Introduction

Read about the ET Stock Forecast 2025 (Energy Transfer), growth rates, dividends, and the company’s tendency towards decarbonization efforts. Find out whether or not ET is a good dividend stock to invest in.

Energy Transfer (ET) has become one of the major forces in the energy industry, mainly due to its vast midstream portfolio and various sources of income. In the changing dynamics of the global energy scenario, ET has challenges as well as opportunities at different points such as the continuously rising demand of natural gas and the growing focus on decarbonization and renewable energy. [1]

This article explains ET’s stock prediction for 2025 by evaluating its financial performance, reasonable lucrative number based on growth scenarios, and operation overview. We will also look at the company’s dividend history, concentric revenue growth, and strategies toward sustainability. Although we do not make direct calls to buy or sell, we try to provide you with enough information to make your own decision.

Let’s examine some of ET’s strategies from the perspectives of both the earnings-driven investor and the investor with an eye on growth opportunities in this fluctuating and fast-growing sector.

What is ET Doing for Decarbonization?

Energy Transfer (ET) is slowly shifting its business model toward the changing global environment for energy consumption and distribution by incorporating efforts to decrease its use of fossil fuels while continuing to focus on crude oil transportation.

The company is focusing on the following decarbonization strategies:

Carbon Capture and Storage (CCS)

ET is incorporating pilot projects that will help the company to trap and sequester its carbon emissions. This is in line with its strategy of reducing its adverse environmental effects, and helping its customers reduce their emissions.

Renewable Energy Integration

The ET has been integrating renewable sources of energy to its operations. For instance, it has adopted renewable power systems in some of its centers and considers more prospects for the organization of such systems in pipelines.

Sustainable Partnerships

Through its partnerships, ET works towards understanding new energy systems such as the hydrogen pipeline as well as bi-fuels. These deals are meant to broaden the range of projects in which ET is involved and present the company as an actor in the new, sustainable economy.

Emissions Monitoring

The company uses modern tools to monitor methane emissions in the pipeline systems with the aim of minimizing leakage. This is among goals that the company has set in its course of trying to meet environmental standards and work more efficiently. [2]

Different Segments and Revenues

Energy Transfer is run through segments that bring most of their revenues through the midstream business to make it among the leading players in the industry.

| Segment | Description |

| Natural Gas Pipelines | The largest segment, transporting natural gas through an extensive pipeline network. |

| Liquefied Natural Gas (LNG) | Focused on global LNG demand, providing storage and transportation solutions. |

| Crude Oil Pipelines | Facilitates the movement of crude oil across major U.S. regions. |

| NGL & Refined Products | Handles natural gas liquids and refined products like propane and ethane. |

Segment Highlights

Natural Gas Pipelines

Stable demand for natural gas due to power generation, export especially in the form of LNG is a source of strength for ET. The existence of strong pipeline internal is evident in the regular receipt of cash inflows from this segment. Are you interested in oil market stocks? Here is another big player Exxon Mobil Stock Forecast 2025: Fair Valuation

Crude Oil Pipelines

This segment has continued to be important although it has some challenges such as dwindling oil consumption in some areas. However, these challenges are attributable to long term contracts and strategic locations.

Liquefied Natural Gas (LNG)

ET is diversifying into more geographically dispersed locations so as to take advantage of rising global demand for natural gas as a cleaner source of energy. This segment holds good future prospects as the global energy markets shift from coal & oil.

NGL & Refined Products

In this sense, ET is able to obtain more revenue sources by dealing with value-added products such as propane and ethane while at the same time enhancing the downstream industries such as the petrochemical sector and manufacturing industries.

Thus, the long-term focus on decarbonization combined with diversification of revenue sources is a clear sign that demonstrates that ET aims both to strengthen its positions on the traditional energy market while shifting towards the future growth drivers at the same time. These efforts place ET within a challenging operating environment, in an industry that is progressive.

Shareholder’s Metrics for Energy Transfer (ET)

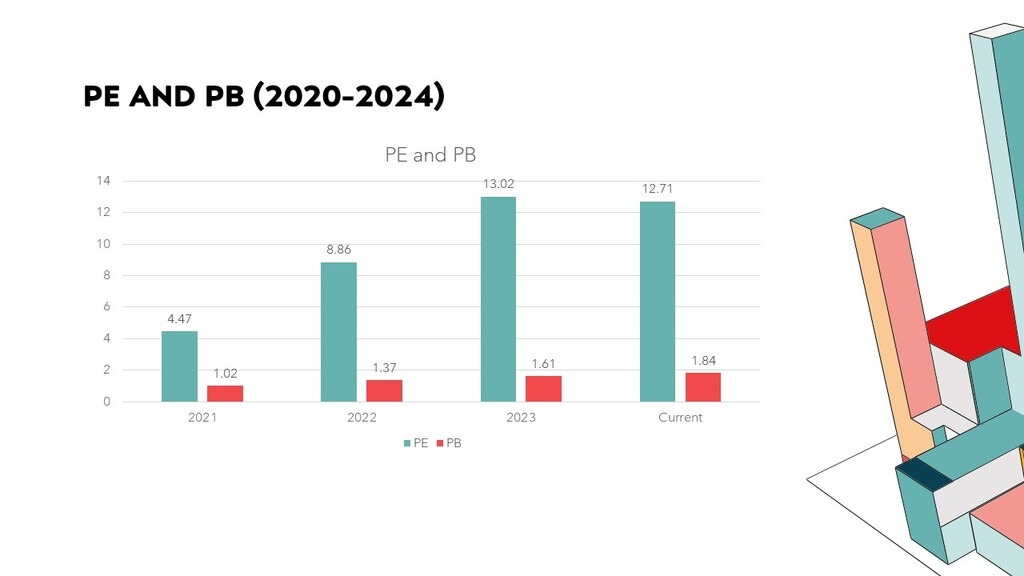

| Metric | 2021 | 2022 | 2023 | TTM (2024) |

| P/E Ratio | 4.47 | 8.86 | 13.02 | 12.71 |

| P/B Ratio | 1.02 | 1.37 | 1.61 | 1.84 |

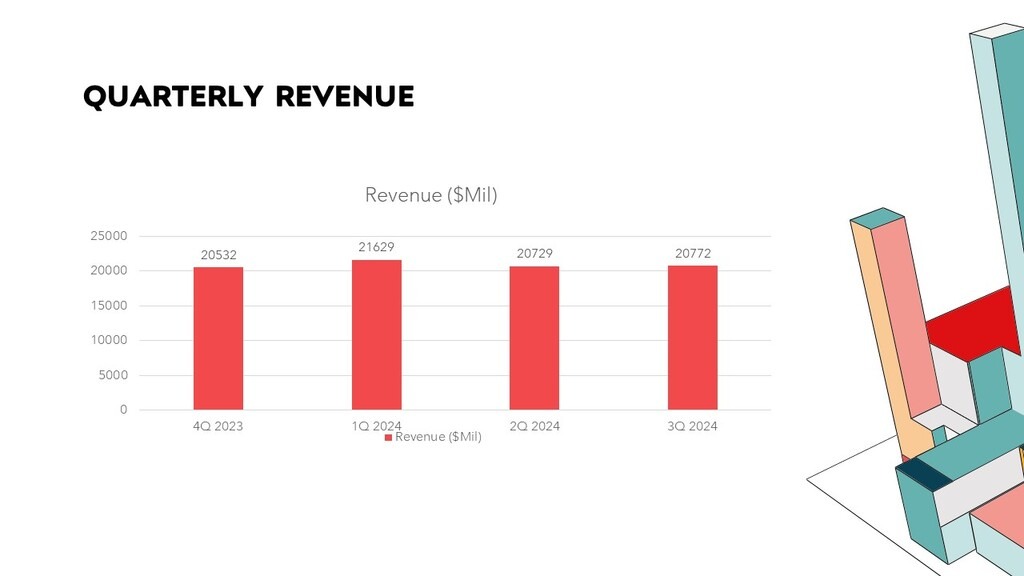

| Revenue Growth | $67.42B | $89.88B | $78.59B | $83.66B |

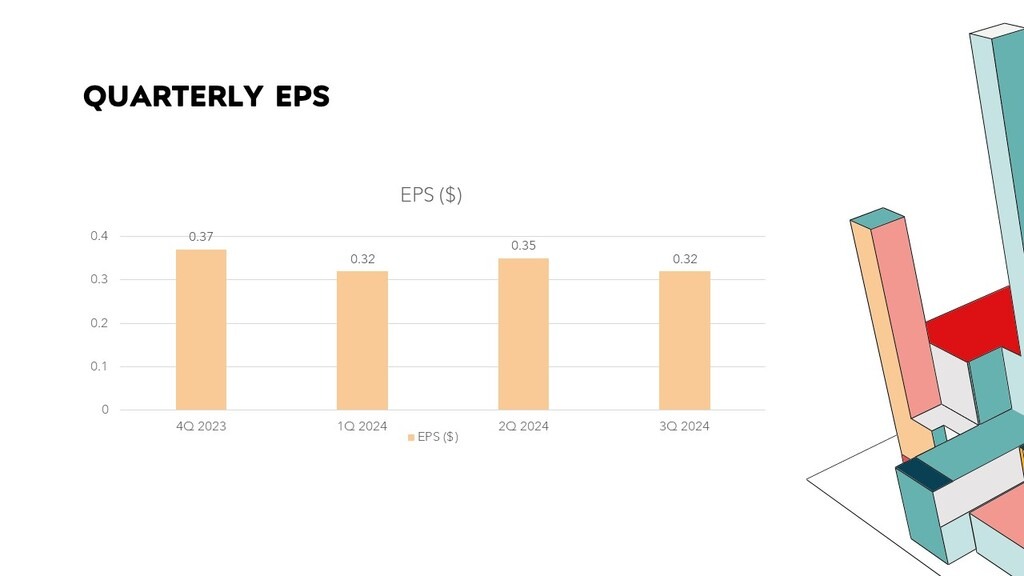

| EPS | 1.89 | 1.40 | 1.09 | $1.36 |

| EBITDA | $12.95B | $12.54B | $12.56B | $15.09B |

| Free Cash Flow (FCF) | $8.34B | -$5.67B | $6.42B | $6.82B |

| Dividend Yield | 7.41% | 7.33% | 8.95% | 6.72% |

Shareholder’s Metrics Analysis

P/E and P/B for Energy Transfer (ET)

With PE ratio of 12.71, ET is neither cheap nor overpriced in its valuation as it provides a nice blend of growth and market risks potentials. PB ratio 1.84 is considered reasonable as ET’s stock is slightly above to its book value during the current high stock market valuations, demonstrating fair valuation with room for moderate growth. [3]

Market Cap

It illustrates the company’s huge size and important place in the midstream energy industry.

Revenue Growth for Energy Transfer (ET)

It stresses significant operational capabilities and ability to respond to emerging market opportunities and challenges. [4]

EPS for Energy Transfer (ET)

It indicates strong and sustainable profit-making and shareholder’s value creation.

EBITDA for Energy Transfer

It refers to sound primary activities and the ability to generate cash flows.

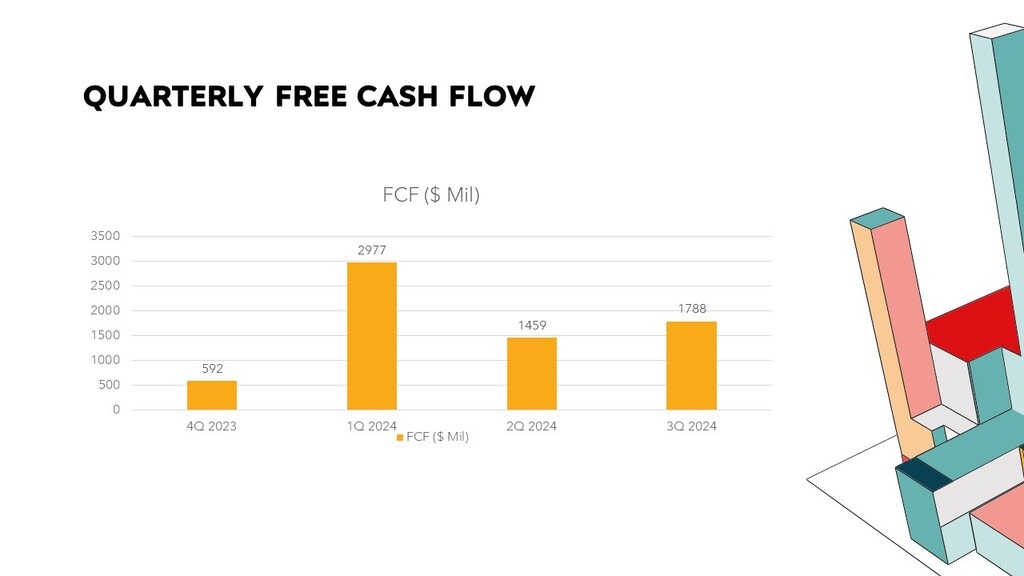

Free Cash Flow for Energy Transfer (ET)

Decreasing growth rates for prior year’s volatility indicates better cash flow management and operating efficiencies.

Dividend Yield for Energy Transfer

Due to its high yield, ET is promising to income-oriented investors since it signifies high shareholder returns. [3]

ET’s’ financial performance shows revenue growth and profitability, shareholder return as significant aspects on a balanced approach. Despite the variation in FCF, the increasing EBITDA as well as consistently growing dividends indicate that ET is still operating as a stable company in energy sector.

Energy Transfer (ET) Price Prediction

| Growth Scenario | Fair Value (Estimated Price Per Share) |

| Low Growth | $11 |

| Medium Growth | $13 |

| High Growth | $15 |

Low Growth

Represents a base case with which ET can achieve low levels of additional revenues or operations growth, which may be due to slow market or industry rates.

Medium Growth

Indicates reasonable growth, suggesting that, while protecting ET’s core operational segments, reasonable increase is also achievable in terms of additional gains from the LNG and decarbonization operations.

High Growth

Leads to competitive and rapid growth approaches due to the increase in revenue, increased efficiency after integration, and success in cleaner energy business models.

These estimates give a range of forecasts for investors to assess ET potential at different market environment stressing flexibility and efficiency.

FAQs

Is ET a Good Investment?

The selection of ET provides investors with stable revenues, reliable cash flow and attractive dividend yield, but at the same time it has risks, such as possible changes in the regulation of the electricity sector, fluctuations in the overall economic environment, and threats that arise due to the transition to a low-carbon economy. It is up to the investor to choose which of the growth scenarios is suitable depending on their tolerance to the risks and the set investment objective accordingly.

Is ET a Safe Stock?

ET has a good and sound business model for revenue generation and safety. However, safety is based on extrinsic factors like the variation in energy cost and volatilities of the energy market. From this perspective, it is relatively safe for dividend investors but may not be good for those who are in it for quick capital appreciate.

Is ET a Good Dividend Stock to Buy?

ET also has quite a good dividend track record and free cash flow is on an uptrend, thus it makes for a good dividend payout company. Nevertheless, the strengths cannot continue to pay out high and sustainable dividends due to fluctuating financial performance and turbulent energy markets.

Conclusion

Energy Transfer (ET) continues to be an attractive stock in the midstream energy space, bolstered by both healthy revenue generation along with the company’s attempts to transition to the new energy economy. The company has a well-diversified revenue stream, consistent EBITDA growth, and has a favorable and attractive dividend yield of 7.18%.

The estimates for fair value ranging from $11- $15 per share shows the company’s growth potential under different growth rates, while providing a picture of the company’s current position that can expand further strategically. Some concerns like cash fluctuations can remain problematic, but ET’s fixed revenue growth over time and its drive to decarbonize indicates adaptability of the company.

As the dynamics of the energy sector keeps evolving, ETs focus on sustainability and the efficient use of resources could go a long way into delivering sustainable returns to its shareholders. Although not a ‘buy’ or ‘sell’ signal, ET is justified to be on investor’s radar for anyone who wishes to maintain a sensible blend of income generation and growth prospects.

**Please be informed that the content is informational and by no means serve as a buy or sell signal. The company is not responsible for the loss of capital.