Introduction

You can now discover the 5 Best AI Stocks to Buy Now in 2025 by comparing NVIDIA, Microsoft, Alphabet, Amazon, and Alibaba using profitability and performance measures, thereby improving their investment performance.

Artificial intelligence is driving the development of groundbreaking technologies such as autonomous vehicles, natural language processing, cloud computing, and targeted advertising. These advancements are transforming industries and human lifestyles. As global AI investment continues to rise, investors are focusing on finding top artificial intelligence stocks. However, it’s challenging to find companies with sound financial situations, expanding profit margins, and straightforward AI projects.

The article examines the five most successful artificial intelligence stock companies, NVIDIA, Microsoft, Alphabet, Amazon, and Alibaba, using metrics like gross margin, operating margin, and net margin. This article provides a comparison of valuations and efficiency analysis to help investors make informed decisions in the artificial intelligence market landscape of 2025.

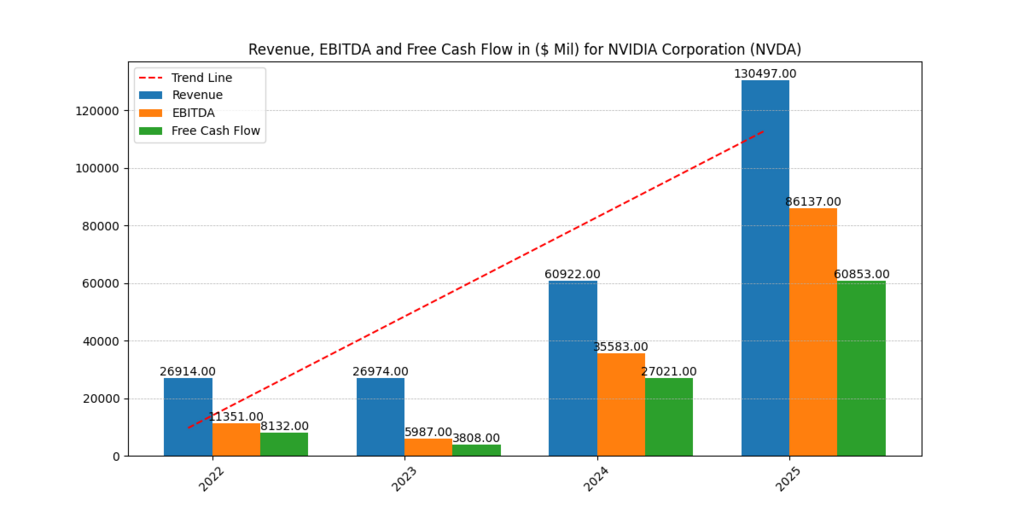

NVIDIA (NVDA)

NVIDIA Corporation is the economic leader in the artificial intelligence industry, renowned for its top-performance chips used in artificial intelligence data centers and model training applications. The company’s GPU architecture leadership is responsible for gaming and complex machine learning operations across various sectors. NVIDIA’s high profitability is attributed to its competitive rates and effective business operations. Consistent funding for research and development, backed by good cash flow performance, maintains its technological advantage.

NVIDIA’s efficiency and return productivity are remarkable, and its strategic connections with clients contribute to its premium pricing. Investors seeking leaders with profitability potential and long-term value in artificial intelligence may consider NVIDIA as a solid investment opportunity. NVIDIA’s enduring and stable foundations make it a solid and high-growth firm that should be included in portfolios dedicated to artificial intelligence innovation, regardless of market conditions.

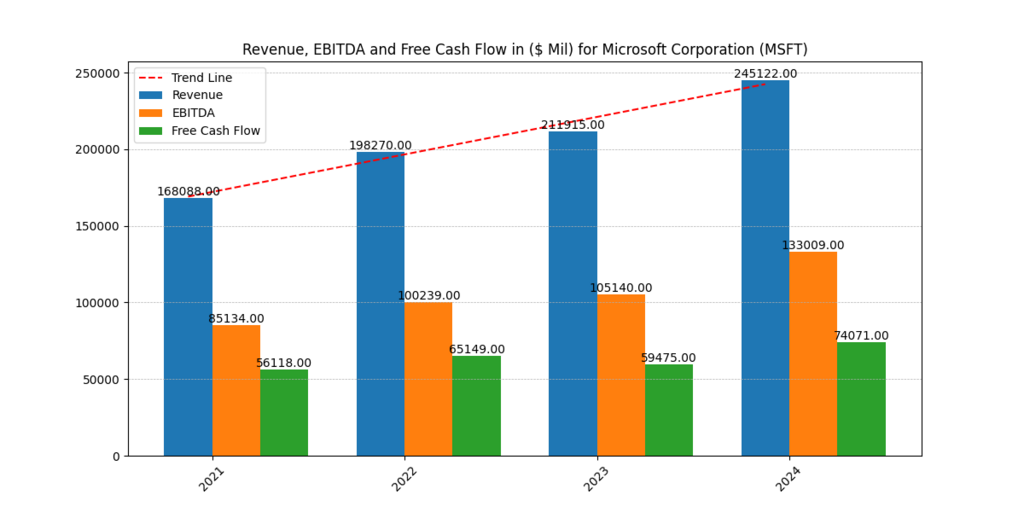

Microsoft (MSFT)

Microsoft successfully integrates profits from its operations with innovation in the artificial intelligence sector by connecting its artificial intelligence approach with cloud infrastructure, enterprise software, and productivity tools. This results in recurring income, which funds robust performance numbers. By implementing AI services on a large scale, Microsoft achieves efficiency and cost reductions. The company’s financial filings show consistent annual revenue conversion to profit and a substantial cash on hand. It also has an affordable capacity for innovation and acquisition.

Microsoft’s diverse business divisions and main market, serving major institutions, help defend against product failures, boosting its safety margin. The company’s consistent growth is reflected in its share price, but there is potential for additional growth due to the increasing adoption of AI. Investors with a focus on stable profits, scalable AI deployment, and stable corporate operations should consider Microsoft as a viable financial option. [1]

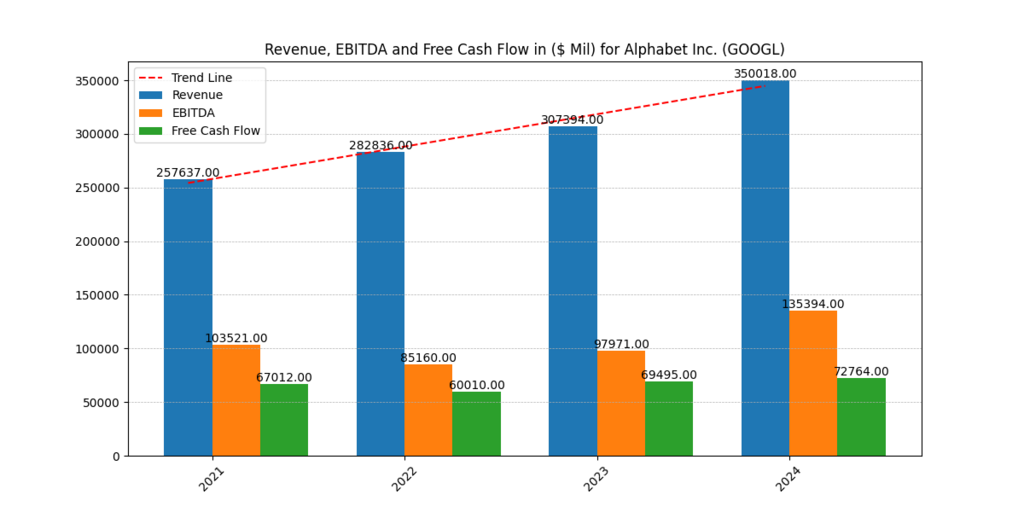

Alphabet (GOOGL)

Alphabet, a relatively unknown leader in artificial intelligence, has maintained strong financial stability through its AI capabilities across major business sectors like search and advertising, self-driving technology, and cloud hosting operations. The company’s vertical expansion positions it as a formidable future market player due to its ability to control costs and innovate product development. DeepMind, a core division, widens its technological barriers through investments in artificial intelligence research. Alphabet exhibits responsible financial management, generating superior returns despite regulatory concerns and economic fluctuations. Here you can find out Best Dividend Paying AI Stocks!

Compared to other firms, Alphabet stands out due to its stock price to earnings ratio, offering investors additional investment opportunities. The company has transformed itself into a technological company suitable for investment, providing investors with a reliable and effective artificial intelligence investing framework, particularly useful in a rapidly developing sector. Alphabet’s stock price to earnings ratio offers investors additional investment opportunities, making it a suitable investment choice. [2]

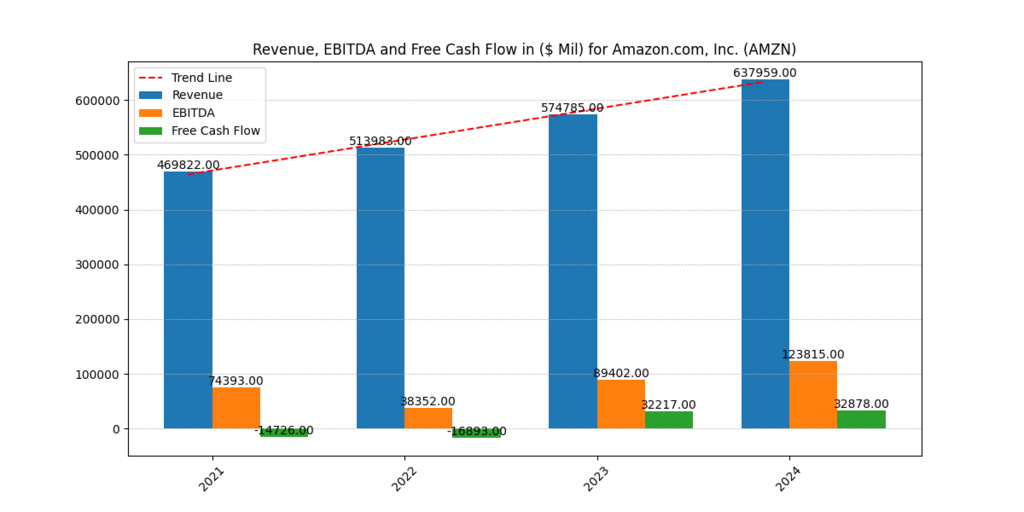

Amazon (AMZN)

Amazon leverages its vast e-commerce and cloud platforms to capitalize on artificial intelligence investing opportunities. Amazon Web Services, its primary cloud-based innovation center, generates significant profits by compensating less profitable business divisions. The company has also invested in operational efficiency through voice assistants, personalized shopping features, and logistics automation technologies powered by artificial intelligence.

Despite generating minimal direct profitability, Amazon’s financial operations show improvement annually. The company’s reinvestment plan aims to ensure future market dominance. Despite generating minimal direct profitability, Amazon’s extensive operations and diverse economic activities, along with its vast database resources, demonstrate substantial value. The company’s market valuation is directly proportional to its future prospects in artificial intelligence services. Investors can leverage Amazon’s infrastructure-based prospects for artificial intelligence expansion, thanks to its long-term investment time and growth interest. This approach allows Amazon to continue dominating the market in the future.

Alibaba (BABA)

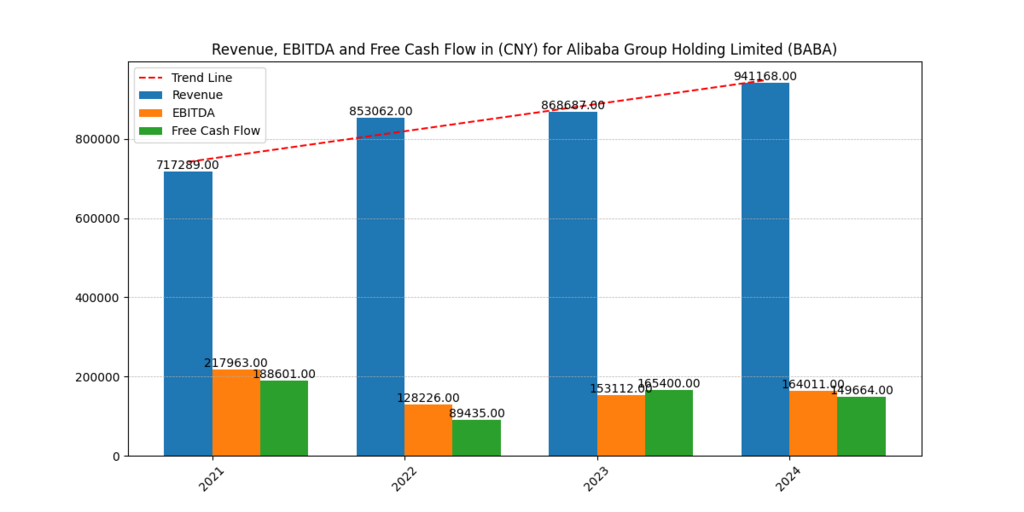

Alibaba, a leading player in the AI market, operates in various sectors such as retail, financial technology, and cloud computing. Despite lower margins compared to US-based technology businesses, Alibaba generates significant profits from its operations. Its efficient cloud-based infrastructure and AI-driven logistical operations contribute to its cost-effectiveness.

Despite ongoing optimization efforts, Alibaba’s financial performance remains stable, with an undervalued valuation. This puts it behind many competitors in the industry, offering opportunities for value-based investments. Alibaba’s vast consumer data and large scale allow it to leverage AI insights and generate revenue streams. Despite geopolitical challenges and government supervision, Alibaba maintains a stable operations base and the ability to increase margins. Its strategic investment potential provides investors with exposure to AI and offers opportunities to expand markets. [4]

Comparison of Returns Between these 5 Companies

| Company | ROA (%) | ROE (%) | ROTC (%) |

| NVDA | 65.3 | 91.87 | 94.06 |

| GOOGL | 23.35 | 32.15 | 35.72 |

| MSFT | 17.37 | 30.64 | 28.67 |

| BABA | 6.52 | 12.08 | 11.91 |

| AMZN | 9.48 | 20.72 | 16.09 |

Recent AI Projects of the Five Companies

| Company | Project Name | Year | Description |

| NVIDIA | DGX GH200 AI Supercomputer | 2024 | Launched a powerful AI supercomputer using Grace Hopper chips to accelerate GenAI model training. |

| Microsoft | Copilot for Microsoft 365 | 2024 | Integrated OpenAI’s GPT-4 into Microsoft 365 apps (Word, Excel, Outlook) to assist with content creation and productivity. |

| Alphabet | Gemini (formerly Bard) | 2024 | Released a next-gen multimodal AI model to compete with ChatGPT across Google services. |

| Amazon | Bedrock AI Platform | 2024 | Enabled AWS users to build and scale generative AI apps using foundational models from multiple providers. |

| Alibaba | Tongyi Qianwen 2.0 | 2024 | Released an upgraded LLM integrated across Alibaba products, including e-commerce, logistics, and cloud. |

Conclusion

To choose the top artificial intelligence stocks to buy, investors must conduct financial analysis, strategic focus, and innovative capacity. NVIDIA has the most profitable position, while Microsoft integrates business solutions for corporate integration. Alphabet is a good investment due to its superior financial performance control and AI skills. Alibaba offers potential for future market expansion, while Amazon, a cloud leader, has long-term growth opportunities. These companies demonstrate commitment to digital transformation and employ innovative AI approaches. Investors should analyze the financial stability and innovative techniques of these companies to gain future-proof advantages in the rapidly developing artificial intelligence market of 2025.

Disclaimer

The content provided herein is for informational purposes only and should not be construed as financial, investment, or other professional advice. It does not constitute a recommendation or an offer to buy or sell any financial instruments. The company accepts no responsibility for any loss or damage incurred as a result of reliance on the information provided. We strongly encourage consulting with a qualified financial advisor before making any investment decisions.