Introduction

People search for best AI stocks with potential investment value. The AI semiconductor market sees its leadership sorted between Nvidia and TSMC as both generate rising revenues together with strong ROE and healthy cash flows. Understand the reasons why these two organizations currently dominate the Artificial Intelligence transformation.

Two companies named Nvidia (NVDA) and Taiwan Semiconductor Manufacturing Company (TSMC) drive the industrial transformation powered by artificial intelligence (AI) technology. These companies currently function as the key drivers for AI innovation through their leading roles in chip development and manufacturing operations which experience rapidly expanding capability.

Nvidia maintains its position as the main AI chip designer worldwide through its Blackwell series which runs data centers and autonomous vehicles and machine learning applications. The company offers GPUs which serve as essential components for training and executing AI models which positions it as the leading option for AI computing operations. TSMC operates as the globe’s biggest semiconductor foundry unit which produces leading-edge chips for customers including Nvidia and Apple as well as AMD.

TSMC functions as the exclusive manufacturer of top-tier AI processors to help maintain an important position throughout the AI hardware supply chain. The notable revenue growth combined with robust free cash flow (FCF) and superstar return on equity (ROE) make these two companies the ideal choices for AI investing.

This post analyzes Nvidia and TSMC’s overwhelming control of AI markets together with their financial power and the rationale behind their position as crucial AI investment opportunities during the revolution.

Nvidia Corporation

Nvidia achieved extraordinary financial expansion through its leading position in artificial intelligence chip manufacturing during these last years. During the fiscal year that ended January 26, 2024 the company recorded a 78% increase in revenue which reached $39.3 billion while exceeding analysts’ predicted $38.3 billion. The overall financial performance of the company resulted in an 80% boost in net income which reached $22.1 billion in the most recent fiscal year.

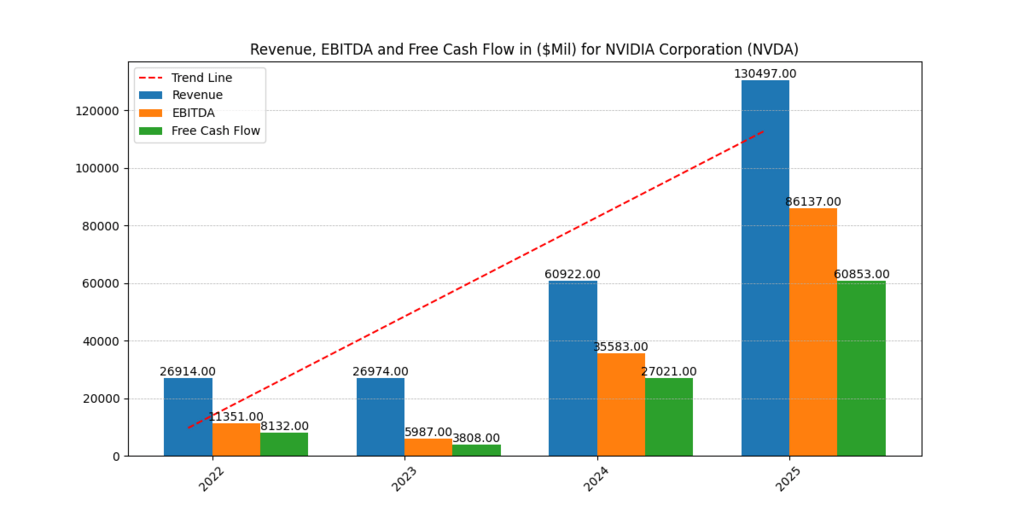

The development of Nvidia’s Blackwell generation of chips has become instrumental to this product expansion. The advanced Blackwell chips registered “amazing” market demand which brought $11 billion revenue into the quarter while major tech firms continued to build up their AI capabilities. The annual financial performance of Nvidia demonstrates strong growth with $26.914 billion in 2021 revenue transforming to $130.497 billion in 2024. The company witnessed a significant boost in EBITDA which grew from $1.351 billion in 2021 to $86.137 billion in 2024 while free cash flow experienced a comparable increase from $8.132 billion to $60.853 billion during this time period. Find our complete analysis on NVIDIA and if it is a buy now in 2025?

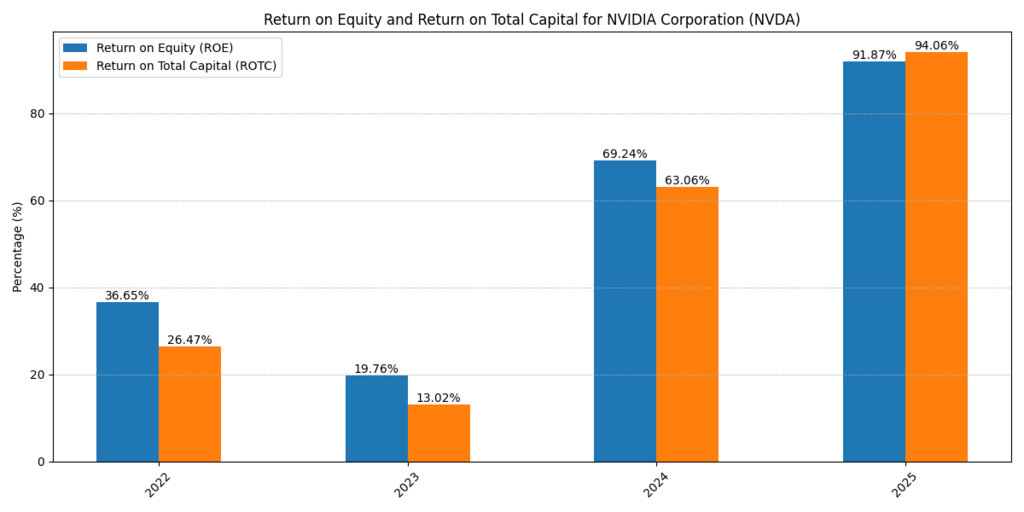

The financial performance metrics ROE and ROTC demonstrate remarkable growth during this period as ROE climbed from 36.65% in 2021 up to 91.87% in 2024 while ROTC rose from 26.47% to 94.06% throughout the same period. Nvidia operates with significant hurdles despite its successful market performance.

Chinese AI start-up DeepSeek has developed a chip platform that trains models using entry-grade equipment which creates doubt about future needs for Nvidia’s premium products. CEO Jensen Huang reacted to these concerns by highlighting that Blackwell chips maintain a secure market position. The operations of Nvidia could experience effects from potential new U.S. export controls along with tariffs because of the company’s substantial geopolitical exposure between Washington and Beijing. [2]

Taiwan Semiconductor Manufacturing Company (TSMC)

TSMC advances its industry leadership status within the global AI supply chain as it demonstrates business strength during times of geopolitical challenges. The fourth quarter of 2024 brought TSMC a net profit of NT$374.7 billion ($11.4 billion) which represented a 57% increase as well as revenue that grew by 39% during that period. During the last twelve months TSMC witnessed a remarkable performance as its Taipei stock prices reached 90% growth and its American depository receipts experienced 103% increase. The AI chip market demands serve as the basis for the company’s champion financial results which have caused its substantial market expansion.

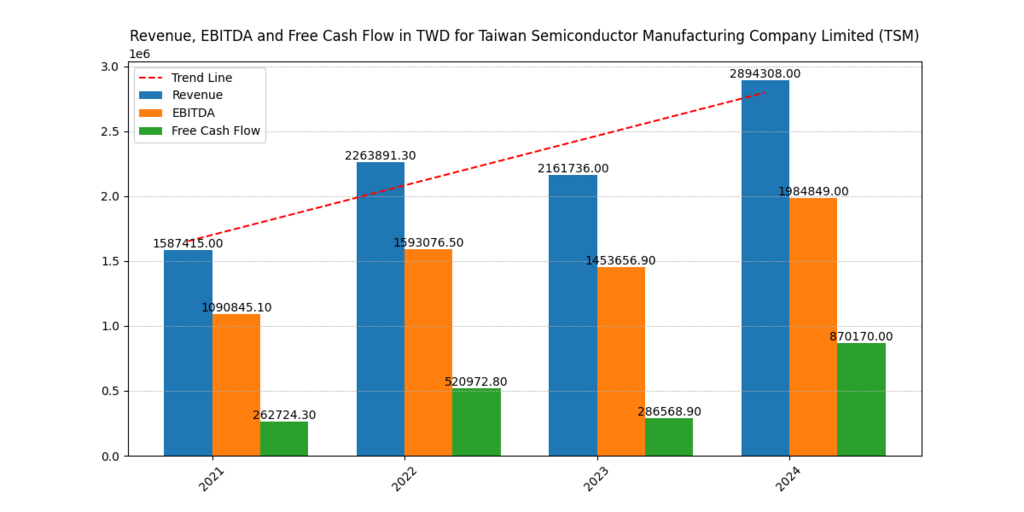

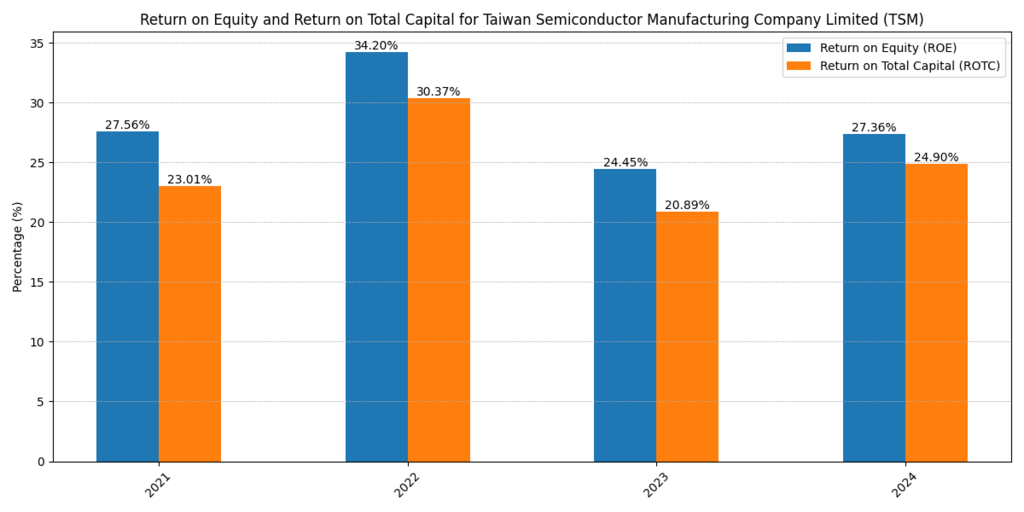

Multiple financial indicators show that the company demonstrates progressive financial performance. Between 2021 and 2024 TSMC experienced revenue growth rising from $1,587.415 million to $2,894.308 million. The company generated EBITDA growth of $1,090.845 million to reach $1,984.849 million while free cash flow improved from $262.724 million to $870.170 million in the same period. The company achieved a rise in ROE from 27.56% to 27.36% during the period 2021 to 2024 alongside a ROTC growth from 23.01% to 24.90%. [4]

The U.S. government has implemented tough restrictions on exporting chip technology to China which creates serious problems for TSMC. More regulatory compliance requirements stemming from these export restrictions may boost operational costs while impacting business partnerships with particular customers. TSMC’s revenue from China has decreased significantly so that China now represents 10% of total revenue while remaining at 16% in the second quarter of the previous year. Apple and Nvidia along with other major North American clients produced 65% of TSMC’s total net revenue in the second quarter of the previous fiscal year although the company concentrates on this market. [3]

Key Revenue-Contributing Segments of NVIDIA and TSMC

| Company | Segment | Contribution to Revenue | Financial Impact |

| NVIDIA | Data Center & AI Chips | ~80% of total revenue (Q4 2023) | Surging demand for AI processing has driven record revenue growth, making this NVIDIA’s most profitable segment. |

| NVIDIA | Gaming GPUs | ~17% of total revenue (Q4 2023) | While still a significant segment, gaming revenue has been overshadowed by the rapid expansion of AI and cloud computing. |

| TSMC | High-Performance Computing (HPC) | ~42% of total revenue (2023) | The increasing need for AI chips has strengthened TSMC’s position as the leading semiconductor manufacturer, boosting profitability. |

| TSMC | Smartphone Chips | ~33% of total revenue (2023) | Consistent demand from Apple, Qualcomm, and other smartphone manufacturers keeps this segment stable and profitable. |

Significant AI Projects

| Company | Project | Date | Financial Impact |

| NVIDIA | Blackwell AI Chip | 2024 | Contributed to a 78% YoY revenue increase to $39.3 billion in the quarter ending January 26, 2025. Net income surged by 80% to $22.1 billion. |

| NVIDIA | Investment in CoreWeave | 2024 | CoreWeave, a cloud computing firm specializing in AI model development, is preparing for a $4 billion IPO, valuing the company at approximately $35 billion. NVIDIA holds a 5% stake in CoreWeave. |

| TSMC | Expansion of U.S. Operations | 2024 | Pledged to increase U.S. investments by $100 billion to avoid tariffs, strengthening its position in the AI chip manufacturing sector. |

What are the best AI stocks to buy?

The AI stock market presents remarkable development opportunities and NVIDIA and Taiwan Semiconductor Manufacturing Company (TSMC) stand at its forefront. The market value of NVIDIA has expanded significantly through its advanced GPU development leading to its recognition as the seventh American company with a trillion-dollar valuation. NVIDIA’s increased market valuation results mainly from rising customer demand for data center chips with AI capabilities which has pushed the company to lead the AI industry sector.

TSMC functions as the world’s biggest contract chipmaker to provide semiconductor fabrication services which support mainstream technology companies including Apple and NVIDIA through their AI supply chain operations. The global position of its operations keeps the company vital to the core development structure of artificial intelligence technology. AI’s robust potential creates attractive investment opportunities for investors through these two companies which strong presence in the marketplace. [2]

Are AI Stocks a Strong Investment?

A $1.8 trillion value for the AI industry is expected by 2030 because of quick improvements in machine learning and cloud computing along with automatic processes. Businesses which adopt AI solutions witness growing requirements for high-performance chips together with increased computing needs. NVIDIA and TSMC function as pioneering companies supplying leaders of this transformation with AI hardware and semiconductor technology which fuels breakthroughs in multiple industrial sectors.

The dual leadership of AI GPU technology by NVIDIA and semiconductor manufacturing edge of TSMC makes both companies crucial elements for the ongoing Artificial Intelligence boom. These companies can expect ongoing revenue expansion and market growth because the AI adoption rate keeps increasing throughout healthcare and automotive and financial services industries. Long-term investors seeking exposure to the upcoming technological revolution should consider AI stocks since market analysts predict these stocks will outperform traditional tech stocks. [1]

Conclusion

AI stocks present a lucrative investment opportunity as technology continues to transform industries worldwide. Key players like NVIDIA and TSMC are leading this revolution, with their AI segments contributing significantly to their financial growth. NVIDIA specializes in AI chips and data centers, while TSMC is significant in high-performance computing and semiconductor manufacturing. As AI adoption expands from healthcare to finance, the demand for bots, chips, and computing power will increase. AI stocks can be added to portfolios for long-term growth, as they are at the forefront of innovation and are strong vehicles for revenue growth and shareholder value. This makes them a compelling choice for investment in the rapidly evolving tech landscape.

**Please be informed that the content is informational and by no means serve as a buy or sell signal. The company is not responsible for the loss of capital.