion in Q4 2024 and corrected to $7.69 billion in Q2 2025 (see Figure 3). The reduction of the free cash flow at the beginning of 25 indicates the vulnerability of the free cash flow due to customer demand cycles and supply chain problems. The ASML Stock Intrinsic Value depends on these operational patterns as inputs.

Figure 3: Revenue, EBITDA, and Free Cash Flow of ASML Holding N.V., which shows performance by quarter and changes in cash flow.

Valuation Scenarios

Two scenarios of intrinsic value are specifically topical:

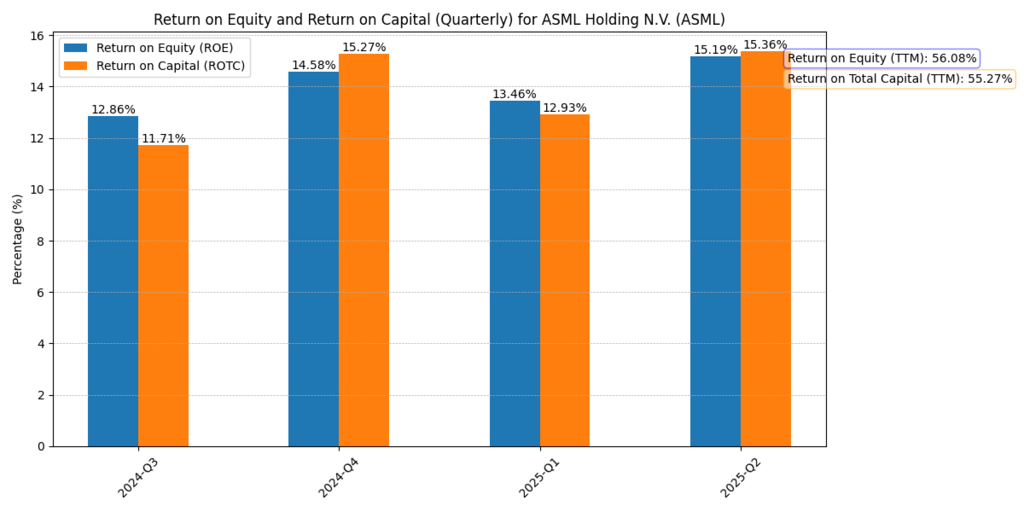

Figure 4: Return on Equity (ROE) and Return on Total Capital (ROTC) between Q3 2024 to Q2 2025, which shows a better capital efficiency.

Bear Case – Valuation at $574 per Share

On the negative side, in an event where the growth of ASML slows down significantly under the impact of macroeconomic headwinds, geopolitical risks, or decreased demand in EUV, the intrinsic value is pegged at the price of $574 per share at growth rate of 6.5%. This is a scenario when there is low margin expansion, and there is consideration of using a higher discount rate due to the high risk (Barron’s, 2025). The extreme fall in value casts light on the effects of tariffs, especially the 30 per cent U.S import tariff on semiconductor equipment, which may drastically reduce the ASML Stock Intrinsic Value (Reuters, 2025).

Further Reading: Uncover Nvidia’s True Value

Base/Bull Case – Valuation at $727 per Share

By continuing to maintain the current year growth rate of 7%, due to sustained demand for chips driven by AI, or adoption of EUV systems, the intrinsic value of the stock could be around $727 per share. This situation is an indicator of ASML’s competitive edge, pricing ability, and long-term secular growth of semiconductor fabrication (Financial Times, 2025).

Market Sentiment and Analyst’s Views

Various analysts have given a mixed response after the Q2 results. Jefferies estimated that revenue would fall by 2 per cent in 2026 if tariff risks persist, and others cautioned that increased expenditure on research and development (which would be well over €1.2bn per quarter) would have a drag effect on subsequent margins (Barron’s W, 2025). The Q2 gross margin of 53.7 per cent may not be maintained until the end of the year, in case the customer hesitates in their investments amidst global economic uncertainty.

Geopolitical and Macro Risks

The shares of ASML Stock Intrinsic Value are intimately related to geopolitical events. The current tension between the United States and China and export bans on high-tech chip manufacturing tools are a major threat to revenue growth (Reuters, 2025). Also, exposure of equipment in Europe to possible U.S. tariffs may increase prices by as much as 30 per cent, cutting margins and customer demand.

Conclusion

The Q2 2025 earnings of ASML renew its claims as a leader of the advanced semiconductor equipment industry, but at the same time testify to the risks associated with globally unstable trade relations and cyclical demand. The intrinsic value of this company will be in the interest of range, approximately, between $574 (when considering a bear scenario) and $727 (a growth scenario), respectively, but with possible results of limited margin of safety at current prices. Comparing the extreme technological advantage of the company to the external risks, investors should analyse whether the current price of ASML properly accounts for the market uncertainty.

Disclaimer

The content provided herein is for informational purposes only and should not be construed as financial, investment, or other professional advice. It does not constitute a recommendation or an offer to buy or sell any financial instruments. The company accepts no responsibility for any loss or damage incurred as a result of reliance on the information provided. We strongly encourage consulting with a qualified financial advisor before making any investment decisions.