Introduction

An analysis of top semiconductor stocks for 2025 will evaluate their financial data including revenue performance, margin rates and debt conditions. Determine which market leaders dominate the sector and what challenges existing organizations face in market share growth.

Modern technology is made possible by the semiconductor sector, which supports all technical applications, including data centers that use artificial intelligence and smartphones. Since revenue growth, profit margins, and financial stability characterize success, the top semiconductor makers will continue to face competitive challenges in 2025. To determine their current market position, the study assesses five prominent semiconductor companies: Taiwan Semiconductor Manufacturing Company (TSM), Broadcom (AVGO), Advanced Micro Devices (AMD), Qualcomm (QCOM) and Micron Technology (MU) . Our examination of cash flow, debt ratios, revenue, and margin performance shows which businesses are resilient and which struggle to maintain their market leadership in the quickly evolving industry sector.

Key takeaways

1. Organisations that are driving their investments in the semiconductor technology powered by artificial intelligence, like TSMC are acquiring competitive advantages in the emerging technology sector.

2. A company with higher margins, higher than average revenue growth and good debt management as the Qualcomm and Broadcom have shown good financial performance and good financial solvency in long run.

3. Collaborations with cloud providers, smartphone manufacturers along with enterprise customers are helping the semiconductor companies to grow their artificial intelligence prowess and reach.

4. Threats like supply chain disruption, geopolitics, and the entrance of competitors like organizations like Apple and Amazon into the chip-making market still linger.

5. Improvement of new AI chip topologies and energy-saving technologies will define the industry’s development in the years to come.

Qualcomm (QCOM): A Strong Revenue Performer with Stable Margins

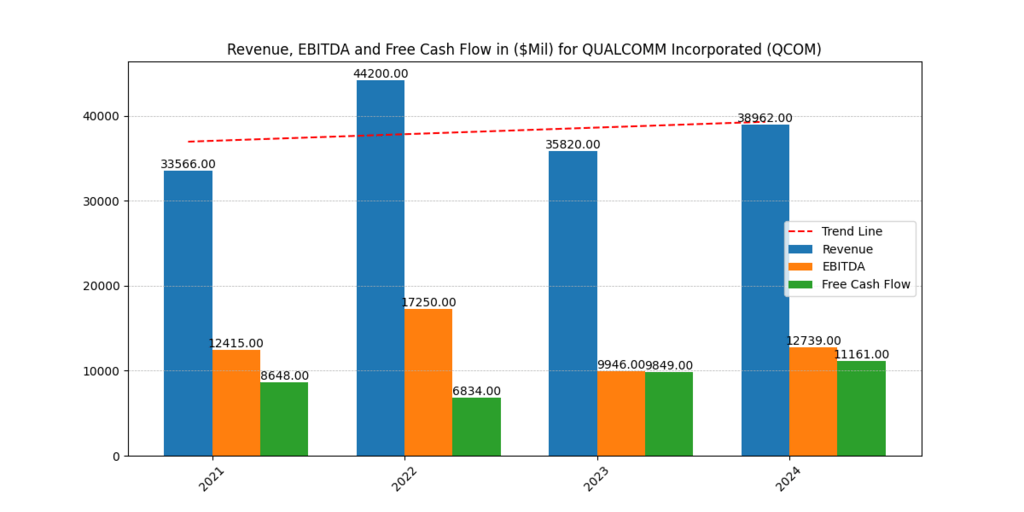

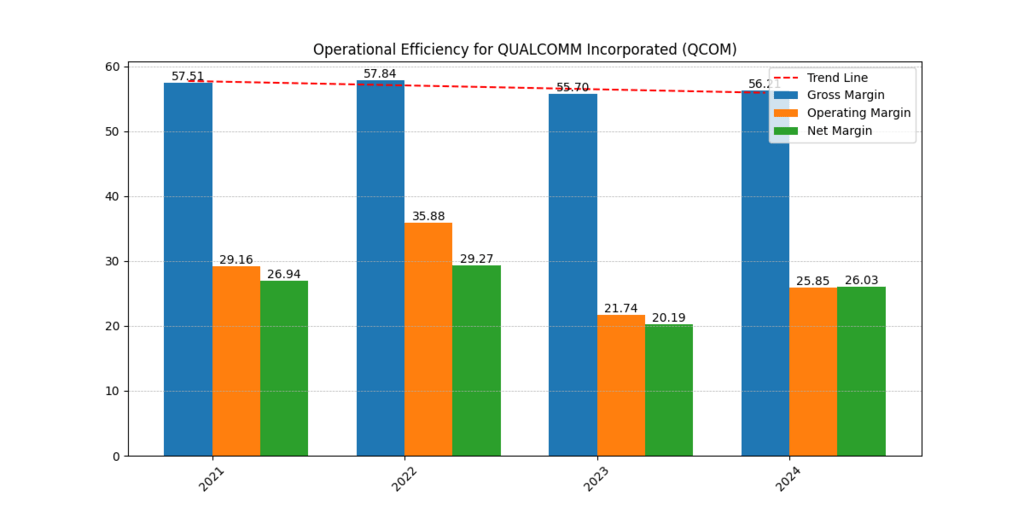

The semiconductor market leader Qualcomm maintains its domain through mobile and wireless communication chips. The company achieved a revenue of $38.96 billion in 2025 which reflects its partial recovery from the downfall during 2023. The operating margin of Qualcomm reached its best point in 2022 at 35.88% before reducing to 21.74% in 2023 but has shown improvement in 2024 to 25.85% which demonstrates enhanced cost control measures.

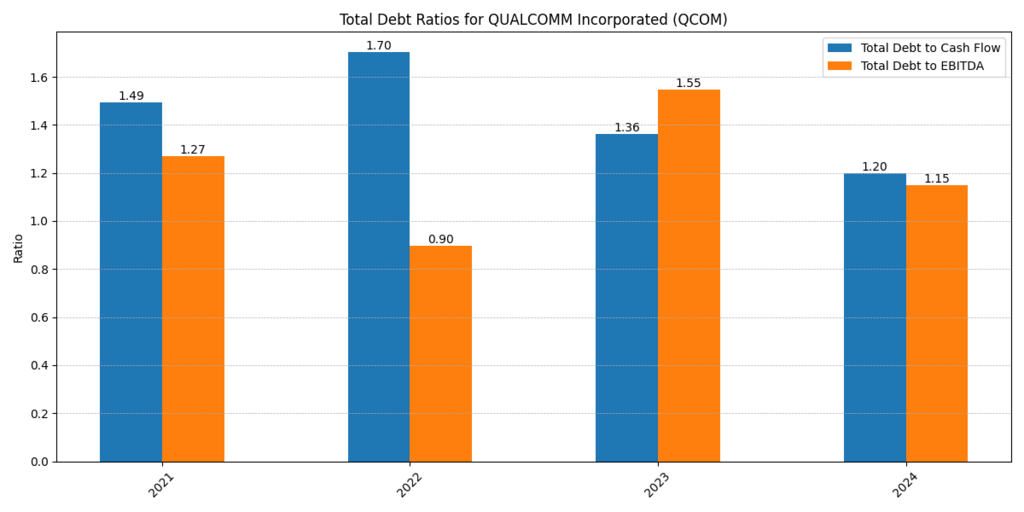

Qualcomm demonstrates strong price stability through its constant gross margin which sits between 55-57 percent in each year. The company’s 2024 net margin reaches 26.03% indicating promising profitability numbers. The financial stability of Qualcomm improves significantly during 2024 because its Total Debt to Cash Flow ratio developed from 1.70 in 2022 to 1.20.

Qualcomm demonstrates sound earnings stability and improved debt performance which positions it well as a strong semiconductor industry participant even though it does not lead in margin generation.

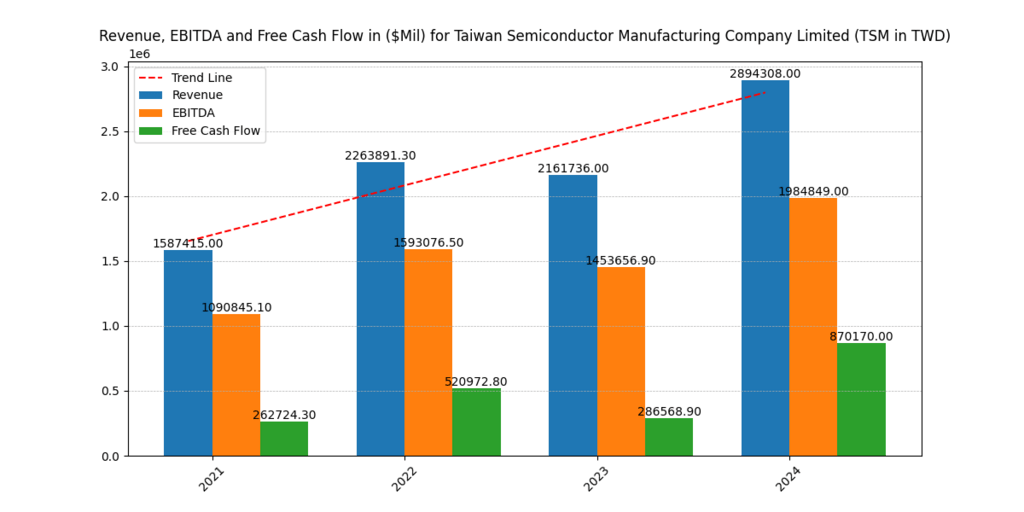

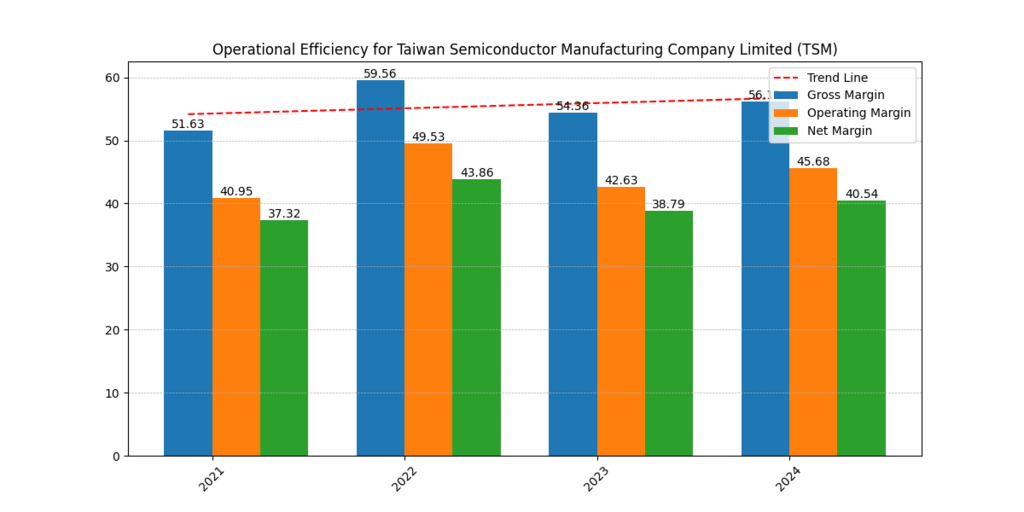

Taiwan Semiconductor Manufacturing Company (TSM): The Industry Giant with High Margins

As the largest contract semiconductor manufacturer worldwide TSMC generates $2.89 trillion in revenue during 2024. TSMC plays a vital strategic chip production role because its revenue has shown significant expansion while serving Apple and NVIDIA and other companies.

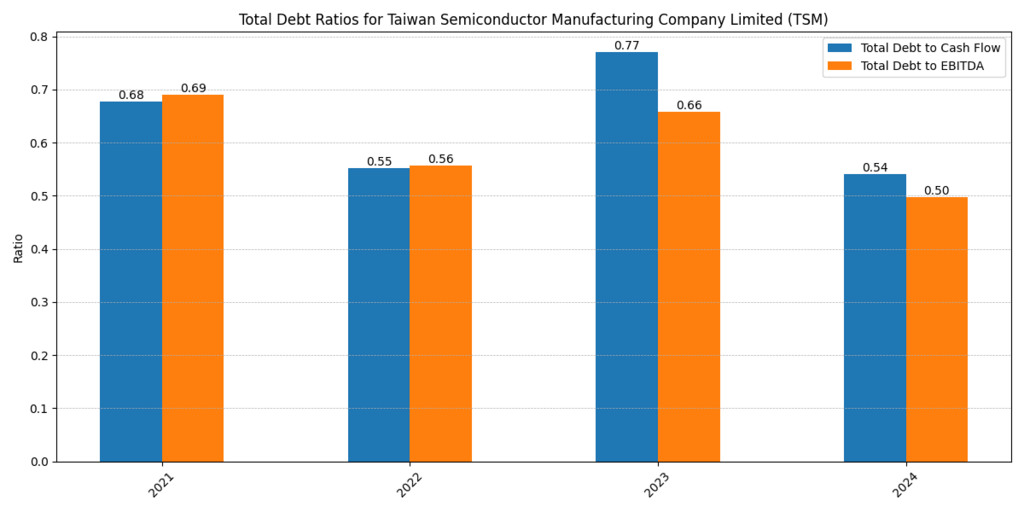

The financial standings of TSMC stand out through its 45.68% operating margin and 40.54% net margin achieved during 2024. Its price authority together with excellent operational performance is evidenced by these financial indicators. The financial ratio of Total Debt to EBITDA experienced significant improvement over time starting from 0.69 in 2021 and reaching 0.50 in 2024 which reflects TSMC’s robust financial position. Our Detailed Analysis on TSMC (TSM) Earnings Analysis and Fair Value in 2025.

With its dominant market position, TSMC outperforms in both revenue generation and profitability. The combination of strong pricing power and debt management proves TSMC to be one of the most prosperous semiconductor stocks existing in 2025.

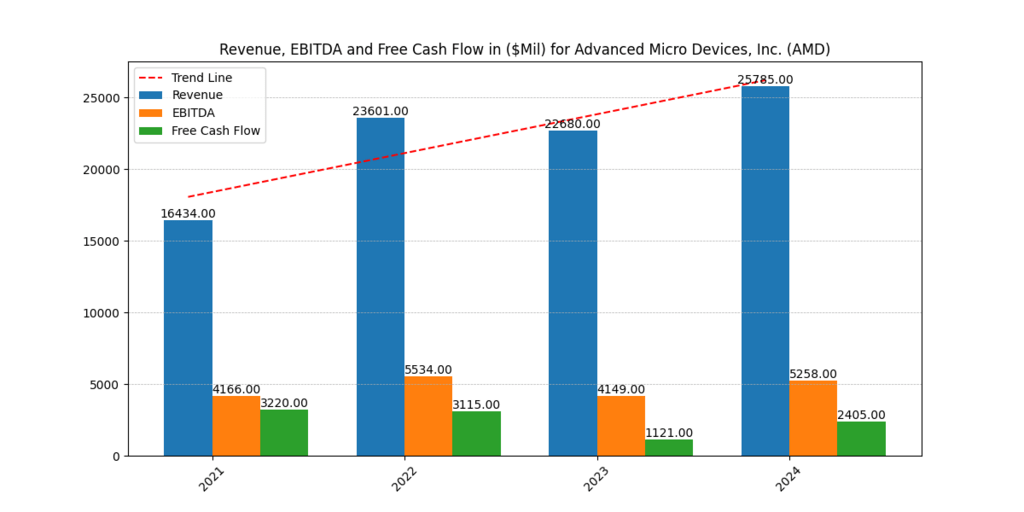

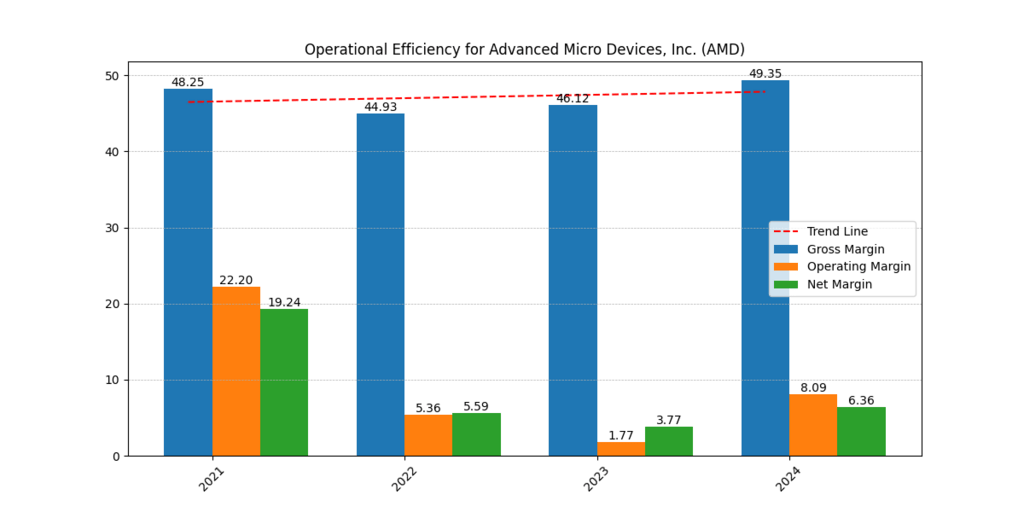

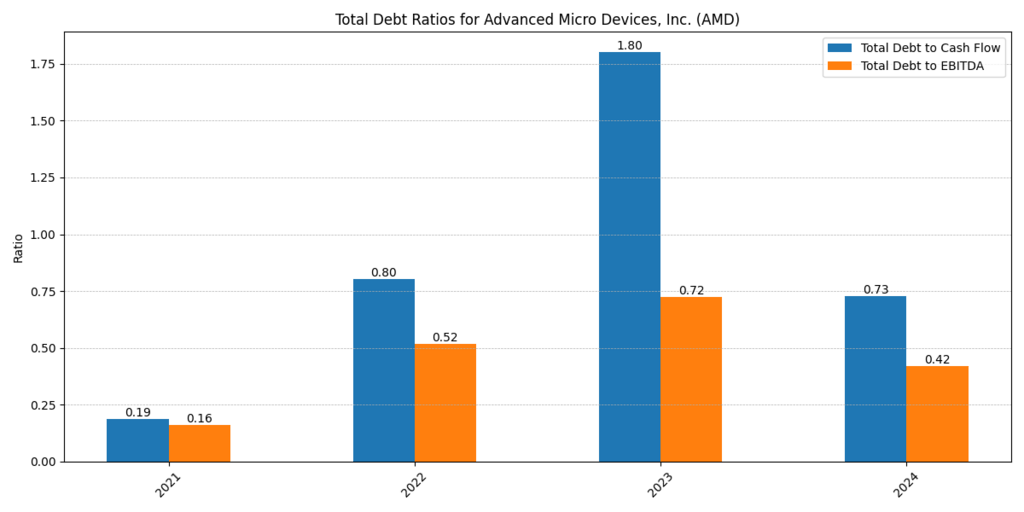

Advanced Micro Devices (AMD): A Mixed Performance with Improving Prospects

The financial performance of AMD has followed an unpredictable pattern throughout recent times. The company reported its highest revenue of $25.78 billion during 2024 as a result of continuous business growth. The company’s current net margin of 6.36% stands considerably weaker than what TSMC and Qualcomm achieve at 9.32% and 17.72% respectively in 2024.

The company achieved a marginal operating margin of 8.09% after facing substantial decreases from 1.77% in 2023. Total Debt to Cash Flow ratio improved significantly in 2024 demonstrating enhanced financial management because it rose from 1.80 in 2023 to 0.73. AMD generates increasing revenues yet its reduced profitability combined with elevated financial dangers make it a choice that is less appealing than TSMC or Qualcomm to investors.

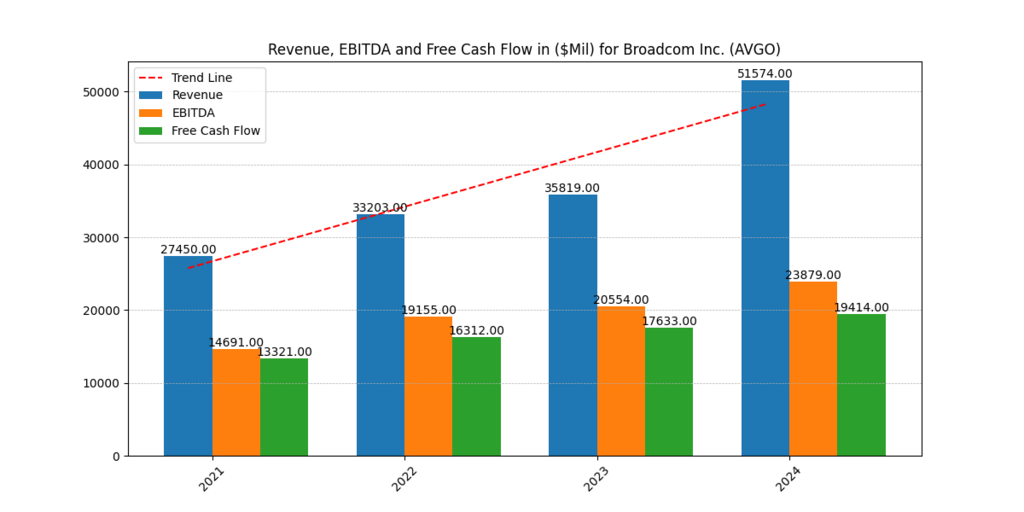

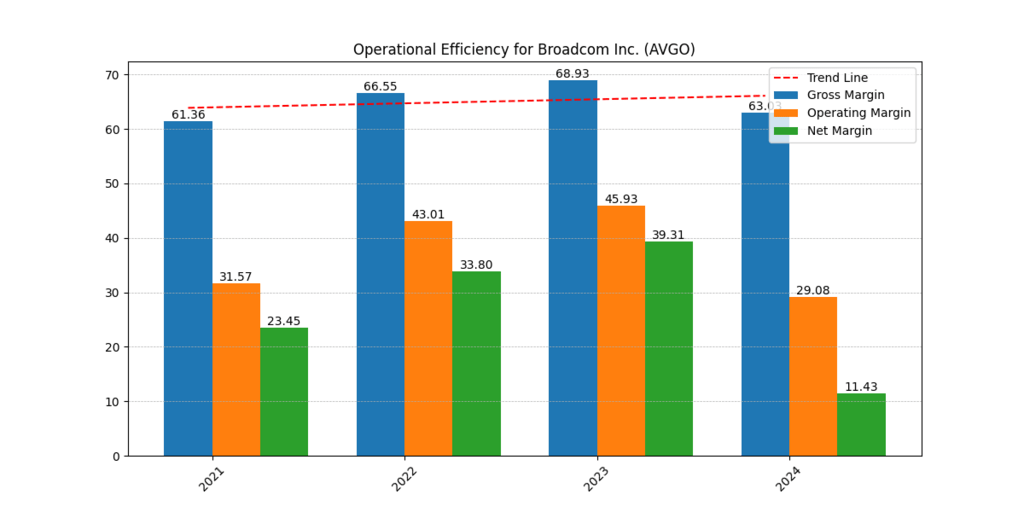

Broadcom (AVGO): High Margins but Rising Debt

The revenue projections for Broadcom in 2024 exceeded $51.57 billion which stood out as the top figure among its rivals who do not include TSMC. Broadcom continues its market expansion by gaining stronger control over networking, broadband and semiconductor infrastructure markets.

The 2024 financial results demonstrate that Broadcom continues as a profitable company through its gross margin of 63.03% combined with net margin of 11.43% although both figures show a slight reduction compared to past year performance.

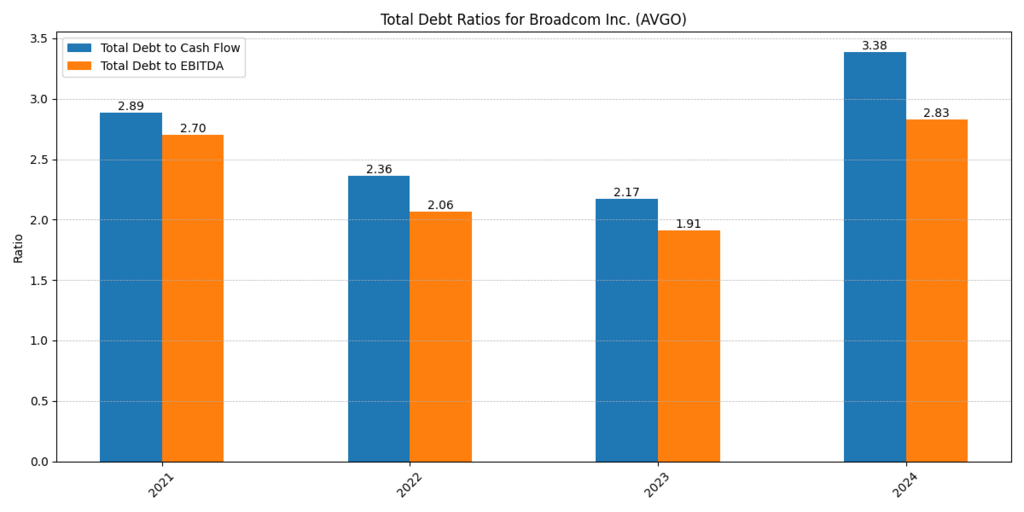

Broadcom faces an increasing financial risk due to rising debt levels as its 2024 Total Debt to Cash Flow ratio reaches 3.38 which stands as the highest among its peers. Despite profitability the company faces financial risks because of its increasing debt which investors need to understand.

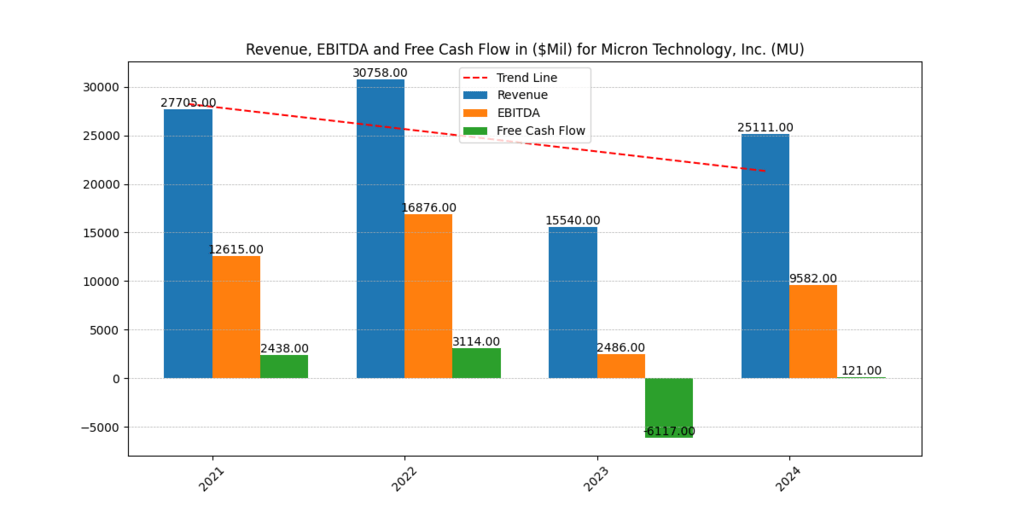

Micron Technology (MU): A Struggle to Maintain Stability

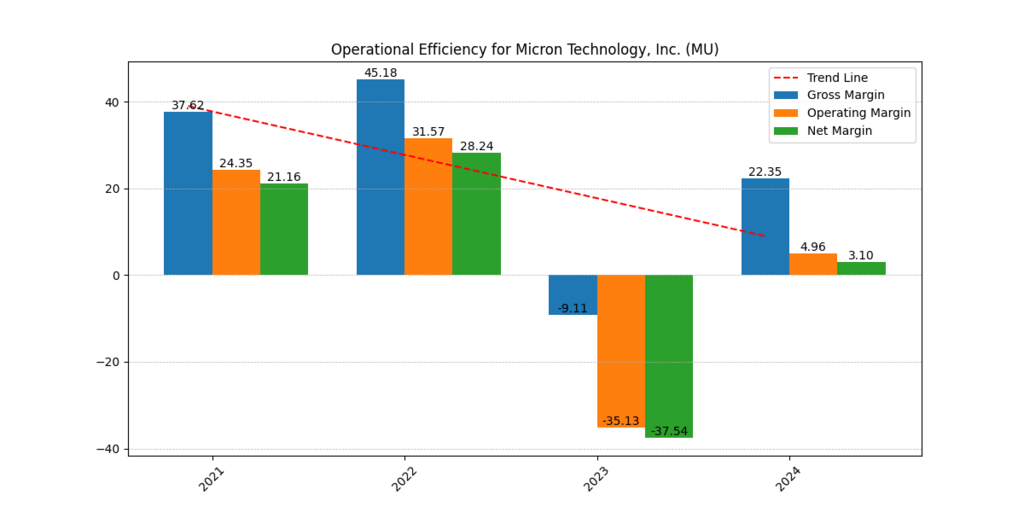

The memory chip market deficiencies resulted in Micron experiencing a devastating gross margin level of -9.11% during 2023. In 2024 the gross profit margin stood at 22.35% but this figure remains the least compared to all other analyzed businesses.

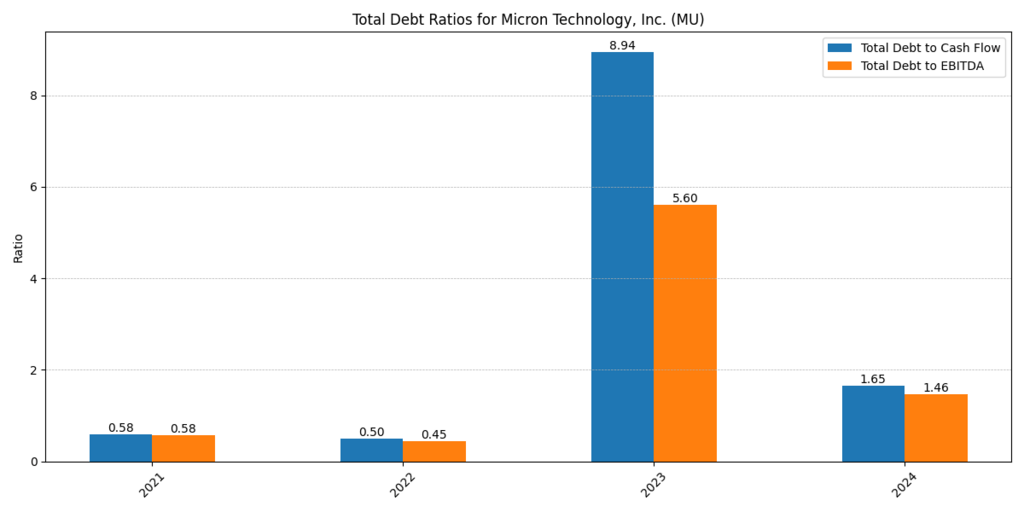

The present profitability issues within Micron Technologies can be observed through the 2024 operating margin of 4.96% and net margin of 3.10%. Micron’s position regarding debt deepens its concerns as the Total Debt to Cash Flow ratio reached 8.94 in 2023 but reduced to 1.65 in 2024. The recovery trend at Micron exists but investors should consider this company a high-risk option among semiconductor stocks in 2025.

AI and R&D Initiatives of Each Semiconductor Company

Each of these companies invests heavily in artificial intelligence (AI) and research and development (R&D) to maintain their competitive edge. Below is an overview of their key AI projects and R&D investments:

| Company | Key AI Projects | R&D Investment (2024) |

| TSMC | AI-driven semiconductor manufacturing, advanced chip packaging for AI workloads | $10.5 billion |

| Qualcomm | AI-powered mobile processors, Snapdragon AI engine | $7.9 billion |

| AMD | AI-optimized GPUs, Ryzen AI for edge computing | $6.5 billion |

| Broadcom | AI-powered network infrastructure, custom AI accelerators | $5.3 billion |

| Micron | AI-enhanced memory and storage, high-bandwidth AI memory solutions | $4.1 billion |

Strategic Partnerships and Industry Collaborations

| Company | Major Partnerships |

| TSMC | Partners with Apple for advanced AI-driven chip manufacturing, NVIDIA for cutting-edge GPUs, and Google for AI-focused semiconductor research. |

| Qualcomm | Works with Samsung to enhance AI capabilities in Snapdragon processors, Microsoft for AI integration in Windows on ARM devices, and Meta for on-device AI acceleration in AR/VR applications. |

| AMD | Collaborates with Microsoft Azure, Google Cloud, and Amazon Web Services (AWS) to optimize AI-powered data centers and cloud computing; partners with Tesla for AI-driven automotive chips. |

| Broadcom | Works with Cisco to develop AI-powered networking solutions, VMware for AI-driven enterprise software, and Google Cloud for AI-enhanced data center infrastructure. |

| Micron | Partners with NVIDIA for AI-optimized memory solutions, Intel for high-performance AI computing, and Tesla for AI-powered autonomous driving systems. |

Challenges in AI-Driven Semiconductor Innovation

Despite the rapid advancements in AI-powered semiconductors, companies in this space face significant challenges. These obstacles shape both production efficiency and innovation because they affect supply chain operations and the escalating market competition.

Their intricate production requirements are the biggest challenge for chip producers. Better processor performance is necessary for the creation of sophisticated AI models. By creating 3nm and next-generation nodes, semiconductor production pioneers TSMC and Samsung are further advancing node technology. Chip manufacturing is extremely complex due to advanced equipment, significant financial backing, and accurate engineering procedures. Delays in the manufacturing process slow down the development of AI and generate issues for supply chains.

The production of semiconductors faces significant obstacles due to global political conflicts that limit international trade operations. The company depends on diversification across its global supply chain where specific areas handle materials production and component assembly separately. The competing interests between China and the U.S. and export limitations and government policies affect major semiconductor corporations including TSMC, Qualcomm and NVIDIA. The selling restriction of high-end AI chips to China diminishes both revenue flow and market growth potential.

AI semiconductor manufacturers must deal with increasing market competition in their sector. The semiconductor market includes established companies Intel and AMD together with Broadcom while they contend with new competition and self-made chips from industry leaders Apple and Google. The companies now create their AI chips for direct use without aid from traditional semiconductor providers. The market competition requires major chipmaking companies to create distinct architectural solutions with enhanced power efficiency while optimizing AI functionality.

Conclusion

TSMC, AMD, and Qualcomm are driving innovation in the artificial intelligence semiconductor market through sophisticated chip architectures and strategic alliances. As AI applications become more widespread, the demand for powerful and energy-efficient semiconductor components increases. However, supply chain complexities, geopolitical tensions, and competition from native chip manufacturers pose challenges. Resolving these constraints is crucial for maintaining a strong position in the AI revolution. Semiconductor companies that invest in pioneering research and form collaborative alliances will facilitate the development of AI-driven computing and technology possibilities. This will help drive growth in the AI semiconductor market.

**Please be informed that the content is informational and by no means serve as a buy or sell signal. The company is not responsible for the loss of capital.