Meta stock prediction 2030 has been re-evaluated, based on full-year earnings for 2025. Assessment of long-term value, growth assumptions, margin sustainability, and expected returns of Meta Platforms through 2030.

Introduction: Meta Price Prediction 2030

The discussion on Meta stock prediction 2030 is more crucial after the publication of the annual 2025 financial performance. Investors now seek to understand whether Meta stands a good chance of growing in the long run or if future returns are already being put into consideration in the stock. The evaluation of the financial performance, growth potential, and profit trend of Meta and value assumptions that will be evaluated in this article to establish the potential stock value in 2030 (Yahoo Finance, 2026).

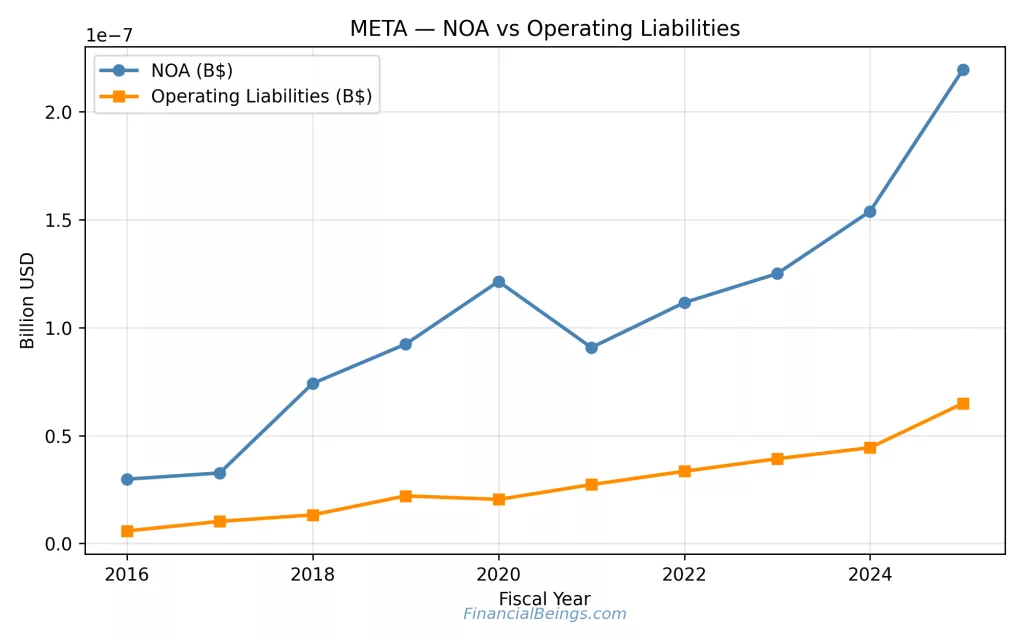

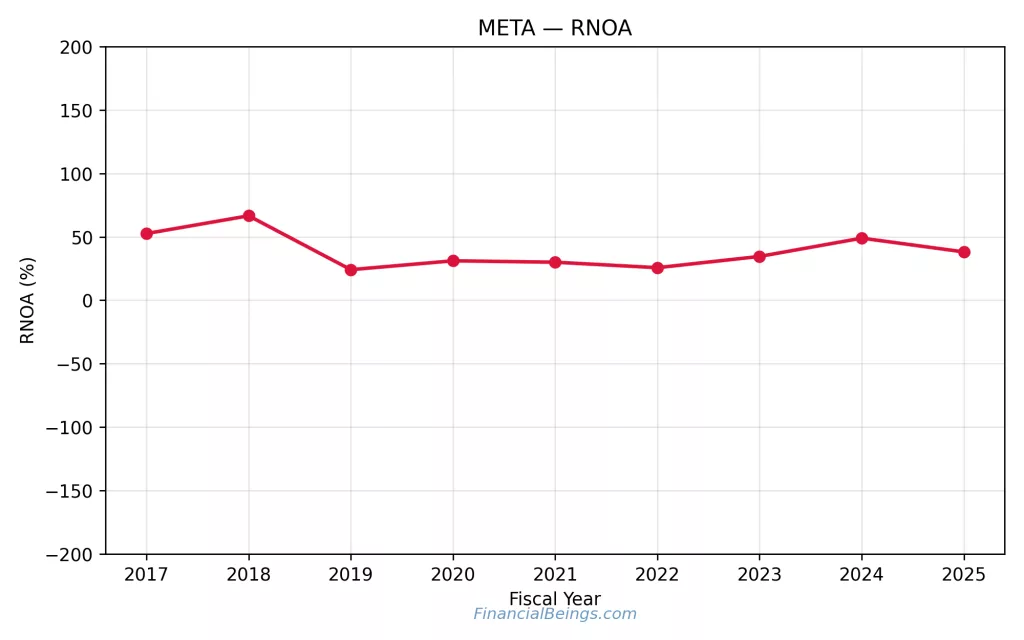

The analysis will be done in the operating fundamentals of the Net Operating Assets (NOA), operating liabilities, return on Net Operating Assets (RNOA), and sensitivity of valuation based on the assumptions of the terminal growth. These are indicators that are used to determine the business efficiency and returns to shareholders of Meta. It is to come up with a meta stock forecast 2030 that gives realistic growth and risk estimates.

It also examines current valuation levels as signs of how the future growth of Meta is envisaged by the market. The trend analysis of operating performance and valuation models offers a fair view of Meta’s long-term opportunities (Financial Times, 2026).

Table 1: Meta Core Financial Trends

| Metric | 2021 | 2022 | 2023 | 2024 | 2025 |

| Operating Income (B$) | 43.67 | 28.94 | 46.75 | 69.38 | 83.28 |

| Operating Liabilities (B$) | 27.23 | 33.42 | 39.22 | 44.36 | 64.88 |

| Sustainable RNOA (%) | 34.30 | 23.03 | 32.57 | 43.88 | 31.40 |

| Residual Operating Income (B) | 23.63 | 13.77 | 26.81 | 48.07 | 42.47 |

The growth in the performance of operating income and residual income of Meta demonstrates that the company generates economic value significantly more than in the previous years (Yahoo Finance, 2026).

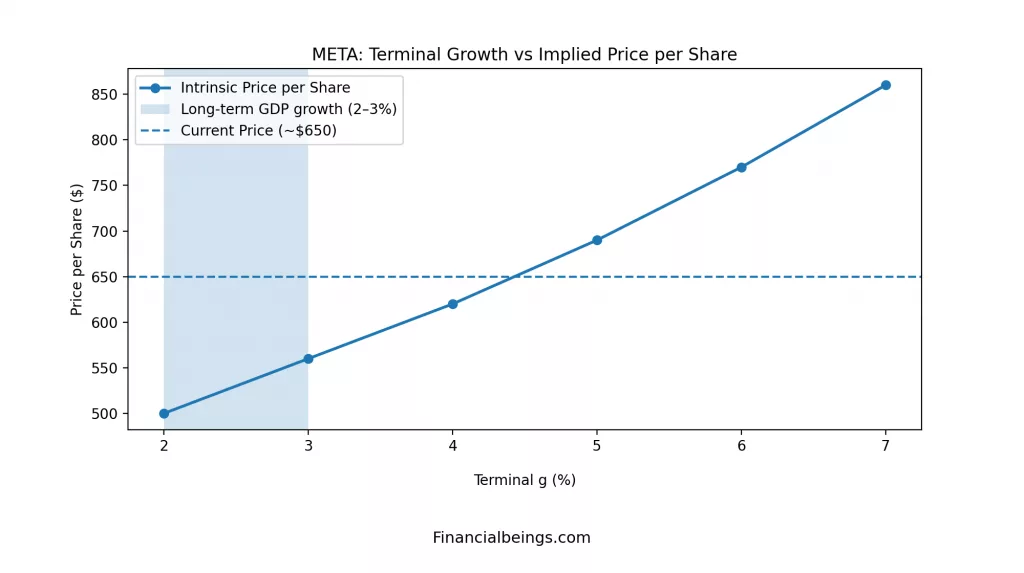

Table 2: Intrinsic Price Sensitivity to Terminal Growth

| Terminal Growth | Intrinsic Value |

| 2% | $482 |

| 3% | $523 |

| 4% | $578 |

| 5% | $652 |

| 6% | $759 |

| 7% | $927 |

These findings are the basis of the meta long-term stock prediction, and the valuation expectation in line with market pricing trends (Financial Times, 2026)

Meta Stock Prediction 2030 After Full-Year 2025 Earnings

The future of meta stock forecast 2030 must begin by evaluating the 2025 earnings of Meta’s financial strength. The operating income of Meta is performing well and it has grown to approximately $83 billion in 2025. This is an indication of a healthy recovery and positive business momentum after a historical growth and decline of profitability (Yahoo Finance, 2026).

The operating liabilities were also increasing significantly to nearly $65 billion. It is an indication that Meta is taking advantage of supplier financing and operating leverage to expand. Growth in liabilities is not always negative since it might increase efficiency in capital, provided that the operating income continues to grow.

This sustainable RNOA of Meta declines a binomial point between 2024 and 2025 but remains strong above 30%. Such operating return shows that the primary advertising business of Meta continues to give it high profitability (Financial Times, 2026).

The remaining operating income was higher than $40 billion as well, meaning that Meta remains a high economic profit maker. These profits indicate that the company is creating more value than its cost of capital, and it therefore survives the positive meta stock valuation analysis (Yahoo Finance, 2026).

What the Market Is Already Pricing into Meta Through 2030

The current share price of around $650 indicates that the market anticipates further moderate long-term growth. Based on valuation sensitivity, the price is closest to reflecting a growth expectation of about 5% at the end of the term since the model will produce a share price of about $652.

It implies that investors are already expecting that Meta will experience another high growth in ad revenue and successful AI monetization. The market projected growth rate suggests that the market is having higher expectations above the US GDP growth rates (Financial Times, 2026).

Awareness of growth priced into Meta stock helps the investor make an evaluation of the possibility of the stock fetching good returns in the future. In a scenario where the expectations have already been high, future upside requires that Meta exceed such growth assumptions.

The performance of the operations of the Meta over the years has been high, and the income growth and operating margins are good. However, according to the valuation analysis, much of the projected growth has already been incorporated into the current price (Yahoo Finance, 2026).

This is noteworthy to investors who are analyzing market-implied growth because the valuation risk increases with the market expectations that are aggressive.

Re-Assessing Meta’s Long-Term Growth Drivers Beyond 2025

It is the sustainable revenue drivers that meta’s long-term stock prediction, is heavily relying on. The digital part of the advertisement is the biggest revenue generator of the company. The active usage of social media is one of the more powerful drivers of the development of advertising.

Meta is also working hard on artificial intelligence to make the ads more personalized and convenient. The meta-AI monetization strategy of the company will focus on maximizing the ad conversion rates and is intended to enable the new digital services (Yahoo Finance, 2026).

The other growth driver is the growth in messaging and online shopping services. These services will be able to increase revenue per user and improve efficiency in the entire monetization process.

Reality Labs is a long-term expansion programme. While current financial performance displays the ongoing investment costs, the segment will be able to create new revenue sources in the virtual and augmented reality market. However, reality labs long-term impact is not evident, but could have an impact on future development.

The meta-advertising ecosystem is continuing to experience strong digital marketing demand in the world market. This supports the meta revenue growth outlook that is yet to become negative as a result of the operating income tendencies.

Margin Sustainability and Capital Discipline: The Real 2030 Question

The operating margin stability is one of the most important factors that will contribute to meta stock prediction 2030. The profit margin of Meta has declined during the times of over-investment, and it has increased significantly by 2024 (Yahoo Finance, 2026).

Capital discipline is a primary factor in ensuring strong returns. Another way that AI infrastructure and data centers were consumed more by Meta was to enhance longer-term innovation, but at the expense of the free cash flow in the short term (Financial Times, 2026).

The company has a high level of RNOA of 38% and that means it utilizes the capital efficiently. The fact that operating income is growing higher than the growth of assets is also an indication of efficient operating leverage.

Meta’s capital allocation strategy balances the investments in innovative efforts and the payments to the shareholders through the use of share buybacks. This is an indicator of meta capital allocation discipline that leads to long-term shareholder value (Yahoo Finance, 2026).

The sustainability of the operating margin will be based on the ability of Meta to turn the AI investments into profit and control the operating expenses. The profitability can be decreased in case the cost increment exceeds the increment in revenue.

Valuation Scenarios for Meta Stock Through 2030

Meta 2025 earnings analysis will be done on the sensitivity of the valuation, and thus, the Meta stock price target 2030 will be estimated assuming different growth rates.

Table 3: Meta Valuation Scenarios

| Scenario | Growth Assumption | Estimated Price Range |

| Bear Case | 2% Growth | ~$500 |

| Base Case | 5% Growth | ~$652 |

| Bull Case | 6-7% Growth | ~$760-$927 |

The base case assumes that the advertising business is going to be at parity with the growth of Meta, and the monetization of AI will make revenues more efficient at a slow pace. The meta stock bull base bear case assumes the greater development of digital advertising and the successful commercialization of AI services.

The worst-case scenario will assume a decline in digital advertising growth meta demand, or even reduced returns on investment in AI. These scenarios indicate the sensitivity of valuation to long-run growth expectations (Financial Times, 2026).

This argument supports the concept of the intrinsic value of Meta stock, which suggests that the slight changes in the growth assumptions can significantly impact valuation in the long term (Yahoo Finance, 2026).

Figure 3: Meta Terminal Growth vs Intrinsic Share Price Sensitivity

Risks That Could Break the Meta Stock Prediction 2030 Narrative

The meta stock prediction 2030 outlook can have several threats. One of the issues is regulatory risk. The governments continue to implement the surveillance of social media and digital advertising. Stronger regulation can lower the efficiency of advertising or increase compliance costs (Financial Times, 2026).

Competitive pressure is also a significant risk. The market share of Meta may drop because of the competition from digital advertisements by new platforms and AI-based marketing tools.

Capital investment risk is another factor. Meta is investing heavily on AI platform and VR development. In case such investments do not provide sufficient returns, the shareholder value may be diluted (Yahoo Finance, 2026).

These risks indicate that risk should have been considered in the valuation expectations of the Meta stock in the long term.

Expected Returns from Meta Stock If Growth Normalizes by 2030

The valuation, as well as sustainability in growth, are vital to the projected returns on shareholders. Valuation analysis reflects above average returns of 8.47%-9.34% by assuming that Meta would grow at an approximate of 4.5%-5% in the long run. However, the returns would exceed 10%, if the growth remains at or above 6%.

The affirmative growth may also lead to better returns to shareholders provided that Meta is able to monetize AI and expansion of digital advertising revenues. However, when the growth slows to the GDP level, then the expectations of returns are withdrawn (Financial Times, 2026).

This happens to be in line with showing that the high performance in the past does not show returns in the future as long as the valuation expectations are still high (Yahoo Finance, 2026).

The investors making a meta stock forecast 2030 will be required to trade-off growth prospects and valuation risk. The long-term returns on investments will be associated with the reality that Meta will remain a high-profit business that is able to undertake growth strategies and strategies.

Portfolio Suitability Analysis

Growth Portfolio

To invest in AI-based growth portfolios, it can take into account investing in Meta, which is a very profitable company with high operating returns, and its AI capabilities are expanding. The advertising business of the same company is reported to be good in terms of generating stable revenue, as shown by (Yahoo Finance 2026).

Balanced Portfolio

It is also possible to incorporate meta in the balanced portfolios because economic profits are frequently generated, as well as the discipline of capital allocation.

Conservative Portfolio

However, there is high sensitivity of valuation, which means that Meta is not the ideal investment to employ in case the prime investor is interested in the stability of dividends or low volatility (Financial Times, 2026).

The meta may be viewed as a tactical technological investment by long-term investors who believe that the monetization of AI and digital advertisement development could take place.

Diversified technology portfolios could be favored by those investors who are interested in an asset with a fixed income or lower exposure to risk than a concentrated Meta exposure.

Conclusion

The meta stock prediction 2030 is positive but highly dependent on the capacity to maintain the growth in the long term. The 2025 operating performance of Meta indicates that the company is very profitable, the operating leverage is increasing, and the company is economically profitable (Yahoo Finance, 2026).

It is sensitive to the valuation analysis, such that the intrinsic value of Meta takes a broad range of values depending on the assumptions of growth. The current price means that the investors are already projecting above average growth. The future value of stock will be defined by the success of Meta to monetize AI investments, increase advertising income, and operating levels (Financial Times, 2026).

Overall, Meta continues to demonstrate good business fundamentals and a future. Realistic growth expectations and observation of regulatory and competitive risks will, however, form the basis of success in investment.

All calculations and valuation estimates are FinancialBeings’ own, based on data sourced from SEC filings META (10K and 10Q), use or reproduction before prior approval is prohibited.

Investors’ Frequently Asked Questions (FAQs)

What will Meta stock be worth in 2030?

The valuation sensitivity model indicates that the forecasted price of Meta in 2030 is pegged on the performance of growth in the long term. In the assumption that Meta would surpass terminal growth of around 5%, the model would provide an estimated value of around $652 per share, but increased growth will lead to a high valuation. Advertising expansion and keeping the margin will be the actual future price.

Can Meta stock reach $1000?

Meta stock could reach a high of up to $1000 as long as the company sees a long-term growth of more than 7% and is in a position to realize AI and new digital services. This would, however, be at the expense of strong revenue growth and sustainable growth in profits. It can reach the $1000 price per share, but it is a very bullish growth expectancy.

Is it too late to buy META?

It does not need to be mentioned that there is still no time to buy Meta, but the valuation indicates that the market is already expecting high growth. The future returns will depend on whether Meta will be able to exceed the expectations of this growth. Investors have to consider their risk-taking capacity and long-term investment goals before they venture into investment. Growth and Balanced portfolios can take on the investment due to good long-term returns while conservative investors may wait for a good entry point or stay on the sidelines to avoid volatility.

Usama Ali

Usama Ali is the founder of Financial Beings and a self-taught investor who blends classic valuation study with insights from psychology. Inspired by works from Benjamin Graham, Aswath Damodaran, Stephen Penman, Daniel Kahneman, and Morgan Housel, he shares independent, data-driven research to help readers connect money, mind, and happiness.

Disclaimer

The content provided herein is for informational purposes only and should not be construed as financial, investment, or other professional advice. It does not constitute a recommendation or an offer to buy or sell any financial instruments. The company accepts no responsibility for any loss or damage incurred as a result of reliance on the information provided. We strongly encourage consulting with a qualified financial advisor before making any investment decisions.