Overview

GOOGL Stock AI Driven Growth – Discover how the proper growth of artificial intelligence-based GOOGL stock signifies Alphabet’s possession of a robust AI ecosystem, which fosters innovation, profitability, and long-term shareholder value. Alphabet Inc. is at the center of a technological revolution powered by artificial intelligence, and it is owned by Google, its parent company.

Not only does the GOOGL stock’s AI-driven growth history reflect the value of hype, but it also highlights the measurable transformation in the way Alphabet utilizes machine learning in its advertising, cloud, and consumer infrastructure (Alphabet, 2024). The shift of Alphabet to an AI-first rather than a search-based conglomerate, which has occurred over the past decade, has altered the trajectory of its evolution and long-term shareholder outlook (Reuters, 2025).

The leaders of AI companies offer sufficient confidence, albeit not as direct as the immediate turnaround. As the markets become more data-driven and efficiency-based, AI is an ecosystem, with two key areas being Google Cloud AI services and AI-based ad targeting, which position Alphabet to generate long-term operational and financial benefits (Bloomberg Intelligence, 2024). The study breaks down the thespian of the GOOGL stock AI driven growth pattern in terms of the financial metrics of Net Operating Assets (NOA), Operating Liability Leverage (OLLEV), Return on Net Operating Assets (RNOA), and Residual Operating Income (ReOI) to figure out whether the market expectations of 2025-2027 will be fulfilled, or overambitious (Alphabet, 2024).

Alphabet’s AI Ecosystem and Competitive Edge

Artificial intelligence is one of the frameworks in which Alphabet is fundamentally expanding its business. The state-of-the-art models will be launched through the AI-first approach to Google Search, YouTube recommendations, Google Cloud, and Waymo autonomous systems, an Alphabet AI business expansion that will ease profitability with the help of automation, efficiency, and personalization (Alphabet, 2024; Bloomberg Intelligence, 2024).

The strategy still revolves around the Google Cloud AI strategy. As Amazon and Azure compete with Google Cloud services like Vertex AI and Gemini to claim the Big Tech AI competition 2025 space, predictive analytics through generative AI and enhanced ML are now being introduced to businesses, which would put Google Cloud platforms ahead in the competition (Reuters, 2025; Bloomberg Intelligence, 2024). The 2025 emphasis of Alphabet machine learning investments 2025 is to process and inference at scale in real time, the key AI-driven stock performance, and the valuation premium (Morningstar, 2025).

The efficiency of ad conversion has been enhanced, and the marginal costs have been decreased efficiently with the help of advertising algorithms and AI analytics, and that is why the application of AI is linked to the sustainability of margins, which is the basis of valuation analysis at Alphabet (Alphabet, 2024; Morningstar, 2025). This is why this propensity of analysts to explain the development of GOOGL stock AI driven growth, as the possibility of Alphabet to expand revenues without the decline in technological superiority (Bloomberg Intelligence, 2024).

Financial Fundamentals: NOA, OLLEV, and RNOA Trends

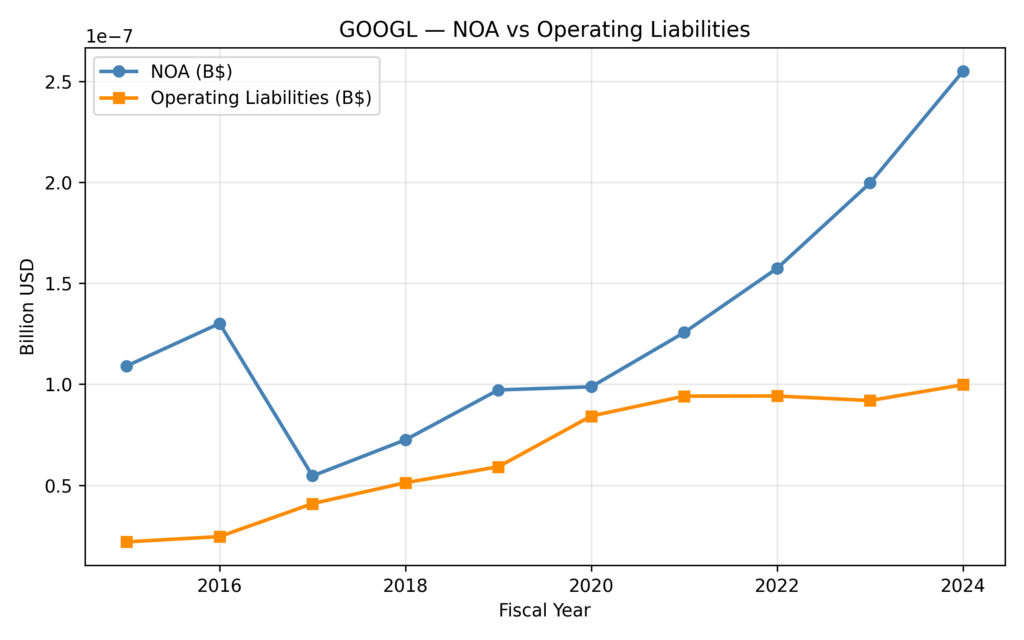

The operational resilience of Alphabet, driven by AI, can be observed in its filings and long-horizon charts (2015-2024). Under the NOA vs. Operating Liabilities point of view, the Net Operating Assets grow until 2024, and it means that there will be a new investment into AI infrastructure, data centres, and Cloud possibilities (Alphabet, 2024). The increase in operating liabilities is more moderate, indicating restrained leverage with high capital expenditures, a characteristic also of cash-based growth (Alphabet, 2024).

Figure 1. Operating Liabilities vs Net Operating Assets (Alphabet (GOOGL) (2015-2024). According to the chart, there is a continuous increase in NOA as compared to a moderate increase in operating liabilities, which indicates capital reinvestment in AI infrastructure and moderate leverage.

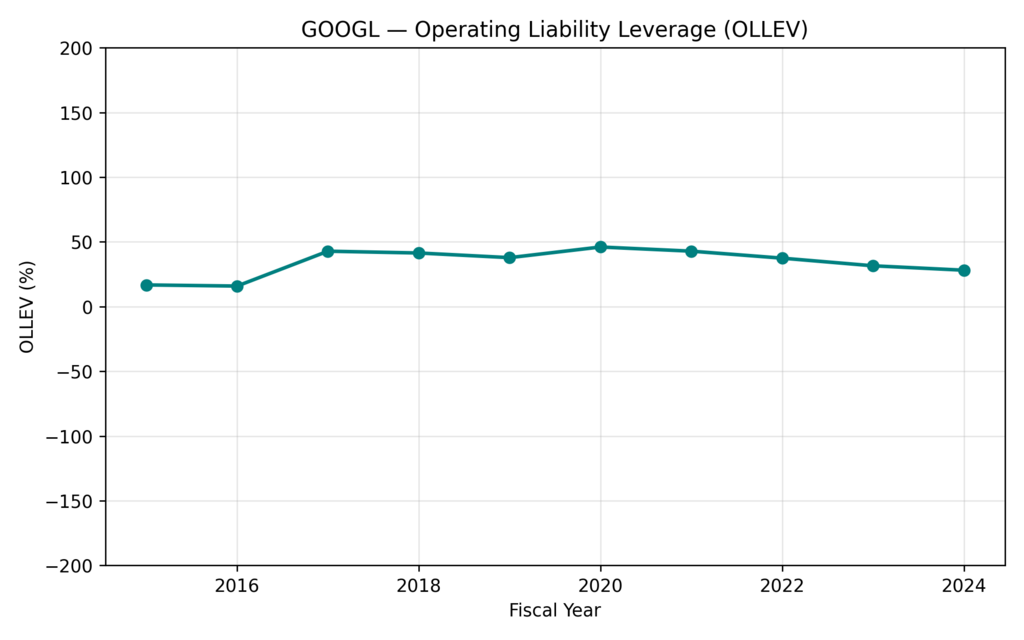

The Operating Liability Leverage (OLLEV) pattern operating in a moderate range of 30-45% is going a long way to cover the period subject to the fact that, the Alphabet funds its operations through the creation of internal cash and does not use external debt, which happens to be a balance-sheet position that favors the value in the long-term (Morningstar, 2025).

Figure 2. GOOGL Alphabet (GOOGL)- Operating Liability Leverage (OLLEV), 2015-2024. This figure illustrates the consistency of Alphabet’s leverage management, which serves as a testament to the stability of its operations, achieved through internal liquidity rather than debt accumulation.

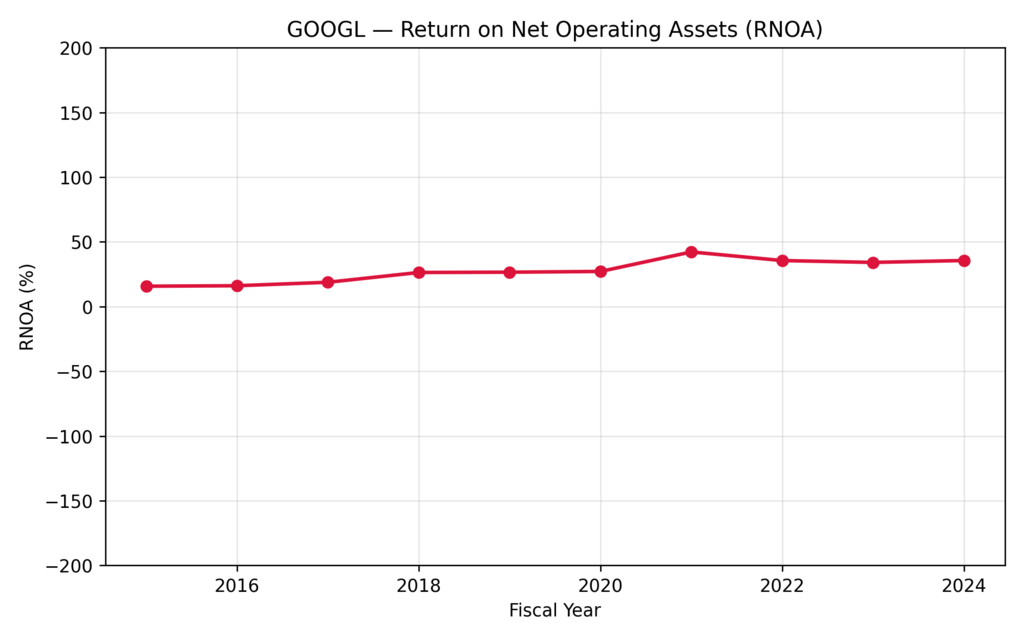

One of the primary profitability metrics, Alphabet’s Return on Net Operating Assets (RNOA), is also sufficient and increases throughout the period, aligning with the efficiency gains of Ads and Cloud due to AI (Alphabet, 2024; Bloomberg Intelligence, 2024). It will be favorable if a trusted RNOA makes the investor believe that GOOGL stock AI driven growth is not based on speculation, but on operating performance (Morningstar, 2025).

Figure 3. Return on Net Operating Assets (RNOA), 2015-2024. Alphabet (GOOGL). This value indicates a high performance in profitability of Alphabet, which has managed to experience operational efficiency in its business processes through AI.

Residual Earnings and Value Creation

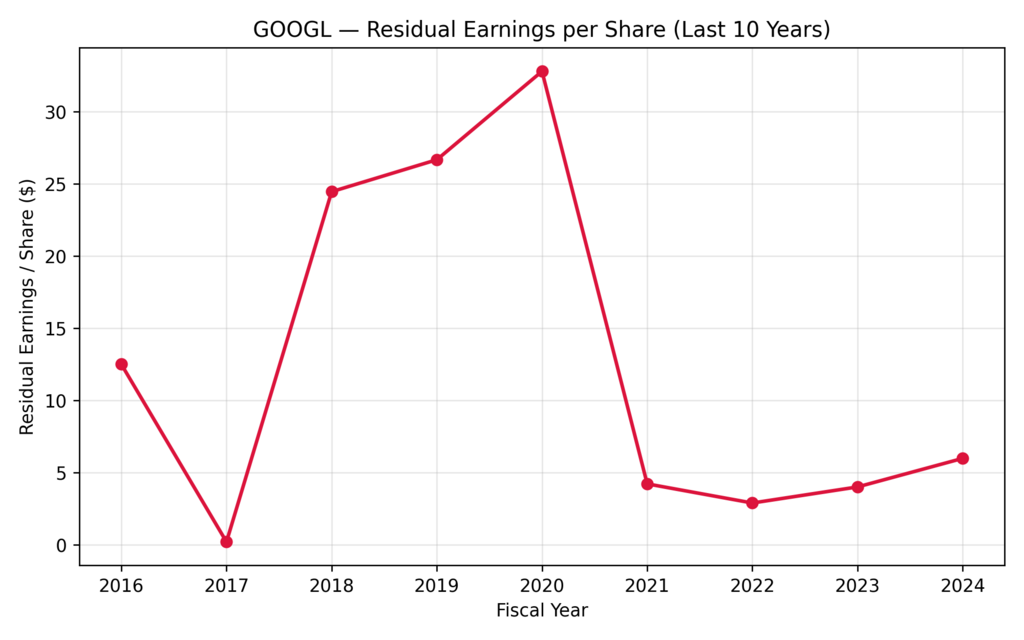

The Value formed above the cost of capital is stated in the form of the residual earnings per share (REPS). The REPS of Alphabet reached its peak and normalized in 2020, stabilizing in 2024 – fluctuations that will be subject to shifts in the cycles of macro conditions and AI sentiment (Alphabet, 2024; Morningstar, 2025). The broader implication is behavioral: investors will still view Alphabet as an AI platform in the long term, given that its products already utilize AI at scale, such as ad quality systems and enterprise AI services (Bloomberg Intelligence, 2024; Reuters, 2025). Hence, the GOOGLE stock AI-driven growth is a rational narrative that has its foundations in reality, outcomes in the form of products (Alphabet, 2024).

Figure 4. Alphabet (GOOGL) Residual (2015-2024). This value is an indicator of the cyclic and robust residual earnings performance of Alphabet, indicating investors’ attitudes towards its AI ecosystem and monetization policy.

Market-Implied Growth & ReOI (ReOI) Analysis

The market-implied expectations for 2025–2027 are summarized:

| Fiscal Year | Projected ReOI ($B) | Scenario Tag |

| 2025 | 84.0 | Achievable |

| 2026 | 92.3 | Achievable |

| 2027 | 100.8 | Achievable |

Interpretation and Growth Drivers

- Very High (2025): Double-digit growth and ReOI≈84.0B will require aggressive profit-margin (PM) uplift and asset-turnover (ATO) acceleration, or, otherwise stated, best possible implementation of Ads and Cloud jointly. It can only happen when AI monetization results in catch-up in large cohorts of clients (Bloomberg Intelligence, 2024).

- Moderate (2026): ReOI ≈92.3B: It means that it stabilizes further AI-assisted mix-shift and incremental ATO gains of maturing Cloud workloads and AI-enhanced ad yield (Alphabet, 2024; Morningstar, 2025).

- Grounded & Achievable (2027): ReOI≈ $100.8B is in line with the history of gains in efficiency, steady adoption of AI – no heroic assumptions and just scale (Alphabet, 2024).

When these PM/ATOs are combined, it means that the market is demanding high, but not implausible, execution. As long as Alphabet can sustain the efficiency increments that come with AI-powered advertising and cloud services, the current valuation can be justified by internally generated operating performance (Morningstar, 2025; Bloomberg Intelligence, 2024). Thus, the GOOGL stock AI driven growth thesis is not purely story-based or fundamentals-based.

Further Reading: Google Stock Prediction 2025: Expert Insights and Forecasts That Could Shape Your Investment Strategy!

AI Economics and Human Psychology in Valuation

Regarding behavioral finance, investors tend to award companies deemed to have AI platforms with network effects and data moats premium multiples (Bloomberg Intelligence, 2024). Alphabet is one of these investors. AI applications in Ads, the Cloud, and consumer products can be replicated, which has led to cash flows that justify optimism, creating a feedback loop between implementation and several (Morningstar, 2025). Unlike the former technology cycles, the present market leaders of AI have already demonstrated the monetization of large-scale AI, which supports the GOOGL long-term stock outlook (Reuters, 2025; Alphabet, 2024). The upshot: GOOGL stock AI driven growth is both operationally implemented and supported by good investor psychology.

Strategic Outlook: 2025–2027

Among all the sensitive applications of Cloud mix, including inference workloads and AI functions built into Search, YouTube, and Workspace, the Alphabet revenue growth forecast is the most sensitive (Alphabet, 2024; Bloomberg Intelligence, 2024). The margins will increase as utilised and software-mix customisability matures with the development of Google Cloud AI strategy and the ongoing proliferation of Ads, continuing to multiply the ROI with the help of AI-enhanced targeting (Morningstar, 2025).

Alphabet will fulfill its expectations with PM/ATO ratios by operating disciplined and not taking extreme assumptions since market-implied ReOI is out of the range of $84.0B (2025) to $100.8B (2027) to meet its expectations. That will help establish a good Alphabet valuation analysis model based on internally visible leverages, as opposed to externally visible expectations for investors. To conclude, the case of artificial trading of the GOOGL stock AI driven growth in the realistic operating environment.

Conclusion

The strategy that Alphabet is pursuing is the smart scale, where the effectiveness of algorithms is the value-creating force. GOOGL stock AI driven growth is not speculative but is operational as evidenced by evidence presented by NOA, OLLEV, RNOA and ReOI (Alphabet, 2024; Morningstar, 2025). With the help of a comprehensive AI ecosystem – advertising, cloud, and platform services- Alphabet has a sustainable advantage in Artificial Intelligence innovation at Google that has a strong monetization (Bloomberg Intelligence, 2024; Reuters, 2025).

Investor psychology prefers such AI executives. As long as the performance of Alphabet has remained in the Moderate to Grounded and Achievable PM/ATO ranges, the value-pride as implied by the market can be validated, in support of a robust GOOGLE long-term stock outlook (Alphabet, 2024).

All calculations and valuation estimates are FinancialBeings’ own, based on data sourced from SEC filings (10K and 10Q), use or reproduction before prior approval is prohibited.

Usama Ali

Usama Ali is the founder of Financial Beings and a self-taught investor who blends classic valuation study with insights from psychology. Inspired by works from Benjamin Graham, Aswath Damodaran, Stephen Penman, Daniel Kahneman, and Morgan Housel, he shares independent, data-driven research to help readers connect money, mind, and happiness.

Disclaimer

The content provided herein is for informational purposes only and should not be construed as financial, investment, or other professional advice. It does not constitute a recommendation or an offer to buy or sell any financial instruments. The company accepts no responsibility for any loss or damage incurred as a result of reliance on the information provided. We strongly encourage consulting with a qualified financial advisor before making any investment decisions.