Introduction: What is Sustainable Future

How sustainable future can be achieved by 5 prudent financial tips, read this story. An American philanthropist Ronald read, who was by profession a janitor and a gas station attendant. His hobbies were investing and chopping wood. When he died at the age of 92 in 2014, approximately 2,813,000 Americans died in the same year of which 4000 had the net worth of over $8 million. Ronald read was one of them. Was there a lottery involved? What did he do to make such a big net worth that other highly intelligent individuals couldn’t do? He spent less, saved more and invested in high valued stable stocks. It all comes down to managing our finances and letting the money work for ourselves. Let’s discuss some prudent financial tips for sustainable future.

FOCUS POINTS: 5 Financial Tips (1 minute read )

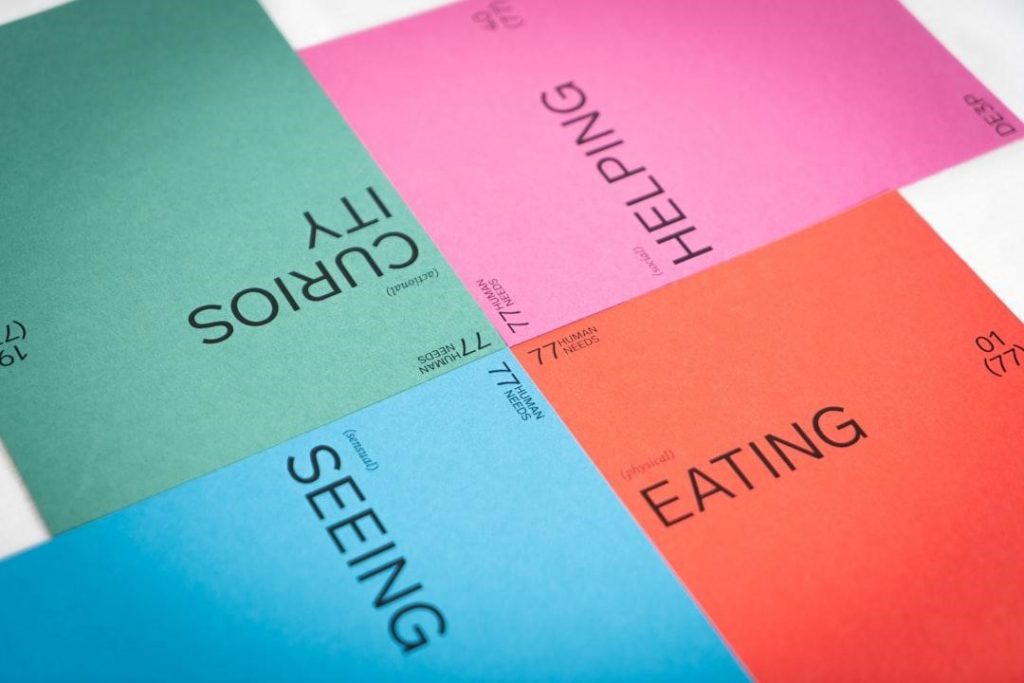

1. Differentiating Needs and Wants: Recognize and distinguish between essential needs (food, shelter, health, education, and clothing) and non-essential wants (luxuries and impulsive purchases) to secure a sustainable financial future.

2. Planning and Budgeting: Implement systematic planning, budgeting, saving, and spending strategies to streamline complex financial decisions and improve overall financial management.

3. Prudent Spending Habits: Adopt prudent spending habits by living within your means, focusing on savings, and resisting the urge to spend money before it’s earned, as demonstrated by the tale of the two brothers.

4. Mindful Shopping: Engage in mindful shopping by setting spending limits, comparing prices, and avoiding excessive shopping sprees that can lead to financial instability.

5. Leveraging Financial Knowledge: Utilize financial planning apps to better manage and analyze personal finances, promoting financial literacy and enabling informed decision-making for budgeting, saving, and investing.

Needs and Wants: Why Sustainable Future

The quote from Sherlock Holmes states, ‘‘The world is full of obvious things which nobody by any chance ever observes’’. Same is the case with needs and wants, where most of the people don’t know, how their decisions regarding wants and needs effect their financial future. It is the necessity of the time that you should know, what is necessary for you and what can be postponed. Here comes the part where you want to control the amount of money you spend on things that are of utmost importance like a human breath and food.

What are needs

Needs the necessities of life. A single person or a family have their needs in order to have a basic sociable life. The items that are the must include: food, shelter, health, education and clothing. A person has to spend on these items and there’s no way around. Simply put life depends on it.

What are Wants

Wants are desires of an individual or a family. It is always good to have desires. Desires push us to work more and achieve more. Desires of an easy and comfortable life has pushed the societies to innovate and derive value out of old and tiresome processes. I want a big house, an expensive car, branded clothes, expensive mobile phones, sure, why not? These are not

necessary and thus are considered as wants. Most of the times these are impulsive and show off ‘‘buy’’ to impress the people around us.

Planning our Little World: Financial Success

Planning is perhaps the most important financial tip that saves us the hassle of complicated and stressful decisions. Divide and rule was the British policy to control their expanded colonies around the world. The use of this rule in order to control the peoples’ lives in order to keep them enslaved is bad. But the rule is good when used in a positive manner. Why not divide our complicated household decisions into simpler ones? We should plan ourselves well so that we conduct ourselves better in this chaotic world. Saving, budgeting, investing and spending should be divided and then ruled one by one by our planning.

Spending in the time of Saving

‘‘Never spend your money before you have it’’, says Thomas Jefferson. I would add to it, spend less while you have it. A tale of 2 brothers, one earning 70,000 a year and the second earning 40,000. Mike earning 70,000, has a good car, nice house and wear brands. Nathan earning 40,000 living in a simple 1-2 room apartment in not so expensive area, has a used car, wear simple but good quality non-branded clothes. Mike saves 5% of his annual income while Nathan saves 15% of his annual income. If we calculate their yearly savings, 5% of 70,000 is 3,500 a year while for Nathan 15% of 40,000 is 6000. Who is going to have a more sustainable future? All I want to show you is that your salary has the least to do with your net worth in the future. Please take care while you are able to do it.

Shopping but not on a Shopping Spree

Shopping is good. That makes people happy, active, lively, enhances the mood and in-fact improves the health. Shopping spree is the exactly opposite, makes people sad, inactive, dull, spoils the mood and thus health deteriorates but in the distant future. Future is unpredictable for everyone but it is damn predictable for the people who spend extravagantly. People who waste money, money will waste them sooner than later. Let’s go for shopping on a Saturday, we have a full day, we will buy everything we want to and we will enjoy a lot. But let’s anchor our brains to the amount we are going to spend overall and we will visit multiple shops to check for the prices.

Power of Knowledge

Knowledge is the power to understand and interpret. Understanding in the age of unlimited knowledge is difficult. How to manage and plan the expenses if we do not have the right amount of our own financial data? It is sometimes wise to not do things manually but to do digitally in the world of Information and Technology. It is better to use apps that have good ratings and a reasonable price to plan for budgeting, saving, investing as a financial planning knowledge base. To keep track of your personal balance sheet it is vital to your data in a well tabulated way that takes time. By paying for these apps, you are certainly taking a step towards financial literacy and planning. The more your are aware of your spending habits, the more you can see with your eyes, the damage you are doing to yourself. If you keep on opening these apps, then availability heuristic will keep on working and you will think many times before making many purchases. Learn more about Best investment books beginners can read!

Conclusion

Ronald Read’s life exemplifies that prudent financial management is not solely reserved for high-earning individuals or financial experts. His legacy teaches us that the key to financial freedom lies in distinguishing needs from wants, planning meticulously, saving diligently, and spending wisely. By adopting these principles, anyone can set themselves on a path towards a sustainable and secure financial future.

In an era of instant gratification and rampant consumerism, it’s easy to lose sight of long-term financial goals. However, mindful spending, meticulous planning, and the power of financial knowledge can help steer us towards lasting prosperity. Remember, it’s not about how much you earn, but how wisely you manage what you have. As we navigate our financial journeys, let Ronald Read’s story inspire us to be disciplined, informed, and strategic in our approach to money.

Ultimately, financial success is a cumulative result of small, consistent actions taken over time. Start today with a conscious effort to understand your financial habits, set clear priorities, and use the tools available to manage your finances effectively. Your future self will thank you.