Introduction

Let’s analyse TSMC Earnings in 2024, its main customers, current happenings, and what its stock price is projected to reach in 2025. Learn about TSMC Earnings, other important financial data and growth possibilities to help you make better investment choices.

TSMC is a global leader in semiconductor manufacturing, assisting businesses in developing cutting-edge technology across numerous sectors. Today, TSMC produces cutting-edge chips for several well-known businesses that have remained loyal customer of the company since many years, including AMD, NVIDIA, and Apple. TSMC’s continuous improvements with its 3nm production process and plant expansions are enabling them to build on their success history and continue expanding. [1]

This article examines TSMC’s financial performance, going over their total sales revenue, EBITDA profitability, earnings per share, and free cash in hand. These financial breakdowns serve as the foundation for our projections of TSMC earnings and overall potential position in 2025. This analysis brings together all the facts that investors need to understand TSMC’s existing market position and potential for future growth.

Major Customers and Recent Developments

The majority of the chips ordered by the largest tech businesses come from TSMC, a semiconductor manufacturer based in Taiwan. Among their primary customers are Apple, NVIDIA, AMD, Qualcomm, and MediaTek. TSMC assists in the development of numerous products, including smartphones, artificial intelligence equipment, and self-driving cars, with its major clients dispersed across multiple industries.

In light of their long-standing partnership, Apple has regularly supplied TSMC with the components it needs to produce the chips that run important Apple devices, such as laptops, tablets, and smartphones. In order to produce its cutting-edge Graphics Processing Units, or GPUs, which support AI and manage data centers, NVIDIA only uses TSMC’s products. TSMC’s diverse clientele supports the company’s dominant position in the worldwide chip industry and keeps its manufacturing line occupied.

TSMC continues to advance its electrical chip assembly methods to 3nm, putting it ahead of other companies attempting to produce more potent and compact chips. Leaders in the industry, particularly Apple, have taken a keen interest in the 3nm node since its launch and are currently using it in their newest phones and other devices. With this innovative technology, TSMC becomes the world leader in chip manufacturing while reducing expenses and conserving energy. Because of its track record of creating cutting-edge technological advancements for customers in need of advanced chip technology, TSMC continues to attract new, affluent clients.

For its US-based manufacturing, TSMC has initiated a significant expansion plan in an effort to lessen dependence on a few important markets. As concerns about the security of chip production throughout the world increase, TSMC makes a calculated investment to adapt factory capacity to shifting domestic and global market conditions. In addition to strengthening relationships with important American customers, the Arizona facility helps TSMC increase its market share in the United States and provides additional capacity for the development of 3nm and 5nm chip designs. These initiatives address global supply chain issues and demonstrate TSMC’s commitment to maintaining its leadership position in the semiconductor industry for a very long time.

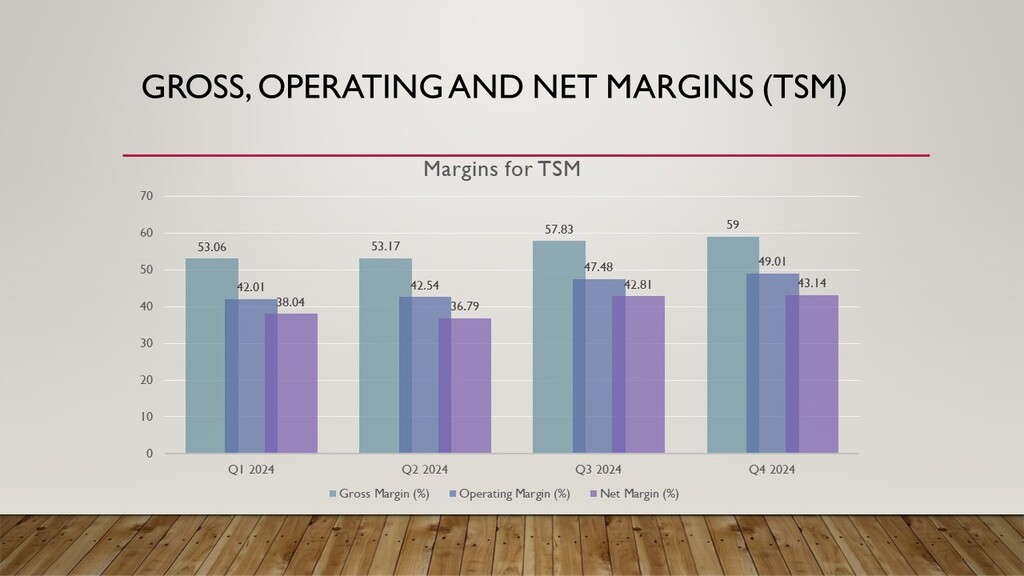

Financial Performance Metrics for 2024

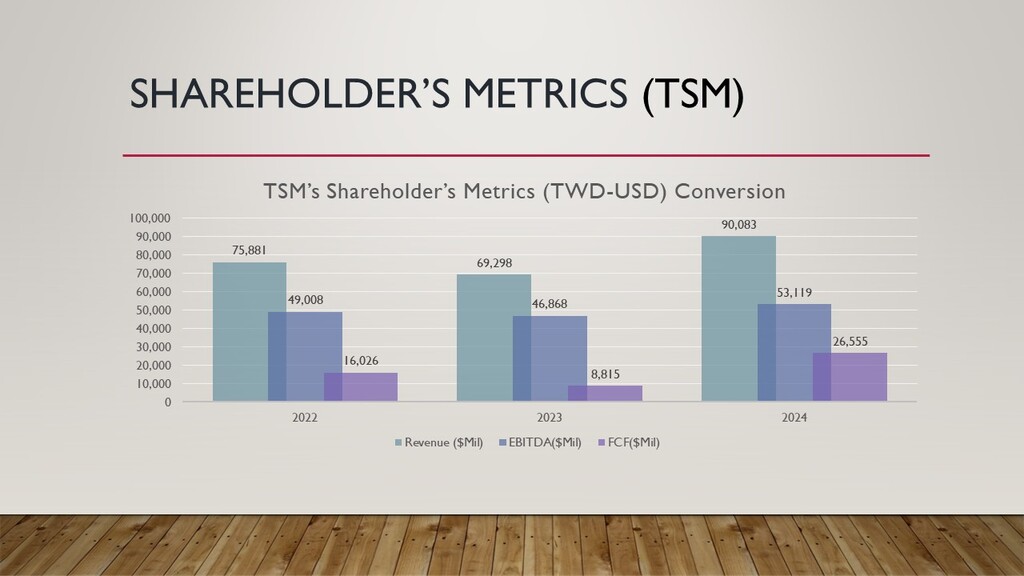

Below are the key financial metrics for TSMC in 2024 (all figures in TWD):

| Metric (TTM) | Value |

| Revenue | 2,438,415,951,000 |

| EBITDA | 1,726,705,720,000 |

| EPS (Earnings Per Share) | 180.55 |

| Free Cash Flow (FCF) | 711,273,303,000 |

These robust financial results reflect TSMC’s leadership in the semiconductor space, supported by high demand for advanced chips and its consistent technological advancements.

Despite market headwinds, TSMC’s 2024 figures demonstrate its ability to maintain its leadership position. With a total revenue of TWD 2,438.4 trillion in 2024, TSMC demonstrated its ability to meet the growing demand from customers for superior semiconductors. A number of factors contribute to TSMC’s increased revenue in 2024, including increased customer preference for its newest 3nm technology, close collaboration with major customers Apple and NVIDIA, and rising demand in the fields of artificial intelligence, driverless cars, and 5G technology. By creating industry-leading chip-making technologies and enticing customers to return, TSMC acquired its reputation as the top semiconductor foundry.

Its 1,726.7 trillion Taiwanese dollar EBITDA demonstrates how successfully and profitably the company operates. TSMC generates revenue at an astounding 70% net profit before taxes, depreciation, debt interest, and other costs. This suggests that their company operates really well and gains from handling massive amounts of daily tasks. By providing cutting-edge chips and raising prices for more recent technological models, TSMC maintains its market leadership. Power-efficient circuits that perform well are sought after by various industries, allowing TSMC to charge more for its newest innovations and increase earnings. You can also find out our analysis for another AI giant: Alphabet Inc. (GOOGL) Stock Analysis in 2025.

By earning $180.55 per share, TSMC produced a strong return to stockholders, which is excellent for investors. This high EPS demonstrates that TSMC achieved a healthy profit while controlling expenses and managing operations effectively. When TSMC generates significant profits for its stockholders, it demonstrates the company’s ability to generate revenue per share, increasing the stock’s value for investors hoping to hold onto their money for a long time. To keep ahead of the competition, companies like TSMC must invest heavily in research and development, and this profitability data aids in that process.

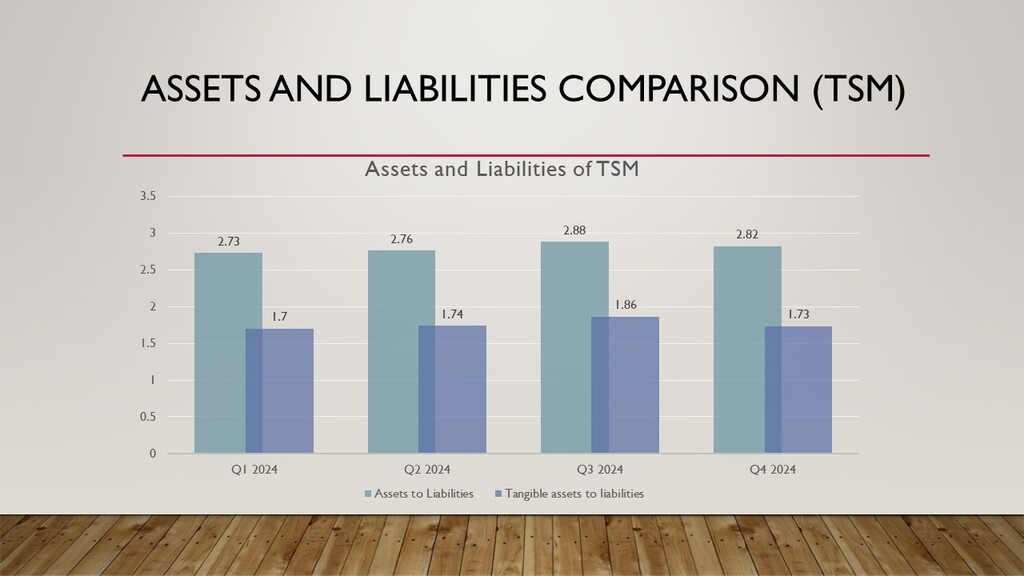

After spending on day-to-day operations, the company secured a figure of TWD 711.3 billion of free cash flow, demonstrating their strong financial standing. By producing strong cash flow from its large capital investments in new factories and improved manufacturing technology, TSMC maintains its financial stability and enables them to make future investments without experiencing a financial crisis. TSMC combats concerns like shifting global politics, escalating competitiveness, and supply chain issues by using its robust cash flow.

According to its TTM financial statistics, TSMC is the industry leader in semiconductors. What sets TSMC apart is its consistent ability to increase sales, turn a profit, and produce robust cash flows — all of which give it a strong market position and make it an excellent investment option.

2025 Fair Value Estimate

Using the 2024 financial results, we estimate TSMC’s fair value for 2025 based on three growth scenarios.

| Scenario | Price Per Share (USD) | Firm Value (USD Trillion) |

| High Growth | $246 | $1.28 |

| Medium Growth | $194 | $1.01 |

| Low Growth | $181 | $0.94 |

The price predictions are based on a conversion rate of 1 USD = 0.30 TWD, reflecting potential valuation outcomes under varying growth trajectories.

TSMC’s 2025 fair value estimations are based on its 2024 performance, which gives us a prediction of what company could accomplish in various scenarios involving corporate expansion. The projected outcomes demonstrate that TSMC can maintain its leadership position despite shifts in the semiconductor industry.

With a market value of $1.28 trillion, TSMC’s stock is valued at $246 per share because to its strong growth trajectory. This demonstrates how TSMC can take advantage of growing orders from the AI, 5G, and self-driving car industries thanks to its innovative technologies, such as the 3nm process. The share price of TSMC is expected to reach $246, and its total value may reach $1.28 trillion, if it is successful in developing its facility in Arizona and creates robust growth via new agreements with Apple, NVIDIA, and AMD.

The company’s market value is $1.01 trillion, and the stock price is $194 per share in the middle-growth scenario. As long as there is a steady market for their highly sophisticated chip fabrication, their earnings should continue to grow steadily. This scenario addresses potential problems like rising competition, international tension, and high investment costs for new technology.

The market value of TSMC drops to $940 billion under this growth scenario, and the company’s share price drops to $181. We arrive at this conservative lower-tech scenario by taking into account three potential scenarios: delayed chip adoption, supply chain issues, or changes in customer demand. Despite the sharp decline in revenues, TSMC maintains its reputation as a highly reputable business, demonstrating its resilience in a volatile industry.

The anticipated outcomes demonstrate that TSMC is in excellent financial standing and will keep making progress. With impressive outcomes as it enters 2024, TSMC’s continued success will depend on how efficiently it leverages these advantages and handles commercial obstacles. Investors can see how much TSMC could be worth in 2025 by looking at the various possibilities.

Conclusion

TSMC, a leading chip company, demonstrated industry demand in 2024 by maintaining high financial performance, continuously improving technology, and staying ahead of major tech firms like Apple, NVIDIA, and AMD. The company produces advanced solutions like its 3nm process and builds new plants globally, including the Arizona factory. TSMC predicts future earnings based on high, normal, and lower market growth rates, maintaining a stable worth of $940 billion. If TSMC can capitalize on growing AI, 5G, and autonomous tech demand, its stock may rise to $246 per share. Investors will find TSMC attractive due to its capabilities to create new technologies, maintain strong finances, and anticipate trends.

**Please be informed that the content is informational and by no means serve as a buy or sell signal. The company is not responsible for the loss of capital.