Introduction

Is verizon a good stock to buy and hold for the long-term? Learn about Verizon’s financial status, its reasonable P/E ratio, revenue and earnings growth rates, and dividend payout to determine if this telecom behemoth should be on your long-term investment list.

Verizon Communications Inc. is one of the leading telecommunications and technology organizations offering critical services in wireline and wireless sectors as well as other digital technologies. Potential investor will need to analyze its balance sheets and future prospects as they consider whether Verizon is a good investment company for long-term investment. In this article, we will look at Verizon’s fundamental health of the company, its numbers in terms of revenue, whether Verizon has high dividend yield and how fairly valued the company is in relation to its growth in order to be able to answer the question of whether or not Verizon should be bought and held. [1]

Businesses of VZ (Products)

Verizon is telecommunications and technology organization that provides data, voice, and video services for consumers, businesses, and government. These offerings are primarily organized under three key segments Wireless Services, Broadband & Fiber Optics and Enterprise Solutions.

Wireless Services

Verizon Wireless Network is one of the foremost services offered by Verizon as it is famous for coverage and dependability of the service. It has its mobile voice and data service brand Verizon through which it caters to more than 100 million customers across the country. As new trends in 5G appear, Verizon aimed at providing internet connections with higher speeds and little latency, providing customers with more optimal connections for streaming, online gaming, or remote employment. Some of Verizon’s 5G networks, particularly 5G Ultra-Wideband, has been popularized in the metropolitan cities due to the transformative experiences that customers are likely to achieve in all aspects of digital use.

Broadband and Fiber Optics

Verizon provide many services in this segment with FiOS currently its fiber-optic internet service offering. Fios is a service provider in several product lines that include communication services such as internet, television, and phone services with a strength in populous regions. Fios is well appreciated by the customers mostly because of its dependable network and high speed availability meets the bandwidth demands of many households. Moreover, Verizon’s 5G Home Internet offers customer’s broadband Internet service without cable to enhance the power of smart home and Internet of things.

Enterprise Solutions

Verizon also offers a broad range of services for enterprises from SMBs to large and medium companies and state bodies through the enterprise segment. The set of services provided by DXC Technology Company includes such services as cloud, protected and managed services, security, and IoT. As the usage of remote work increases, companies that need reliable protection and cloud services turn to Verizon’s solutions. In addition, Verizon IoT solutions help logistics, healthcare and manufacturing sectors accelerate operations and gain a deeper understanding of the same.

Altogether, these products allow Verizon to present itself as a versatile telecom company representing its offerings according to the existing technology paradigms to appeal to a vast number of clients and build reliable sources of income.

Investor’s Metrics for Verizon

| Metric | Value |

| P/E Ratio (TTM) | 17.87 [2] |

| P/B Ratio (TTM) | 1.9 |

| Market Cap | $172.05 billion USD |

| Revenue Growth (2021-2024) | 2021: $133613 2022: $136835 2023: $133974 TTM: $134243 (0.5% increase) |

| EPS (TTM) | $2.31 |

| EBITDA (TTM) | $39.1 billion |

| Free Cash Flow (FCF) | 2021: $-28343 2022: -$10401 2023: $12912 TTM: $13932 (significant improvement) |

| Dividend Yield | 6.1% |

P/E and P/B Ratios

The P/E ratio of Verizon stands at 17.87, which is above its average making this stock slightly overpriced on an earning basis. The P/B ratio of 1.9 is still lower than the industry average which signifies reasonable price for the business in terms of its assets.

Market Capitalization

Verizon, in particular, currently has a market capitalization of $184.7 billion, thus it belongs to the telecom industry, which has favorable characteristic such as market stability and predictable revenue.

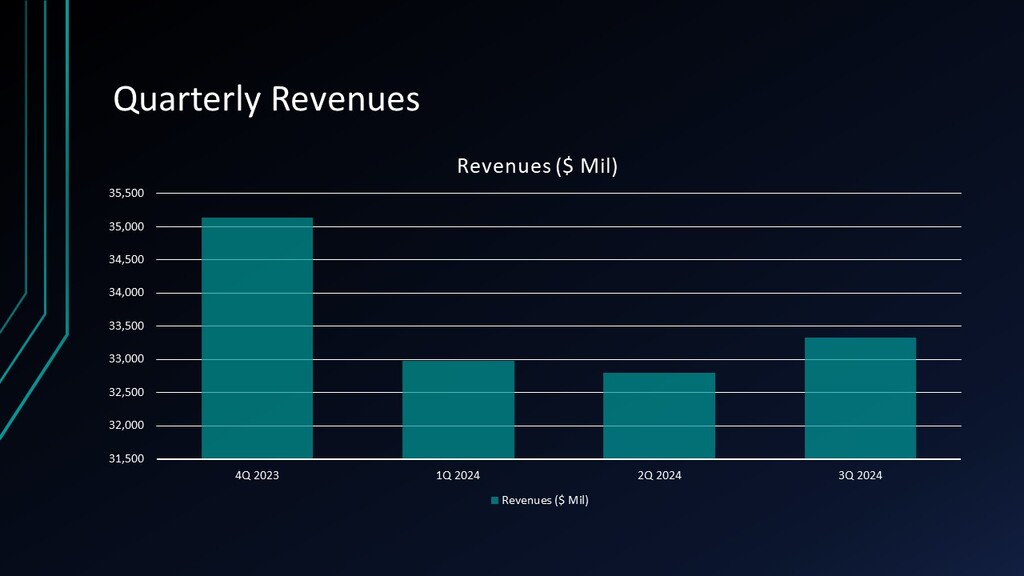

Revenue Growth (2021-2024)

Revenue has grown marginally by registering $133,613 million in 2021 and $134,243 million for the trailing twelve months (TTM). This shows that Verizon’s total revenue growth is fairly stagnant, usual in today’s telecommunication market where the growth is slow and gradual.

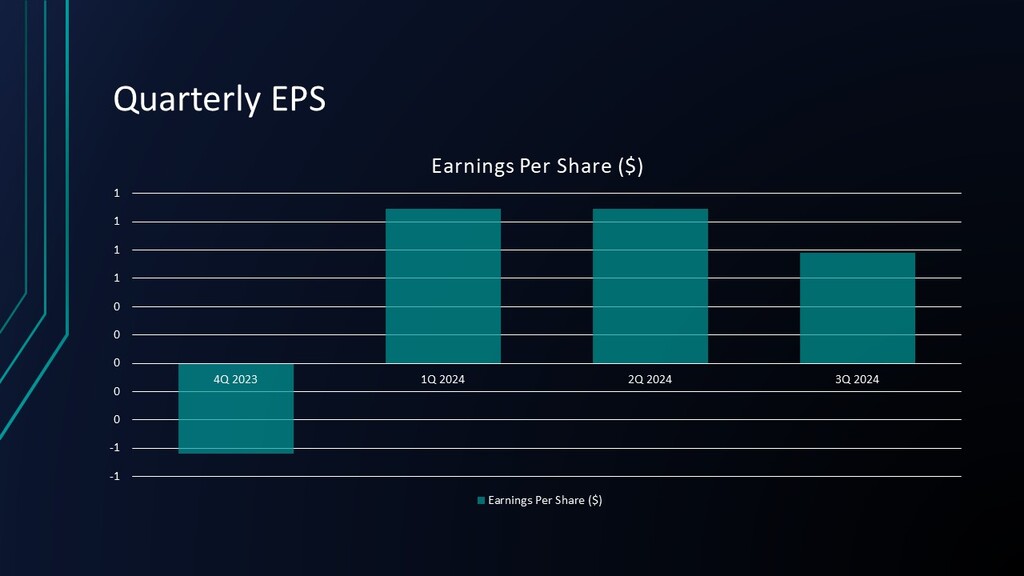

EPS

The EPS of $2.31 depicts growth and profitability of Verizon but the growth exhibited is very low in an industry which has limited scope for upswing. This EPS may not be attractive to but, it is consistent and may appeal to income-oriented growth investors but may not suit the aggressive growth investor.

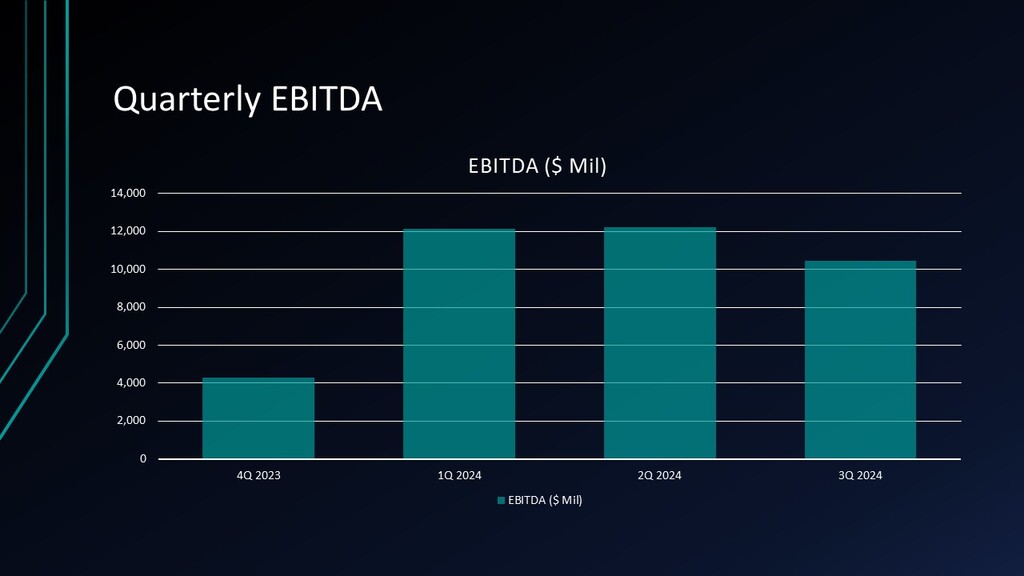

EBITDA

Verizon has an EBITDA of $39.1 billion, proving good operational cash flow generation a factor imperative to maintaining high dividend yield and fund 5G networks.

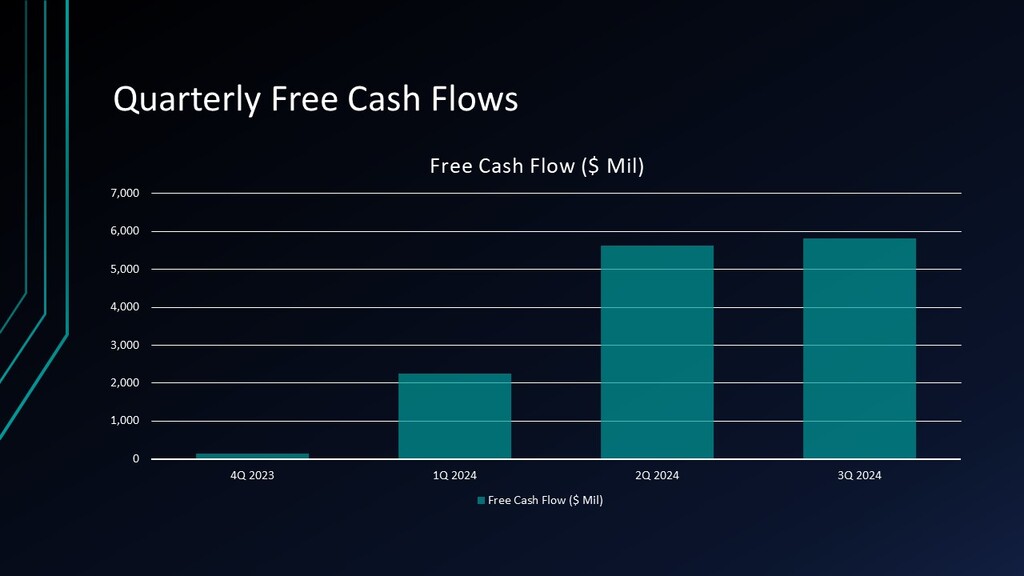

Free Cash Flow (FCF)

Verizon’s FCF has risen significantly, from -$28.3b as of 2021 to $13.9b in the TTM. This strong improvement backs up Verizon’s position of ensuring that its dividend is sustained and is a healthier signal in term of cash appeal to income hunters.

Dividend Yield

From many aspects, the primary attention should be paid to the rather favorable dividend yield equal to 6.1%, which is very beneficial for income investors. This yield together with a large free cash flow in Verizon make the Verizon stock ideal for dividend investors. Find out here Best Dividend Stocks to Buy in 2024: Fair Value Calculation

Price Prediction for Verizon Communications Inc. (VZ)

| Growth Scenario | Fair Value | Upside/Downside |

| Medium Growth | $43 | 3% Upside |

| Low Growth | $29 | 30% Downside |

| High Growth | $57 | 35% Upside |

Medium Growth

In this case, the fair value for Verizon coincide with the current stock price suggesting that expect moderate growth for the company stock price is fair. This implies a small scope for a gain meaning that it is ideal for low risk investors who are more interested in steady income earning than increase in their capital.

Low Growth

If Verizon is to post lower than expected growth then the fair value would be a decline to $29, which is a downside of 30%. Though this scenario could evolve in case of market shocks or slow revenues growth, it explains the danger for those who expected larger profits.

High Growth

In a high-growth picture, Verizon’s FV could go up to $57 – an 11% premium to current levels. This would involve Verizon’s ability to monetize its 5G infrastructure, grow its enterprise offerings, and actually take share from rivals.

Related Questions

1. Should income investors buy VZ for its dividend yield?

Due to the prevailing high yield of 7%, this makes Verizon attractive to income investors willing to enjoy more constant returns. Another deterrent is its healthy cash flow which also backs up its dividend, a premise that the company has adequately adhered to or improved in recent periods.

2. Verizon Price Target for 2025

With reference to the medium, low and high growth valuations stated above, the price target for Verizon stock may hover between $29 and $57 depending on the economic environments, growth of its 5G and Broadband business segments and other factors influencing the telecom industry.

3. Should I Invest in Verizon for the Long Term?

Investors with modest expectations in benefit generated from share price fluctuations and relatively continued and steady income from dividends would find Verizon suitable. It may not be a high growth stock but its predictable cash flows and reasonable dividend yield make it a possible ‘defensive’ play in the current market.

Conclusion

Looking at the Verizon’s financial ratios and fair value analysis, one gets the impression that Verizon might be the best fit for an income investor because of its solid cash flows and relatively high dividend yield accompanied with moderate growth. As is evident in the valuation analysis, there is very little potential for significant appreciation from this investment, except through increased growth. Income-oriented investors might find Verizon suitably irresistible while those in search of higher growth may look for stocks in the faster growing industries.

**Please be informed that the content is informational and by no means serve as a buy or sell signal. The company is not responsible for the loss of capital.