Introduction

Discover the Dell stock forecast 2025 (DELL) to comprehend the company’s value in terms of fair value estimates, financial characteristics, and growth scenarios. Find out more about Dell’s position within the technology industry and its approach towards innovation.

Dell Technologies Inc. (NYSE: DELL) is one of the leading technology companies, specializing in the technology solutions and offering innovative products that forms a part of larger companies and consumer electronics solutions. Dell has not left any stone unturned in offering every kind of computer – be it consumer-friendly, high-performance devices or intricate business-oriented software. As investors and analysts anticipate the company’s future, the question arises: what could Dell’s stock look like in 2025?

In this blog, we focus on explaining Dell’s financial results, market position, and possible growth prospects for its shares and fix the fair value of the stock. Although we do not give buy or sell signals directly, we present important information on the analyzed company, which in this case is Dell, and its offerings, research activities, and financial parameters. Whether you have invested in Dell or simply have an interest in technology, this guide provides a comprehensive insight into what 2025 may have instore for Dell.

What is Dell Doing in the Technology Sector?

Dell Technologies Company is one of the largest companies in the world of tech and innovation, which adaptively demonstrates its innovation in various industries. These ranges from personal computers to enterprise solutions and emerging technologies, putting Dell beyond the normal laptop and desktop manufacturers. In the following sections, we will analyze major areas of activity and their influence over the tech industry.

Enterprise Solutions: Empowering Businesses Globally

Dell is a reliable business solution provider for any organization that needs the latest technologies for its enterprise. PowerEdge servers are durable, highly secure and are appropriate for those organizations that require extensive computational power. Also, Dell’s integrated EMC PowerStore storage systems provide the means to store and secure data and are crucial especially for companies in today’s data-driven economy. It also specializes in cloud and edge services, providing hybrid cloud services via partnerships with VMware and Microsoft Azure. These technologies help organizations to increase capabilities and performance through the choice of delivery channels, boosting the rate of data analysis, and providing real-time analytics in healthcare, manufacturing, and retail streams. [4]

Innovations in PCs and Laptops

Dell is a market leader in PC and laptop industry and it offers a variety of models and types of products to meet consumers’ necessities.

- For Everyday Users: In general the Inspiron series is a reliable and cheap lineup for those who do not need to have a high-performance system for work.

- For Professionals: The Latitude and Precision series come preconfigured with enhanced productivity features such as multitasking, security and durability suitable for business use.

- For Gamers: The Alienware series stands out due to best graphics and performance designed especially for gamers.

- For Creatives and Power Users: The XPS series can be considered as a high-end line due to more elegant designs and very high display quality for managers and creative workers.

Dell’s continued emphasis on innovation guarantees that the laptops it sells retain their relevance, flagship consumer demands, and developments in the technology market.

Pioneering Research and Development

As a leading technology company, Dell has dedicated research and development centers to ensure it provides the latest products in the market. With a focus on emerging fields, Dell’s R&D efforts include:

- Artificial Intelligence (AI): Integrating Artificial Intelligence on its systems aiming at increasing automation, productivity, and use of predictions.

- 5G and Edge Computing: Designing structures for enhanced data utilization particularly in the areas of increased timeliness and real-time applications.

- Sustainability: Introducing environmentally friendly components and materials into the construction of its goods, energy-saving designs, and using environmentally friendly material and packaging for its products.

- Cybersecurity: Securing data for the future by modernizing services such as Dell Data Protection and enhancing advanced encryption. [4]

Strategic Partnerships

The effectiveness of the integration is complemented through strategic alliances with other industry players in the case of Dell. Microsoft and Intel as well as VMware relationships let Dell collaborative co-design unified solutions for complicated requisite scenarios. These partnerships are critical to providing coherent hybrid Cloud solutions integration, bringing the benefits of increasing hardware performance, and developing AI opportunities.

Beyond Hardware: Software and Services

Dell has gone further to offer additional services and products, beyond its conventional ventures in hardware. The VMware group produces products that specialize in virtualization and cloud computing technology, while Dell provides security measures that protect users’ data from being hacked. Furthermore, every organization needs professional services from Dell through which firms are assisted in the effective installation, deployment as well as management of their technology infrastructure. Know the Price Prediction of the Tech Giant Apple Stock Price Prediction for 2030.

Based on the diversified business model, strategic partnerships, and focus on innovations, Dell Technologies not only satisfies the needs of the world where technology is becoming a key to development but also defines the further paths to the development of digitalization. From individual computing needs to business applications and services, Dell has remained a strong industry player and customer’s solution provider worldwide.

Shareholder’s Valuation Metrics Table

| Metric | 2021 | 2022 | 2023 | TTM (2024) |

| P/E Ratio | 6.49 | 16.97 | 21.13 | 25.52 |

| P/B Ratio | 4.81 | – | – | -34.8 |

| Revenue Growth | $88.7B | $101.2B | $102.3B | $91.84B |

| EPS | 4.22 | 7.02 | 3.24 | $5.43 |

| EBITDA | $9.8B | $12B | $7.7B | $8.74B |

| Free Cash Flow (FCF) | $7.51B | -$0.56B | $5.92B | $3.36B |

| Dividend Yield | – | 2.46% | 1.88% | 1.23% |

Shareholder’s Valuation Metrics Analysis

P/E and P/B Ratio for Dell Technologies (DELL)

A P/E ratio of 25.52 of Dell show the ratio of its stock prices to the earnings, which seems moderate investors have faith in the company’s potential earnings. The negative figure of (-34.8), in the P/B ratio, shows the high liabilities or non-tangible assets in the balance sheet, which had problems of equity valuation. [1]

Revenue Trends for Dell Technologies (DELL)

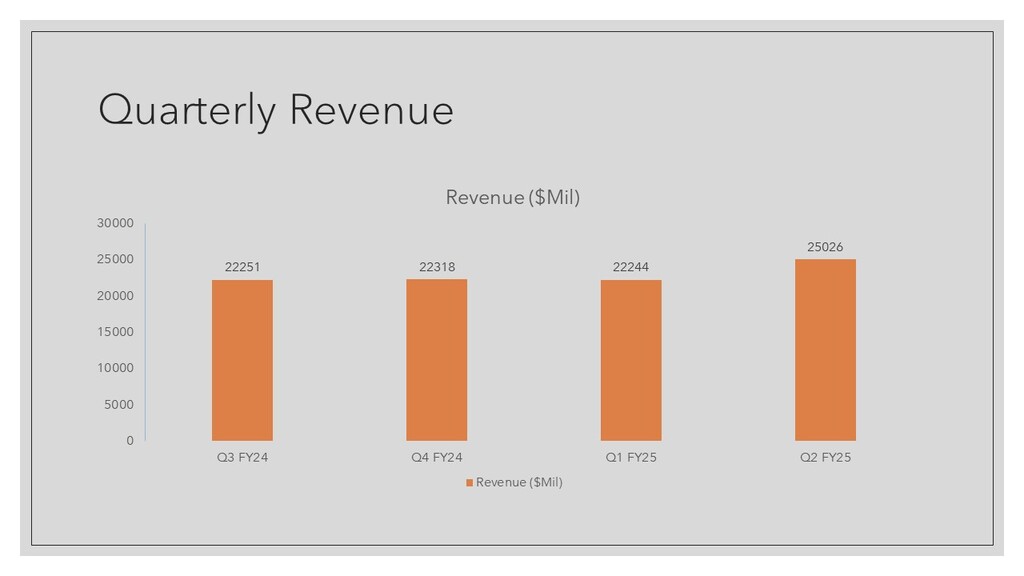

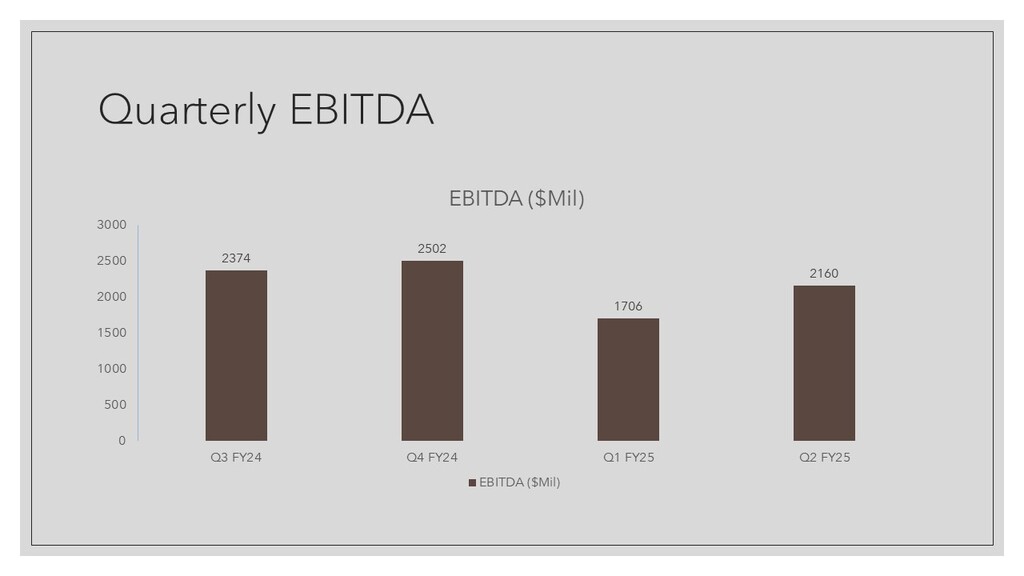

The year-on-year growth in Dell’s revenue was steady in the year 2022 ($ 101.20 billion) and 2023 ($ 102.30 billion) except for a decline in the year 2024 ($ 88.43 billion). It also shows a slight improvement from TTM revenue of $91.84 billion. This implies external market forces or changing market forces affected its revenue generation or top line growth. The Quarterly EBITDA for Dell is

Earnings and Profitability for Dell Technologies (DELL)

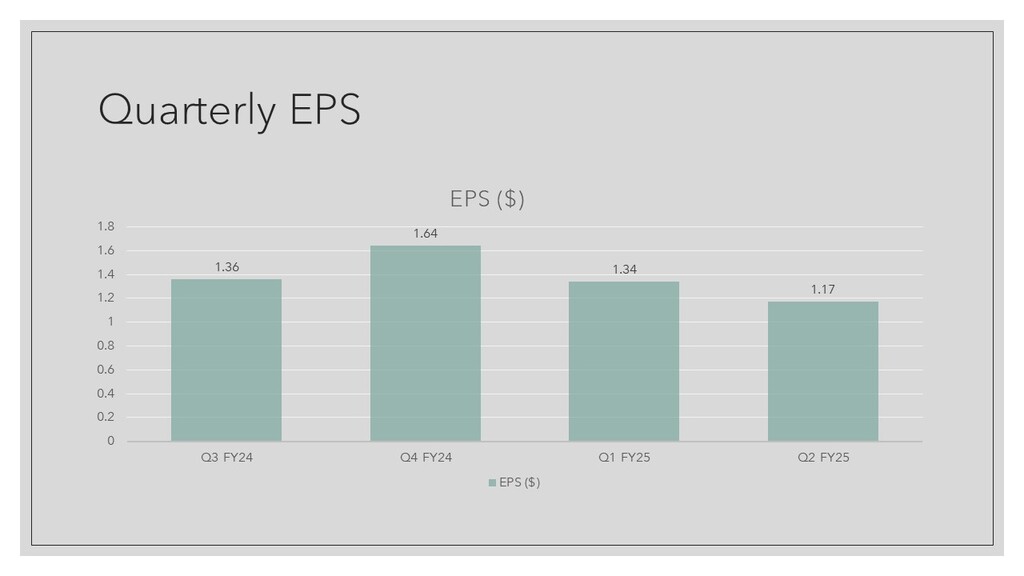

The EPS (TTM) of $5.43 shows the robust earning capacity of Dell and this figure is complemented by the company’s EBITDA of $8.74 billion. These figures show good underlying operating results, which have held up fairly well despite the revenue issues. [2]

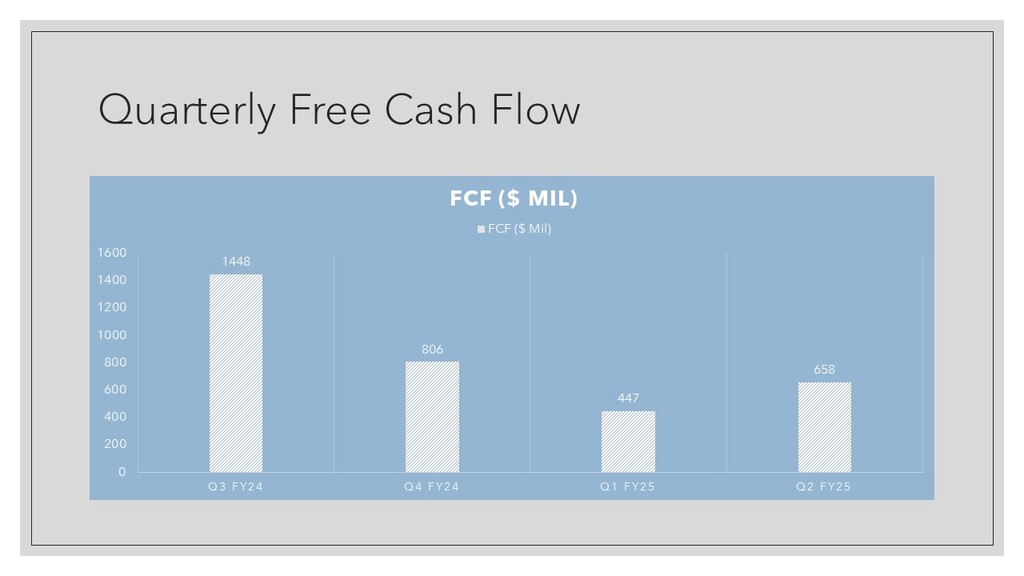

Free Cash Flow for Dell Technologies (DELL)

The free cash flow of Dell has gone through certain oscillations over the last three years, while it was $7.51 billion in 2022, the value became a negative figure of -$0.56 billion in 2023 but again it was $5.92 billion in 2024. The TTM figure of $3.36 billion shows that the firm has enhanced its liquidity circumstance as it seeks steadiness. [3]

Dividends for Dell Technologies (DELL)

For the current year, Dell pays its investors 1.33% as dividend yield, although the focus is on generating reasonable returns to its shareholders and simultaneously, investing in itself for growth prospects.

This financial overview demonstrates Dell’s ability to thrive in a period of macroeconomic downturn with an emphasis on continual investment in future technologies and improvement of current business processes. Although such factors as revenue volatility and issues around valuation should not be ignored, such factors as profitability and recovery of cash flows point to future growth.

Price Prediction for Dell Technologies (DELL)

| Low Growth | $135 |

| Medium Growth | $151 |

| High Growth | $164 |

Dell Technologies’ fair values are based on possible price levels based on the growth opportunities and financiers’ capabilities within the realm of market growth opportunities and performances.

Low Growth

Regarding fair value, which is typical of conservative growth, Dell’s revenue and profit growth rates do not exceed expectations during a period of modest growth. Such a valuation can result from such factors as slow adoption of the enterprise products or services to the market or any adverse economic conditions prevailing.

Medium Growth

In a medium-growth scenario, it is assumed that the company will gradually recover its revenue and EBITDA growth based on the concept of innovation in edge computing, AI, and hybrid cloud solutions. This growth trajectory is suggestive of a fair amount of confidence from investors.

High Growth

In a high-growth situation, Dell continues to leverage on its resource commitments and harness the opportunities created by a burgeoning market for business and consumer solutions. This valuation would be bolstered by a favorable macroeconomic setting and licensing arrangements.

Conclusion

Dell is multinational technology company which operates in wide range of markets across the globe and offers broad selection of products and services that are encompass laptop, enterprise solutions and emerging technologies that include artificial intelligence, edge computing and others. In the light of the fact that revenue and cash flow show some types of variation, Dell has learned how to strengthen its positions by innovation and partnerships. Price per share of the company varies according to growth scenario and ranges from $135 to $164. While the investor confidence is average, Dell’s annual EBITDA of $8.74 billion, positive and improving free cash flows, persistent dividend payments make it fit for growth.

**Please be informed that the content is informational and by no means serve as a buy or sell signal. The company is not responsible for the loss of capital.