In a period of economic uncertainty, people tend to seek refuge in best stocks to buy and hold in consumer defensive sector- those firms that offer goods and services that are non-cyclical, no matter what happens to a market. These companies, including frequent providers of retail, food, and beverage products, as well as household products, are known for their ability to sustain stable revenue, preserve margins, and provide consistent returns even during recessions. They are hence frequently regarded as the best stocks to buy and hold their value over the long term.

The three outstanding defensive consumer companies analyzed here are Walmart Inc. (WMT), Monster Beverage Corporation (MNST), and Procter and Gamble Company (PG). They belong to different parts of the industry, including retail, beverages, and household goods, which will enable a diversified comparative view. When analyzing these three companies, we will examine quarterly and trailing measures, in a graphical trend format, to gain a data-driven understanding of why they are recommended as one of the best stocks to buy and hold in the current market.

Walmart Inc. (WMT): A Pillar of Stability

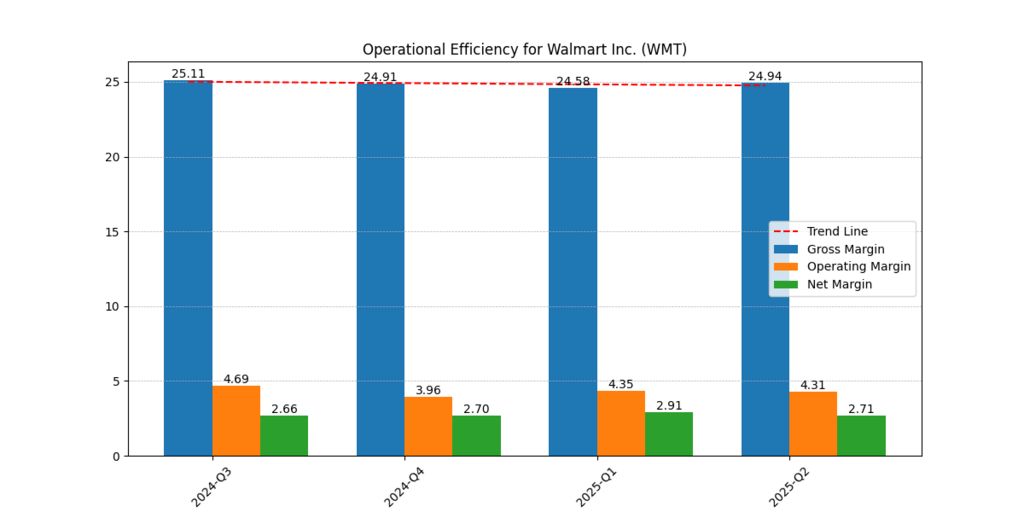

Walmart is the top in terms of stable margins and thus a defensive core of any long-term portfolio. Its gross margin was between 25 and 26 percent over four quarters (Q3, 2024, and Q2, 2025) without significant fluctuations. Its operating margins were kept at about 4-5 percent, whereas the net margins were maintained at 2.6-2.9 percent. This kind of consistency is an indication of cost control and efficiency of operations.

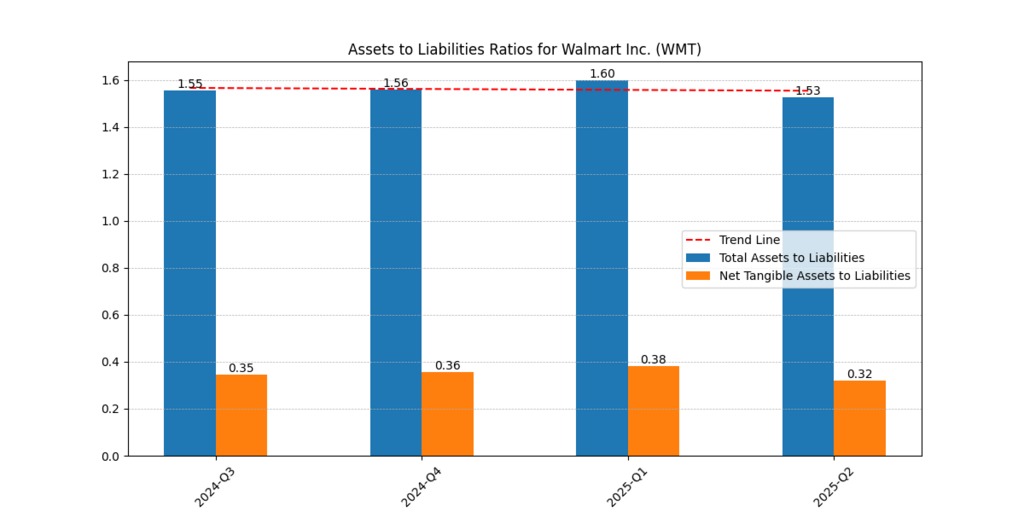

The assets to liabilities ratio stood at 1.49, which equals the company has a healthy financial leverage. The average net tangible assets to liabilities ratio stood at 0.35.

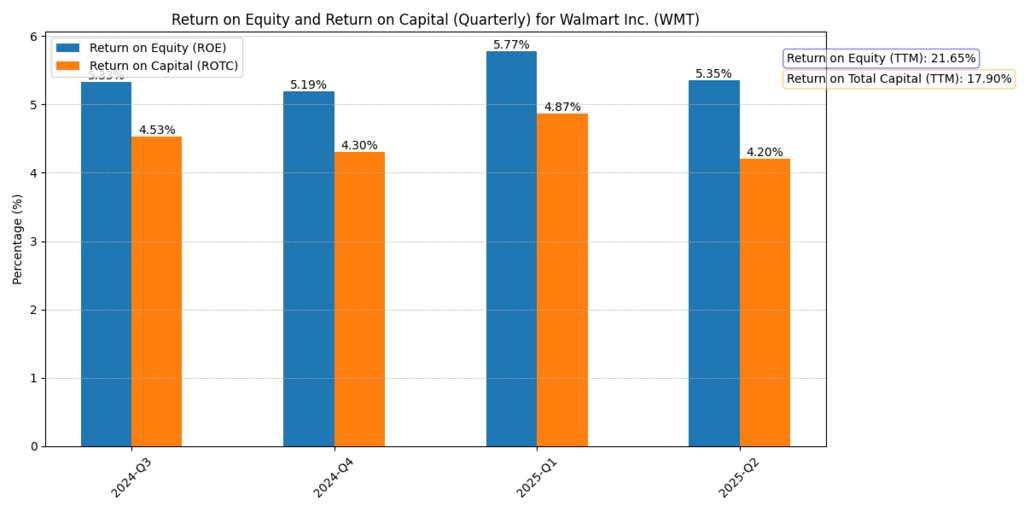

The highest values of Return on Equity (ROE) and Return on Total Capital (ROTC) of Walmart were registered during the first quarter of 2025, and are equal to 5.77% and 4.87% respectively, that is, compared to the previous four quarters, the highest part of Walmart has reported its Return on Equity and Return on Total Capital. These figures cement in its ranks of being one of the finest stocks to own and hold in a conservative portfolio.

Monster Beverage Corporation (MNST): Growth in Motion

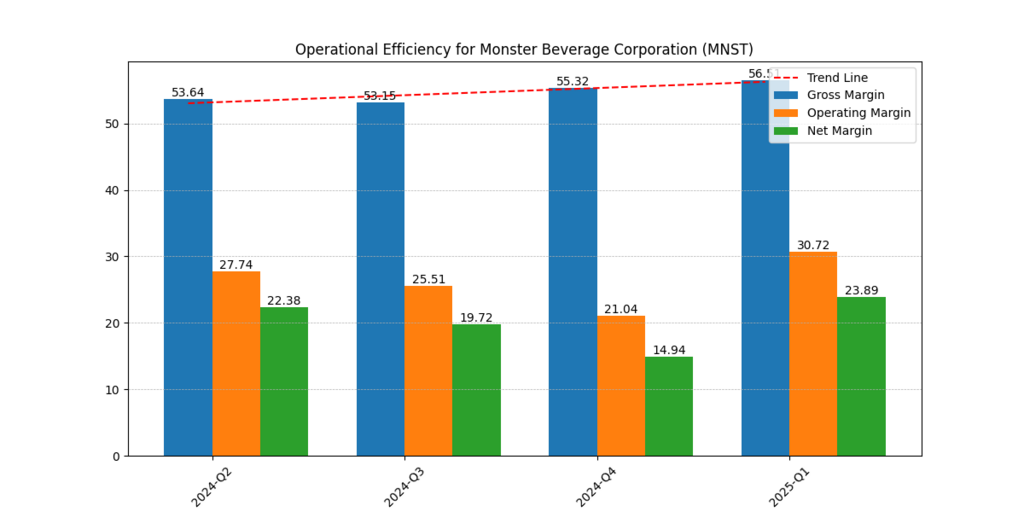

Monster Beverage is a defensive stock favored as a growth company. In the period stretching between Q4 2024 and Q1 2025, its gross margin had grown to 56.51% and operating margin grew to 30.72%. Robust profitability growth is also evidenced by the net margin that jumped to 23.89% in Q1 2025.

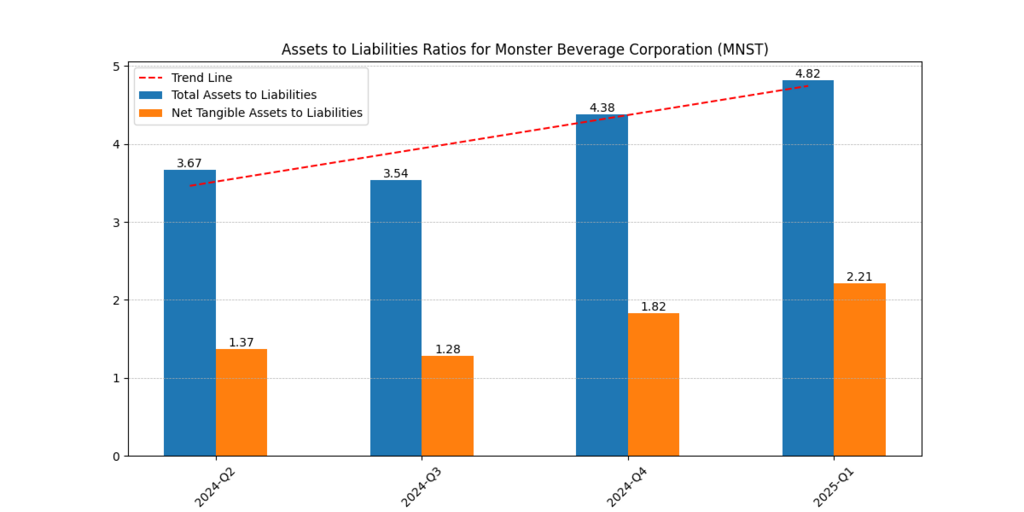

Its four-quarterly increase by the assets-to-liabilities ratio amounted to 0.34 (13 percent), and the net tangible assets to liabilities ratio improved almost twofold to 2.21. Such measures indicate a healthy and increasingly healthy balance sheet.

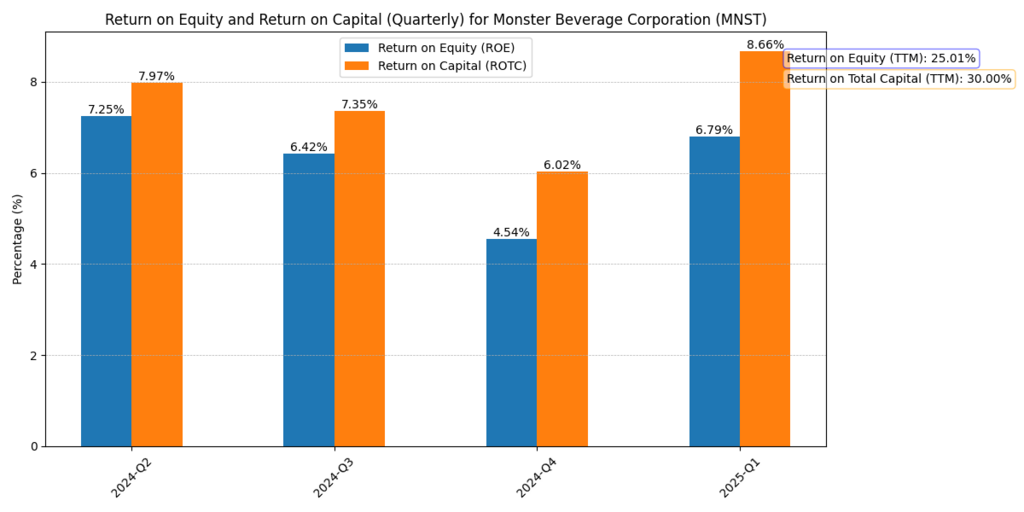

Though the quarterly ROE touched 4.54 percent in Q4 2024, it rose to 6.79 percent in Q1 2025. ROTC is 30.00% and TTM ROE under 25.01%, which is the highest among the three. There is no confusion that Monster is one of the best stocks to purchase and have in a growth-based portfolio.

Procter & Gamble (PG): Balanced Value and Strength

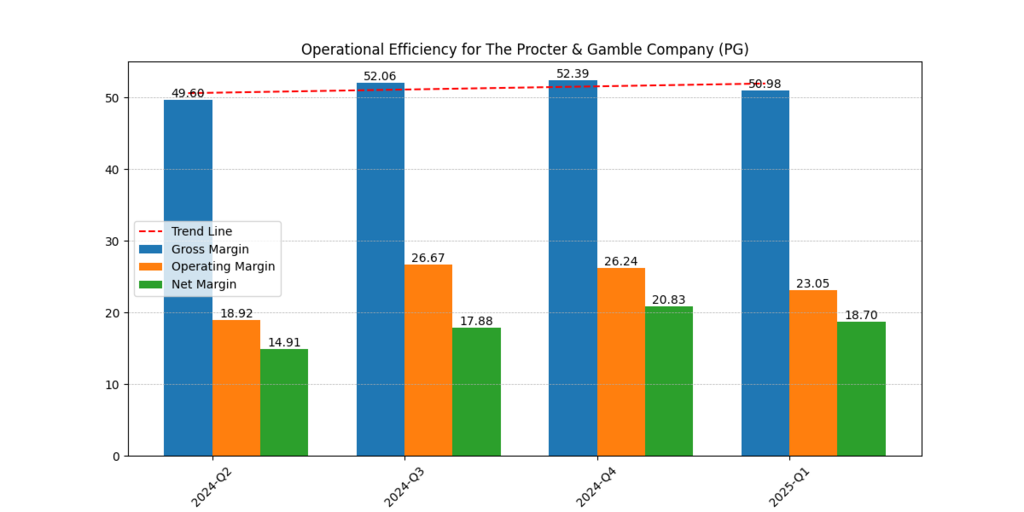

Procter & Gamble offers brand-powered stability, combined with decent margins. The gross margin increased to 50.98% and the operating margin was between 18.9-26.7. Continuing to the Q4 of 2024, the net margins increased to 20.83%. Then, in Q1 of 2025, the net margins decreased marginally to 18.70%. Don’t miss out on our The 3 Best AI Stocks to Buy Right Now article!

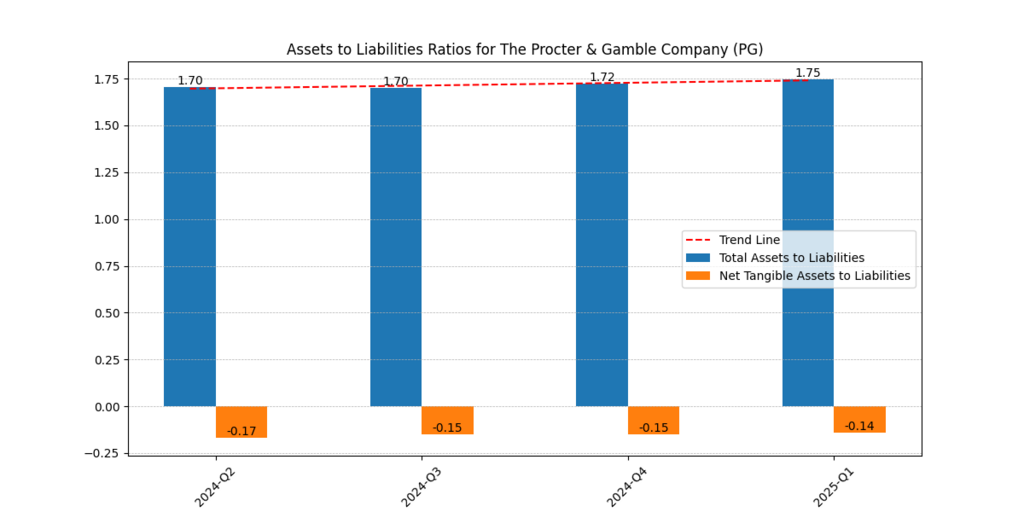

Its assets-to-liabilities ratio has been close to 1.70-1.75 but net tangible assets is negative and implies that there is high intangible assets as a result of brand equity and goodwill.

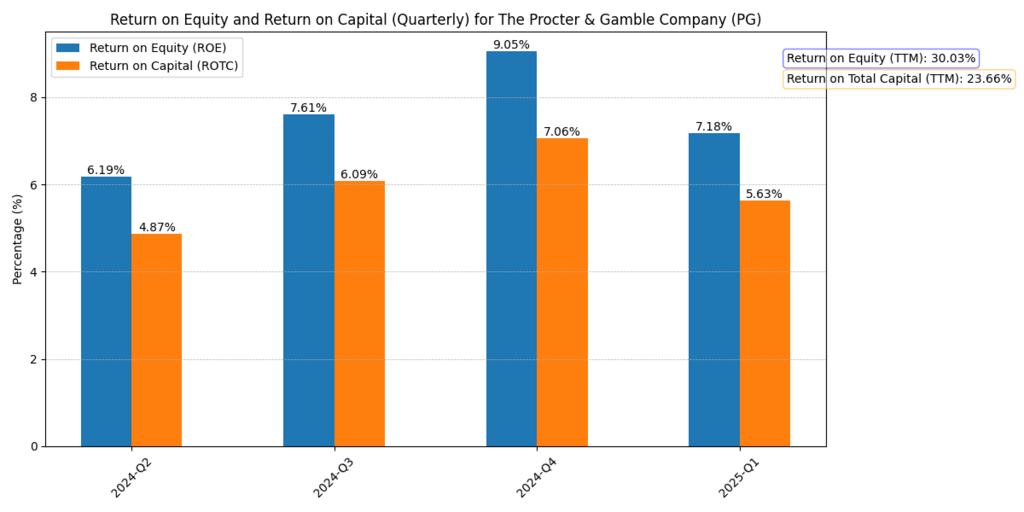

In Oct 2024, quarterly ROE was at 9.05% and TTM ROE was at 30.03% and ROTC was at 23.66% of PG. These strong numbers put it in the category of the best stocks to buy and hold, particularly where a balance between growth and stability is sought.

Conclusion

To conclude, in terms of buy and hold, the top stocks based on margin performance and long-term fundamentals, Walmart (WMT) tops the ranking due to stability, Monster Beverage (MNST) shines by growth in margins, and Procter & Gamble (PG) is a combination of value and power. All three should be considered to make a robust consumer defensive portfolio by a diversified consumer investor under unclear market conditions.

The supply chain and pricing power of Walmart are the factors that explain predictable gross margin performance (Morningstar, 2025). Though burdened by the effects of inflation, Walmart has remained operationally efficient; a factor it has attributed to scale and investment in technologies that automate its operations (Reuters, 2025). These attributes are what make Walmart a favorite stock to own and to hold in times when the market becomes volatile.

The rocketing margins of Monster Beverage indicate the looming improvements of profitability; however, it also implies the power of price and the advancements in the product line. (Nasdaq 2025) stated that the firm is also increasing its presence in other nations, especially in emerging economies, where the demand for energy drinks is gaining traction. Its low debt as well makes it more of a long-term growth stock among the best stocks to buy and hold.

Its large iconic brand portfolio and cost-saving measures drive Procter & Gamble to have a high ROE and sound operational margins (Bloomberg, 2025). Even though it is heavy on intangible assets, its stable cash flows and dividend history assure income investors. PG is a traditional consumer defensive option between growth and risk avoidance.

Disclaimer

The content provided herein is for informational purposes only and should not be construed as financial, investment, or other professional advice. It does not constitute a recommendation or an offer to buy or sell any financial instruments. The company accepts no responsibility for any loss or damage incurred as a result of reliance on the information provided. We strongly encourage consulting with a qualified financial advisor before making any investment decisions.