Introduction

Learn why Alphabet Inc.’s (GOOGL) stock is undervalued. Examine the company’s financial standing, advancements in artificial intelligence, and potential prospects to spark your interest in investing in it.

Alphabet Inc. (GOOGL), the parent company of Google, is one of the leading companies in the global technology market. Alphabet, which is regarded as a popular innovator in advancing technology, is a consolidation of companies that manufacture and sell consumer gadgets like Nest, engage in AI and cloud computing, and offer digital advertising like Google. In spite of being the most capitalized company, Alphabet appears to be undervalued in comparison to other companies in the MAG-7 group, which suggests that the company may be able to create value for investors.

Based on important financial metrics including revenues, EPS, and FCF, this blog article focuses on Alphabet’s valuation. Its current and upcoming AI initiatives, such as generative models, cloud computing, and the production of its own AI chips, are also examined because they could accelerate its future growth. Emphasizing the aforementioned elements demonstrates Alphabet’s capacity to apply innovation and maintain its leadership in a market that is reasonably competitive.

Key Takeaways

1. Undervaluation: Given that Alphabet’s current P/E ratio of 26.17 is lower than the MAG-7 average, investors may want to take advantage of this opportunity to purchase Alphabet stock.

2. Strong Financials: Alphabet’s operational and financial health is demonstrated by its strong top line, increasing operating margin, EBITDA, and free cash flow.

3. AI Leadership: Alphabet is more optimized for long-term profitability thanks to its investments in generative models and AI in-house chips.

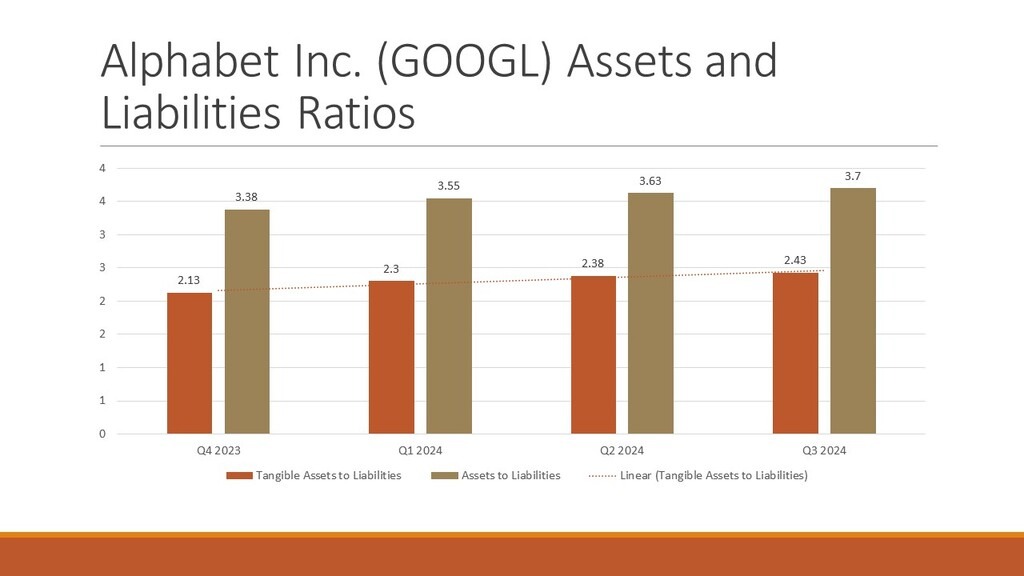

4. Stability and Resilience: The expansion of the net tangible assets to liabilities ratio and operating margins are especially significant when assessing Alphabet’s primary financial statistics.

5. Growth Potential: AI developments combined with numerous, targeted revenue help to maintain and grow company dominance.

Key Financial Metrics for GOOGL Stock

The table below summarizes Alphabet’s key financial metrics:

| Metric | Value | Analysis |

| Revenue (2023) | $339.86 Billion | Reflects Alphabet’s strong market position. |

| EBITDA | $126.690 Billion | High profitability and operational efficiency. |

| EPS | $7.55 | Solid earnings indicate profitability. |

| P/E Ratio | 26.17 | Below the MAG-7 average, signaling undervaluation. |

| Free Cash Flow (FCF) | $55.82 Billion | Robust cash generation supports growth initiatives. |

Alphabet Inc.’s strong and stable market position is supported by massive revenues, exceptional profits, and very good efficiency, according to the financial ratios and figures summarized in the table above. Each metric provides important insights into the company’s value, state, and future development potential.

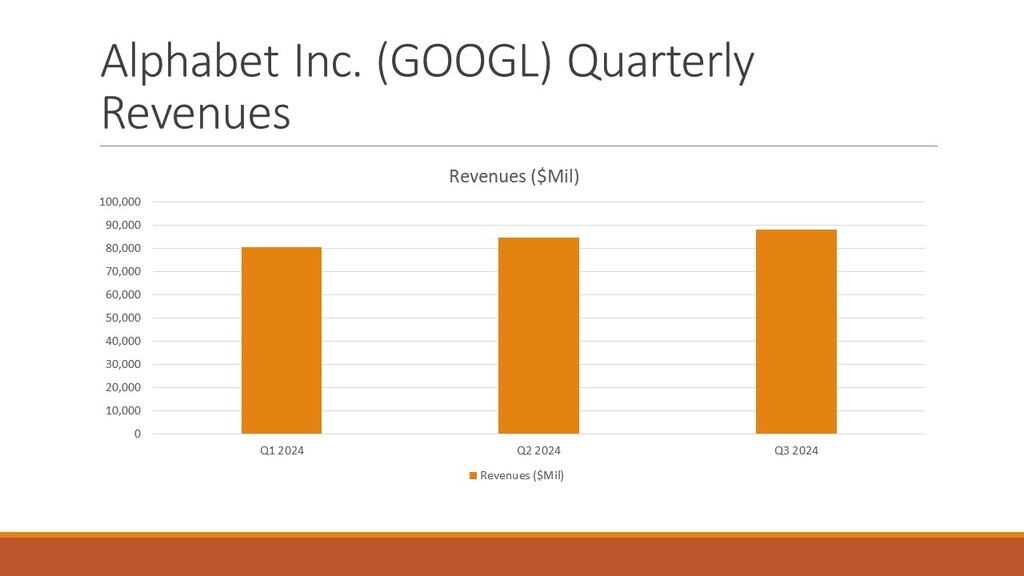

Revenue

Alphabet’s yearly revenue of $339.86 billion US dollars makes it abundantly evident that the company is still one of the world’s top technology companies. This remarkable figure highlights the company’s revenue potential across a variety of industries, including cloud services, internet advertising, and equipment sales. This advantage is reinforced by Alphabet’s revenue scale, which places it among the most significant businesses in the MAG-7 group. [1]

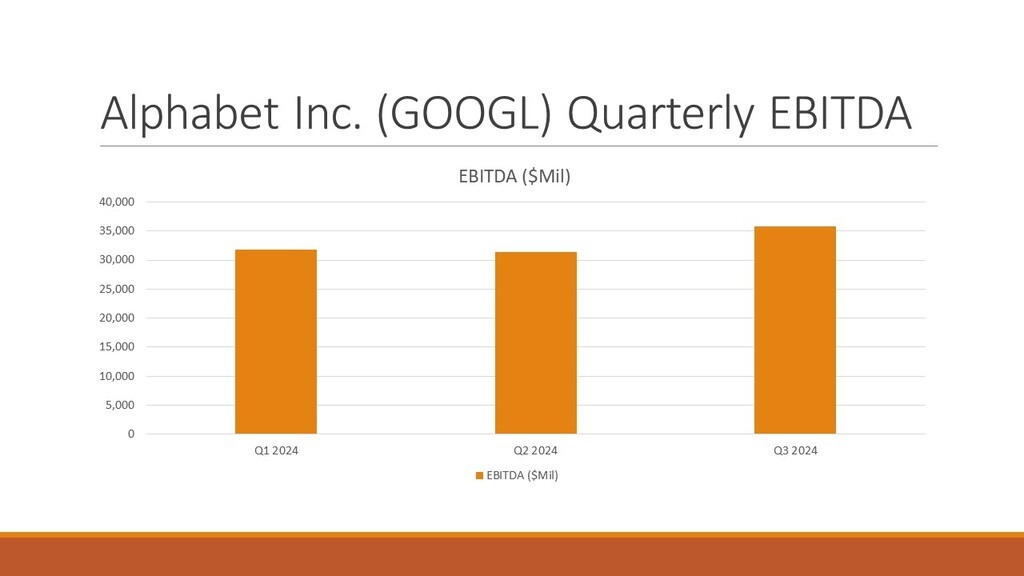

EBITDA

The company’s strong EBITDA of $126.69 billion demonstrates its high level of profitability and rigorous operational management. The ability of Alphabet to maintain its operating margin over years with higher spending on R&D and AI jobs is shown in its EBITDA, a crucial indicator of a company’s operational profitability. Alphabet’s capacity to generate income that may be given to shareholders or reinvested for further growth is demonstrated by this impressive figure. [2]

Earnings Per Share (EPS)

Alphabet’s absolute profitability is instead significantly represented by its earnings of $7.55 per share. It demonstrates the company’s efficiency in turning at least its entire net earnings into returns for shareholders. The company’s strong earnings-profitability is established by Alphabet’s EPS, which is higher than the industry average. Investors are reassured by this indicator that the stock will be able to produce steady profits.

Price-to-Earnings (P/E) Ratio

With a P/E ratio of 26.17, Alphabet is ahead of its MAG-7 competitors, Microsoft, Tesla, and Nvidia, as well as the industry average. Compared to these industry peers, this is lower, suggesting that Alphabet is valued lower by the market than it ought to be. A business that is profitable, has rapid growth, and makes less than the sector average P/E ratio is an appropriate investment in the perspective of investors. It demonstrated Alphabet’s capacity to provide long-term value as the market develops and realizes its true potential. [3]

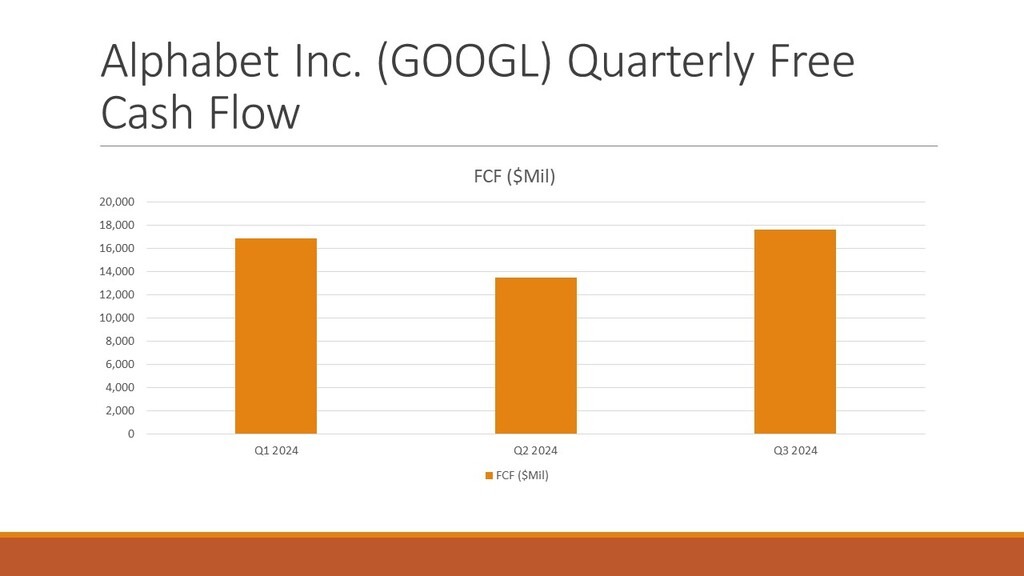

Free Cash Flow (FCF)

The company’s ability to generate cash is demonstrated by Alphabet’s $55.82 billion annual free cash flow. A company’s ability to finance multiple operations, acquire new growth opportunities, and return capital to shareholders makes free cash flow the most essential component of a firm. Alphabet’s strong free cash flow (FCF) position demonstrates that it has the financial strength to support these important projects, such as the creation of proprietary AI chips and generative AI platforms. Alphabet is positioned to benefit from future innovations and maintain its leadership in the technology market owing to such tactics. [4]

Valuation Analysis: MAG-7 Standards

Alphabet’s P/E ratio of 26.17 places it below the average of its MAG-7 peers, which include Microsoft, Tesla, and Nvidia. For example:

1. Microsoft: P/E ratio 33

2. Nvidia: P/E ratio 47

3. Tesla: P/E ratio 75

Alphabet’s AI Innovations and Pipeline

Alphabet Inc., the parent company of Google, has implemented the lead in the artificial intelligence (AI) sector and has utilized this technology to revolutionize several industries and strengthen its position. Google DeepMind, a machine learning and neural networks project that has produced industry-leading products like AlphaFold and AlphaGo, is a crucial component of its AI initiatives. It is important to note that Google Cloud, a branch of Alphabet, offers the newest AI technologies and application programming interfaces to companies seeking to leverage AI for value generation, analysis, and process improvement. Here you can find Magnificent 7 Stocks Performance in 2024.

Since Tensor Processing Units are designed for machine learning processes, Alphabet’s own AI chip manufacturing is one of the primary incentives. These chips can be utilized in large language models (LLMs) and generative AI models like Bard and OpenAI. Alphabet is committed to using AI to enhance numerous services and even organizational areas, but it also prioritizes autonomous mobility with Waymo and search algorithms and the Google Assistant. Alphabet is therefore prepared to sit and carry on with its trajectory of consistent growth and leadership in the AI space with an AI pipeline like this.

Financial Strength and Stability

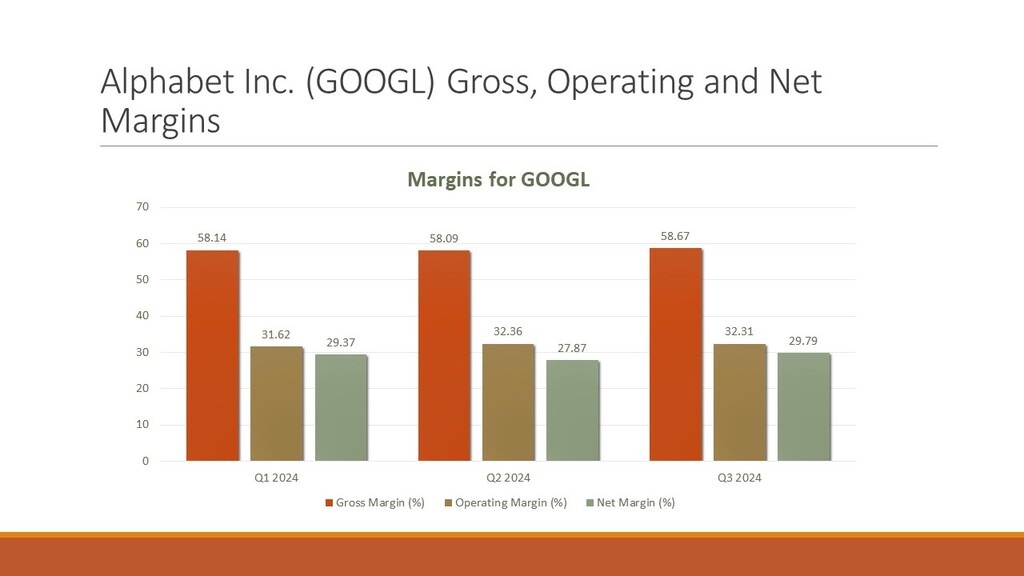

Considering that Alphabet Inc. has a revenue of $339.86 billion and an EBITDA of $126.69 billion, it is clear that the company is both profitable and efficient in its operations. Alphabet’s tremendous free cash flow (FCF) is evidence of the company’s strong liquidity position. This demonstrates that the company will be able to make significant investments in relatively newer technologies such as cloud computing and artificial intelligence.

According to this analysis of Alphabet’s price in comparison to its industry peers, as well as its strong financial standing and semi peripheral AI foundation, GOOGL stock is undervalued gold with an exceptionally optimistic outlook for returns. As a leading IT business with a lot of untapped potential, Alphabet is a favorable option for investors in this field.

The company has declared an impressive earnings per share (EPS) of $7.55, which is significantly higher than the standard MAG-7 company, and it is presently trading at a price-to-earnings ratio of 26.17, which is pretty low. A positive resource endowment, good financial ratios, and the ability to deploy and utilize its resources are all factors that contribute to Alphabet’s status as a sustainable investment.

Conclusion

Due to the fact that Alphabet Inc. (NASDAQ: GOOGL) is undervalued and it has strong financials and has development prospects through artificial intelligence and cloud technologies, the company stands out as an interesting investment opportunity. The stock price of the company, however, should get closer to its true value as a result of an increase in market share and a higher upgrade in profitability, which will reward investors who hold the stock for a longer period of time.

**Please be informed that the content is informational and by no means serve as a buy or sell signal. The company is not responsible for the loss of capital.