Introduction

Eli Lilly stock forecast 2025-2030: Read our research on the financial forecast of Eli Lilly and Company, the fair value of the stock, growth possibilities, and possible performance of shares. Find out if LLY is a good long term investment opportunity.

Eli Lilly and Company a leading pharmaceutical company has undertaken innovations in pharmaceutical industry especially for therapy areas such as, oncology, immunology and neuroscience. Hence, this study seeks to look at the stock prospects of Eli Lilly by the year 2025 to 2030 relative to key parameters including the current P/E ratio, fair value, market capitalization, and revenue growth. We will also look into different growth rate situations in order to achieve further comparative analysis on the potential position of the stocks.

What is Eli Lilly and Company?

The company originated in 1876, and its headquarters is in Indianapolis in Indiana. Eli Lilly is a world’s largest pharmaceutical company that has many achievements in the field of medicine recognized drugs like Trulicity and Jardiance. The firm focuses on areas of treatment and cure, including diabetes, cancer, and immune diseases. In recent years, Eli Lilly has been able to build a portfolio of products to address the growing medical requirements and provide optimal patient care. [1]

Eli Lilly’s Product Portfolio

Eli Lilly’s current product lineup features its revolutionary diabetes management solutions that have catapulted the company to this market competitive position. More notably, Trulicity, Jardiance, and Basaglar are now recognized as essentials for diabetes patient management as they offer good solutions suited to patients at all levels of diabetes. Trulicity, currently offered as a once a week injection, has become popular as it is effective in controlling blood sugar level and is convenient to use. Jardiance SGLT2 inhibitor effectively contributes to blood sugar control along with heart and kidney, and brings benefits as well while Basaglar insulin analogue is safe with affordable and easy to obtain for patients.

In oncology, new molecular products like Verzenio and Cyramza witness a growing potential of survival and enhanced quality of life of cancer patients. Verzenio has been effective especially in the treatment of breast cancer due to its ability to work directly on proteins that, for instance, promote the growth of cancer cells. Another key therapy, Cyramza, is employed in such diseases as gastric and non-small cell lung cancer, confirming Lilly’s focus on challenging malignancies, where numerous targeted therapies create value for patients improving clinical outcomes and forging new standards in oncology. Do not miss out on our list of Best US Large Healthcare Compaines in 2024.

Immunology and neuroscience are main domains segments, and products like Taltz and Emgality are some notable examples of the company’s efforts to address sophisticated diseases. Taltz is an effective medicine that helps people with psoriasis and psoriatic arthritis, as well as with other chronic inflammatory diseases. Emgality targets the prevention of migraine, and is a part of Lilly’s diversification to neuroscience as it tackles migraine impacts by offering a product designed to prevent migraines and lessen their occurrence. Expanding across the four key categories of therapeutic areas has positioned Eli Lilly for global competitiveness in the pharmaceutical industry.

Eli Lilly Stock Analysis

| Metric | Value (USD) |

| P/E Ratio | 109.94 |

| Market Cap | 813.31 Billion |

| Fair Value | $430 (est.) |

| Dividend Yield | 0.58% |

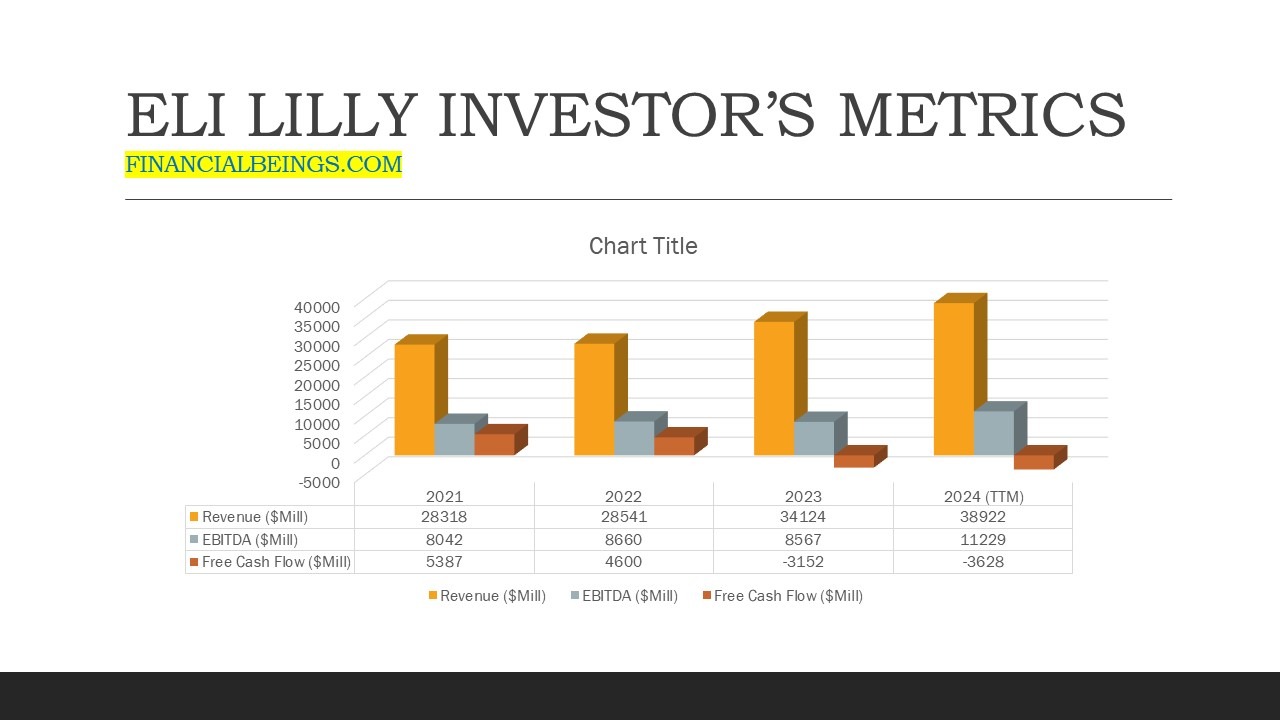

| EBITDA | 2021: 8.04B, 2022: 8.66B, 2023: 8.57B, TTM: 11.23B |

| Revenue | 2021: 28.32B, 2022: 28.54B, 2023: 34.12B, TTM: 38.92B |

| EPS | 8.12 |

| Free Cash Flow | 2021: 53.87B, 2022: 46B, 2023: -31.52B, TTM: -36.28B [2] |

Eli Lilly Stock Forecast 2025 to 2030

Market expectation is high due to Eli Lilly having a P/E ratio of 109.94. However, it leads to the possibility of the figure showing the stock as overpriced in the current market. Such a high P/E normally signifies that investors are expecting rapid earnings growth because of the company’s pipeline and recent increase in the demand of its products. Still, this valuation is risky as the high P/E also means that such growth expectations are likely to be reflected in the share price already, and therefore the hope for more upside movement might be futile.

The market cap of $813.31 billion strengthened the market’s confidence, which place it among the largest companies worldwide. However, the focus should now remain high to maintain such a valuation.

Earnings for Eli Lilly has grown over the times, from $28.32 billion in the year 2021 to the TTM value of $38.92 billion. This added revenues especially the one shown in 2023 can be associated with growth in product portfolio within the regions of operation in diabetes, oncology and immunology. EBITDA also shows an upward trend having been realized at $8.04 billion in 2021 and grew to $11.23 billion TTM.

Nonetheless, free cash flow has gone down negative from 53.87 billion in 2021 to -$36.28 billion TTM. This decline could mean that there has been higher expenditures, this could be as a result of higher R&D investment or more acquisitions. Although, the annual revenue growth rate seems quite healthy, the negative cash flow may be interpreted as the sign of inefficiency of company’s operation and lack of cash flow sustainability in the long run.

The EPS of 8.12 show a good profitability of the Eli Lilly and this enhances the image of the company in the resulting pharmaceutical sector. However, the company has a low dividend yield that stands at 0.58% that can pull off the investors’ interest. This low yield imply that Eli Lilly is ploughing back a greater percentage of its earnings for reinvestment than it is distributing to shareholders. From the activity in the firm’s development pipeline, this approach is consistent with the growth strategy of the company even though it could make the stock less appealing to income-focused investors.

Eli Lilly Stock Price Prediction (2025-2030)

Eli Lilly continues to be an industry giant with sound business prospects for growth and seemingly steady revenues and profits. However, care should be taken since the current price at the market may be subjected to downward reviews in case the expected growth rate fails to materialize. The short-term changes might be of concern to the investors, though in the longer perspective, investors might be willing to accept had the company is Eli Lilly, especially with continued high-revenue drugs and efficient cost structure.

- By looking at the historical compound annual growth rate CAGR of around 4% and then maintaining a CAGR of around 4%, the price per share would be $368 per share (downside from the current market price is 60%).

- By looking at the historical compound annual growth rate CAGR of around 4% and then bringing it up to compound annual growth rate CAGR of around 7.8% (3.8% increase in revenue from CAGR of 4% ), the price per share would be $529 (downside from the current market price is 42%).

- Let’s assume a high growth due to recent increase in the revenue of around 3-year CAGR of 11% and suppose we maintain a high growth for the next 10 years. At an compound annual average growth rate of 9%, the expected share price per share would be $604 and even at this aggressive growth rate the downside would be -34%. In all the above mentioned conditions the stock looks extremely overvalued.

Conclusion

Therefore, Eli Lilly and Company share has favorable market sentiments with sound revenues and EBITDA due to its diversified product portfolio that belongs to the market health segments such as diabetes and oncology. Nonetheless, the current high P/E ratio and the recent negative cash flow present overtrading risk, which points towards overvaluation, where investors are expecting high growth rates.

Although these moves suggest a low dividend and high reinvestment model, which is good for income seeking investors, they have minimally suited this business model. Considering these volatile signals, Eli Lilly is still attractive for the investors who are focused on company’s growth but it definitely contains certain risks connected to the necessity of stable revenue growth and effective cash flow management.

FAQs

1. What is the price forecast for LLY in 2030?

Based on our long term perspective we predict that further steady growth may take Eli Lilly’s fairly priced share to between $500 and $600 a share by 2030 but only if the company continues to enjoy a high rate of growth.

2. How high will Lilly stock go?

If its revenue growth rate increases, the shares might go beyond $600 by 2030. However, if it fails to sustain such high growth, sharp market swings are quite possible.

3. Is Eli Lilly a good investment?

Eli Lilly and Company is a robust player in this industry with a stable positive growth, which would make this business interesting to long-term investment. Nevertheless, there can be certain overvaluation issues, so it may not be the best thing to buy at the moment.