Introduction

Looking for Best Stocks to buy now under $10 and affordable investment opportunities? Explore five high-growth stocks for purchase right now that cost less than $10 in this investment opportunity. The financial performance and analyst price targets along with risk elements get reviewed for Nokia, Vale, 1-800-Flowers, ACCO Brands, and Ammo Inc.

Publicly traded stocks priced below $10 pose an appealing investment path for capitalists who want to seize market potential without spending large sums on their initial investment. Stocks belonging to smaller volatile companies tend to show substantial price fluctuations when measured in terms of both positive and negative values. Financial investment in stocks below $10 needs careful examination from investors because they entail significant risk.

The article examines five different companies operating under ten dollars each because investors find them appealing for their growth chances coupled with their current market advancements.

The article provides an analysis of financial aspects such as revenue trends together with margins and projected data so readers can decide whether these stocks suit their investment portfolios. Small businesses that pose high-return opportunities also present considerable volatility together with investment risk so investors must fully understand stock price uncertainty.

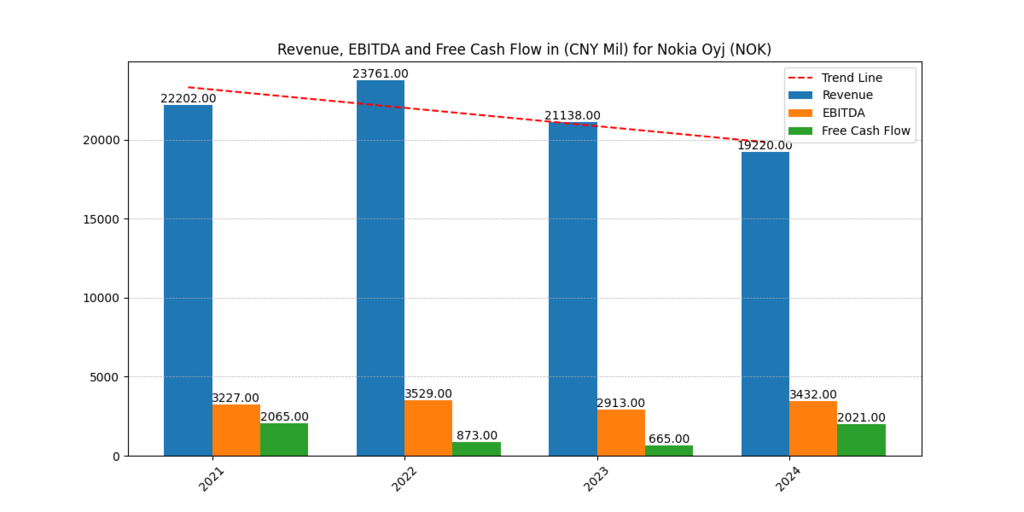

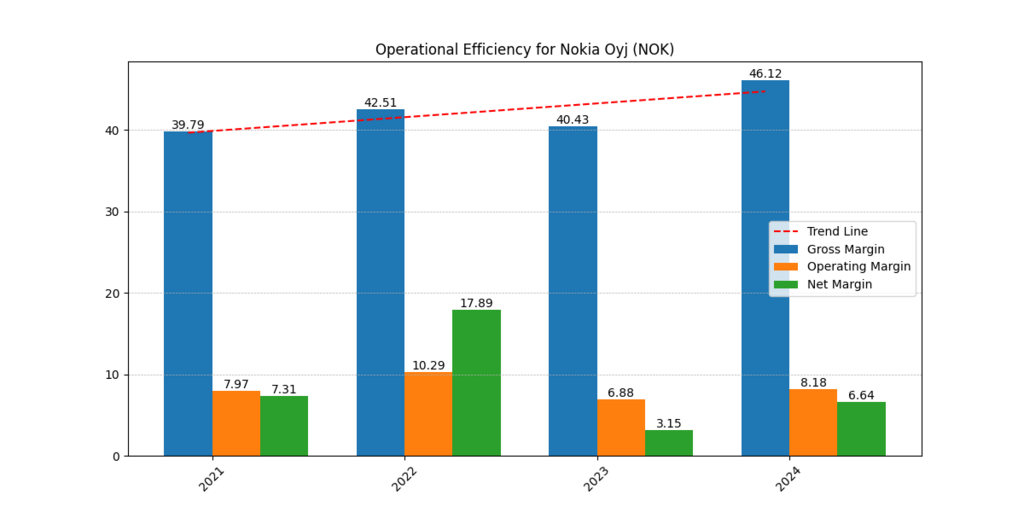

Nokia Corp (NOK) Revenues and Operational Efficiency

Despite intense competition in the telecoms market, Nokia has maintained its upward trajectory in financial results. Effective management of production costs allows the organization to sustain an appropriate gross margin.

With an ever-increasing operating margin, Nokia has proven repeatedly that it is a formidable competitor in the business. Market factors including pricing dynamics and competitive pressures have an impact on Nokia’s reported net margin fluctuations. Revenue for the company has been volatile for the past several months, but it has now settled into a solid growth trend.

Due to the ever-increasing need for telecommunications infrastructure around the world, Nokia has shown that it can sustain economic expansion by concentrating on network infrastructure, 5G technology, and mobile services.

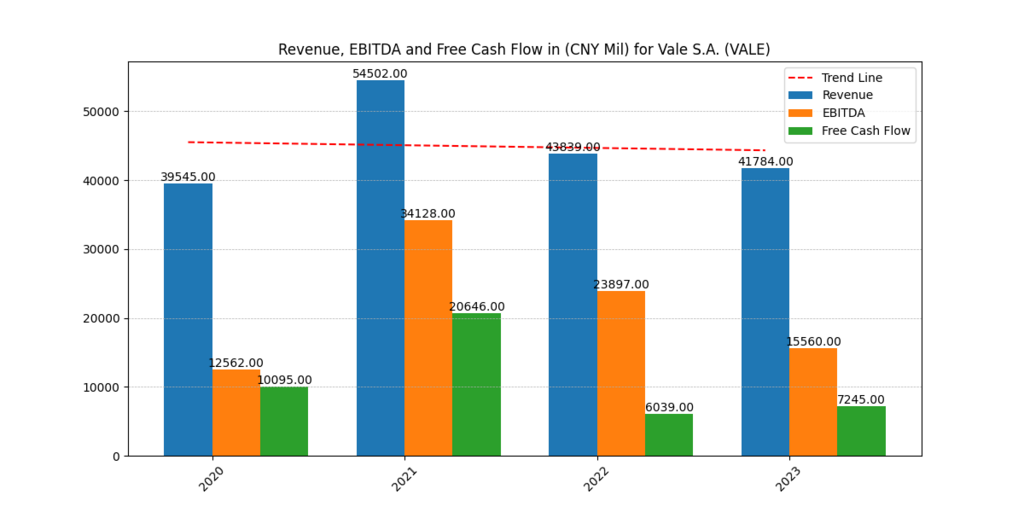

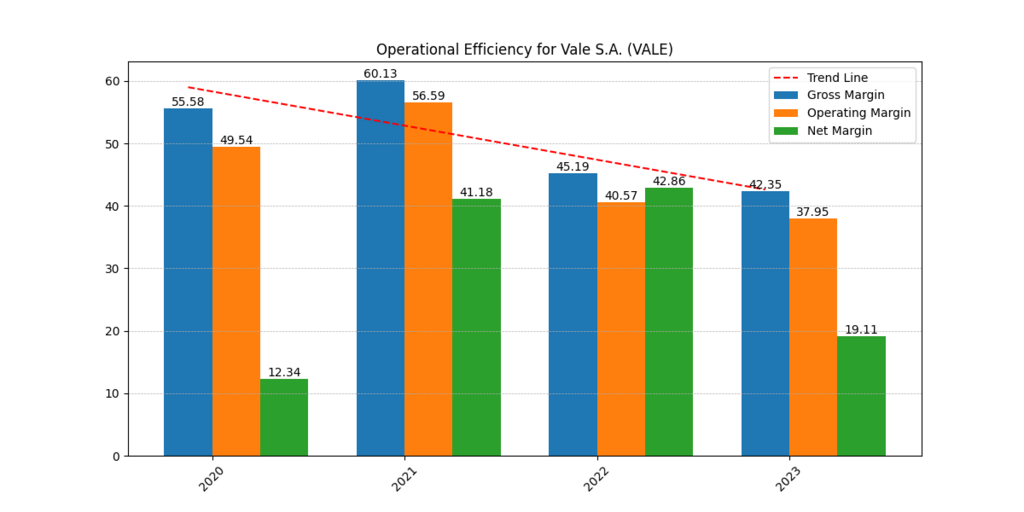

Vale S.A. (VALE) EBITDA and Operational Efficiency

In spite of the uncertainty in the mining business, Vale has been able to maintain favorable financial results. The consistency of the company’s pricing, especially for its primary commodity iron ore, is shown by its robust gross margin. Changing commodity values and manufacturing costs could be the source of a little but significant decline in margins, therefore it’s important to keep an eye on them.

Despite the fact that the company’s yearly income has grown substantially, its performance has recently dropped due to global economic slowdowns and decreased material demand from customers. Strong cash flow allows the organization to maintain liquidity even in tough times. The mining sector follows a cyclical pattern, but Vale stays competitive on a worldwide scale. Investors who are ready to ride out commodity price volatility could benefit from initiatives and market expansion in growing countries.

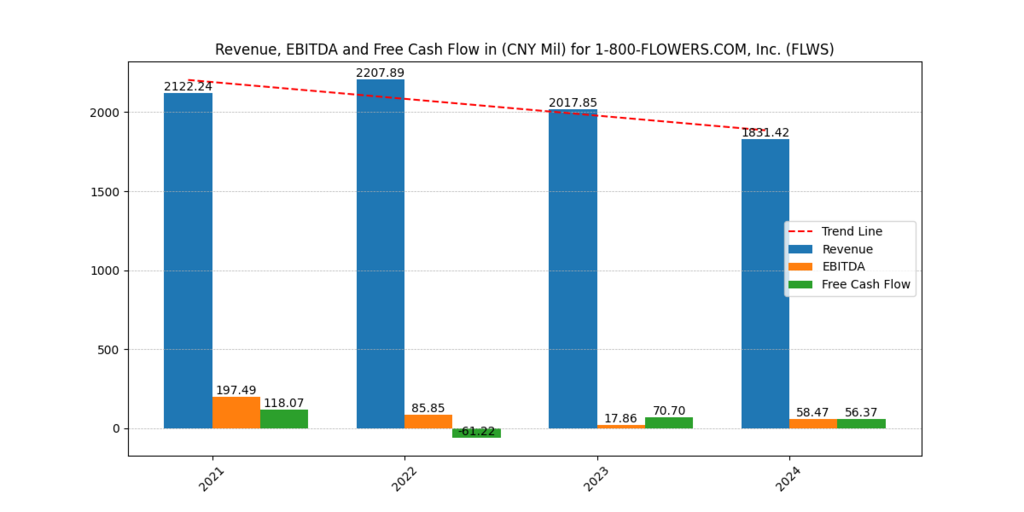

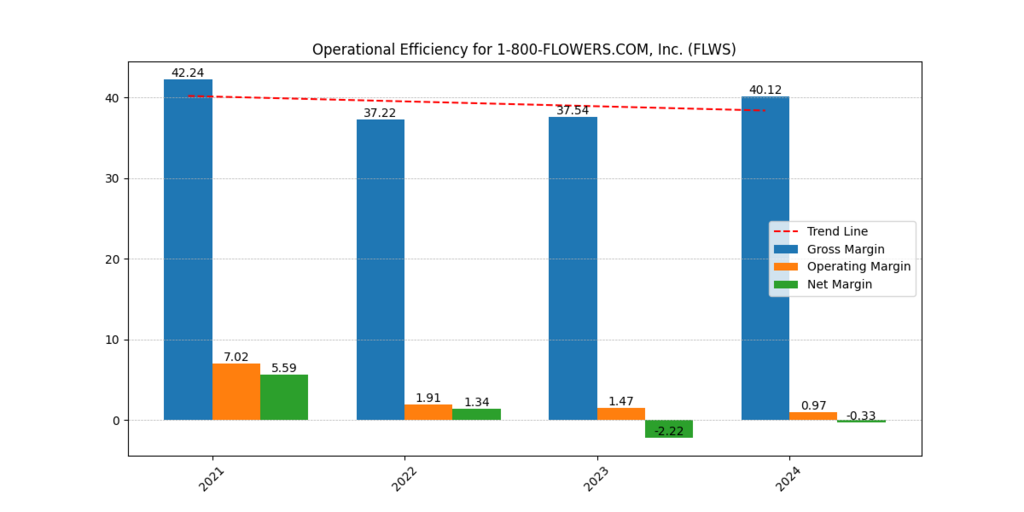

1-800-FLOWERS.COM, Inc. (FLWS) FCF and Operating Margins

Margins are falling and revenues are fluctuating in 1-800-FLOWERS.COM, Inc.’s most current financial condition. The business sector is highly dependent on seasonal operations, which means that earnings figures during non-holiday seasons can be somewhat unpredictable. Greater competition, increasing procurement and logistics costs, and other factors are putting persistent pressure on operating and net margins. The company diversifies its income by acquiring other brands, which allows it to generate more consistent income.

Investors need to stay alert because the company’s cash flow stability remains inconsistent even though its profitability needs monitoring. The business can recoup some of its losses by shifting its consumer strategy to prioritize e-gifting and home delivery. Hey! our another list of best dividend stocks here!

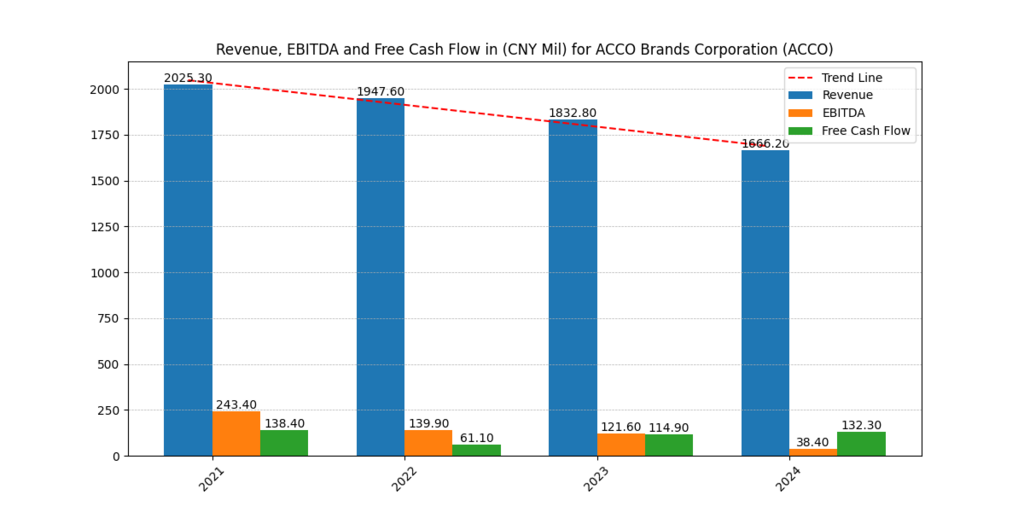

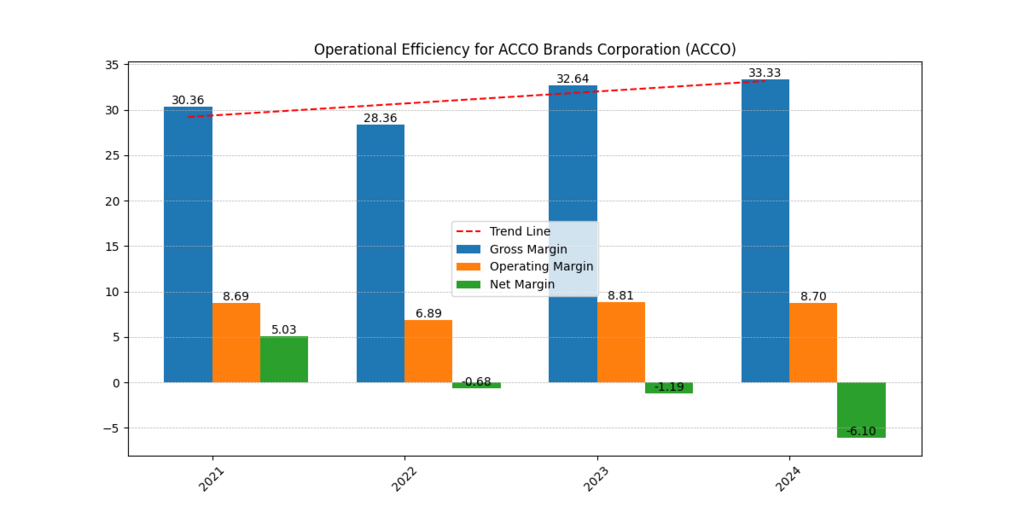

ACCO Brands Corp (ACCO) Financials and Operational Efficiency

Changes in management-operated expenses and market-related variables cause margin swings in ACCO Brands’ financial operations, which indicate marginal changes. Although there have been some minor gains, the company’s gross profit margin is nevertheless under constant pressure from rising input costs.

Operating margin data shows that ACCO Brands’ profitability is falling as a result of the reduction in net margins it experienced in prior years. Company sales have been on the decline as a result of the office supply market’s stagnation and the shift towards digital business models. The consistency of the company’s free cash flow is indicative of its competence in managing its liquidity. As digital trends continue to rise, investors are increasingly focused on ACCO’s ability to innovate and adapt to market developments.

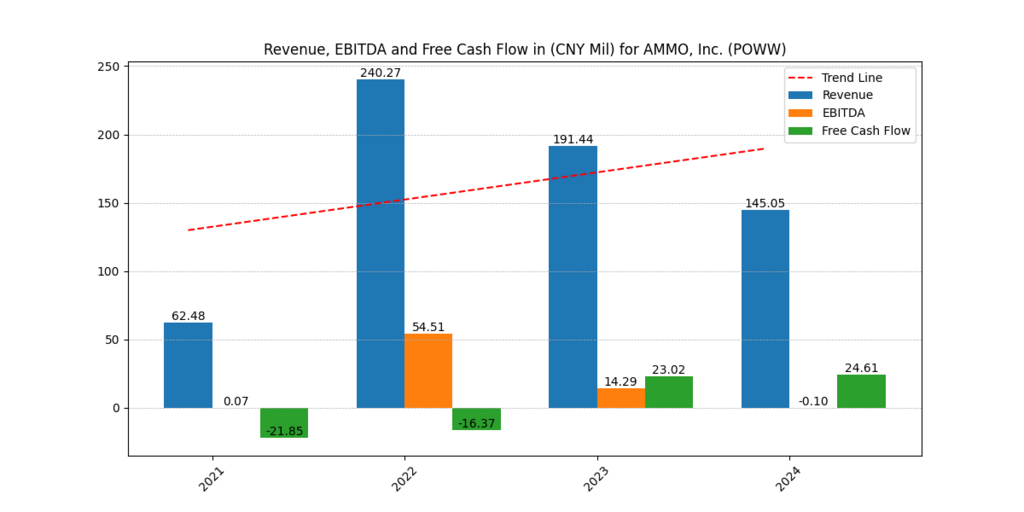

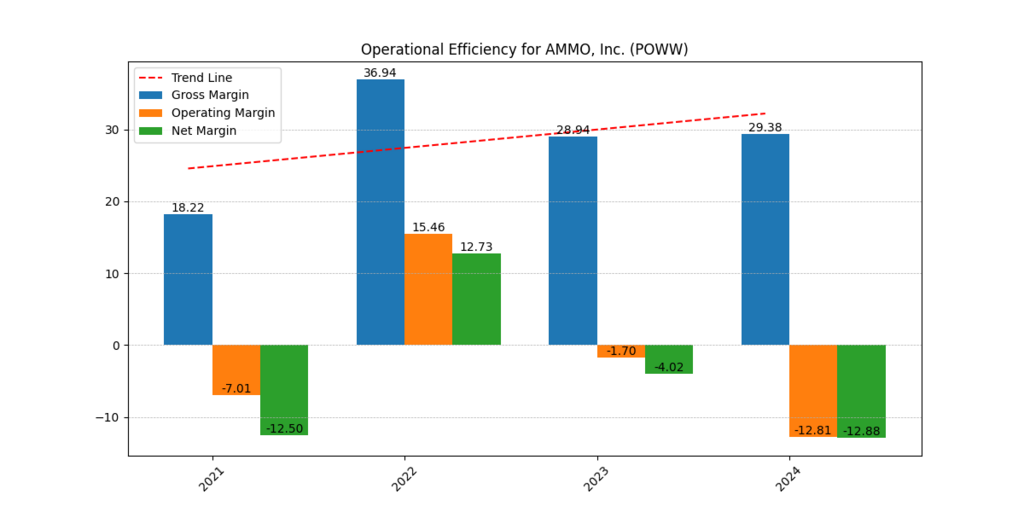

Ammo Inc (POWW) Revenue, EBITDA, FCF and Operational Efficiency

In recent years, Ammo Inc.’s margins have fluctuated due to the industry’s erratic financial performance, which is driven by the firearms and ammunition sector. The company’s net and operating margins have been negative in previous years, which has led to unpredictable financial performance. Due to higher market demand during political eras and outbreaks of societal turmoil, the corporation has seen stronger revenue outcomes.

After recent profitability issues, investors can be interested in the company’s capacity to generate positive free cash flow. There is a high degree of uncertainty associated with investing in the munitions industry because of the large swings in profit and loss that occur as a result of the industry’s strong cyclical patterns. Although Ammo Inc. investors have chances due to exposure to anticipated growth in market demand, they must carefully assess the industry’s high level of market volatility.

Conclusion

Stocks under $10 offer potential for growth and are suitable for investors who accept market risk fluctuations. Nokia, Vale, 1-800-FLOWERS.COM, ACCO Brands, and Ammo Inc each have their own advantages and disadvantages.

Nokia’s telecom position and 5G technology development offer sustained growth opportunities, while Vale’s strong commodity holdings can fulfill global growth needs.

1-800-FLOWERS.COM faces annual sales patterns but could enhance its digital gifting sector.

ACCO Brands’ decreasing market presence presents investment challenges due to free cash flow protection against market instability.

Ammo Inc’s market performance is cyclical and depends on political events and social trends. Investors should thoroughly research each stock and determine their risk thresholds before making purchase decisions.

Correction: In Revenue, EBITDA and FCF Plots the currency is in ($Mil) instead of (CNY Mil).

Disclaimer:

The content provided herein is for informational purposes only and should not be construed as financial, investment, or other professional advice. It does not constitute a recommendation or an offer to buy or sell any financial instruments. The company accepts no responsibility for any loss or damage incurred as a result of reliance on the information provided. We strongly encourage consulting with a qualified financial advisor before making any investment decisions.