Introduction

Find out best dividend stocks to buy in 2025 — Johnson & Johnson, Coca-Cola, Microsoft, Procter & Gamble, and Chevron — are the top 5 forward dividend business tyrants for the year 2025. To help you make prudent investment decision-making, find more about their payout percentages, financial capabilities, and dividend history.

Companies that have increased their dividend payments for more than 25 years are known as dividend aristocrats, and they offer investors a safety net as well as the chance to expand their profits. Regardless of the economic cycle they experience, these businesses are resilient to recessions thanks to the multibagger scale, which makes them suitable for consistent returns. Johnson & Johnson, The Coca-Cola Company, Microsoft Corporation, The Procter & Gamble Company, and Chevron Corporation are the top five dividend aristocrats in this regard.

They all have demonstrated long-term operating dividend policies, which is indicative of their solid financial and business bases. After examining their dividend history and results from the previous year, we will use the TTM data to calculate their payout ratios, which include the dividend per share and the EPS. The purpose of this assessment is to determine if they are a best dividend stock to buy in 2025.

Payout Ratio

| Company | Ticker | Payout Ratio |

| Johnson & Johnson | JNJ | 79.71% |

| The Coca-Cola Company | KO | 80.20% |

| Microsoft Corporation | MSFT | 25.97% |

| The Procter & Gamble Company | PG | 69.31% |

| Chevron Corporation | CVX | 71.57% |

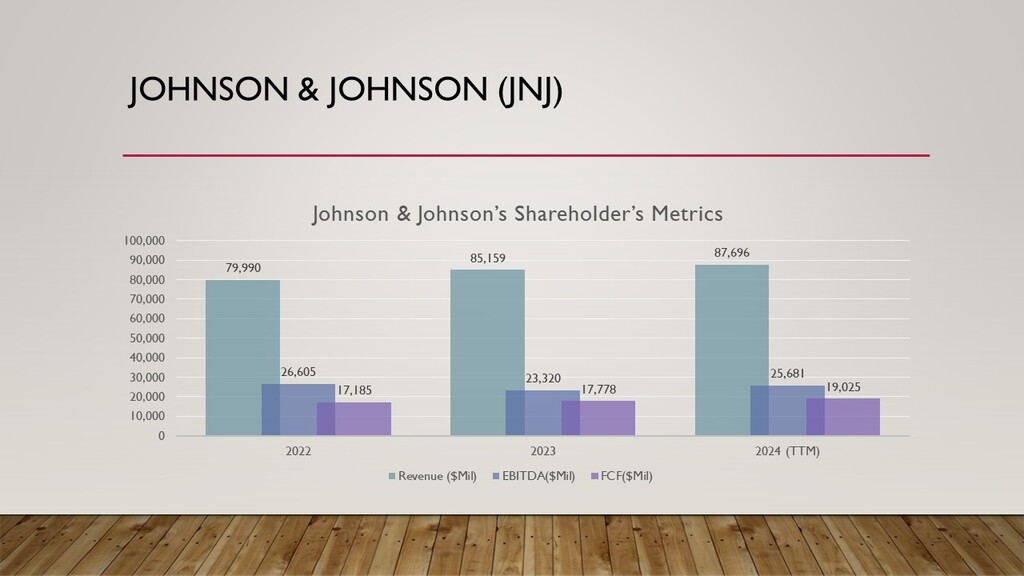

Johnson & Johnson (JNJ)

With a payout ratio of 79.71%, Johnson & Johnson is a diversified healthcare firm that has distributed a significant amount of its profits as dividends. This high payout ratio demonstrates the company’s commitment to provide investors with a consistent income, making it a dividend aristocrat. J&J’s third-quarter sales in the most recent financial performance were $22.47 billion, which was 5% higher than the same period the previous year and higher than the market anticipated. Mostly due to one-time charges like litigation and acquisition fees, net income dropped 38% to $2.69 billion from the previous year. However, the adjusted profit for New Zealand was $5.88 billion, which was $563 million more than the staff had anticipated.

The company’s full-year sales projections are therefore between $88.4 billion and $88.8 billion. J&J has robust economic cycles thanks to its diverse business operations, which include consumer items, medical equipment, and pharmaceuticals. To compete in the healthcare industry, they additionally strengthen the firm with an outstanding research and development division. With a current stock price of $142.06, as of January 11, 2025, J&J has a dividend yield of roughly 3.44%. Therefore, Johnson & Johnson is a perfect option for dividend-seeking investors looking for stability and consistent returns because it offers a highly diverse business activity in addition to a logical and timely dividend payout strategy. [1]

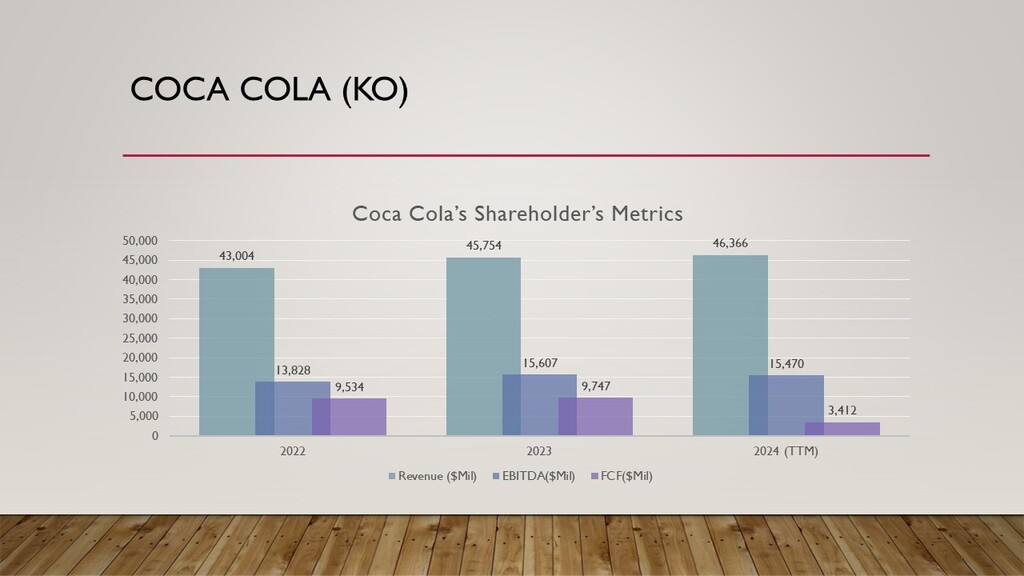

The Coca-Cola Company (KO)

With an 80.20 percent payout ratio, the Coca-Cola Company distributes a significant share of its profits to shareholders. This high payout ratio shows how committed the company is to giving its investors value and acting as a dividend aristocrat. In 2024, Coca-Cola reported a 1% drop in sales, bringing its total sales to $11.854 billion. Restructuring charges and lower sales volume caused the $2.848 billion net income to be 8% lower than the prior year.

Nonetheless, the company managed to produce a 9% increase in organic income, surpassing initial projections. However, currencies and structures can have a detrimental effect on real revenue growth. Coca-Cola has diversified its product line to include energy drinks, juices, sodas, and healthier options including sports drinks and sparkling water. Regular cash generation and frequent dividend challenges further reinforce the company’s varied positioning advantage and brand image. These are more reliable indicators for investors because The Coca-Cola Company is a favorite among income-seeking investors due to its high payout ratio and wide range of products. [2]

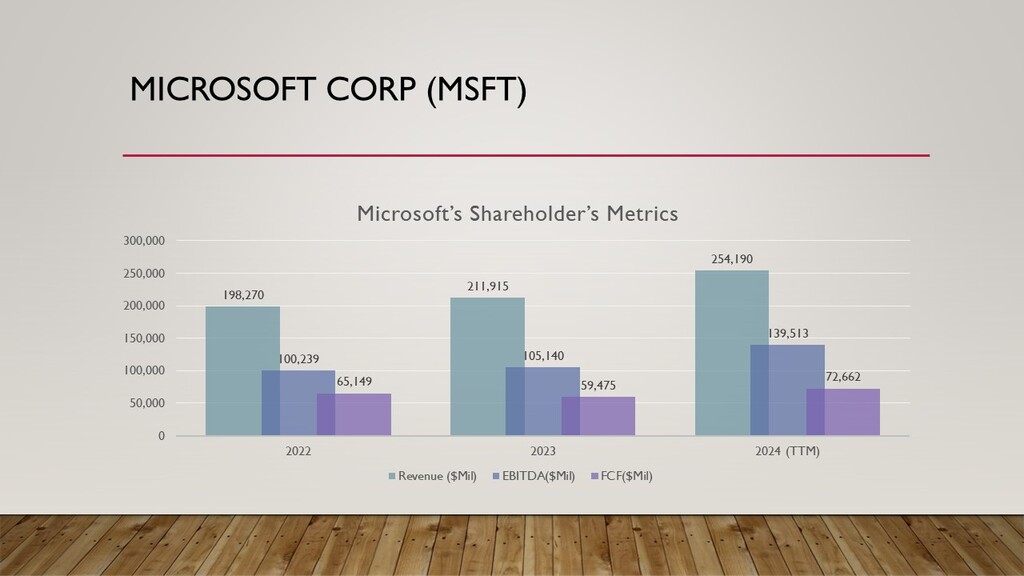

Microsoft Corporation (MSFT)

With a payout ratio of 24.97%, Microsoft Corporation distributes only a small percentage of its earnings as dividends to shareholders. As befits a tech powerhouse, Microsoft makes a substantial amount of its retained earnings in pursuit of expansion projects, as evidenced by its present, comparatively lower percentage. With revenue reaching $254.190 billion and EBITDA reaching $139.513 billion, Microsoft has shown impressive and noteworthy financial development in the TTM ending in 2023 and prior to 2024. You can also read our Best Growth Stocks for 2025 with Dividends, where we discuss stocks with high growth potential while also providing dividends.

Due to the company’s strong operational and cash-generating capabilities, free cash flow also increased to $72.662 billion. Aside from Azure, Microsoft offers a wide range of products, including Office and LinkedIn, which have contributed to its consistent development. The business expanded its market and growth opportunities by concentrating on innovation and smart acquisitions. According to Microsoft Corporation’s historical operating data, the company’s stock price as of November 1, 2025, was $418.95. Microsoft is one of the greatest stocks for dividend and growth investors seeking to invest in technology businesses, despite having a smaller dividend yield than the majority of traditional dividend-paying businesses. This is due to its excellent financial position and compound dividend growth. [3]

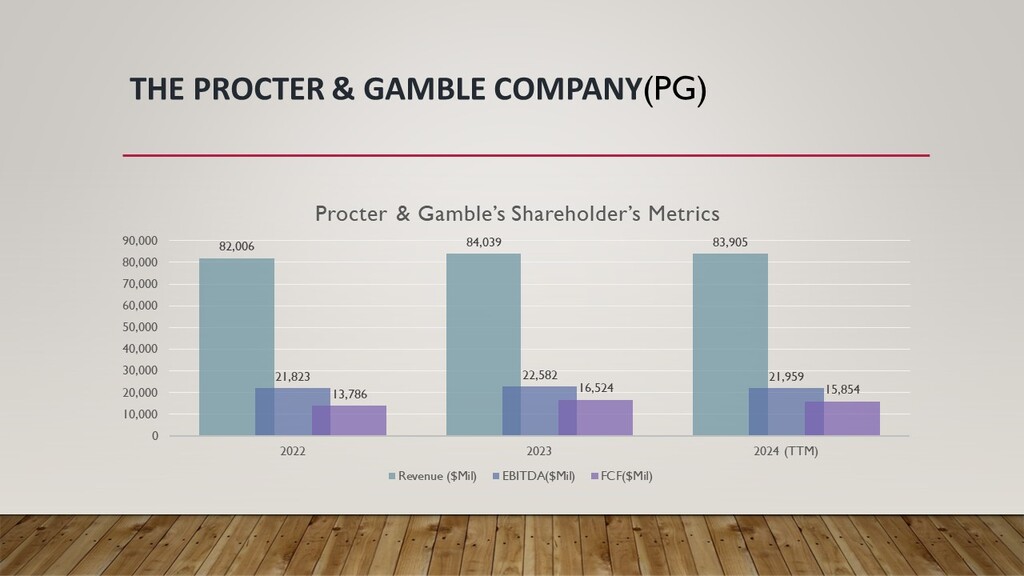

The Procter & Gamble Company (PG)

P&G pays out a significant percentage of its profits as dividends to shareholders, as indicated by its payout ratio of 69.31%. P&G has demonstrated cash generating consistency and investor remuneration commitment by setting a record of producing dividend rises for 68 years in a row, exemplifying this pass-through value concept. In terms of financial performance, P&G has shown growth and consistency during the current fiscal year 2018–19 in Bog, which has encompassed the majority of its product categories, including fabric, home care, beauty, grooming, health care, and infant care, which have the most well-known brand identities.

The company enjoys a competitive advantage in the consumer products sector thanks to its innovative ideas, strong brands, and effective sales strategies. Examining the free cash flow indicator, which shows the business’s ability to sustain and grow both regular and additional cash flow. It permits the corresponding expansion and continuity of the basic and supplemental in addition to P&G’s ability to sustain and grow dividend payments is demonstrated by its steady free cash flow.

The business now has the financial freedom it needs to finance investments in its core brand and market expansion thanks to its strict cost control and productivity-boosting initiatives. According to the January 11, 2025, P&G’s share price is $158.56. The Procter & Gamble Company is the best option for investors looking for long-term dividend-driven income due to its good payment, steady and growing dividends, and wide range of products. [4]

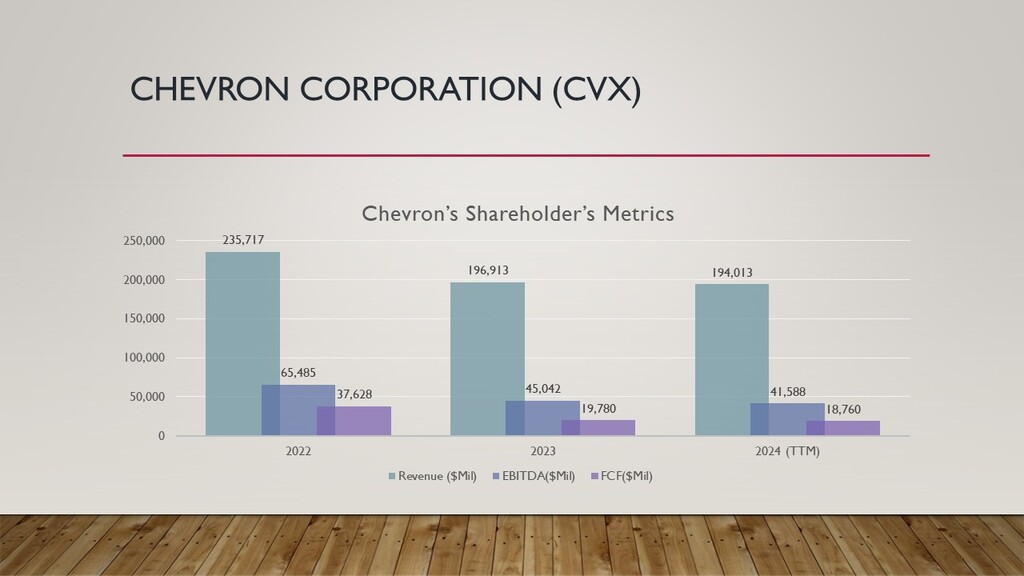

Chevron Corporation (CVX)

With a payout ratio of about 70.28%, Chevron Corporation (CVX) indicates that it distributes a substantial portion of its profits to its shareholders. In the third quarter of 2024, Chevron reported earnings per share of $2.48; in the same quarter in 2023, it reported earnings of $6.5 billion and earnings per share of $3.48. This explains the overall depletion that was primarily brought on by a decline in the level of realizations and a decrease in the gross profit margins on sales of refined products. Even though the company’s overall profitability fell, it nonetheless distributed $7.7 billion in cash to shareholders throughout the quarter, demonstrating its strong commitment to creating value for shareholders.

Chevron’s financial management plan calls for a $15 billion capital investment in 2025, which will be based on steady operational improvement and portfolio management. Additionally, the company has identified additional restructuring expenditures for the fourth quarter of 2024 that aim to increase efficiency and range from $1.1 to $1.5 billion. As of the recorded date of January 11, 2025, Chevron’s stock price is $153.14 per share, and the company’s dividend yield is around 4.26%. Chevron appears to be a compelling option for dividend-focused investors looking to make investments in the energy industry because of its respectable yield, consistent dividend payments, and alluring capital expenditure on production. [5]

Conclusion

In terms of dividend yield and capital appreciation, well-known companies like Microsoft Corp., Procter & Gamble Co., Johnson & Johnson Co., Coca-Cola Co., and Chevron Co. are good investments. The findings demonstrate that these companies have generated competitive returns and demonstrated consistent dividend performance over an extended period of time, which ought to entice yield-focused investors.

The current social dividend yields for Coca-Cola and Johnson & Johnson are approximately 3.5% and 3.49%, respectively. Since Johnson & Johnson and Coca-Cola have raised their dividends for over 50 years in a row, they are both regarded as dividend king businesses. About 0.8 percent of Microsoft’s profits are distributed as dividends, with the remainder going toward supporting expansion plans like cloud computing and artificial intelligence.

Procter & Gamble’s dividend yield to shareholders is approximately 2.5 percent, and payouts have been rising steadily, which demonstrates the company’s robust cash flow and the expansion of its portfolio of well-known brands. Chevron pays out roughly 4.26% of its total earnings, demonstrating its value in the oil and energy sectors by placing a high priority on dividend payments. In 2025, these businesses are excellent investment choices due to their consistent and healthy dividend payments and balanced risk/reward ratios.

**Please be informed that the content is informational and by no means serve as a buy or sell signal. The company is not responsible for the loss of capital.