UNH stock 5 year projection and long-term earnings outlook, valuation possibilities, expected returns, and the major risks by 2030.

Introduction: UNH Stock 5-Year Forecast

UnitedHealth Group (UNH) is the largest healthcare company based in the United States, attracting much attention in terms of investor activities due to its good performance in the industry and its diversified healthcare services. This article presents a systematic UNH stock 5-year outlook on the sensitivity of valuation, long-term operating performance, and key business risk determinants. It is aimed to provide a coherent UnitedHealth 5 year stock outlook.

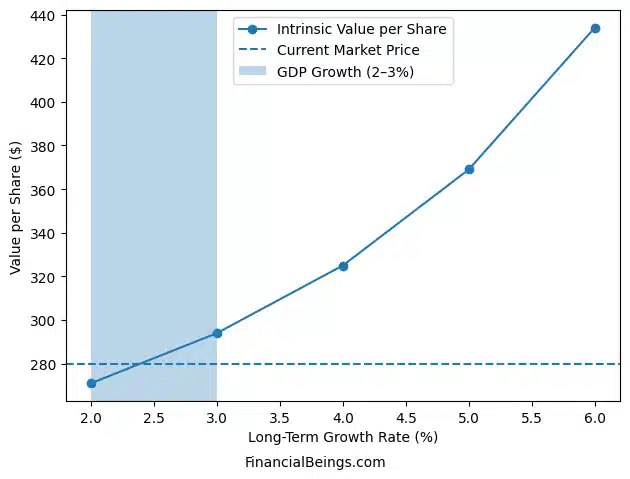

The valuation shows the variations of UnitedHealth’s intrinsic value under long-term growth assumptions. For a detailed breakdown of how intrinsic value is calculated and updated since 2025, see our analysis on What Is the Intrinsic Value of UNH Stock in 2025 and beyond? The existing price in the market is $280 share, and the intrinsic value differs widely depending on the future performance of the growth. The strategy contributes to the explanation of the UNH stock long-term forecast due to the strong growth requirements of reimbursement policies, median cost of healthcare, and policy modifications of medical charges.

UNH Stock 5-Year Forecast (2026–2030): What This Analysis Covers

This UNH stock 5 year forecast is centered on three fundamental areas that define the performance at long-term:

- Long-term growth assumptions of valuation.

- UnitedHealth’s increase in earnings and profitability.

- Valuation risks and expected return results.

These elements assist investors to be aware of the UnitedHealth long-term investment potential by 2030.

Valuation-Driven Forecast

A valuation-based forecast describes the behaviours of stocks by assessing the existing market value against the intrinsic value estimates. Based on the sensitivity of valuation, it indicates that intrinsic value varies greatly according to the expectations of growth. Valuation is close to the current price when the assumptions of growth are low. Nevertheless, intrinsic value is increasing significantly when the growth assumption is greater.

Table 1: UNH Intrinsic Value Under Different Growth Assumptions

| Long-Term Growth Rate | Intrinsic Value Per Share ($) | Difference vs Market Price ($280) |

| 2% | 272 | Slightly Below Market Price |

| 3% | 294 | Moderate Upside |

| 4% | 325 | Stronger Upside |

| 5% | 370 | High Upside |

| 6% | 435 | Very High Upside |

The current market price is between the 2 percent and 3 percent growth assumption. This implies that the investors are now expecting moderate growth instead of aggressive growth. Thus, the UNH stock forecast 2030 primarily relies on the possibility of UnitedHealth demonstrating more successful growth results than the market expects.

Figure 1. UNH intrinsic value per share under various long-term growth assumptions (2%-6%) compared to current market price of $280.

The valuations of health care insurers often change when there are reports in the policy. There are frequent cases of investor confidence and insurer stock performance being affected by the discussion of reimbursement policy (Financial Times, 2026). Equally, it is reported in Yahoo Finance that the trends of costs and margins have considerable influence on the share price movements of UnitedHealth (Yahoo Finance, 2026).

UNH Stock 5-Year Valuation Scenarios Explained

The best way of analyzing the UNH stock 5 year forecast is by examining the intrinsic value change within various long-term growth rate assumptions. According to the valuation, even small fluctuations in growth expectations have huge differences in estimated share value. This implies that future returns will be very sensitive to the rate at which UnitedHealth can increase earnings in the period between 2026-2030.

The valuation model has three key scenarios, including Bear Case, Base Case and Bull Case. Every case depicts a variant of growth trajectory and a variant of the expected outcome of returns.

Base Case: Reasonable Growth and normalised returns.

The base case presupposes a growth between 3-4% in the long term. In this case, the intrinsic value grows on average between $294 and $325 per share. This case is an indication of consistent business expansion with increasing healthcare demand and balanced cost and regulatory issues.

Base Case Characteristics

- Consistent increase in healthcare demand because of equality of reimbursement and cost environment.

- Average expectations of returns.

- This situation will favor steady yet average returns, which shows a realistic UnitedHealth stocks 5 year outlook.

Bull Case: Strong Execution and Favorable Policy Environment

Bull case is that the growth will be 5-6 percent, thus, intrinsic value will be between $370-$435 per share. This is an outcome that necessitates effective cost management, favourable regulatory trends, and further growth of healthcare services.

Bull Case Growth Drivers

- Good demand of healthcare services.

- Good Medicare reimbursement climate.

- Cost management and expansion of operation.

Positive healthcare policy may provide avenues of growth that will help to boost insurers’ valuation (Financial Times, 2026).

Bear Case: Slower Growth and Higher Cost Pressure

Bear case presupposes a long-term growth of between 2% and declines intrinsic value to an average of $272 per share. This situation can be the case when there is a growth in medical expenses is not anticipated or the regulations limit the profit margins.

Bear Case Risk Factors

- Increasing healthcare claim costs.

- Adverse reimbursement changes.

- Increased or strict regulation.

According to Yahoo Finance, unanticipated rises in healthcare expenses often cause adverse investor attitudes and margin strain to insurance companies (Yahoo Finance, 2026).

UNH Long-Term Earnings and Growth Outlook (2026–2030)

The healthcare demand trends and efficiency of managing expenses largely dictate the earnings growth outlook of UnitedHealth. The demand of healthcare is usually high due to the rise in population, ageing of the population, and rise in the use of healthcare. These aspects claim the potential of long-term growth in revenues of UnitedHealth.

Yet, health insurance companies have very controlled markets in which their profitability is contingent upon the control of costs and stability of prices. Policies on reimbursement and regulatory control have a strong impact on the profitability of insurers and their market price (Financial Times, 2026). It is also stated in Yahoo Finance that the performance of UnitedHealth earnings tends to rely too much on the cost trend management of the medical costs as opposed to merely raising the revenue (Yahoo Finance, 2026).

Operating Performance and Business Quality Indicators

It is very substantive in considering the UnitedHealth intrinsic value and growth potential in the long run.

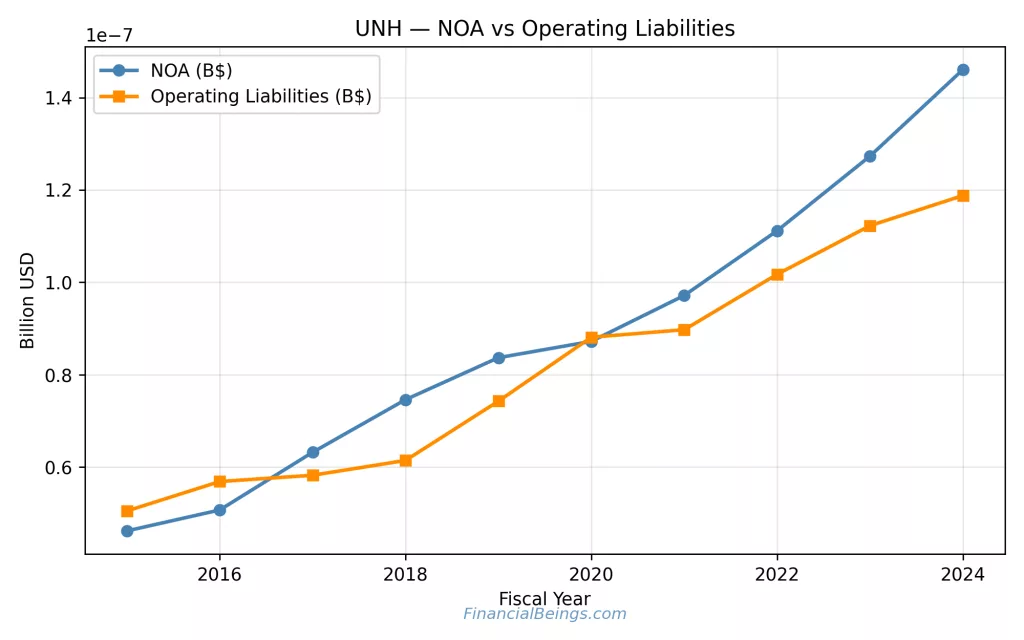

NOA and Operating Liabilities Growth

The NOA and Operating Liabilities presents steady growth of operating size.

Table 2: NOA vs Operating Liabilities

| Year | NOA (B$) | Operating Liabilities (B$) |

| 2015 | 0.46 | 0.50 |

| 2016 | 0.51 | 0.57 |

| 2017 | 0.63 | 0.58 |

| 2018 | 0.74 | 0.61 |

| 2019 | 0.83 | 0.74 |

| 2020 | 0.88 | 0.88 |

| 2021 | 0.97 | 0.90 |

| 2022 | 1.11 | 1.01 |

| 2023 | 1.27 | 1.12 |

| 2024 | 1.46 | 1.19 |

The consistent rise in both measures indicates improvement in the operating capacity, which encourages improvement in business in the long term.

Figure 2. UNH Net Operating Assets (NOA) and Operating Liabilities (B$), 2015–2024

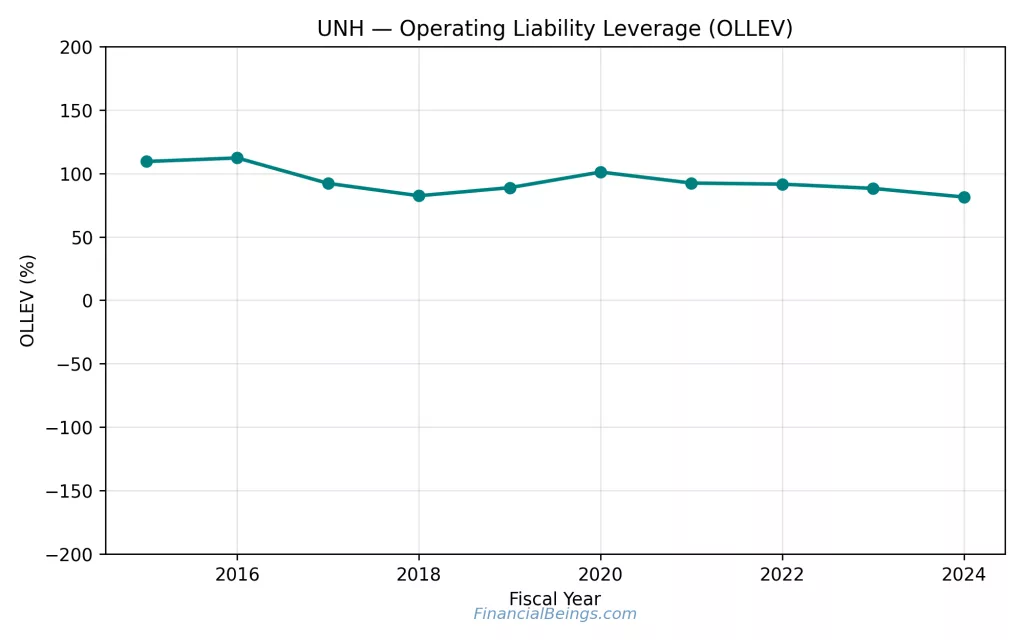

Operating Liability Leverage (OLLEV) Trend

OLLEV is falling gradually with time, indicating a decreased use of liability-based leverage.

Table 3: Operating Liability Leverage Trend

| Year | OLLEV (%) |

| 2015 | 110 |

| 2016 | 112 |

| 2017 | 92 |

| 2018 | 83 |

| 2019 | 88 |

| 2020 | 101 |

| 2021 | 92 |

| 2022 | 91 |

| 2023 | 88 |

| 2024 | 82 |

The reduction of OLLEV means that the balance between working capital and debts is increasing, and it contributes to the stable financial performance in the long term.

Figure 3. UNH Operating Liability Leverage (OLLEV %), 2015–2024

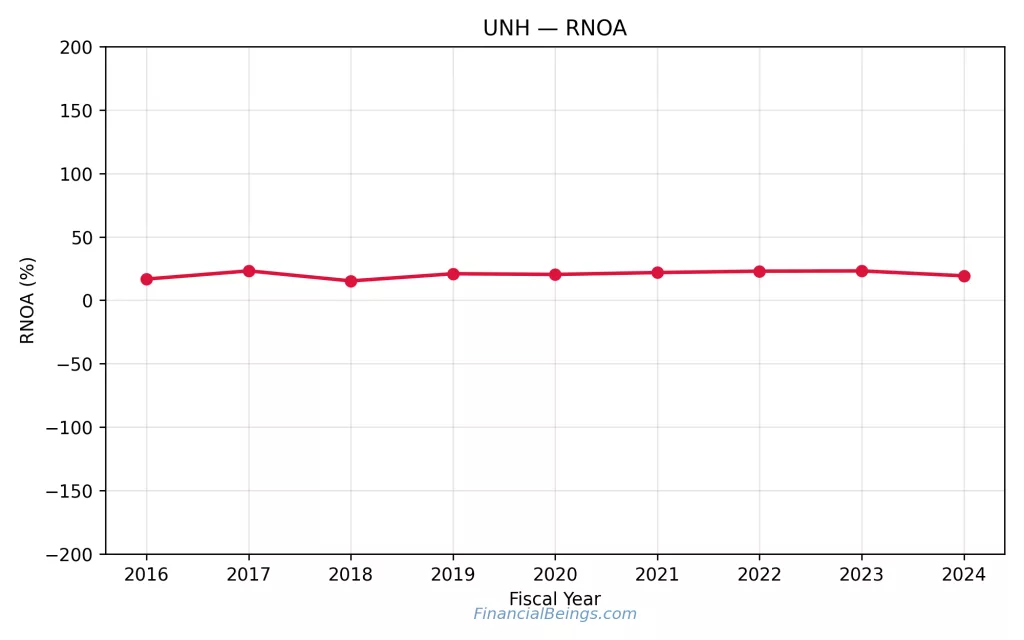

RNOA Profitability Stability

The RNOA shows consistent operational efficiency.

Table 4: RNOA Performance

| Year | RNOA (%) |

| 2016 | 17 |

| 2017 | 24 |

| 2018 | 16 |

| 2019 | 22 |

| 2020 | 21 |

| 2021 | 23 |

| 2022 | 24 |

| 2023 | 24 |

| 2024 | 20 |

Strong operating profitability is observed in the form of stable RNOA, which justifies the UnitedHealth long-term investment thesis.

Figure 4. UNH Return on Net Operating Assets (RNOA %), 2016–2024.

Expected Returns From UNH Stock Over the Next 5 Years

Growth assumptions are central to expected returns. When intrinsic value converges toward the current market price over a five-year horizon, even small changes in long-term growth assumptions can produce materially different return outcomes.

Table 5: Expected Return Outcomes

| Growth Scenario | Intrinsic Value | Return Outlook |

| 2% Growth | $272 | Minimal or Negative Returns |

| 3% Growth | $294 | Low Positive Returns |

| 4% Growth | $325 | Moderate Returns |

| 5% Growth | $370 | Strong Returns |

| 6% Growth | $435 | Very Strong Returns |

The prevailing stock price indicates that market is anticipating growth in the range of 2%-3%; that is, conservative growth scenario and increase in growth would significantly impact intrinsic valuation growth.

The stock prices of insurers tend to respond strongly to changes in the reimbursement policy, so the expected outcomes related to returns can be sensitive (Financial Times, 2026). Yahoo Finance also lists the effect of medical cost trends on investor expectations and valuation ratings (Yahoo Finance, 2026).

What Growth Is Already Priced into UNH Today?

The current market anticipations indicate that investors are valuing moderate long-term growth in UNH stock and not intensive growth. The analyst predictions suggest that the increase in revenue will not increase in the same way UnitedHealth has done it previously, and it is projected to increase in the range of mid-single-digit per year in the upcoming years. For a shorter-term perspective on 2025 earnings expectations and consensus projections, see our UNH Stock Forecast 2025 analysis.

Simultaneously, analyst commentary and management reports suggest that the earnings and margins may rise again once the cost pressures are over to anticipate stable yet sustainable growth (Yahoo Finance, 2026). This in general indicates that the current stock price is based on a balanced outlook where investors are expect a steady growth in the stock although not higher than normal performance, i.e. the higher than expected growth in earnings would result in an increase in the future stock valuation.

Key Risks Affecting the UNH Stock 5-Year Forecast

Several risks may affect the UnitedHealth valuation risk and stock performance in the long run.

Major Risk Factors

- Medicare Advantage policies of reimbursement.

- Medical inflation of costs that was not foreseen.

- Compliance and regulatory scrutiny.

- Improper assumptions regarding long term growth.

The discussions regarding government healthcare reimbursement often provoke unstable share prices of insurance companies (Financial Times, 2026). It is also observed that increasing medical expenses may have an impressive effect on profitability and shareholder mood (Yahoo Finance, 2026).

Conclusion

The UNH stock 5 year forecast shows that long-term valuation results are primarily related to the sustainability of the growth. The market price is currently at a growth level of 2% to 3% indicating that there are negative market sentiments. An average growth rate between 3% and 4% can have a moderate upside effect on UNH price, whereas a growth between 5% and 6% percent will have a good very good impact on share price. Nevertheless, a reduced growth rate may constrain returns to investors.

The continued growth of the NOA, a healthy RNOA, and falling OLLEV are only a few of the indicators of the business fundamentals that UnitedHealth has. However, the trends in healthcare costs, reimbursement policies, and regulatory developments are also very important elements that affect the UnitedHealth 5 year outlook. These variables must be carefully considered by investors estimating the potential of expected returns of the UNH stock forecast through 2030.

UNH Stock 5-Year Forecast: Investor FAQs

What could UNH stock be worth in five years?

The stock value of UNH in five years will primarily depend on the increase in long-term earnings and the stability of the healthcare policies. Depending on the valuation situations, in case the growth is not high (around 3-4%), the stock will experience gradual yet not significant growth. Better execution and better reimbursement terms may be beneficial in promoting greater upside. Nevertheless, the long-term performance can be affected by the medical cost pressures and regulatory developments (Financial Times, 2026; Yahoo Finance, 2026). We see UNH as a less risky investment with significant coverage of market cap by intrinsic value. We consider the stock has a significant upside with price per share between $350-$400.

Is UnitedHealth fairly valued based on long-term fundamentals?

UnitedHealth is priced as per the current market expectations that are pessimistic but it has shown consistent performance in operations in the past. The stock value is indicative of a low to moderate growth but not aggressive growth. Good operating statistics like stable profitability encourages long-term intrinsic value potential. But valuation is still vulnerable to the fluctuation of reimbursement and trends in healthcare costs (Financial Times, 2026; Yahoo Finance, 2026).

What growth rate does UNH need to justify today’s price?

Recent analysis indicates UNH even at lower growth rates of 2-3% is not expensive. The market seems to be pricing low to moderate growth as opposed to high growth. Current valuation makes it undervalued for long-term investors and in case earnings increase steadily and margins improve the stock can offer a good upside for patient investors.

Usama Ali

Usama Ali is the founder of Financial Beings and a self-taught investor who blends classic valuation study with insights from psychology. Inspired by works from Benjamin Graham, Aswath Damodaran, Stephen Penman, Daniel Kahneman, and Morgan Housel, he shares independent, data-driven research to help readers connect money, mind, and happiness.

Disclaimer

The content provided herein is for informational purposes only and should not be construed as financial, investment, or other professional advice. It does not constitute a recommendation or an offer to buy or sell any financial instruments. The company accepts no responsibility for any loss or damage incurred as a result of reliance on the information provided. We strongly encourage consulting with a qualified financial advisor before making any investment decisions.