Introduction

Is Tesla a good stock to buy right now? Tesla’s Q1 2025 financial report has caused significant investor uncertainty, leading to the reduction of profitability ratios. This has raised concerns about Tesla’s future stock purchase, as the company, the leader in the electric vehicle industry, faces potential investor pessimism.

Tesla’s Q1 2025 financial report has sparked discussions about its future investment value due to its decreased profitability indicators. Analysts are uncertain about whether Tesla should be considered a safe bet due to decreased profit margins, reduced return on equity, and intensified competition. CEO Elon Musk’s AI and robotics ambitions may cause commercial concern. The essay evaluates Tesla’s current results and investigates the possibility of purchasing stock at this stage. The company must overcome significant hurdles, including decreased profit margins, reduced return on equity, and intensified competition from BYD as well as boycotts around the world.

Profitability Takes a Hit

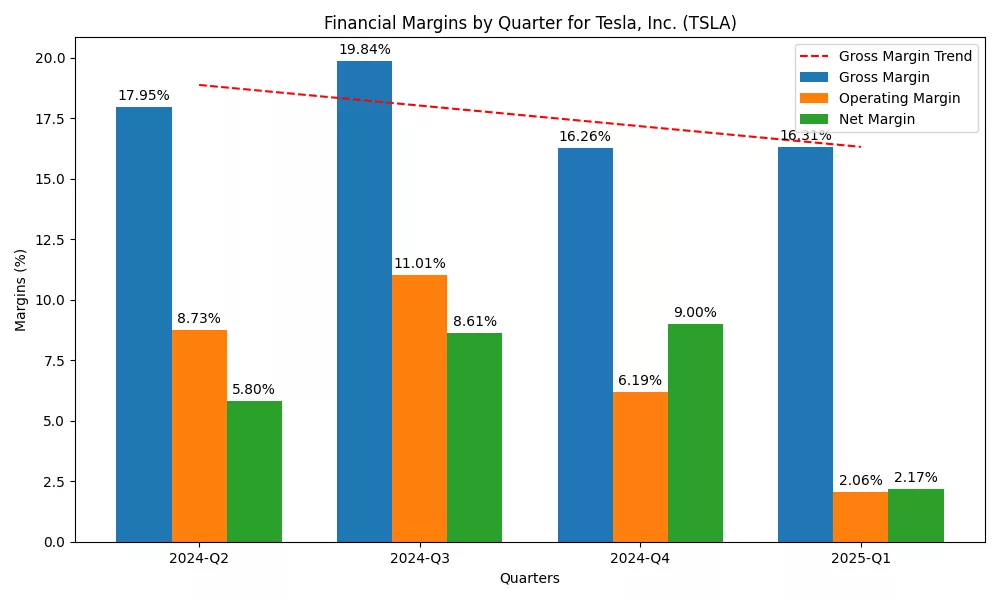

The company’s quarterly financial margins have shown a persistent decline from Q2 2024 to Q1 2025, with a gross margin of 19.84% in Q3 2024 and 16.31% in Q1 2025. This pattern indicates that margin performance will continue to be negative, with a consistent downward movement. The operating margin dropped from 11.01% in Q3 2024 to 2.06% in Q1 2025, and the net margin dropped from 9.00% in Q4 2024 to 2.17% in Q1 2025.

The company’s profitability decline is attributed to rising operational expenses, increased competitiveness in the electric vehicle industry, rising production costs, and a reduction in pricing strategy. Investors should consider this reduction in profitability as a significant warning indicator. The trend is represented by a horizontal dashed red line. [1]

ROE Deterioration Signals Weak Returns

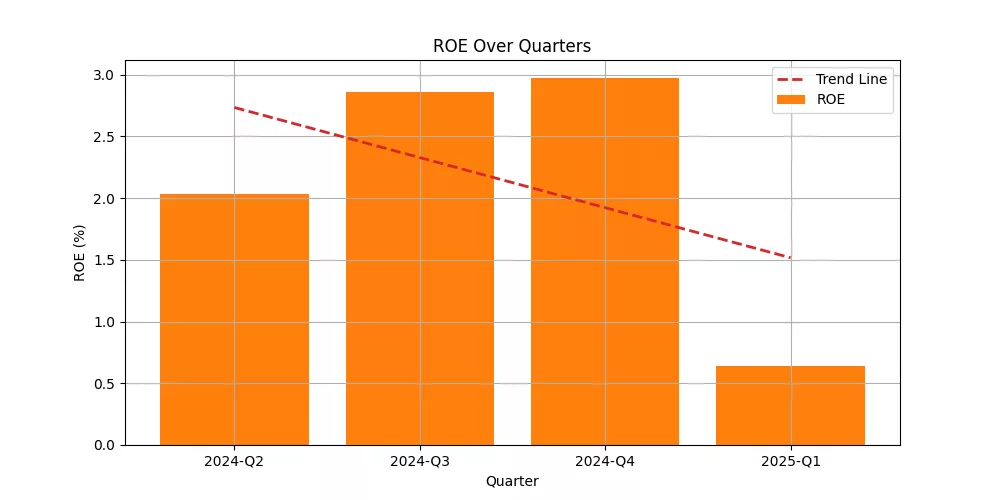

Tesla’s Return on Equity (ROE) has been declining over time, dropping from 2.96% in Q4 2024 to 0.64% in Q1. This decline indicates that Tesla’s profitability is not generating value to its stockholders, as it falls below 1%. This negative trend suggests that Tesla will face future obstacles to improve its profitability, unless it can recover its profitability. The company’s failure to generate value to its stockholders is a clear indication of the challenges it will need to overcome to improve its profitability. Do not forget to read our article on the EV Champ of 2025.

Book Value Per Share Still Growing

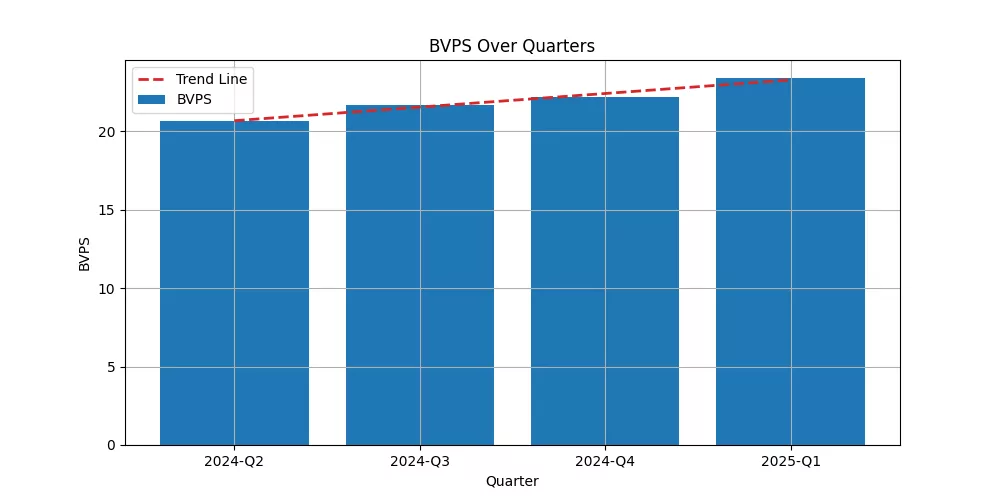

The Book Value Per Share (BVPS) of a company has consistently increased from $20.6 in Q2 2024 to $23.4 in Q1 2025, indicating consistent growth on its balance sheet. This growth suggests the company has effectively increased its assets or invested in profitable quarters. Investors need assurance that momentary profits will not worsen, especially for short-term performance or momentum traders. [2]

Market and Strategic Headwinds

Tesla, a leading electric vehicle company, is facing increasing competition and aggression in the market. The company is facing a decline in profit margins due to increased Chinese automakers, a slowdown in North American demand for electric vehicles, and the need to invest more in artificial intelligence and robotics programs. These issues have negatively impacted Tesla’s revenue targets and shipment estimates. The company is also facing delays in developing its vehicle platform and challenges in expanding its cybertruck operations. Despite these challenges, CEO Elon Musk is taking significant risks to secure future success in autonomous and robotics.

Analyst and Market Sentiment

After Tesla’s earnings statement, analysts have shifted their evaluation of the company’s shares from positive to negative due to price power weakness and execution uncertainty. The market has shifted its focus from growth expectations to price power weakness. Despite the optimism about Tesla’s AI and energy projects, the market data does not provide enough evidence to warrant bullish forecasts for future performance.

Tesla’s latest AI-related investments

| Investment Name | Description | Year |

| Dojo Supercomputer | Custom-built AI training supercomputer focused on FSD and neural net development. | 2023–2025 (ongoing) |

| Tesla FSD (v12 updates) | Continued upgrades to Tesla’s Full Self-Driving software using end-to-end AI. | 2024–2025 |

| AI Chip Development | In-house development of next-gen AI chips to reduce reliance on Nvidia. | 2024 |

| Humanoid Robot – Optimus | AI-powered robot developed for factory work and commercial use. | 2023–2025 (active development) |

| AI Data Labeling Farm | Internal investment in AI-driven data labeling systems for training autonomy models. | 2024 |

| Energy Forecasting AI | AI systems integrated into Tesla Energy for real-time solar and battery optimization. | 2024 |

Is Tesla a Good Buy?

Not in the short term.

Based on Q1 2025 results, Tesla is currently not an attractive buy for value or earnings-focused investors. The sharp decline in operating and net margins, a steep drop in ROE, and increasing competitive threats signal a bumpy road ahead.

Long-term investors with high risk tolerance and belief in Tesla’s AI and energy transformation may still hold or consider dollar-cost averaging. But for those seeking financial stability and solid near-term returns, it may be wise to stay on the sidelines until Tesla shows signs of margin recovery and strategic clarity.

Disclaimer

The content provided herein is for informational purposes only and should not be construed as financial, investment, or other professional advice. It does not constitute a recommendation or an offer to buy or sell any financial instruments. The company accepts no responsibility for any loss or damage incurred as a result of reliance on the information provided. We strongly encourage consulting with a qualified financial advisor before making any investment decisions.