Best stocks to invest in right now based on value investing analysis, the fundamental reasoning behind the approach is to seek out companies where the intrinsic value is substantially higher than the market price. Frequently, these are stocks whose market prices are incorrect because of short-term headwinds, cyclical declines or an inability to recognize future growth potential – particularly in the instance where their conventional valuation measures fail to reflect the true worth that is being produced such as price-to-earnings (P/E) ratios or earnings per share (EPS).

In the place of accounting profits, savvy investors are relying more and more on Residual Earnings (sometimes called Value Added Earnings), the amount of money a business takes in after charging the cost of capital.

Besides, Return on Equity (ROE) is a vital measure of the effective reinvestment of a company’s assets to yield returns, especially when ROE is sustainably above the cost of equity of the firm. To take the valuation even further still, the Unlevered Market Implied Growth Rates remove the impact of debt and isolate the core operational growth.

This article uses such forward-looking, intrinsic-value methodology to three companies misunderstood or underrated by the market at the moment: Occidental Petroleum Corporation (OXY), a conventional energy company with a new efficiency; BYD Company Limited (BYDDF), an electric vehicle and battery leader with explosive profit potential globally; and Alphabet Inc. (GOOGL), a tech powerhouse that is nonetheless undervalued when analyzed in terms of creating residual value. All these firms have a convincing, compelling argument to land on any indicator of the best stocks to invest in in terms of value-added earnings, projected residual earnings growth, and ratio of unlevered growth rates, which makes the firms a good candidate/elevate value-oriented portfolios in 2025 and beyond.

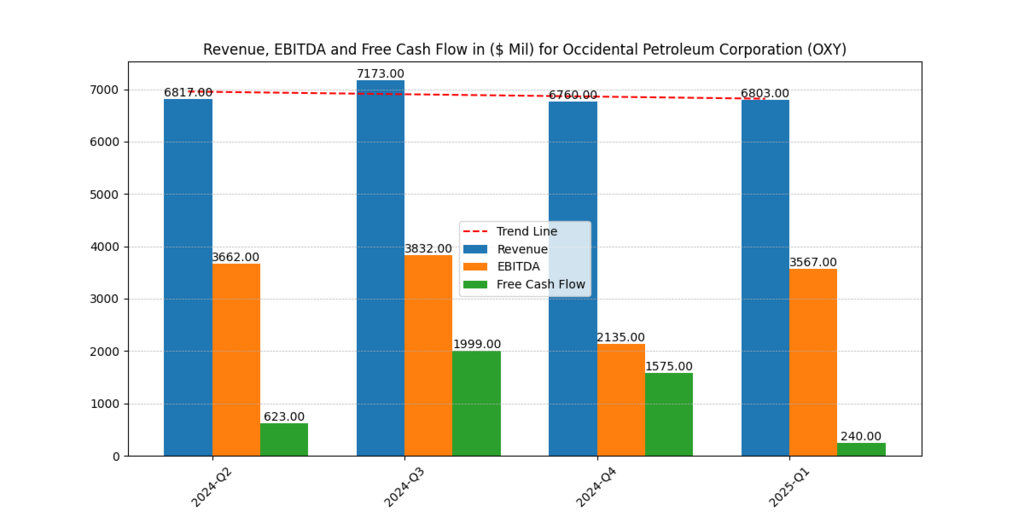

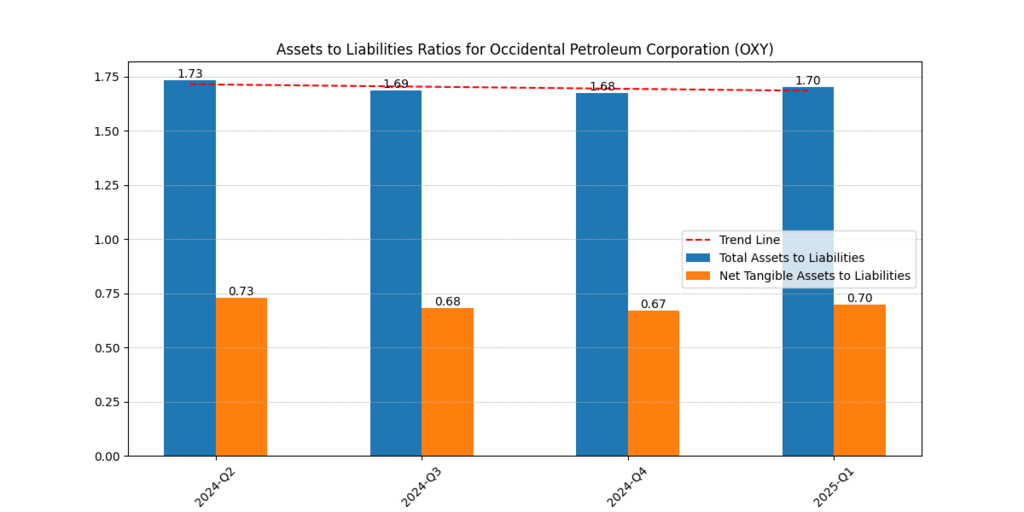

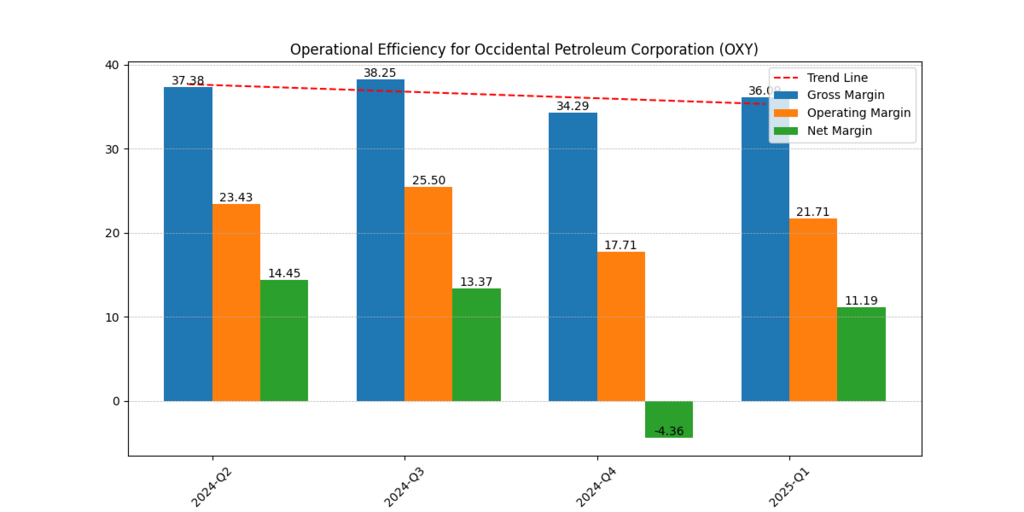

Occidental Petroleum Corporation (OXY)

Occidental, a so-called traditional energy play, becomes a deep value stock when more deeply scrutinized in the financial sense. its ROE rose to 9.23 percent in 2025, which is likely to increase further to 11.16 percent in 2026, meaning that its operations will improve and increase its returns (Morningstar, 2025). More to the point, residual earnings that take into consideration the cost of capital (hurdle rate: 8%) indicate a leap of 0.32 percent in 2025 to 0.85 percent in 2026. This is matched by an incredible residual earnings growth rate of 162.14% and is certainly one of the best stocks to invest in when you are a value investor (Damodaran, 2023).

BYD Company Limited (BYDDF)

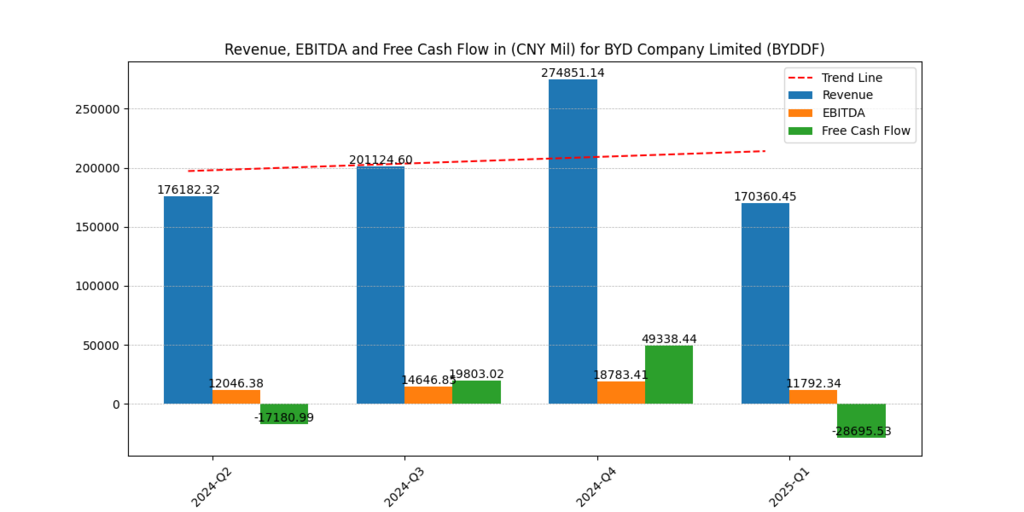

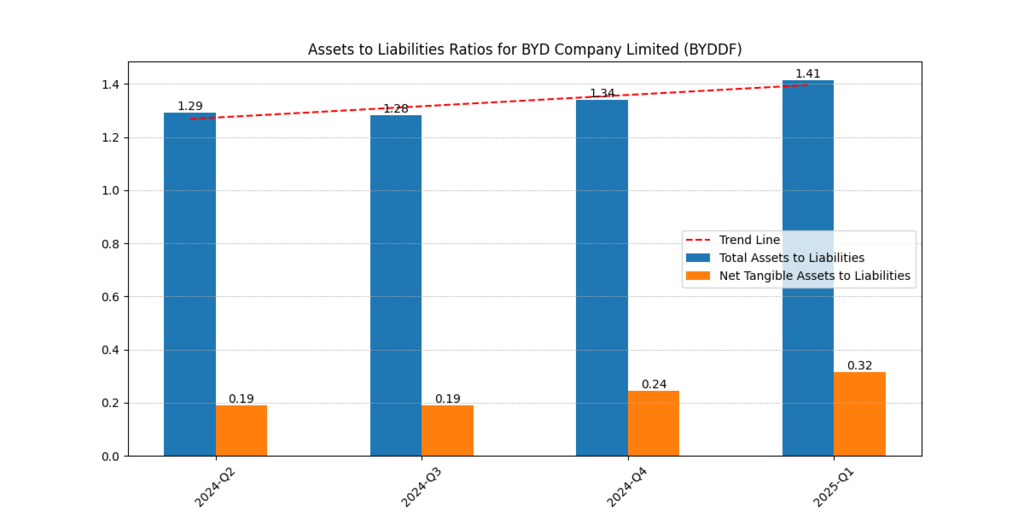

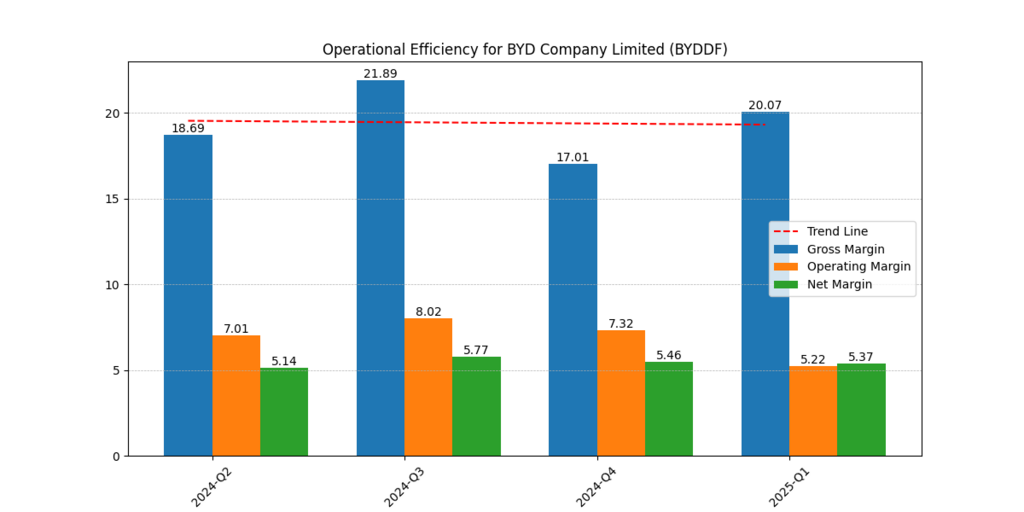

A Chinese battery and electric vehicle manufacturing giant, BYDDF, is perhaps the most underappreciated company by global investors because of the current geopolitical issues and regulatory risk caused by China. Nevertheless, BYDDF has outstanding financial performance, despite these external concerns. It is estimated to have a Return on Equity (ROE) of 40.51 percent in 2025 and 39.76 percent in 2026, a sign of effective and normal shareholder capital deployment (Morningstar, 2025).

More persuasive is the residual earnings of the company, which go up by 5.43 to 7.04 percent in the years 2025 and 2026, representing a growth rate of 29.56 percent. This increase is especially remarkable because it far surpasses the BYDDF 6% minimum hurdle rate and shows that the company is creating a great deal of value over and above the cost of capital (Damodaran, 2023).

To further buttress the investment case of BYDDF is the fact that its unlevered market implied growth is at 31.07%, a good sign that the market is underestimating the growth of this company once all debts are removed (Yahoo Finance, 2025).

Alphabet Inc. (GOOGL)

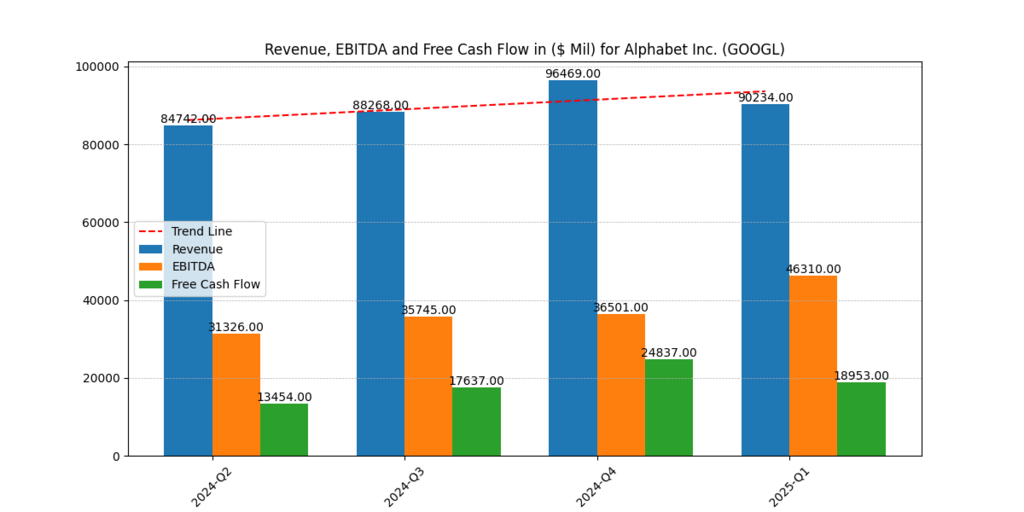

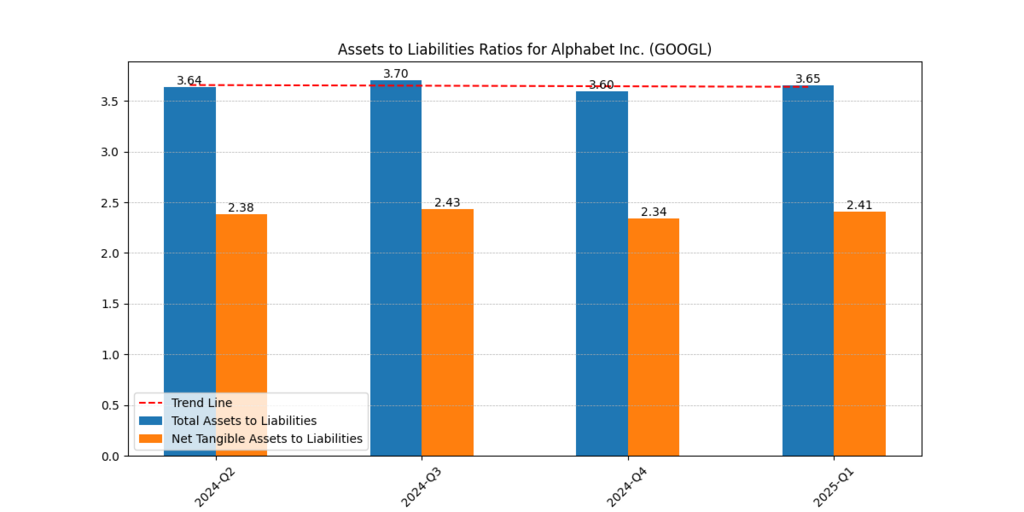

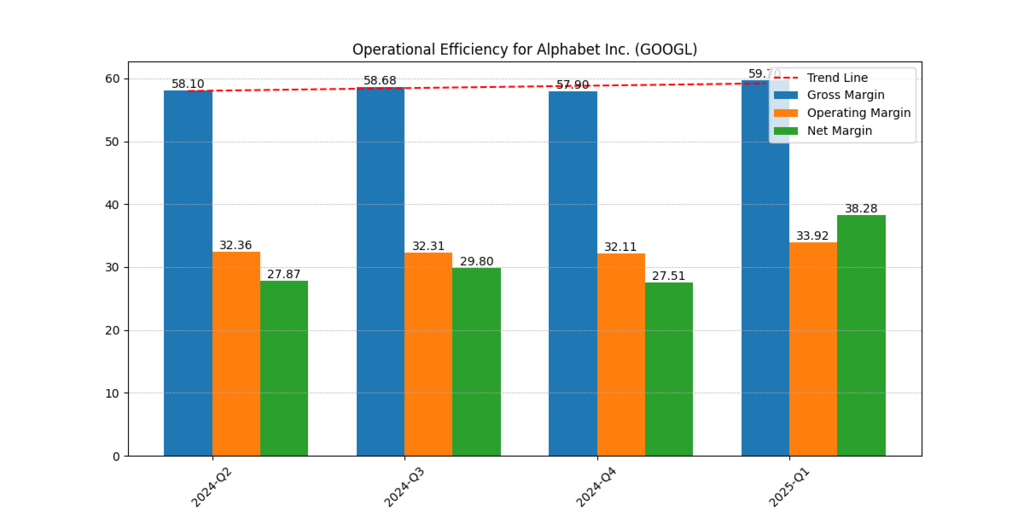

Alphabet might be an unusual entry in a value-oriented list given its mega-cap growth in market cap, but the metrics do not lie. Alphabet also has an impressive capital efficiency with a 2025 ROE of 39.84 percent and a virtually identical 2026 ROE of 39.57 percent. More so, its residual earnings have projected a figure of 7.19 percent in 2025 and 7.61 percent in 2026, indicating that it is already a value-creating machine with residual earnings covering its 10 percent cost of capital (Damodaran, 2023). Our 3 Best Consumer Defensive Stocks to Buy and Hold!

About Alphabet, specifically, what is especially attractive is its unlevered growth rate of 39.85%. It means that the company investors might be undervaluing its potential value in monetization of AI, cloud, and fresh digital eco-systems in the long run (Financial Times, 2025). These future-oriented building blocks disrupt the view of GOOGL as a stock that is overvalued, but rather demonstrate that it is one of the best stocks to invest in with a strong and compound dividend in the long term.

Comparative Table: Key Metrics Snapshot

| Company | 2025 ROE Estimate (%) | 2026 ROE Estimate (%) | Residual Earnings 2025 (%) | Residual Earnings 2026 (%) | Residual Earnings Growth (%) | Unlevered Growth Rate (%) |

| OXY | 9.23 | 11.16 | 0.32 | 0.85 | 162.14 | 4.14 |

| BYDDF | 40.51 | 39.76 | 5.43 | 7.04 | 29.56 | 31.07 |

| GOOGL | 39.84 | 39.57 | 7.19 | 7.61 | 5.84 | 39.85 |

Conclusion

Conclusively, all three companies are capable of providing value investment opportunities and not necessarily rationalized by low prices, but rather based on the disengagement between the market-implied growth measures and the reality of the intrinsic growth measures. Occidental Petroleum is conventional under valuation with huge growth potential through energy cycles. BYDDF is a poorly perceived global EV leader with robust residual growth and palpable financial support. When viewed through the prism of residual earnings and unlevered growth, Alphabet, the so-called growth behemoth, has unrealized potential.

Disclaimer

The content provided herein is for informational purposes only and should not be construed as financial, investment, or other professional advice. It does not constitute a recommendation or an offer to buy or sell any financial instruments. The company accepts no responsibility for any loss or damage incurred as a result of reliance on the information provided. We strongly encourage consulting with a qualified financial advisor before making any investment decisions.