Introduction

Is Microsoft a Buy after Q3 2025 earnings? Learn why Microsoft’s robust earnings beat, analyst predictions, and expansion of the cloud and AI could make it worthy of a long-term investment.

Microsoft, a key player in the global technology industry, constantly adapts to the ever-changing landscape through its focus on corporate software, cloud computing, and artificial intelligence. Despite its reputation for long-term stability, Microsoft has strengthened its position in the industry by offering advanced artificial intelligence tools and robust cloud services, allowing the company to expand its offerings.

The recent earnings report has sparked interest in purchasing Microsoft among investors. Despite the compelling numbers, the company’s robust business strategy, product innovation, and consumer trust make it a strong contender. This analysis aims to help investors decide whether to hold out for Microsoft at the moment or if it’s a good time to buy. As an investor, it’s crucial to consider the company’s recent performance, market sentiment, and strategic moves to make an informed decision.

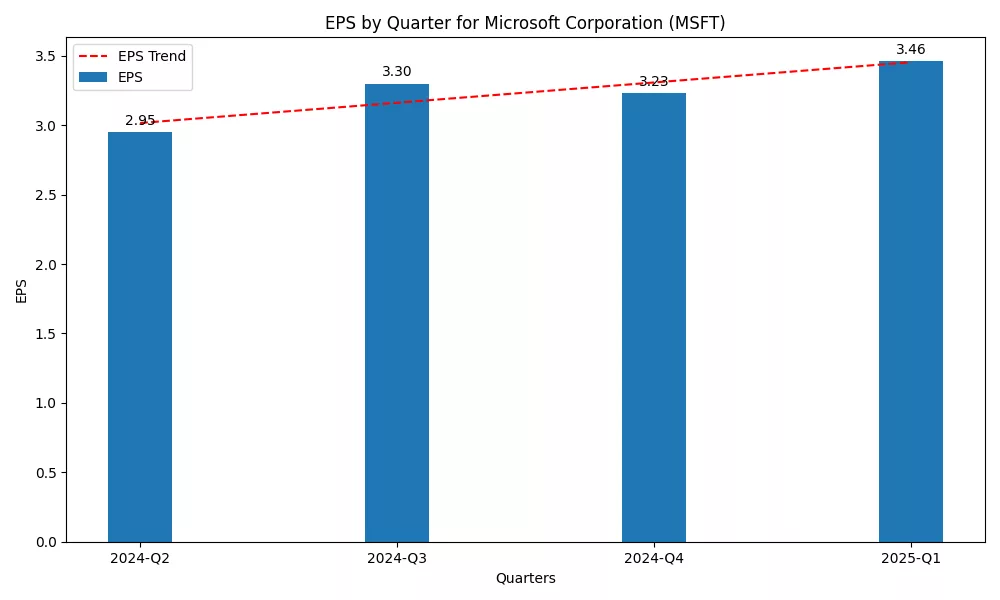

Earnings Strength Driven by Cloud and AI Demand

Microsoft’s quarterly success is largely due to its significant growth in cloud and artificial intelligence businesses. The company’s shift towards hybrid and digital-first models has led to a surge in cloud infrastructure and intelligent technologies.

Microsoft Azure, its cloud platform, has thrived as part of enterprise-grade contracts. The incorporation of generative artificial intelligence in the cloud and Microsoft’s productivity tools is another driving factor. Microsoft’s stake in this growth is due to its ability to integrate artificial intelligence into its ecosystem, including Office products and Azure.

Businesses desire increased efficiency and automation to retain customers, increase pricing power, and boost profit margins. Microsoft’s ability to anticipate business needs and deliver integrated solutions that generate recurring revenue is the reason for the company’s failure to meet its profitability forecast. Microsoft is also 1 of the best 5 AI Stocks here.

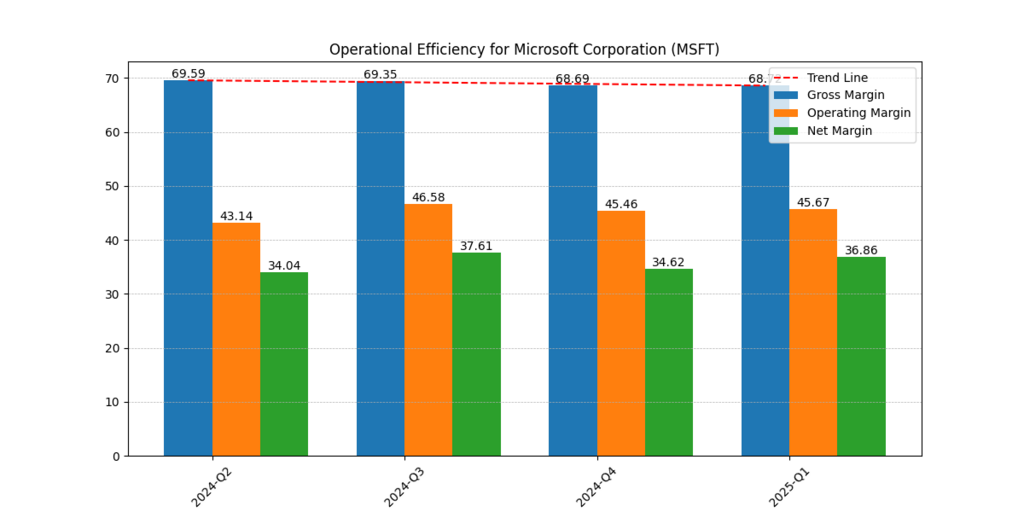

Operating Margins Reflect Strategic Cost Discipline

Microsoft’s recent results show favorable operating margins, indicating a disciplined approach to expense management.

Despite investing millions in artificial intelligence, cloud infrastructure, and human capital, Microsoft has managed to control operating costs without causing them to balloon. This mature corporate approach focuses on profitability rather than enterprise scale, demonstrating that growth is dependent on profitability rather than enterprise scale. [1]

Microsoft has strategically allocated areas for long-term profits while reducing spending on less urgent activities. This approach, including reducing non-core divisions and increasing internal operations efficiency through automation, has resulted in high returns despite rising input costs and uncertainty in the macroeconomic environment.

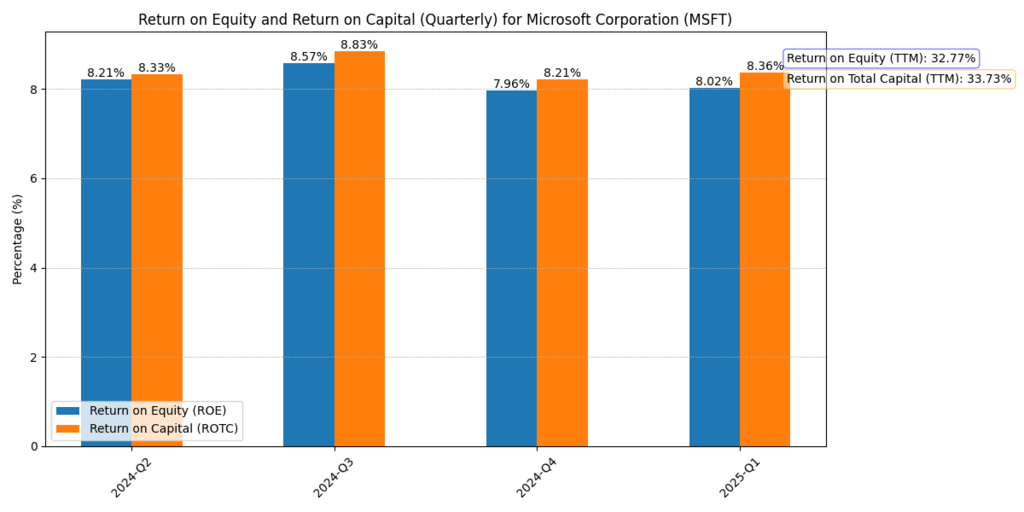

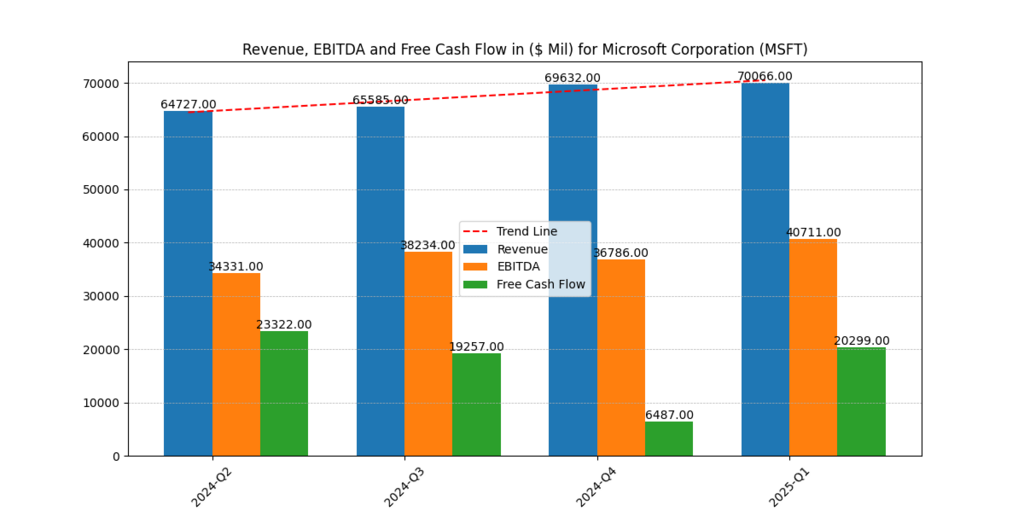

Balance Sheet Resilience and Cash Flow Strength

Microsoft’s balance sheet is highly resilient in the technology industry, largely reliant on investor trust. Its strong free cash flow and conservative liabilities contribute to its financial resilience.

The firm’s high capital liquidity allows it to finance growth, provide shareholders with returns through buybacks and dividends, and maintain stability amidst short-term market shocks. This dynamic balance sheet demonstrates Microsoft’s ability to adapt to market fluctuations.

Microsoft’s constant cash generation allows for long-term investments in innovation without affecting shareholder value. This allows the company to respond quickly to potential startups or technologies, reinforcing its market position. [1]

Microsoft’s ability to fund these efforts at a time when other technology companies are investing heavily in artificial intelligence demonstrates its ability to respond quickly and reduce financial risk, thereby enabling the company to acquire promising companies or technologies.

Investor Sentiment and Forward Outlook

Microsoft’s constant cash generation allows for long-term investments in innovation without affecting shareholder value. This allows the company to respond quickly to potential startups or technologies, reinforcing its market position.

Microsoft’s ability to fund these efforts at a time when other technology companies are investing heavily in artificial intelligence demonstrates its ability to respond quickly and reduce financial risk, thereby enabling the company to acquire promising companies or technologies. Microsoft’s long-term success is attributed to its exceptional leadership, diverse revenue streams, and forward-leaning AI integration.

Despite potential short-term fluctuations due to macro or competitive moves, the company’s fundamentals offer a solid buffer, making short-term pullbacks an opportunity for investors to invest in a strategically aligned and structurally sound company. [2]

Recent Microsoft Projects

| Project Name | Year | Description | Impact on Stock |

| Copilot+ PCs | 2025 | Microsoft introduced lower-priced Surface devices equipped with Qualcomm’s Snapdragon X Plus chips, aiming to make AI features more accessible. These devices support Microsoft’s “Copilot+” AI features, allowing users to interact with the system using natural language queries and request AI-generated document drafts. | The launch broadened Microsoft’s hardware appeal, potentially increasing market share in the AI PC segment and positively influencing investor sentiment. |

| Gears of War: Reloaded | 2025 | Microsoft announced a remaster of the original Gears of War game, featuring enhanced graphics and cross-platform play, including availability on PlayStation. This move aims to expand the game’s audience beyond the Xbox ecosystem. | The cross-platform strategy could lead to increased game sales and recurring revenue, positively impacting Microsoft’s gaming division and overall stock performance. |

| OpenAI Structural Changes | 2025 | OpenAI decided to abandon its plan to transition into a for-profit company, maintaining its nonprofit structure. This decision affects Microsoft’s investment and partnership dynamics with OpenAI. | The structural change introduced uncertainty over control and profit sharing, leading to initial declines in Microsoft’s share value. However, the continued collaboration may still yield benefits, including increased spending from OpenAI on Microsoft’s cloud services. |

| Microsoft Teams Enhancements | 2025 | Microsoft Teams introduced new features like enhanced OneDrive navigation and Digital Video Recording (DVR) support for Teams town halls, aiming to improve user experience and productivity. | The continuous enhancement of Teams strengthens Microsoft’s position in the collaboration tools market, potentially leading to increased adoption and positively influencing stock performance. |

Concluding Remarks

Microsoft’s strong Q3 2025 earnings, key project launches, and advancements in artificial intelligence, cloud computing, and productivity tools contribute to its growth story. Investor optimism is maintained, as the company’s ability to exceed expectations supports this confidence. Long-term investors will find Microsoft an appealing investment opportunity due to its capabilities.

Disclaimer

The content provided herein is for informational purposes only and should not be construed as financial, investment, or other professional advice. It does not constitute a recommendation or an offer to buy or sell any financial instruments. The company accepts no responsibility for any loss or damage incurred as a result of reliance on the information provided. We strongly encourage consulting with a qualified financial advisor before making any investment decisions.