Introduction

Get a thorough financial analysis of the Best AI Stocks for 2025: NVIDIA, Alphabet, Microsoft, Qualcomm, and TSM. Understanding revenue, EBITDA, and FCF patterns will help you make wise investment choices.

Industry benefits and innovation are being spurred by the growing usage of artificial intelligence (AI) in a degree that is unmatched in previous eras. As a result, investing in the businesses driving the AI revolution is a solid bet because they are expanding at an exponential rate. Based on their efforts to enhance the use of artificial intelligence and their extremely sound balance sheets, a few IT businesses can be considered leaders in the industry at the start of 2025. Here is another list of 5 Best stocks to invest in 2025: A comparative Analysis.

This article uses statistics including revenue, EBITDA, and FCF to determine the top five AI stocks for 2025. It will be feasible to explain why NVIDIA, Alphabet, Microsoft, Qualcomm, and TSM are still active participants in the global AI business by analyzing these figures. To help both seasoned investors seeking to make new investments and those fresh to the world of technology, this study focuses on identifying businesses that are developing and utilizing artificial intelligence. [3]

Nvidia Corp (NVDA)

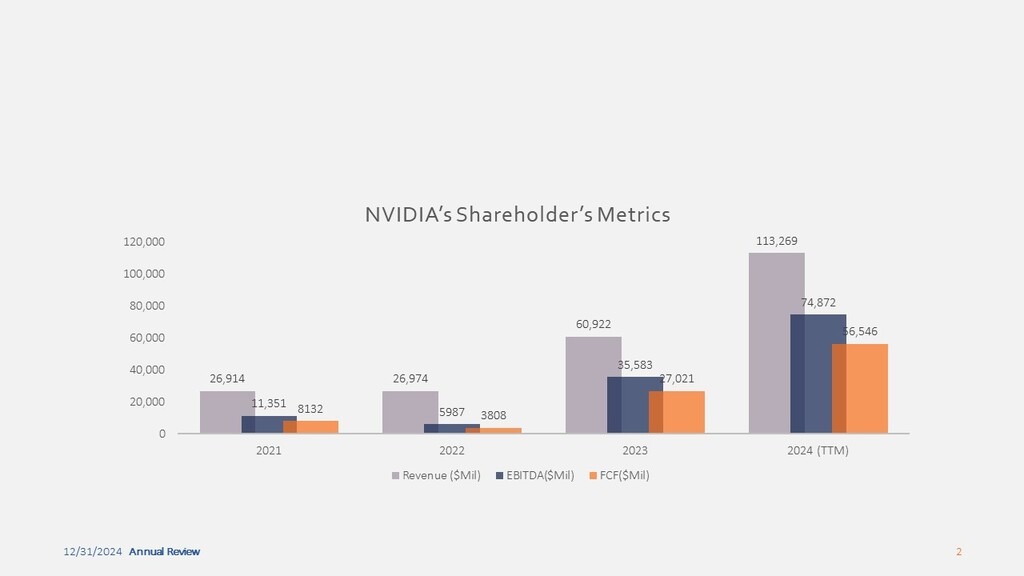

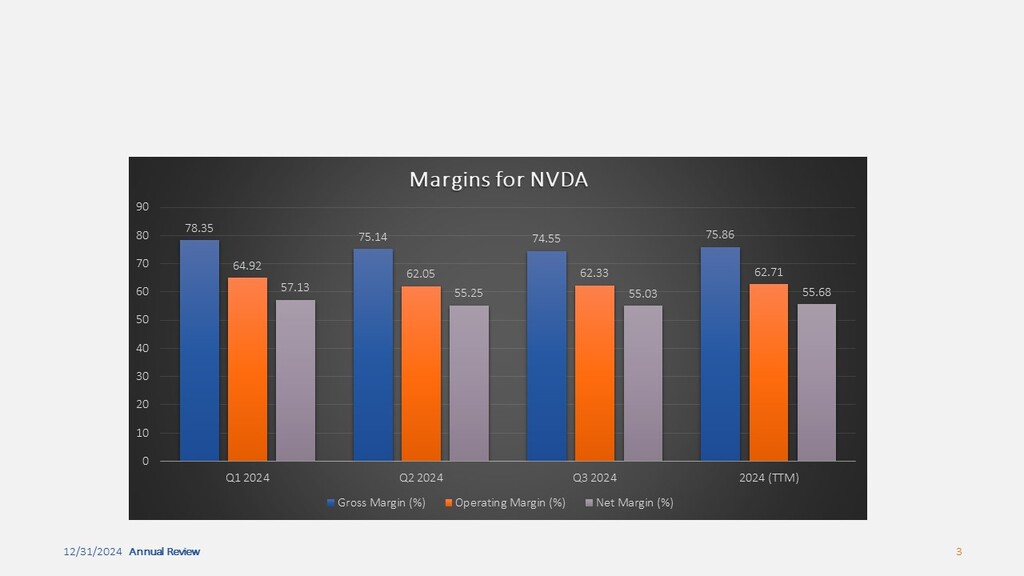

Leading artificial intelligence hardware company Nvidia reported strong Q2 2024 statistics, bringing in $113,269 million for the fiscal year 2024, up from $26,974 million in 2023. The company’s strategy to capitalize on these growing demand sectors, such GPUs for machine learning, or artificial intelligence, is responsible for this rise. Even though Nvidia’s EBITDA increased by 1,150% from $74,872 million in 2024 TTM to $5,987 million in 2023, the company’s size and operational adaptability grow as the dominant force in the AI chip market.

Additionally, the company’s FCF increased to $3,808 in 2023 and $56,546 in 2024 TTM. The current dominance of Nvidia in the AI hardware business, especially in datacenter and AI accelerator-GPUs, also explains high profit margins. Nvidia is one of the greatest stocks to buy if you want to keep an eye on developments in AI technology because of its involvement in innovation and the creation of AI goods. [2]

Alphabet Inc (GOOGL)

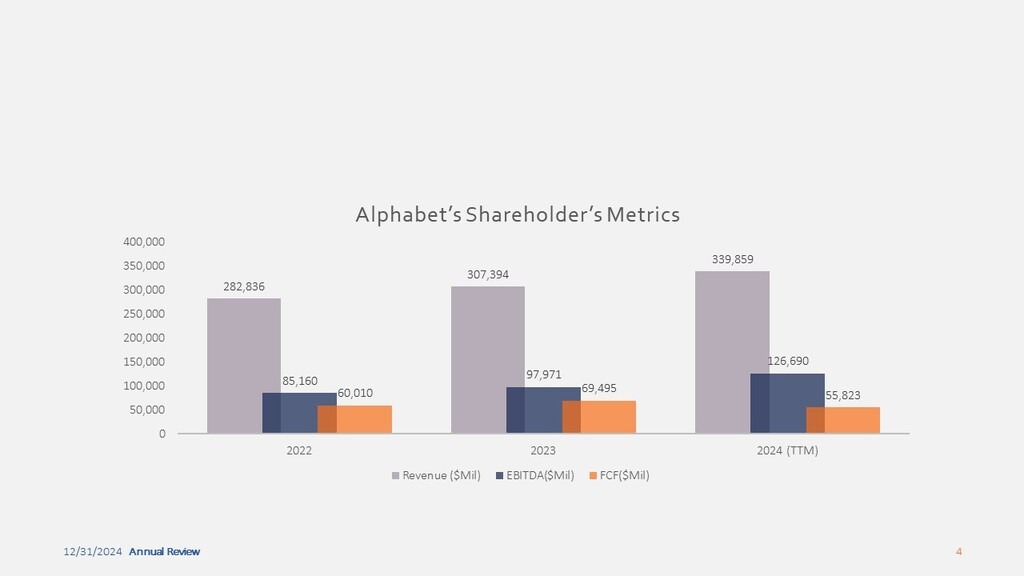

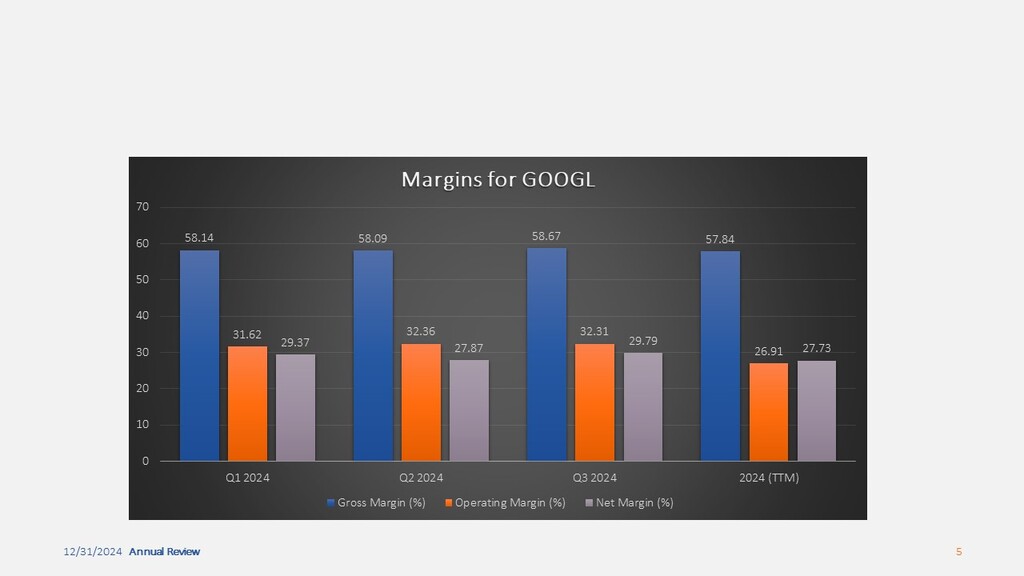

With several of its businesses, including Google Cloud, DeepMind, and AI-based advertising systems, Alphabet, the parent company of Google, has been a major force in the AI industry. Alphabet’s 2024 TTM revenue of $339,859 million represented a YoY gain of 10.6%, up from $307,394 million the year before. Although the company’s EBITDA margin stayed relatively constant, the actual result was spectacular, as the company’s EBITDA climbed by approximately 29% from $97,971 million in 2023 to $126,690 million in the first nine months of 2024 (TTM).

The FCF trend decreased, however, as seen by the estimations below; the FCF was $69,495m in 2023 and $55,823m in 2024 (TTM), most likely as a result of the tech giants’ increased investment in cloud infrastructure and AI research. Alphabet keeps developing generative AI, AI advertising, and language models like Bard to support its future expansion. Alphabet is guaranteed to rank among the Best AI Stocks for 2025 due to its consistent growth in annual revenues and EBITDA, even though the FCF decreased overall. This will draw in investors looking for a long-term value proposition in AI development.

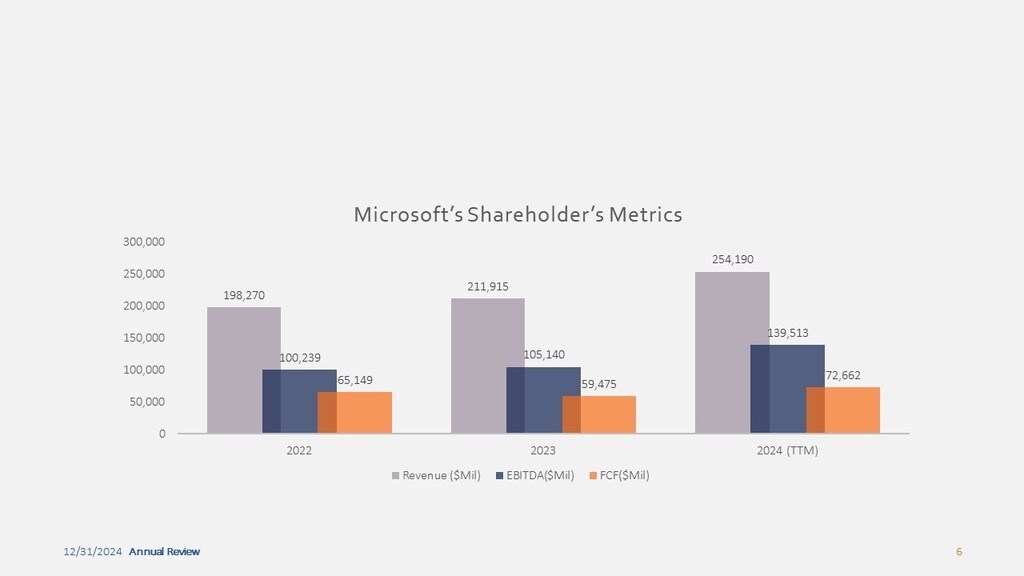

Microsoft Corp (MSFT)

Microsoft has maintained its leadership in artificial intelligence development, application, and deployment through its integration of AI into its services like Microsoft 365 and GitHub Copilot, and its Azure cloud computing service. The company’s financial results reflect its strategic aim to use AI. In the fiscal year ending on the last day of 2024, Microsoft generated $254190 million, a 20% increase from the previous year.

Operational efficiency was demonstrated by a $34,373 million increase in consolidated EBITDA. Free Cash Flow (FCF) increased from $59,475 million in 2023 to $72,662 million for the 12 months leading up to 2024. Microsoft invested in OpenAI, the company that created ChatGPT, and supports other AI initiatives and businesses. These initiatives position Microsoft at the forefront of leveraging technology to make AI accessible to businesses worldwide. [1]

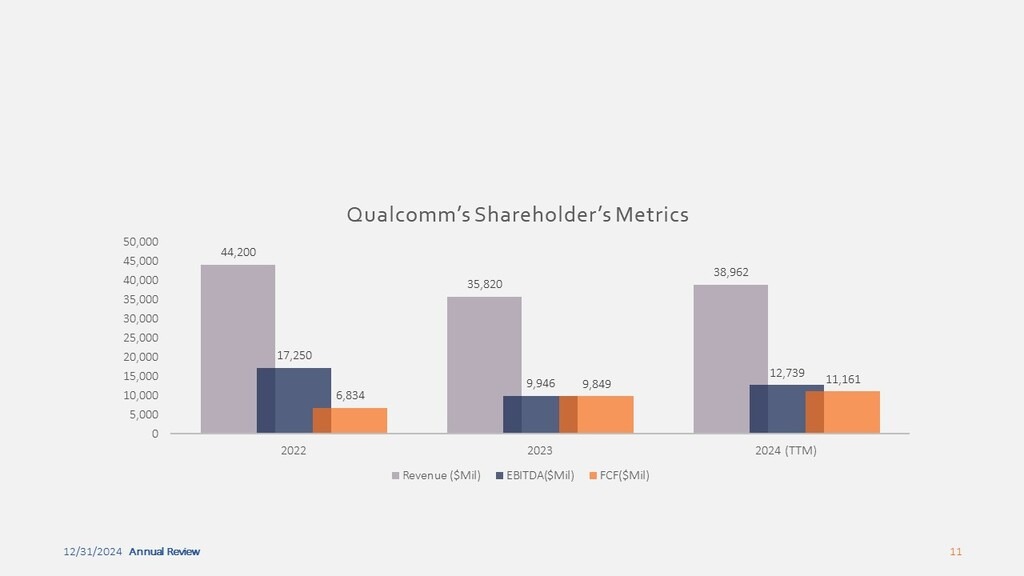

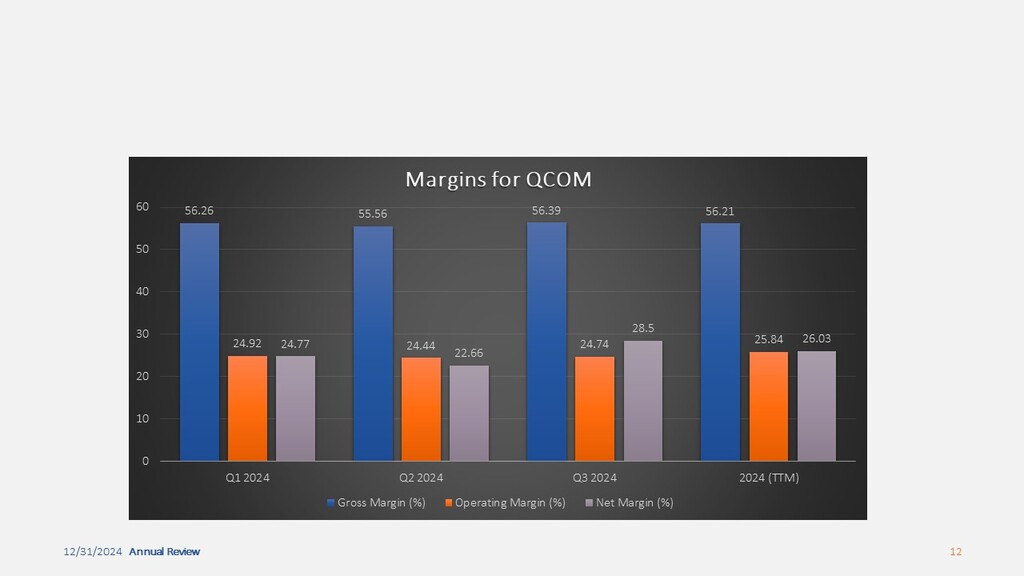

Qualcomm Inc (QCOM)

The behemoth of semiconductor technology, Qualcomm, has been more interested in AI over time, particularly in edge computing and mobile AI. Even while it’s TTM of $39, 962 million is higher than the $35,820 million attained in 2023, its 8.7% AI growth is modest when compared to those industry titans. With an EBITDA of $12,739 million for 2024 (TTM) compared to $9,946 million for the fiscal year 2023, the company’s profitability has increased by 28%. The telecommunications equipment industry giant’s free cash flow (FCF) for 2024 (TTM) increased from $9,849m for 2023 to $11,161m, indicating careful financial management and operational efficiency.

Qualcomm’s focus on cutting-edge AI solutions is demonstrated by some of its recent developments in AI chips for smartphones, the Internet of Things, and self-driving cars. Qualcomm produces AI-powered solutions, all of which will be crucial as 5G and IoT adoption rises. For those who are prepared to invest, it is listed among the Best AI Stocks for 2025 because of its balance and long-term edge AI strategy.

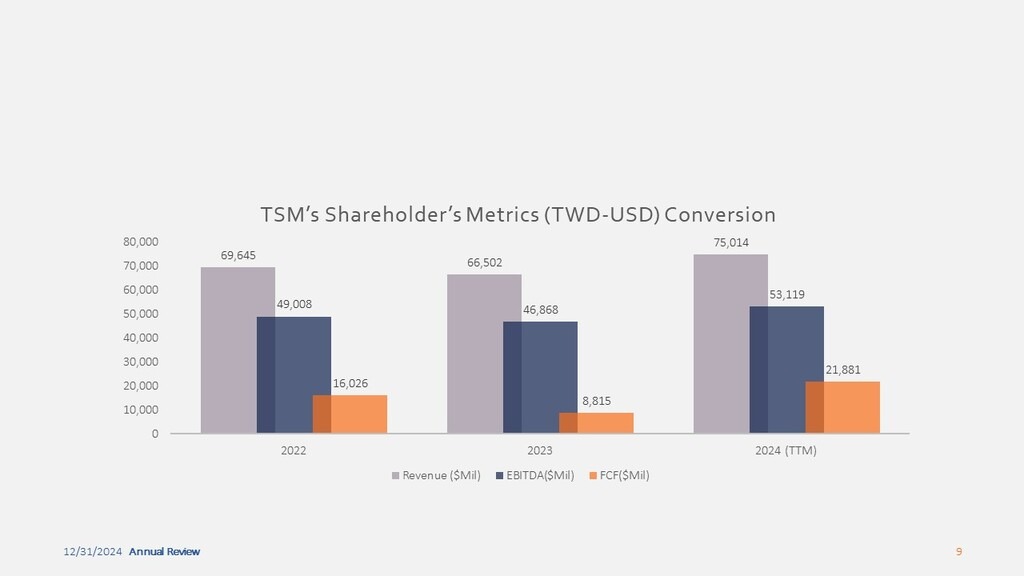

Taiwan Semiconductor Manufacturing Limited (TSM)

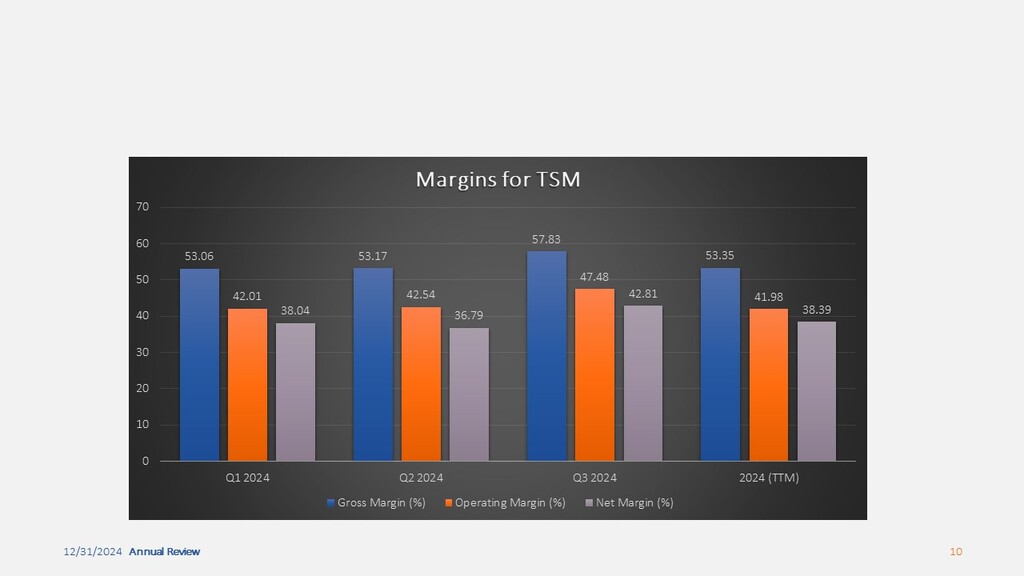

Taiwan Semiconductor Manufacturing Limited (TSM) is a key player in the global artificial intelligence (AI) industry, providing high-performing semiconductor manufacturing for major players like Nvidia, Apple, and AMD. The company’s performance study shows a 12.8% growth rate in revenue from December 2023 to December 2024, with a revenue of $75,014 million. The company’s EBITDA increased to $53,119 million in 2024 due to a 13.3% increase in operating efficiency. The free cash flow also increased significantly, from $8,815,004,688 in 2023 to $21,881,070,495 in 2024.

TSM’s cutting-edge manufacturing processes are essential for the growth of the AI industry, and its indirect support to top AI companies like Nvidia makes it a necessary investment. As a solid stock experiencing good development, TSM should be considered one of the best AI stocks for 2025 for investors interested in the artificial intelligence supply chain.

Conclusion

Investors looking to support future technologies are finding increasing opportunities as a result of the AI field’s rapid growth. Through metrics of financial performance and activities related to AI development, the experiences of the five businesses under study — Nvidia, Alphabet, Microsoft, Qualcomm, and TSM — clearly demonstrate their position among AI leaders. Due to its dominance in the AI hardware market, Nvidia has experienced enormous growth in recent years, placing the company in a dominant position. Alphabet’s growing revenues are a clear indication of their strategy to apply generative AI to a variety of industries. One example of Microsoft’s contribution to the global adoption of AI by businesses is the company’s attempts to integrate AI into its software and cloud.

Even with its focus on edge computing and AI-enabled chips, Qualcomm remains a key player in mobile automation. Conversely, TSM’s significant role in the global semiconductor ecosystem ensures the company’s indispensable position in the AI business. These businesses are not only well-established financially, but they are also actively involved in AI development in order to expand alongside industries that are integrating AI. Given their strong revenue streams and encouraging prospects for future advancements in the field of artificial intelligence, these five businesses need to be included among the Best AI Stocks for 2025.

**Please be informed that the content is informational and by no means serve as a buy or sell signal. The company is not responsible for the loss of capital.