A Review of Best Growth Stocks for the Next 5 Years that is Conducted by Analyzing financial performance and strategic positioning.

Making smart long-term investments today means going beyond following trends and understanding the finances, leadership, and innovation sides of companies. Because of international uncertainty, interest rate changes, and technological changes, equity markets are experiencing both potential hazards and unique new opportunities.

As a result, many investors now prefer companies that can handle unstable markets, earn a lot each quarter, invest money wisely, and lead innovation, whether in products or services. Managers pay more attention to growing the company over the long term through safe and sustainable operations and clear advantages.

Due to their efficient operations, positive returns, solid margins, and promising prospects, our analysis singles out Nvidia Corporation (NVDA), ASML Holding N.V. (ASML), and Occidental Petroleum Corporation (OXY) as three companies that attract us. While these firms focus on AI, semiconductors, and green energy, all of them have a position and a disciplined system that should help them grow strongly in the years to come.

All firms in this list have high margins, are growing their cash flow, and earn above-average returns on equity and capital. As they invest resources in forward-looking technology and efficient capital handling, they have a better chance of benefiting from positive changes in the wider economy and specific industries.

For clarification: No financial recommendations are made based on this analysis, as we are not qualified to give such advice. Universally, markets are risky, and anyone taking financial decisions should do their own research or ask a certified advisor.

1. Nvidia Corporation (NVDA)

Region: United States

Sector: Semiconductors / Artificial Intelligence

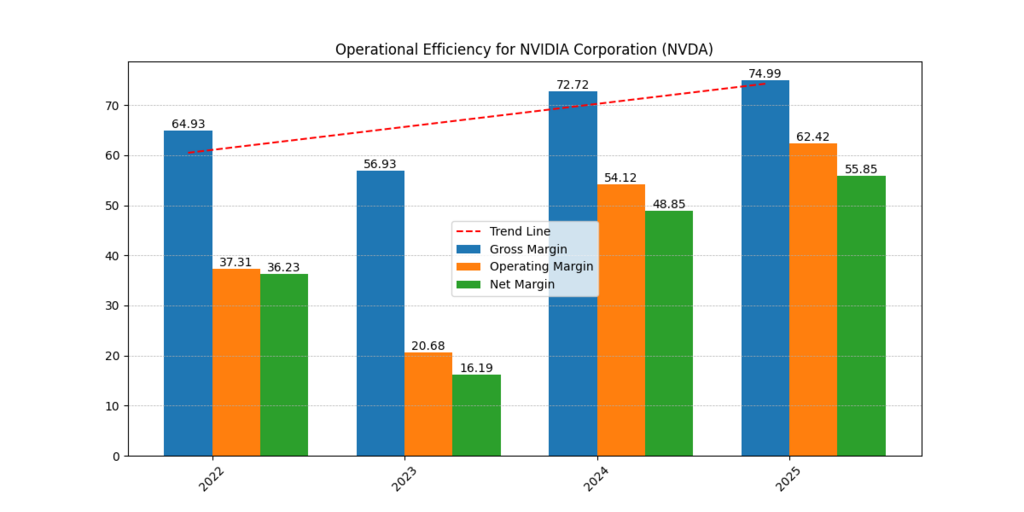

Nvidia is now the leading company in artificial intelligence, controlling GPUs and growing fast in data centers, self-driving cars, and generative AI infrastructure. The great results achieved in 2025 prove that it is a leading company in the industry (Yahoo Finance, 2025).

Key 2025 Financial Highlights: Best Growth Stocks for the Next 5 Years

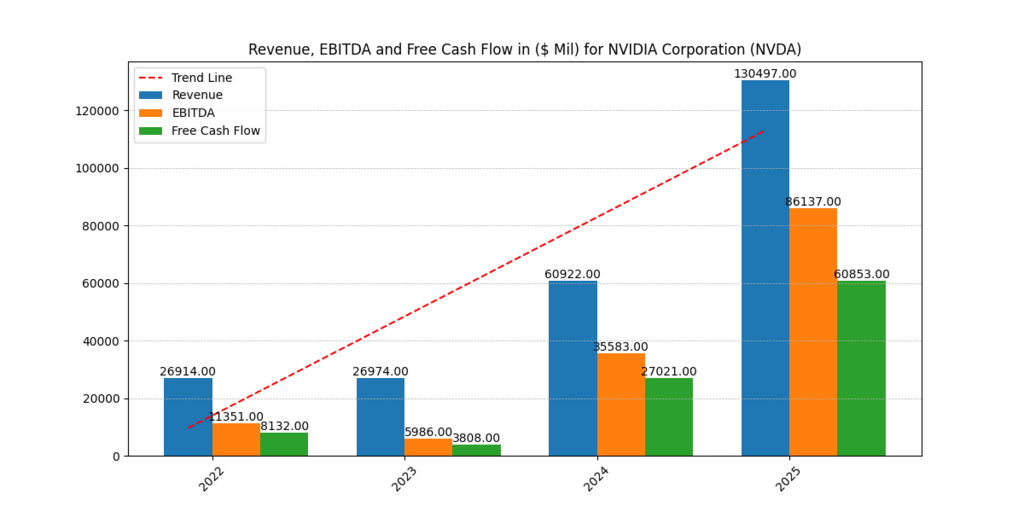

- Revenue: $130.5 billion

- EBITDA: $86.1 billion

- Free Cash Flow (FCF): $60.8 billion

- ROE: 91.87%

- Net Margin: 55.85%

- PE Ratio: 45.18

A notable point is Nvidia’s Return on Total Capital (ROTC), amounting to 94.06%, and its high equity ratio of 88.5%, which shows the company has little debt and strong capital. As more people depend on AI models such as ChatGPT and Google Gemini, which run on GPUs, Nvidia is likely to meet or top EPS expectations (Morningstar, 2025).

Nvidia’s investors are still hopeful about the company, despite the 37.7 EV/EBITDA ratio, given its exceptional technology and the central role it plays in the AI sector (Financial Times,2024).

2. ASML Holding N.V. (ASML)

Region: Netherlands (Europe)

Sector: Semiconductor Equipment

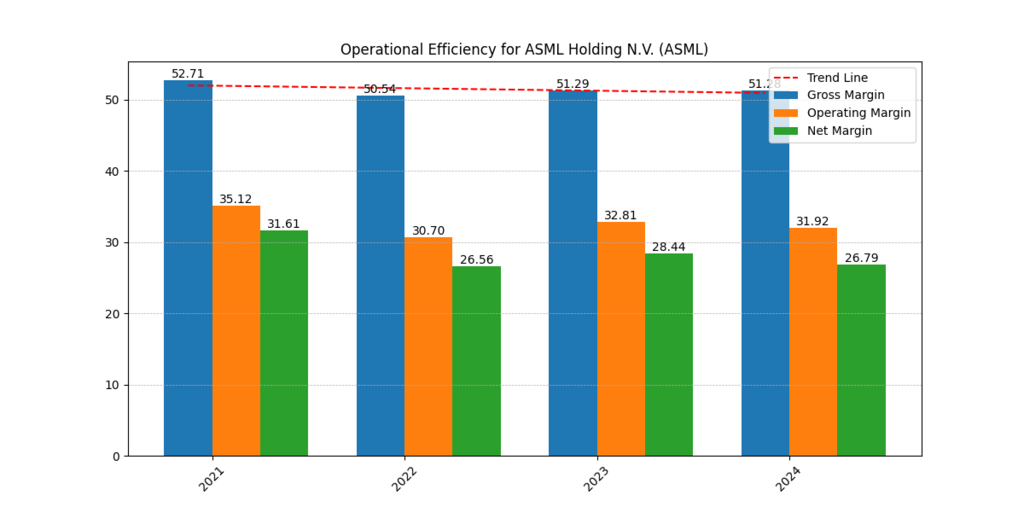

ASML is responsible for designing and building the only EUV lithography machines needed for recent chipmaking. It may not get the same media recognition as the chip industry, but it is vital to the whole semiconductor business. Find out our another list of Growth Stocks to Buy Now amid Tariffs Easing.

Key 2024 Financial Highlights:

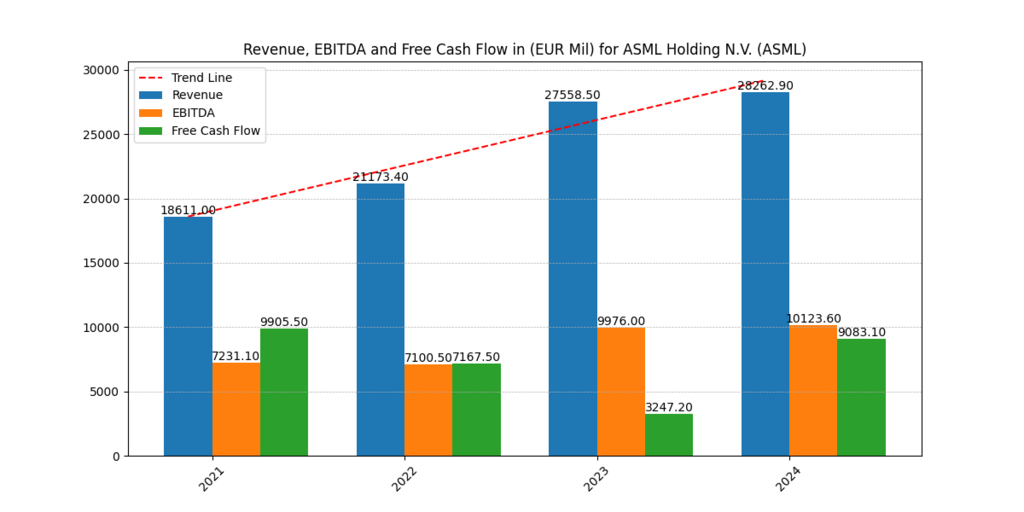

- Revenue: €28.7 billion

- EBITDA: €10.1 billion

- FCF: €9.1 billion

- ROE: 40.98%

- Net Margin: 26.79%

- PE Ratio: 29.68

For a company building complex capital equipment, it is difficult to maintain a gross margin as high as 50%, but ASML does so. The company’s EV/EBITDA is not excessive at 29.5, despite its importance to the overall market (ASML, 2024).

The chip market moving from lows to highs has not stopped the company’s increase in revenue. TSMC, Intel, and Samsung are major clients for ASML, and using EUV is set to increase during the next decade. If the company earns an FCFE of €13.2 billion or greater, it is dedicated to giving shareholders good value (CNBC, 2025).

3. Occidental Petroleum Corporation (OXY)

Region: United States

Sector: Energy / Carbon Management

Occidental Petroleum is referred to as an oil and gas major, yet in recent years, the company has dealt more with carbon capture and clean energy. It makes it suitable for a world that is reducing carbon emissions.

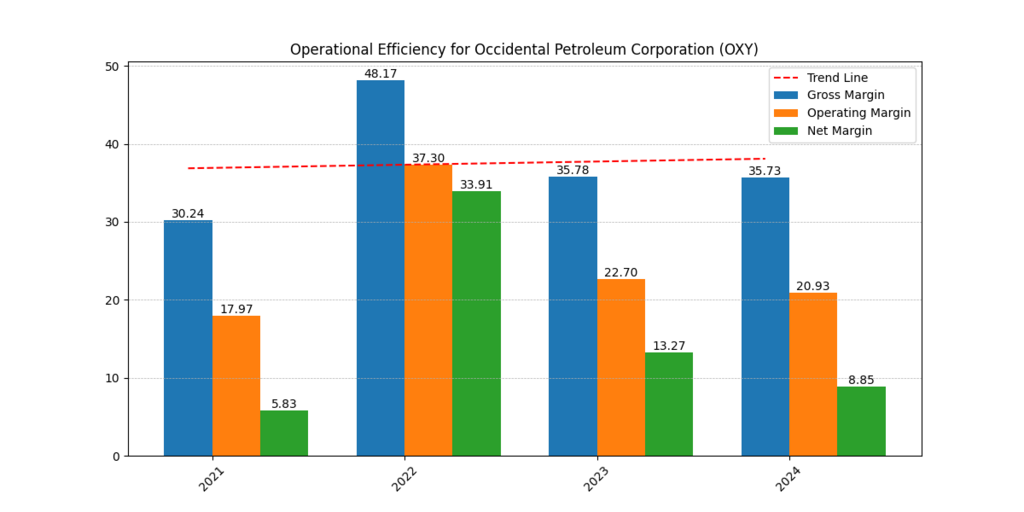

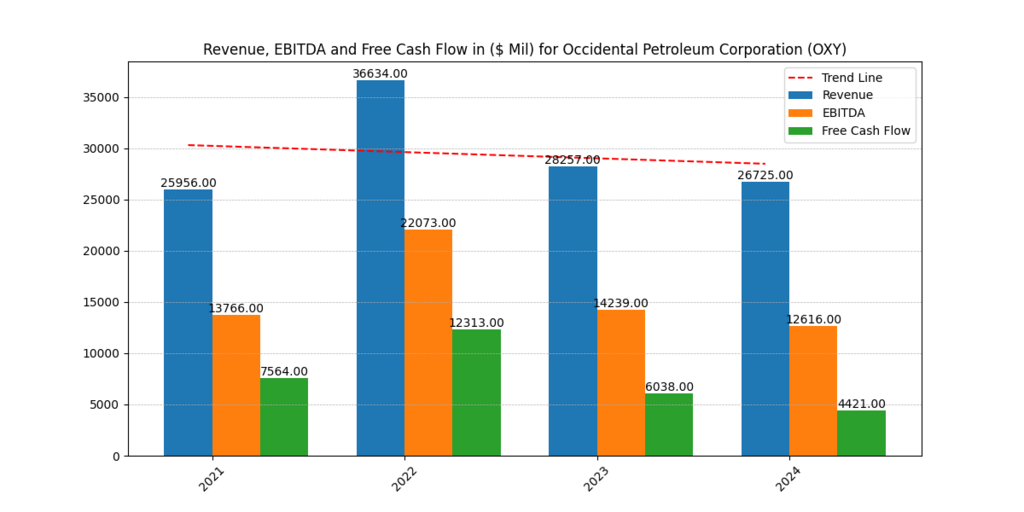

Key 2024 Financial Highlights:

- Revenue: $26.7 billion

- EBITDA: $12.6 billion

- Free Cash Flow: $4.4 billion

- ROE: 11.81%

- Net Margin: 11.43%

- PE Ratio: 16.63

Unlike the other technology stocks listed above, OXY is valued at only 5.26 times its EBITDA and could be trading at a discount for what it owns. Returns on capital and ROE are poorer, still in line with the energy sector’s tendency to require large investments (Nasdaq, 2025).

As Berkshire Hathaway’s main energy partner and a major player in advanced carbon capture, Occidental brings the benefits of both consistency and environmental awareness to its shareholders. The FCFE of $23.5 billion suggests there is strong scope for payments to investors if the price of the currency stabilizes (Berkshire Hathaway, 2024).

Comparison Table: Key Financial Metrics

| Metric | Nvidia (NVDA) | ASML Holding (ASML) | Occidental (OXY) |

| Net Margin (%) | 55.85 | 26.79 | 11.43 |

| Return on Equity (ROE %) | 91.87 | 40.98 | 11.81 |

| EBITDA (Millions) | 86,137 | 10,123.6 | 12,616 |

| Free Cash Flow (Millions) | 60,853 | 9,083 | 4,421 |

| PE Ratio | 45.18 | 29.68 | 16.63 |

| EV/EBITDA | 37.7 | 29.5 | 5.26 |

Conclusion

All of these companies, Nvidia, ASML, and Occidental Petroleum, have different backgrounds (AI, semiconductor equipment, and energy) yet demonstrate a clear plan to keep growing with solid financials.

- Among all companies, Nvidia has excelled in AI by using its money wisely.

- No other company is as important to the worldwide chip supply chain as ASML.

- Occidental Petroleum is changing from a fossil fuel company to a business focused on innovation in sustainability (Occidental Petroleum, 2024).

Although we don’t offer investment guidance, these companies seem to be leading growth stocks for the next five years, due to their strong performance, strategies, and potential for adding value. Whenever possible, do some research or enlist the help of a licensed financial adviser before investing.

Disclaimer

The content provided herein is for informational purposes only and should not be construed as financial, investment, or other professional advice. It does not constitute a recommendation or an offer to buy or sell any financial instruments. The company accepts no responsibility for any loss or damage incurred as a result of reliance on the information provided. We strongly encourage consulting with a qualified financial advisor before making any investment decisions.