Introduction

Learn more about ARM stock price prediction and fair value estimate for 2024 with growth rates, PE ratio, and yearly revenue estimates, as well as ARM Holdings in the age of AI. Check whether ARM stock fits into your investment portfolio.

ARM Holdings, which is famous for developing highly efficient processors and delivering technology licenses for numerous applications, is now considered even more promising because of its possible AI and machine learning markets development. This article will make a sectioned evaluation of ARM’s business model and the company’s financial and growth expectations for a balanced evaluation of the stock.

What is Arm Holdings?

ARM Holdings is a British company that is in the designing of semiconductor and software and is mainly famous for low power processors. The company mainly specializes in the development of ARM architecture for CPUs that is implemented in a diverse range of products ranging from mobile phones to computer servers. Based on its business model, the company produces custom processors and licenses these designs to other firms that make up the markets it is influential in, including mobile computing to the even newer trends like AI and IoT. [1]

Key Business Areas of ARM Holdings

ARM Holdings has penetrated in the Artificial Intelligence by creating the specific AI division known as AI Ventures which has concentrated on the high-performance processors for AI. This sub-segment is focused on the enhanced neural network processing, machine learning, and supercomputing, in response to the growing need for high-performance chips in big data domains. Apart from supporting innovation, ARM also forges AI startups and becomes a source of AI chip technology, realizing increasing application of artificial intelligence solutions in diverse spheres.

ARM contributes technology within the Internet of Things IoT docket, which focuses on connectivity and automating Industrials and consumer devices. ARM IoT platforms are the building blocks for home automation, Industrial applications and connected systems that need real-time information analysis and secure connectivity. As a result of ARM’s IoT design which is built for scalability and portability and which enables IoT systems to be easily integrated across different devices the future of the internet of things is developed across homes, cities, societies, etc. Do not miss out on this Backbone of AI Industry ASML Stock Price Prediction.

ARM is also instrumental in the auto industry where it acts as the supplier of technologies that are used in auto driven or auto connected cars. Core processors and reference architectures that ARM develops help to propel complex safety systems such as ADAS and V2X communication technology to enhance safe and smart mobility. This expansion toward full automation of automobiles makes ARM’s technology of real time data processing feasible for on-road decision making to strengthen its hold in the dynamically transforming automotive industry. [2]

Products of ARM

The ARM architecture from ARM Holdings has several lines of Cortex processors such as the A; R; and M; which are the cores inside mobile gargets, automobiles, and other embedded systems. The Cortex A-Series is applied to the modern mobile and consumer electronic devices because it is capable of supplying the high performance processing which are required in such devices such as mobile phones, tablet computers. However, there is the Cortex-R series well suited for real-time processing typical for automotive and industrial equipment, where both reliability and real time response matter. The Cortex-M series is dedicated to the minimum power consumer devices for IoT, and therefore, best suitable for applications like Wearable Electronics and Smart Home Devices.

The Mali GPUs designed by ARM are playing a huge role in rendering graphical applications within the handheld and other embedded systems. Mali GPUs are specifically designed for very low power consumption while offering high quality of graphics, this is valuable in smart phones and tablets, and smart TVs where power consumption and graphics are important. ARM’s Mali series covers a broad spectrum of graphical requirements and inclusion with everything from simple UI incorporated to IoT devices to high definition mobile gaming and video. For this reason, Mali GPUs are appealing to device makers that seek the highest-performance balance for graphic intensive usage while minimizing power.

Neoverse platform by ARM seeks to meet the ever increasing need for HPC which is common in cloud data centers and edge computing. Neoverse processors are targeted at cloud servers, Artificial Intelligence, and Edge systems high-performance infrastructure requiring high speed, scalability, and power efficiency. With the rise of cloud services and increased integration of edge computing for latency-sensitive use-cases like autonomous vehicles and smart cities, Neoverse constitutes the compute fabric to these demands and places ARM into the data center and HPC market space.

ARM Holdings Stock Price Prediction and Revenues

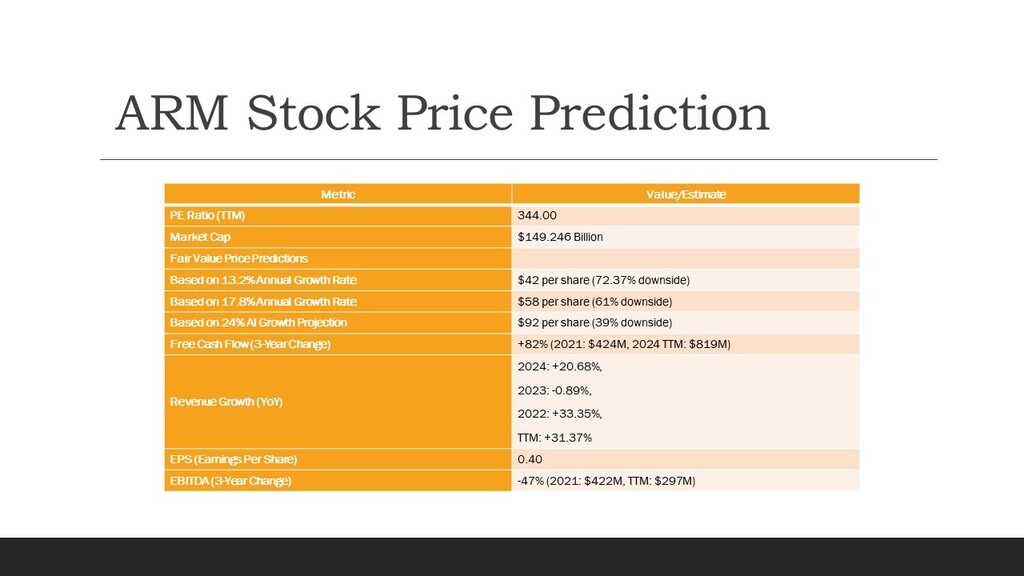

Fair Value Analysis

- Base Growth Scenario (13.2%): A conservative estimate of annual growth of 13.2% means a fair value estimate of $42 per share that is 72.37% below the current price. This scenario is relatively moderate since it underlines the fact that ARM is currently overbought in the market.

- Moderate Growth Scenario (17.8%): If ARM will possess the average growth rate of 17.8%, the fair value appeared at the level of $58 per share along with the downside of 61%. Such scenario would require moderate increase in the pace of ARM’s core operations, which could be fueled by AI and IoT markets.

- High Growth Scenario (24% AI Growth): Based on strong adoption growth rates of 24% following AI and other sophisticated uses, BAC’s share price estimate could increase to $92, but it also suggests at the same time it can go down by 39%. This aggressive growth forecast assumes a strong growth in emerging technologies but notes that the price to stock is high compared to growth estimates. [4]

Financial Performance Analysis

- Free Cash Flow (3-Year Change): Free Cash Flows have also risen by 82% in the past three years and reached $819million (TTM) in comparison to 2021. This growth complements the investments ARM has been making in AI and IoT but shows volatile cash inflows.

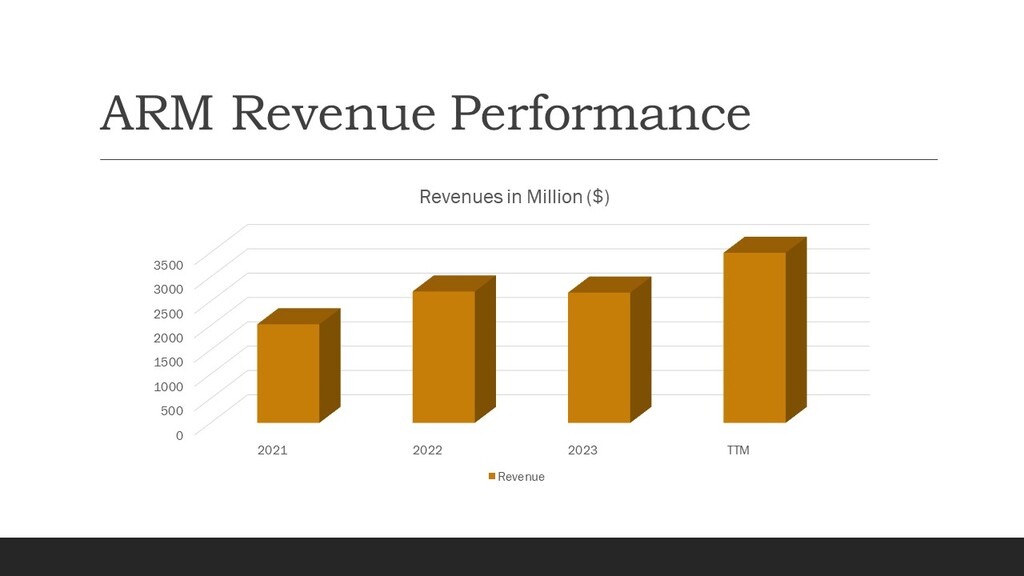

- Revenue Growth Year-over-Year (YoY): The revenues per year have seen inconsistent growth, and for year over year there has been a minor fluctuation such as a leap of 33.35% in 2022 and 31.37 % in the trailing twelve months of 2024 and slight decline in the year 2023 of 0.89%. This is due to ARM’s possibility of experiencing fluctuating growth in its operation across different markets.

- EPS (Earnings per Share): EPS is 0.40 at present, which indicates lower profitability per share comparative to competitors, potentially due to heavy spending on growth initiatives.

- EBITDA (3-Year Change): ARM’s EBITDA has reduced by 47% over the three prior fiscal years from 2021 at $422 million up to the last observed TTM of $297 million which illustrates margin issues and operation costs during the scaling phase. [5]

Questions and Perspectives on ARM Holdings

1.What is the future of ARM Holdings stock?

Given what has been noted on ARM’s growth in AI and IoT, the future of ARM Holdings stock depends on the company’s continued and even higher rates of growth in these areas. Since demand for processors that are optimized for machine learning set, IoT, and edge computing is likely to grow as the respective markets, ARM could experience value appreciation if the markets in question grow as expected. However, in light of the overvaluation indicators currently in place, any additional increase will have to be an enduring growth above the trend.

2. Is ARM a buy or a sell?

Though we will not directly recommend a buy or a sell signal, however, when having taken into account ARM’s fair value with regards to the possible growth rates, we are observing an overvaluation at current market prices. Specifically, investors interested in the prospects of ARM for significant growth in the long term should also compare the company’s ARM fair value to its current growth rate. ARM’s prospects in the AI and automotive markets might offer extra value, but it is necessary to estimate these opportunities together with company’s rather elevated ratios.

Conclusion

ARM Holdings, a company riding the low-power, high-efficiency processors trend, is well-placed for growth in AI, IoT and automotive categories. When we conduct fair value assessment we see certain risks at different growth rates implying that the current value might be slightly over the intrinsic growth rates. Nevertheless, the future in the emerging technology markets and segments might be viewed as a range of ARM’s significant long-term opportunities. Thus, as per usual, we encourage investors to perform their due diligence before making any investment decisions referring to ARM and taking into consideration the company’s fair value along with the market environments.

**Please be informed that the content is informational and by no means serve as a buy or sell signal. The company is not responsible for the loss of capital.