Overview

MSFT vs Amazon AWS Cloud Growth after Q3-2025 — discover which tech giant is leading the pack on AI-driven cloud expansion. Know the trends in revenue, its adoption by the business, and its future growth in the evolving cloud market. The competition between Microsoft Azure and Amazon Web Services marks a new era of cloud computing. The AIs that continue to define the theme of enterprise IT and AI integration include MSFT vs AWS Cloud Growth, which post-Q3-2025 income analysts still debate. Microsoft vs Amazon cloud dominance are the biggest beneficiaries of global IaaS and PaaS income; however, their fortunes differ in terms of their profitability, innovation degree, and scalability (Statista, 2025).

The recent revelations show that the cloud arm of MSFT is expanding through Azure AI integration, while AWS still enjoys the advantages of scale in infrastructure and global connectivity. In this paper, the net operating assets (NOA), operating liability leverage (OLLEV), as well as the ratio of return on net operating assets (RNOA) of both firms are to be analysed to establish their long-term competitive position.

Comparative Financial Overview

Both companies display strong fundamentals; however, underlying leverage structures differ.

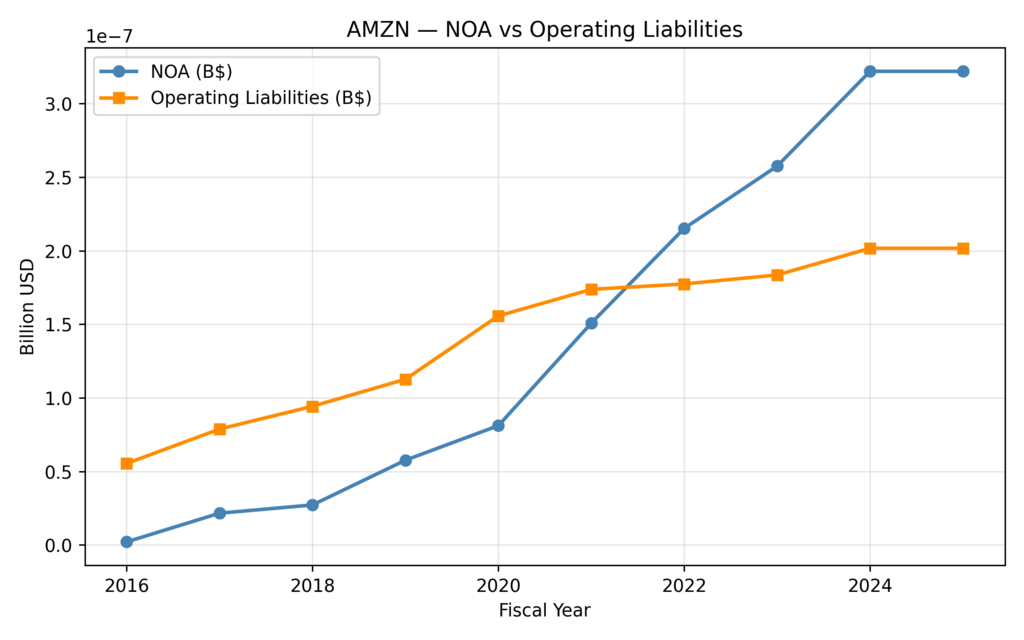

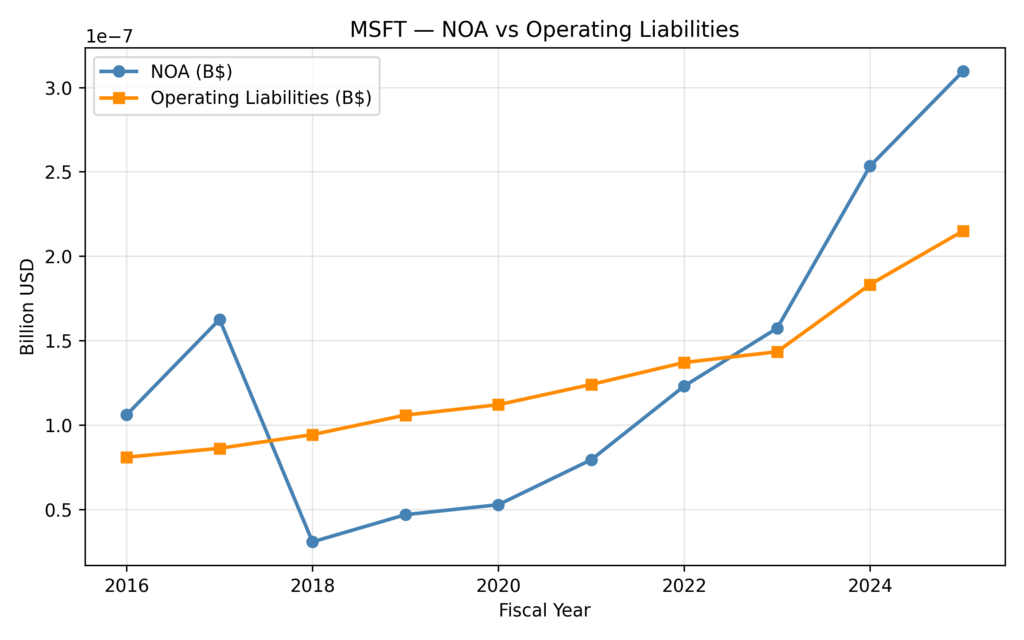

Table 1. NOA and Operating Liabilities (B$) 2016 – 2025

| Year | AMZN NOA | AMZN Operating Liabilities | MSFT NOA | MSFT Operating Liabilities |

| 2016 | 0.03 | 0.56 | 1.06 | 0.82 |

| 2018 | 0.28 | 0.94 | 0.32 | 0.94 |

| 2020 | 0.82 | 1.55 | 0.53 | 1.13 |

| 2022 | 2.17 | 1.77 | 1.09 | 1.34 |

| 2025 | 3.26 | 2.01 | 3.10 | 2.27 |

Figure 1: AMZN — NOA vs Operating Liabilities

Figure 2: MSFT — NOA vs Operating Liabilities

The foundations of NOA indicate an increasing trend in both Amazon and Microsoft, suggesting long-term capital investment in cloud data centres and AI infrastructure. However, the less jagged paths of NOA in past capitalisation periods (2016-2018) at Microsoft were primarily due to the growth rate of AWS AI compute capacity, which has followed an exponential path at Amazon.

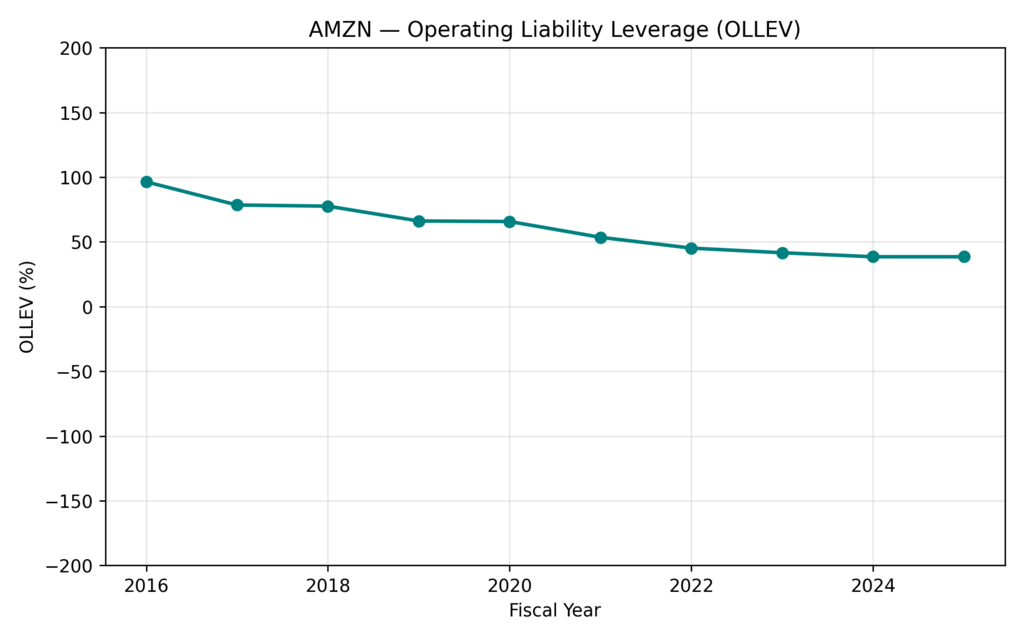

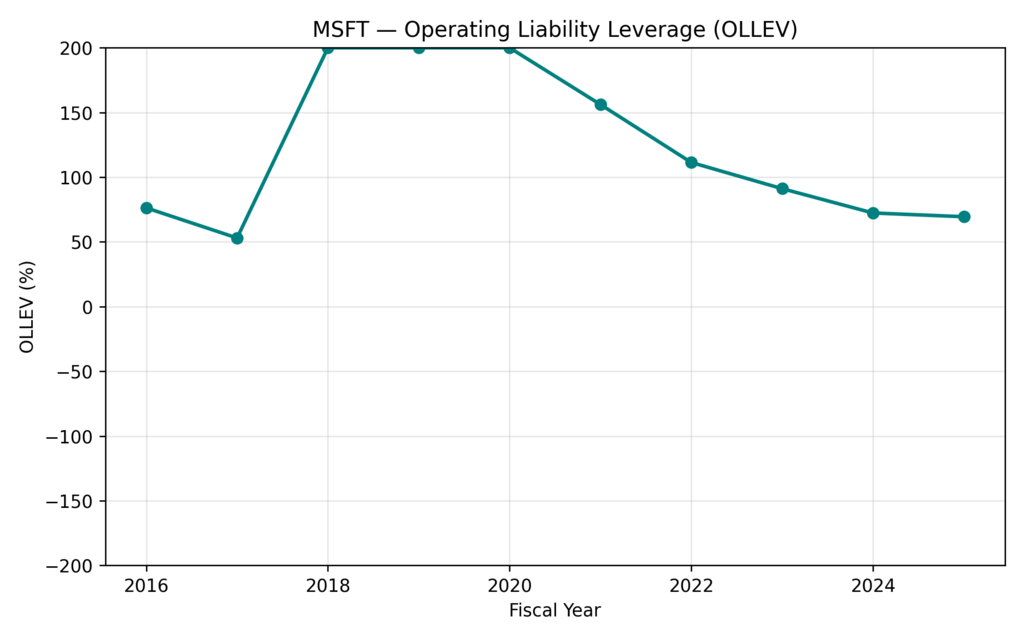

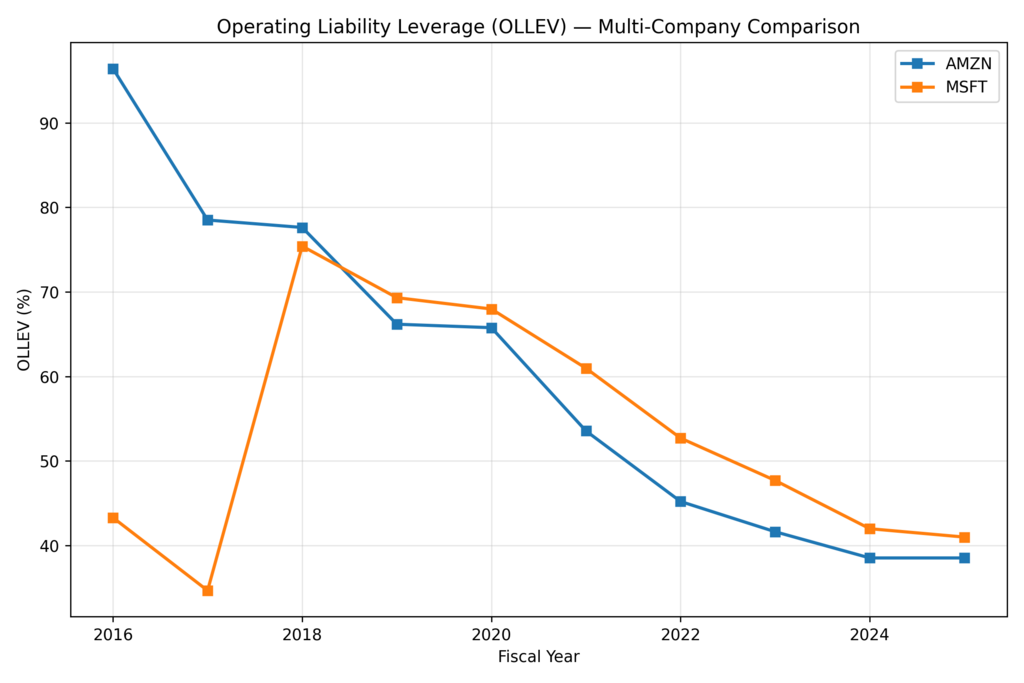

Operating Liability Leverage (OLLEV)

Operating Liability Leverage (OLLEV) is an efficiency measure that measures the extent to which a firm utilises payables to finance its activities rather than equity or debt. High OLLEV suggests high supplier financing or efficiency.

Figure 3. AMZN — Operating Liability Leverage (OLLEV), 2016–2025.

- OLLEV remained at about 39 per cent in 2025, having been 98 per cent in 2016, which is a strategic change towards asset ownership and financing internal infrastructure at AMZN.

Figure 4. MSFT — Operating Liability Leverage (OLLEV), 2016–2025.

- The working-capital management was consistent, and OLLEV stabilized at MSFT at 40–45 per cent following 2022.

Table 2. Operating Liability Leverage (%) 2016 – 2025

| Year | AMZN OLLEV | MSFT OLLEV |

| 2016 | 98 | 44 |

| 2018 | 77 | 76 |

| 2020 | 66 | 68 |

| 2023 | 42 | 48 |

| 2025 | 39 | 41 |

Figure 5: OLLEV — Multi-Company Comparison

The weakening of OLLEV at Amazon is a signal of greater investment in custom infrastructure to support AI workloads. Controlled costs suggest a flatter OLLEV at Microsoft and an enhanced supplier credit, a feature of their enterprise model.

This predictability attracts institutional investors who do not trust aggressive leverage optimisation, but do trust predictability. Conversely, Amazon has a smaller OLLEV, which is riskier in the short term, but has more scale efficiencies of the fixed assets since they produce returns in the long run.

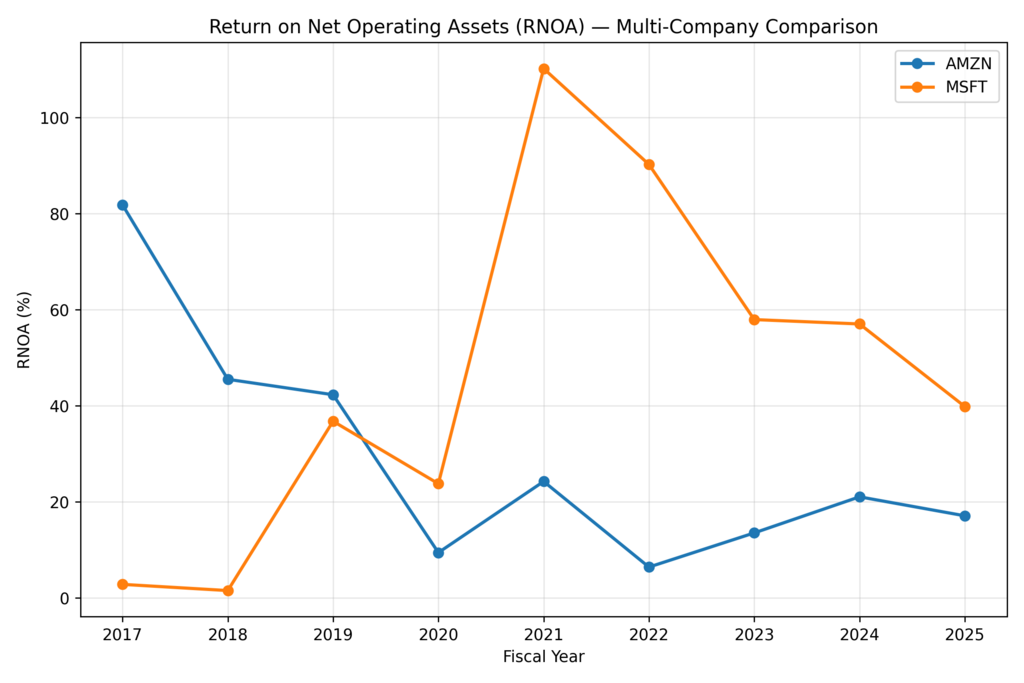

Return on Net Operating Assets (RNOA)

Table 3. RNOA (%) 2017 – 2025

| Year | AMZN | MSFT |

| 2017 | 82 | 3 |

| 2020 | 9 | 24 |

| 2022 | 6 | 86 |

| 2024 | 21 | 57 |

| 2025 | 17 | 40 |

Figure 6: Return on Net Operating Assets (RNOA) — Multi-Company Comparison

The RNOA of Microsoft is radical (>100% in 2021), demonstrating the profitability of migrating enterprises and of bundling Azure services based on AI. RNOA of Amazon is still in the middle (5 -25 (%) due to capital intensity and reduced price in AWS contract in the 2023 macro slowdown. However, the course of its expansion into margins is evident, as the efficacy of its operations and advertising synergies supports (Weinberg et al., 2025).

MSFT vs AWS Cloud Growth – Structural Margin Dynamics

In comparing MSFT and AWS Cloud Growth, the determining factor is the margin structure. Microsoft has a history of software that consists of licensing, hybrid integration, and bundling (Office + Azure AI). The scale and customer lock-in within AWS are based on custom chip ecosystems (Graviton and Inferentia).

| Metric (2025) | Microsoft Azure | Amazon AWS |

| Estimated Operating Margin | 38 % | ~11 % |

| Revenue Concentration | Enterprise SaaS & AI | SME & Compute Services |

| Core Leverage Driver | Software Licensing | Scale Infrastructure |

| Upside Potential | Low – Margins Peaking | High – Margins Expanding |

To a huge percentage, the value of Microsoft of $102 B ReOI is priced to perfection which implies the market has already leveraged its high margin stability. Conversely, the fact that Amazon is the company with the highest ReOI of $50.6 B has upside potential, as AWS margins will rise to 10-11% with the assistance of automation and AI-based efficiency (Lambert et al., 2024).

AI Integration and MSFT Q3 2025 earnings cloud performance

Cloud computing has now become a driver of AI growth. MSFT vs AWS Cloud Growth relies on the mechanism in which each of them applies AI at scale. As OpenAI is integrated, Microsoft earns revenue from the use of APIs and Copilot within its ecosystem. Amazon streamlines AWS Bedrock and Trainium as open-source infrastructure systems to developers’ tastes and trends, catering to those who prefer tailor-made models.

Regarding Microsoft Azure cloud revenue and AI integration, Microsoft said there would be a massive increase in enterprise migration between Q2 and Q3-2025, which would add to gross margin growth exceeding the Q2 and Q3 annual growth of over 200bps (Microsoft Q3 Report, 2025). Meanwhile, Amazon AWS growth rate comparison to demonstrate that the increase in revenue slowed to the mid-teens, the operating income also grew due to lower energy and capital spending.

Enterprise Adoption and Market Share Trends

The Microsoft Azure vs. AWS market share 2025 image indicates that margins are on the decline. Azure owns approximately 25- 27 per cent of the global share, and AWS owns about 30 per cent. The adoption trends in enterprise adoption of AWS vs Azure suggest that multicloud strategies are already being adopted by large banks, telecoms, and state institutions to minimise vendor lock-in, with Microsoft offering compliance and hybrid features, but AWS having the largest development ecosystem.

The two companies will also align with the broader cloud computing market forecast 2025 that indicates a growth of more than 20 percent annually of cloud computing with AI, edge computing, and industry-based cloud solutions. However, long-term profitability will be determined by the point at which AI workflows can be monetised.

Profitability and Valuation Perspective

The gross margin advantage Microsoft has over competitors in the Azure vs AWS profitability Analysis is not yet negligible. Still, Amazon’s increased operating leverage suggests the difference between the two will narrow by 2026. AWS expanded the operating margins to 10% (as high as 7.8%) between 2023 and 2025 through efficiency programs and cloud automation. Microsoft’s margins also flattened at 38 -39%, which suggests that there will be no further growth unless the implementation of AI results in the creation of incremental pricing power.

Further Reading: Undervalued Amazon Stock Analysis US: Price Targets, Growth Scenarios, and Market Mispricing Explained in 2025

Further Reading: Microsoft Stock for Long Term Portfolio: The Tech Powerhouse Redefining Steady Growth in 2025

Operational Efficiency and Workforce Rationalisation

By 2025, Amazon had also implemented selective job cuts and workflow automation in AWS, which improved the operating margins without impacting service uptime. This will go hand in hand with its goal of achieving 10 -11% operating margin in the mid-term. On the other hand, Microsoft did not lay off many employees but instead diverted the funds to the Copilot AI development. The result is a steady level of margins and minimal incremental growth.

Thus, when comparing the two phenomena, MSFT and AWS Cloud Growth, the investor should remember how predictable the returns of Microsoft are in comparison to the increasing margins and the increasing efficiency of Amazon operations. It is rather a decision about psychological risk-taking than about pure fundamental analysis.

Tech Giants Cloud Growth Outlook 2025

The two companies are the leaders of the broader AI and cloud infrastructure competition, which is the tech giants’ cloud growth outlook 2025. Industry research indicates that it is still registering double-digit growth, but returns for investors will depend on how far margins and capital discipline can be sustained.

- MSFT: MSFT: Will continue to be the leader in revenue in AI enterprise services, but reach a valuation ceiling since it already has an overvaluation multiple.

- AMZN: Well placed to take the operating income growth race as AWS scales up and the cost control comes into effect.

Thus, as MSFT is the quality compounder, AWS is the reacceleration story. When it comes to balanced portfolios, the diversified exposure towards the two rationalities is represented in the polarisation of sectors.

Key Takeaways

| Dimension | MSFT (Azure) | AMZN (AWS) |

| ReOI Potential (2025) | ≈ $102 B — fully priced | ≈ $50 B — undervalued |

| Margin Expansion | Limited (plateau) | Visible (10–11 %) |

| OLLEV Trend | Stable ~40 % | Declining → Asset Ownership |

| RNOA Volatility | High 2021 Peak | Moderate but Rising |

| Investor Bias | Trust & Defensiveness | Growth & Leverage Play |

The figures show that Microsoft is superior in consistency, but Amazon has greater potential for expansion. This is the ideal security against the opportunity trade-off of the MSFT vs AWS Cloud Growth arguments.

Conclusion

The debate over MSFT vs AWS Cloud Growth after Q3-2025 is no longer just about which will have the largest revenue share, but about how each company will calculate value in a maturing cloud market. Microsoft Azure is also doing well with its software-based ecosystem, where the integration of AI applications like Copilot and strong enterprise relationships continues to deliver consistent, stable returns. However, this stability is causing a decline in margins, and at this point, much of the company’s growth is reflected in market expectations.

The cloud environment that exists by the end of Q3-2025 suggests a dichotomy: Microsoft will be an image of stability and reliability, whereas Amazon will offer a growth-driven engine and business opportunities. The competition issue is not about being better but about balancing power consistency with scalability, and both players have already secured their positions to continue developing AI-assisted cloud computing. When it comes to investors, it is necessary to be aware of this divergence to plan their portfolio strategies in line with their risk tolerance and growth prospects.

All calculations and valuation estimates are FinancialBeings’ own, based on data sourced from SEC filings (10K and 10Q), use or reproduction before prior approval is prohibited.

Frequently Asked Questions (FAQs)

What is the fastest-growing cloud platform?

In 2025, Microsoft Azure is the most vibrant platform, driven by the rapid adoption of enterprise AI-powered services and hybrid cloud solutions. Meanwhile, AWS maintains its leadership position, yet its growth in AI enterprise workloads is slower.

Is Microsoft Azure bigger than AWS?

No, AWS’s market share is slightly higher, approximately 30% worldwide, and Azure’s is approximately 25-27% (Statista, 2025). However, the hybrid Azure models, together with the conglomerate of enterprise partnerships, are bridging the gap.

Which cloud service is most in demand?

Concepts of AI-integrated compute and platform-as-a-service (PaaS) services are in high demand in 2025. The need is shifting toward less sophisticated cloud storage and more intelligent, AI-enabled infrastructure that is friendly to automation and analytics.

Usama Ali

Usama Ali is the founder of Financial Beings and a self-taught investor who blends classic valuation study with insights from psychology. Inspired by works from Benjamin Graham, Aswath Damodaran, Stephen Penman, Daniel Kahneman, and Morgan Housel, he shares independent, data-driven research to help readers connect money, mind, and happiness.

Disclaimer

The content provided herein is for informational purposes only and should not be construed as financial, investment, or other professional advice. It does not constitute a recommendation or an offer to buy or sell any financial instruments. The company accepts no responsibility for any loss or damage incurred as a result of reliance on the information provided. We strongly encourage consulting with a qualified financial advisor before making any investment decisions.