Meta stock Q1 2025 earnings surpass analyst expectations, indicating strong investment prospects, based on recent performance, EPS trends, and profitability ratios.

Meta Platforms Inc., originally Facebook Inc., is a leading technology company responsible for various social media platforms like Facebook, Instagram, WhatsApp, and Messenger. With over three billion active users, the company has transitioned from a social network organization to a leading technology behemoth.

Its long-term investment strategy focuses on creating digital interaction methods to remain a leader in innovation. Meta’s investments in artificial intelligence, virtual reality, and metaverse principles have allowed it to transition from a social network organization to a leading technology behemoth.

This blogpost examines Meta’s earnings for Q1 2025, profitability measurements, and valuation ratios. It considers earnings per share, return on equity, return on total capital, and free cash flow to provide investors with a comprehensive understanding of Meta’s current condition and potential stock value.

This article is useful for market analysts, investors, and potential portfolio holders, offering insights into Meta’s business status and market potential for advancement.

Meta Stock Analysis

Meta Stock Revenue

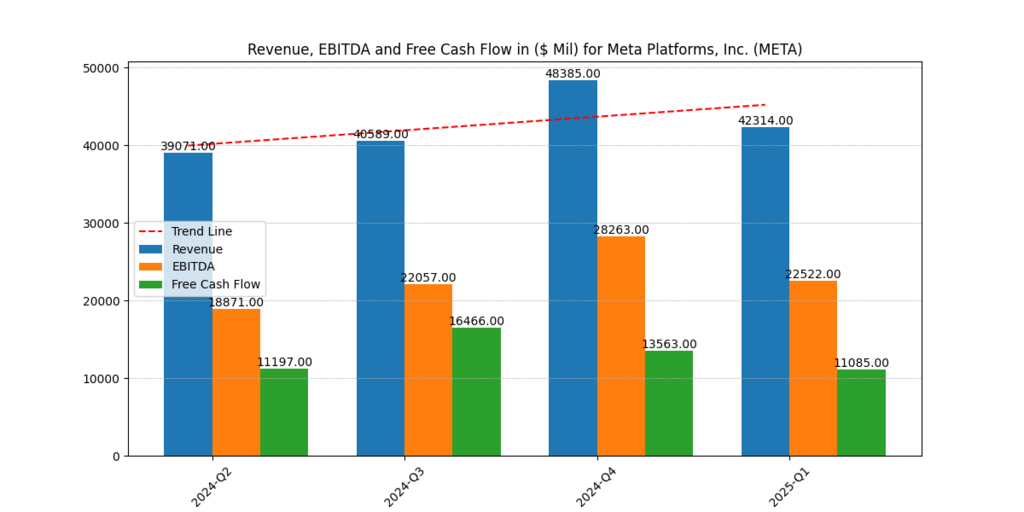

Meta’s revenue growth demonstrates its strong focus on artificial intelligence-powered online advertising and interactive digital experiences. The company is making significant progress in regaining digital advertising revenues, particularly due to the expansion of retail and e-commerce sectors.

Meta’s AI capabilities enhance marketing campaigns’ effectiveness, increasing user spending on advertising. By implementing monetization tactics on messaging platforms and Reels, the company generates new revenue streams and improves the overall marketing strategy. [1]

The firm’s global presence and diverse ad customer sources protect it from economic declines in a single market. Increased user participation, especially in areas outside the US where mobile-first content consumption drives revenue growth, supports the company’s momentum.

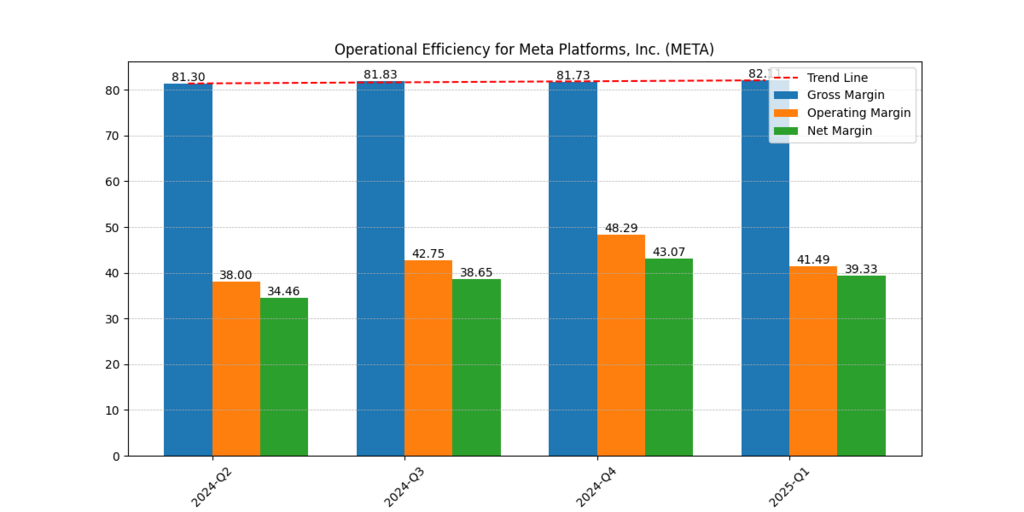

Meta Stock Profitability Margins

The organization effectively manages its cash and allocates financial resources, generating significant free cash flow. Meta’s efforts in building the metaverse and artificial intelligence infrastructure do not impact its robust operating cash flow streams.

The company’s profits are primarily generated through high-margin advertising income and enhanced operational efficiency due to its digital scale. Through streamlining programs and reducing regulatory fines, the company generates more operating cash. The company’s strong financial liquidity allows it to maintain stability amidst unpredictable market conditions, enabling swift adjustments to future developments.

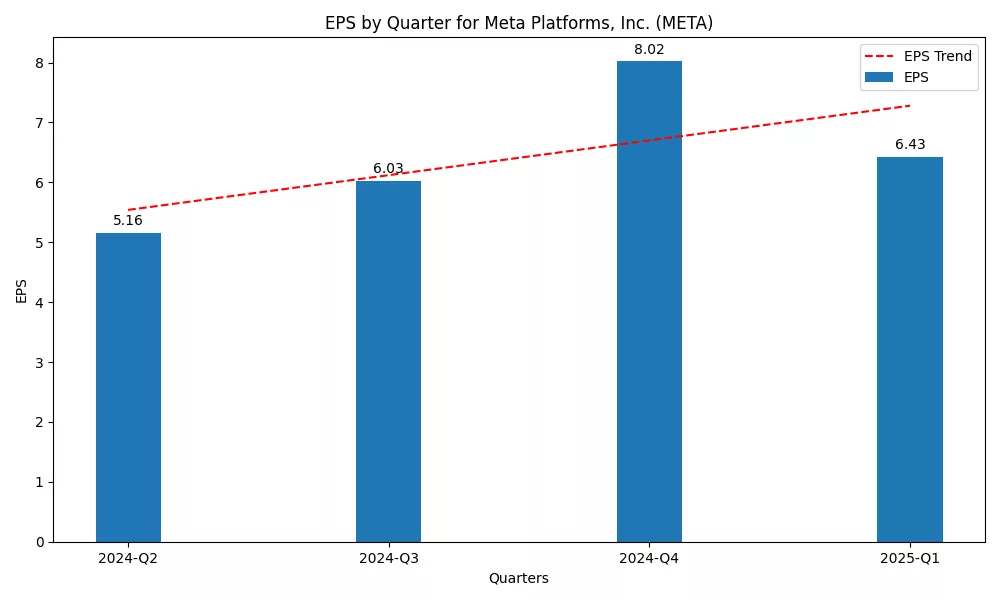

Meta Stock Earnings per Share (EPS)

Meta uses its return on equity metric to generate value for shareholders through sustained net income growth and capital restraint. Smart investments in AI, advertising tools, and social commerce yield significant returns, enabling greater equity use. Meta can expand creative initiatives while maintaining low administrative costs, allowing for profit margins. [2]

Data-based consumer targeting and effective revenue methods, enhanced by network advantages, demonstrate the company’s sustainable value creation, resulting in a high return on equity. These factors demonstrate the company’s ability to create sustainable value and maintain profit margins. More AI companies like META for the best portfolio.

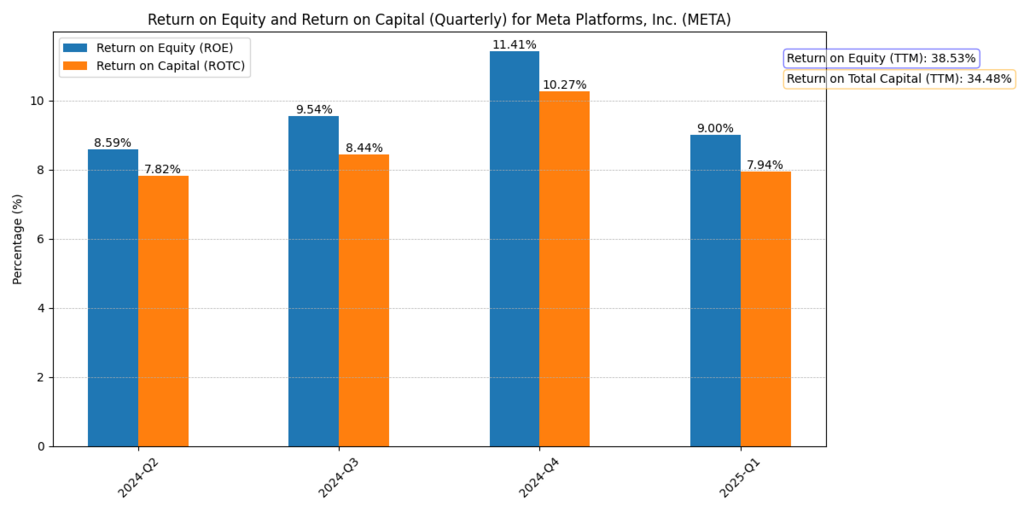

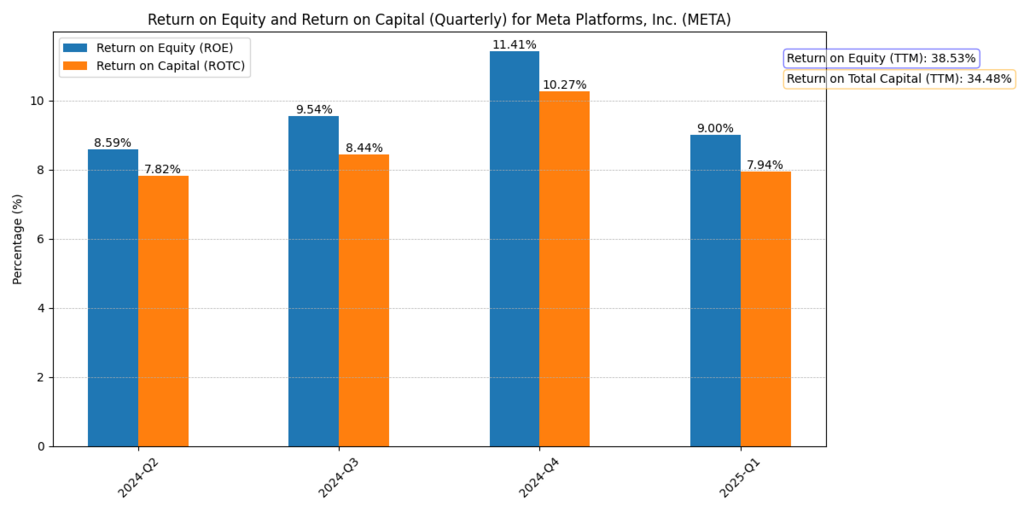

Meta Stock Return on Capital (ROTC)

Meta’s Return on Total Capital demonstrates effective management of its financial capital base, including equity holdings and other forms of capital. By responsible capital expenditure planning and efficient asset use, Meta achieves high financial performance in terms of total capital return.

Investments in artificial intelligence chips and data infrastructure technologies generate automation while cutting long-term operational expenses. Internal funding of expansion projects lowers capital costs and increases profitability. [3]

Limiting debt to manageable levels protects the company against financial risks and ensures efficient use of cash. This disciplined deployment technique supports long-term profitability and strategic flexibility.

Meta Stock Return on Equity (ROE)

Meta Platforms’ Return on Equity (ROE) is a measure of how shareholders’ capital is invested in the company, indicating its effective use of resources for business growth. A high ROE indicates that Meta is effectively utilizing its resources, indicating potential investment.

The company’s solid ROE is attributed to efforts to reduce costs and revenues from digital advertising, platform monetization of Facebook and Instagram, and the implementation of AI and VR technologies. [3]

These advancements have improved Meta’s performance efficiency and market competition power. Investors can show their optimism by increasing their stock prices and receiving favorable market reception due to the company’s consistent profitability.

Meta’s latest AI projects, their descriptions, and their impact on Meta’s stock

| AI Project | Description | Year Launched | Impact on Meta’s Stock |

| M (AI Assistant) | A personalized AI assistant integrated across Meta’s platforms. | 2023 | Boosted user engagement, driving advertising growth. |

| LLaMA (Large Language Model) | A generative AI model for better content creation and user interaction. | 2023 | Strengthened Meta’s AI capabilities, enhancing its competitive edge in content creation. |

| Facebook AI Research (FAIR) | Advanced research in AI and machine learning to drive innovation. | 2022 | Increased confidence in Meta’s long-term tech potential, supporting stock performance. |

| AI-Powered Ads | AI-based tools to optimize ad targeting and improve revenue generation. | 2021 | Improved ad revenue, leading to stock price growth. |

| Meta AI Research Supercluster | One of the fastest AI supercomputers to drive research and development. | 2022 | Strengthened investor sentiment due to advanced R&D capabilities. |

| AI-Driven Content Moderation | AI system to detect harmful content across Meta’s platforms. | 2021 | Enhanced user trust, stabilizing Meta’s stock. |

| Horizon Worlds AI | An immersive VR space powered by AI for social interactions. | 2022 | Pushed stock up, signaling Meta’s commitment to VR. |

| Deepfake Detection AI | AI tool for detecting and removing deepfake content. | 2021 | Improved reputation, sustaining stock value. |

| AI-Driven Video Summarization | AI algorithm for automatic video highlights and summaries. | 2023 | Increased video engagement, contributing to revenue growth. |

| Meta AI for Personalization | AI-driven algorithm to provide personalized content for users. | 2023 | Led to higher user engagement and ad revenue, boosting stock. |

Conclusion: Is Meta a Good Stock to Buy?

Meta Platforms has significantly improved its financial performance due to advancements in artificial intelligence and virtual reality technologies. The company’s consistent profitability, measured by earnings per share and return on equity, allows it to maintain its position as a major player in the technology sector.

Meta’s strategic focus on AI-driven initiatives and digital advertising model has established a robust competitive position. Despite market constraints and regulatory uncertainty, Meta’s agile operations and market potential create significant future growth potential.

The investing community considers Meta stock attractive for long-term growth due to the company’s growing ecosystem and strategic investments in future technology advancements.

Disclaimer

The content provided herein is for informational purposes only and should not be construed as financial, investment, or other professional advice. It does not constitute a recommendation or an offer to buy or sell any financial instruments. The company accepts no responsibility for any loss or damage incurred as a result of reliance on the information provided. We strongly encourage consulting with a qualified financial advisor before making any investment decisions.