Introduction

Is Uber a Good Stock to Buy and Hold? Let’s explore into Uber Technologies Inc. (UBER) stock analysis with the key fair values and growth prospects. Find out about growth opportunities, key metrics, and long-term trends that will help you decide if Uber is a profitable long-term investment.

Uber Technologies Inc. (UBER) is currently operating as one of the largest transportation network companies and online delivery service providers worldwide, therefore, investors tend to wonder if Uber’s stock is wise to invest for future gains. This article analyzes Uber’s current market status and its financial results as well as its potential fair value. It also provides investors with the idea of Uber’s value growth at different rates and stimulates to invest without calling for buying or selling the Uber stock.

However, it is crucial to understand that the current stock market does not immediately reflect changes in a company’s financial performance in its share price. For so many growth-defined businesses, including Uber, the share price does not necessarily mirror the company’s worth until the business shows positive growth rates. As the historical evidence proves Uber’s devotion to expansion, further increases in its value are contingent upon the company’s ability to maintain growth in its revenue and free cash flow. Further down, we will evaluate Uber’s current financial ratios and the fair value based on specific revenue growth rates.

What is Uber Doing Now in the AI Era?

In the modern world dominated by AI, Uber is adapting digital intelligence to make its service better, more comfortable, and more efficient than its competitors. Here are some key initiatives:

- Dynamic Pricing Algorithms: Uber utilizes artificial intelligence to set dynamic prices on car fare depending on the demand and supply in the market. This not only facilitates the generation of revenue but also ensure the availability of cars.

- Predictive Analytics: Through big data, Uber is able to predict the demand for their service in different areas and at different time. This enables the company to deploy drivers in an appropriate manner helping to decrease the waiting time of the customers as well as increasing the overall services delivery.

- Route Optimization: AI is applied in the routing of drivers, which facilitates efficiency in movements, reduces on-road time through traffic and gets the driver to the destination in the shortest time. Not only does this build customer satisfaction but it also minimizes the consumption of fuel.

- Safety Features: Uber has incorporated artificial intelligence in safety features of its operation, such as tracking of trips in real time and mining of data using machine learning technique to give information on risky scenarios. Other features like ride check alerts help improve the safety of riders, and drivers while the automatic route deviation notification further helps in protecting the riders.

- Autonomous Vehicles: Uber has undertaken research towards creating self-driving cars to be used in the Uber rental service. This is in line with a larger strategy that seeks to decrease the expenses incurred in operations while raising efficiency in transit.

- Uber Eats Optimization: In food delivery services which is one of the most relevant segments, AI contributes to managing delivery routes and time of culinary deliveries as well as the identification of popular intervals. [1]

Businesses of Uber (AI Related)

- Ride-hailing: The most important service that employs AI to empower dynamic pricing, demand forecasting and intelligent routes.

- Uber Freight: An intermediary service providing platform where shippers can find available and suitable truck drivers. Thus, AI is used to create the proper match between loads and trucks, and select the proper routes for deliveries.

- Uber Eats: AI applied in the place for order forecast, optimization of supply routes, and the better recommendation of the food based on the prior orders made by the customers.

- Uber Elevate: While this division seems to have been downsized, it was centered on urban air mobility and used AI to improve navigation for aerial ridesharing.

- Advanced Technologies Group: This division is vested in research and innovation in the application of self-driving cars and other robotic and AI-related services that may be incorporated in Uber operations.

Some Products of Uber

- Uber App: The main product which includes options to order and travel by taxi or get food delivered with simple convenient interfaces to passengers and drivers using AI technologies.

- Uber Freight: An application to connect shippers and carriers that makes the process of freight transportation more efficient by using an algorithm that finds a load and available trucks?

- Uber Eats: An online food ordering platform to get meals from various restaurants with the help of AI to improve the customers’ experience and delivery.

- Uber for Business: One of the virtual infrastructure services that can provide companies with the solution for billing and managing employees’ and clients’ transportations through AI-based trip solutions.

- Uber Health: An app developed specifically for healthcare transport service so that health-care providers can schedule a ride for a patient’s appointment and the application will have AI features to monitor the rides.

- Advanced Vehicle Technology: This comprises the improvements in the autonomous driving experience and collaborations with companies that are also investing in the self-driving platform for a shared, efficient transportation system.

- Uber Transit: New product that provides the information of the public transit within the Uber app, allowing people to decide more efficiently where to take Uber and where to take public transportation. [2]

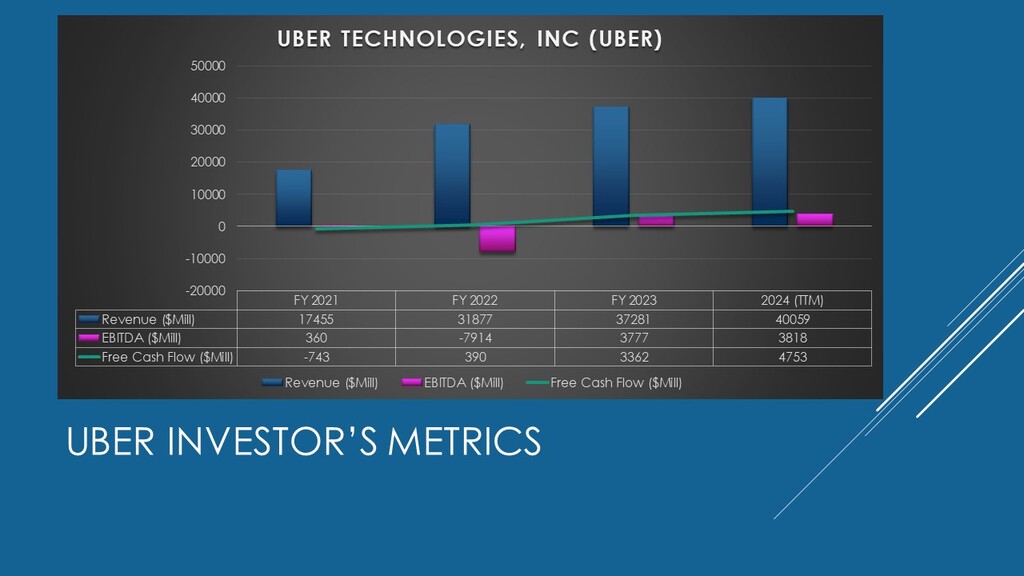

Sharholder’s Metrics for Uber Technologies Inc.

| Metric | Value |

| P/E Ratio | 78.31 |

| Market Cap (USD) | $154,419 million |

| Free Cash Flow (USD) | $4,753 million |

| Revenue Growth (2021–TTM) | 129% |

| Revenue (TTM) | $40,059 million |

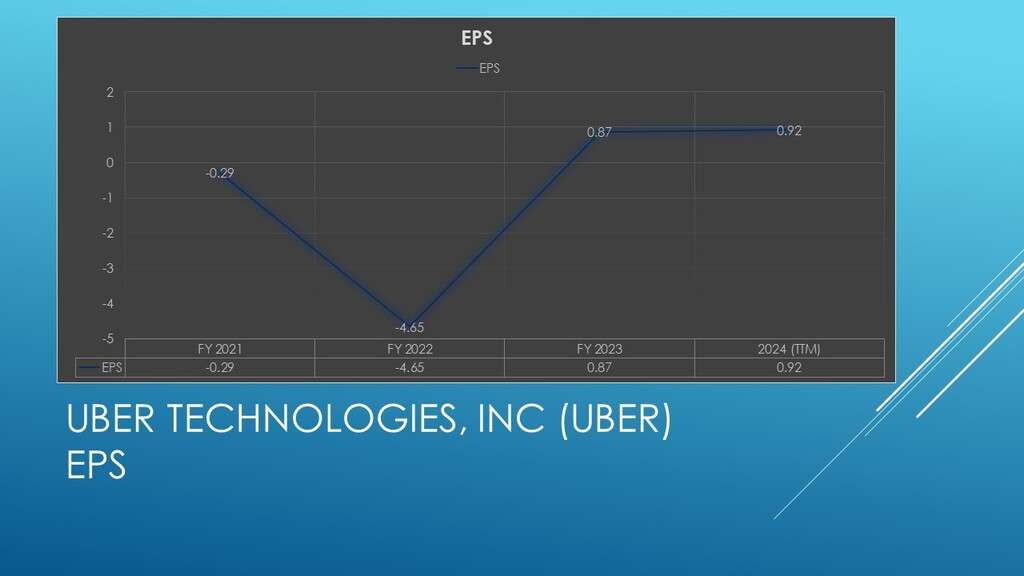

| EPS (Earnings Per Share) | 0.92 |

| EBITDA | $3,818 million |

UBER Longterm Stock Price Prediction

| Growth Scenario (CAGR) | Fair Value per Share | Upside/Downside from Current Price |

| 13.5% CAGR | $118 | 51% Upside |

| 10.5% CAGR | $93 | 19% Upside |

| 8% CAGR | $75 | -4.47% Downside |

| 19% CAGR | $197 | 152% Upside |

UBER Price Prediction Analysis

Low Growth UBER Price Prediction

An assumed 8% constant growth rate appearing to be conservative lowers the fair value estimate to approximately $75 per share which is slightly lower than the current stock price. Another scenario implied in this case is that when growth rates decline, Uber’s valuation is likely to be down only slightly.

Medium Growth UBER Price Prediction

Using the fair value model, Uber’s stock has a compounded annual growth rate of 10.5 percent estimate which ranks in at around $93 per share. This scenario paints a reasonable growth forecast and shows a 19% overall possibility of further revenues expansion.

High Growth UBER Price Prediction

It projects a compound annual growth rate of 13.5 % and calculate Uber’s fair value estimate to be $118 per share. This would add a potential for 51% from the present price, which points to a favorable long-term growth path if that firm can continue to generate sustainable revenues and free cash flows. Learn more about ARM stock price prediction.

Very High Growth UBER Price Prediction

Using the historical growth rate of Uber’s revenue of 19% for CAGR the fair value projection rises to $197 per share. This high-growth scenario offers much more growth opportunity if Uber attains strong growth, increases its profitability and grabs a higher market share. [2]

Long-Term Considerations for Uber Stock

To achieve an optimal level of service, cost efficiency, flexibility, speed, system integration, and customer satisfaction, both the mobility of the delivery system and the expansion of its delivery range have to be achieved. A key strength at Uber is that its two core services, namely Rides and Uber Eats, are today reporting a high growth rate in many parts of the world. The increasing demand for the solutions within the mobility and food delivery markets fuel the future progression. However, competitive and regulatory conditions might influence the way Uber will be able to expand on such service at a profit.

Uber has focus on key innovations, which may help the company to grow in the future such as expand self-driving capabilities, machine learning and other technologies. A positive outcome on these areas could help the organization cut its expenses and possibly spearhead new revenue models beneficial to future valuations. Due to the market’s slow reaction to growth in some situations, Uber price changes may are not linked to true value. Investors should note that further growth in the leading financial indicators including revenues and EBITDA may be necessary for the market fully establish Uber’s value.

Conclusion: Should You Hold Uber for the Long Term?

The fair value assigned to Uber indicates significant future earning capacity because its growth potential has the capacity to achieve such circumstances. However, similar to all companies growing at high rates, the performance will depend on the actual achievement of growth rates by Uber and control of operation expenses. Based on this argument, it could be concluded that Uber might provide rather robust long term investment with focus on its growth aspect which is however to be let to express the outlined performance and influenced by the external factors.

**Please be informed that the content is informational and by no means serve as a buy or sell signal. The company is not responsible for the loss of capital.