Key Takeaways

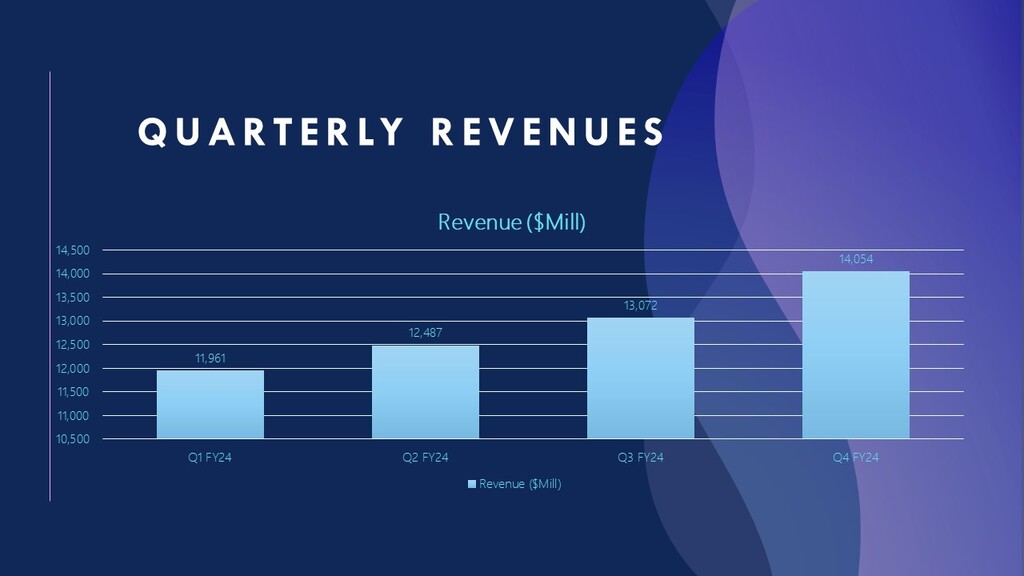

1. Broadcom experienced strong revenue growth in all quarters of FY2024, with Q4 generating the highest revenue of USD 14.05 billion, largely driven by advancements in Artificial Intelligence, semiconductors, and software.

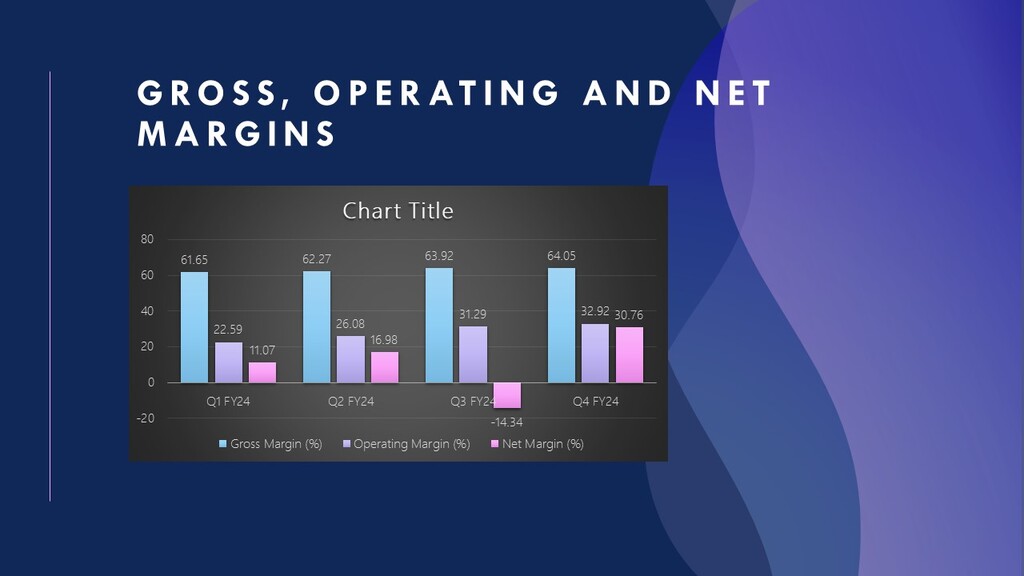

2. The company’s gross, operating, and net margins increased significantly, with Q4 gross margin at 64.05% and operating margin at 32.92%, indicating strong operating expenses throughout the year.

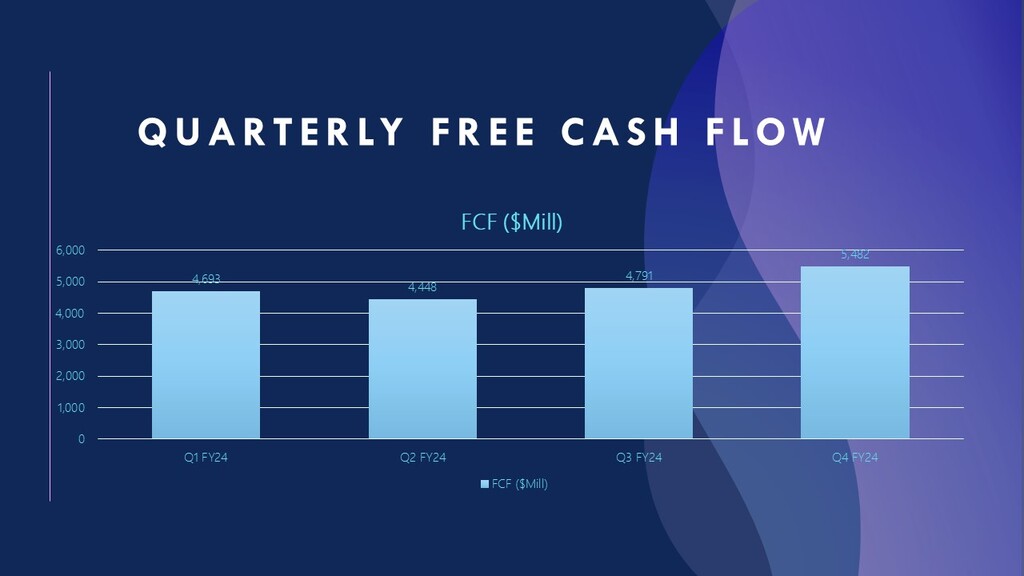

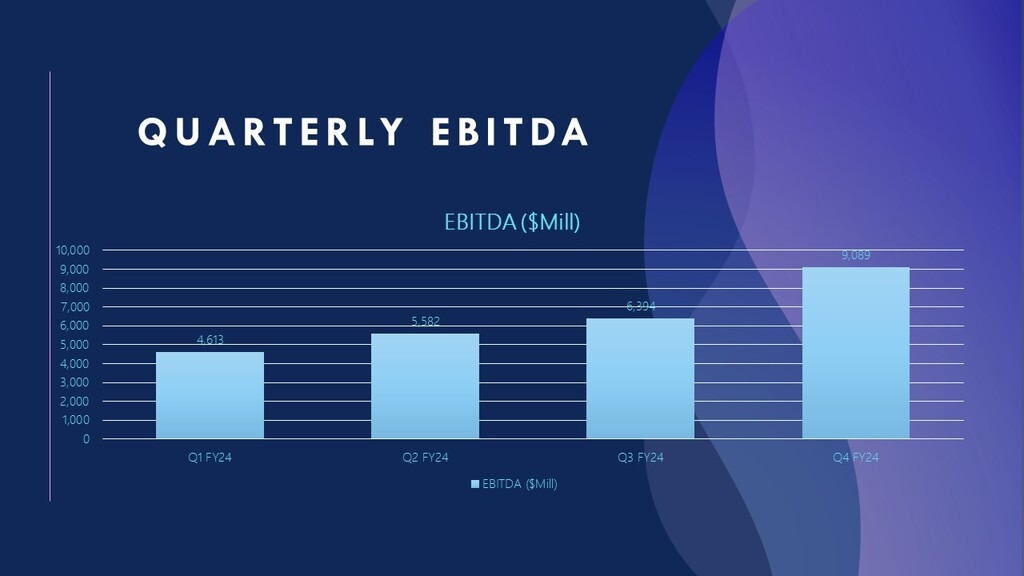

3. Broadcom increased its dividend by 11%, demonstrating its ability to generate consistent cash and shareholder returns, with Q4 earnings of $5.48 billion and EBITDA of $9.09 billion.

4. Broadcom’s high-demand markets offer a competitive edge, allowing it to continue delivering growth and value to shareholders in 2025.

Introduction

Read about Broadcom (AVGO) FY24 earnings summary and price prediction, financial ratios, and fair value estimates. Find out about AI-driven revenue growth, dividends, and the forecast on the stock prices.

Broadcom Inc. is a global technology solutions provider specializing in semiconductor solutions and infrastructure software technologies. Established in 2016, it offers services in Data Center Networking, Broadband Access, Wireless Solutions, Storage, and Enterprise Software.

Broadcom’s semiconductor solutions are used in various sectors, including telecommunications, data centers, and industrial. For enterprises, it provides solutions for application development, security, and IT operations. The company has made significant strides in high-margin markets, a comprehensive IP portfolio, and smart acquisitions, such as CA Technologies and Symantec’s Enterprise Security business. Broadcom has also capitalized on opportunities in Artificial Intelligence (AI), cloud computing, and Internet of Things (IoT) to drive its growth. The company’s increased dividend payouts and strong free cash flows have contributed to its strong shareholder value. [1]

In its fiscal year 2024, AVGO reported its outstanding Q4 earnings figures. A significant increase in AI-generated revenue, targeted acquisitions, and exceptional operations have all contributed to this realization and improved the company’s performance. As a result, Broadcom demonstrated that it is on track for sustained growth by recording the greatest revenue statistics possible and increasing its quarterly dividend by 11%.

This article concentrates on Broadcom’s financial performance for the fourth quarter of FY24, including estimates of revenue, EBITDA, EPS, and margins, as well as the presentation of fair value under various growth rates. This blogpost furher provides both beginner and experienced investors with useful information regarding the potential for Broadcom’s future growth.

Broadcom (AVGO) FY2024 Shareholder’s Metrics

| Metric | 2021 | 2022 | 2023 | 2024 (Q1) | 2024 (Q2) | 2024 (Q3) | 2024 (Q4) |

| Revenue ($ Million) | 27,450 | 33,203 | 35,819 | 11,961 | 12,487 | 13,072 | 14,054 |

| EPS ($) | 1.50 | 2.65 | 3.30 | 0.28 | 0.44 | -0.40 | 0.90 |

| Gross Margin (%) | 61.3 | 66.5 | 68.9 | 61.65 | 62.27 | 63.92 | 64.05 |

| Operating Margin (%) | 31.5 | 43 | 45.9 | 22.59 | 26.08 | 31.29 | 32.92 |

| Net Margin (%) | 24.6 | 37.4 | 42.1 | 11.07 | 16.98 | -14.34 | 30.76 |

| Free Cash Flow ($ Million) | 13,321 | 16,312 | 17,633 | 4,693 | 4,448 | 4,791 | 5,482 |

| EBITDA ($ Million) | 14,691 | 19,155 | 20,554 | 4,613 | 5,582 | 6,394 | 9,089 |

Broadcom (AVGO) FY-24 Earnings Summary and Price Prediction

A financial report of Broadcom for 2021 to Q4 2024 reveals its ability to remain stable and change for the dynamic market condition.

Revenue

Due to the rising demand for semiconductors and software solutions, Broadcom’s revenue increased steadily from 2021 at $27,450 million to $35,819 million in 2023. The overall revenue from testing services increased in FY2024 in line with the quarterly trend, peaking at about $14,054 million in Q4. This demonstrates the degree to which this business may generate a consistent and expanding revenue stream while capitalizing on the rising demands and trends in cloud-based infrastructure, enterprise software solutions, and AI-powered marketplaces. [2]

EPS (Earnings per share)

With its EPS rising from $1.50 in 2021 to $3.30 in 2023, Broadcom has also shown strong profitability in recent years. However, the third quarter of FY2024 had negative EPS of -$0.40, which is most likely the result of unexpected expenses or adjustments. A Q4 return to $0.90 demonstrates Broadcom’s ability to effectively recover from operational inefficiencies and offers additional evidence of its potent earnings-generating potential. Find out about Our 5 Best stocks to invest in for 2025.

Gross Margin

Due to effective cost control and product pricing strategies, the gross margin increased from 61.3% in the year 2021 to 68.9% in the year 2023. In FY2024, quarterly gross margins increased and were on the rise, reaching a Q4 level of 64.05%. This demonstrates that the company can turn a profit despite shifting market conditions and rising costs. [3]

Operating Margin

When the operating margin is shown, it is evident that the operating scalability has changed from 31.5% in 2021 to 45.9% in 2023. Operating margin dropped to 22.59 in Q1 of FY2024 due to higher expenses, but it is now 32.92 in Q4 due to strategic cost control and operational efficiencies. This increased tendency indicates that Broadcom needs to alter some of its own internal processes in order to enhance its operations.

Net Margin

The net margin outlook showed excellent profitability, rising from 24.6% in 2021 to 42.1% in 2023. However, FY2024’s Q3 net margin was significantly worse at -14.34%, which could have been impacted by unusual costs or impairments. This dramatic increase from 30.76% in Q4 shows that the business can control its losses and turn a profit again.

Free Cash Flow (FCF)

The FCF of Broadcom increased steadily from $13,321 million to $17,633 million between 2021 and 2023, demonstrating the company’s ability to produce a respectable amount of cash. FCF during the fourth quarter of FY2024 was $5,482 million, which was again a high level. The company’s ability to fund growth prospects, pay dividends, and settle debts is demonstrated by these types of cash inflows.

EBITDA

The companies’ EBITDA increased from $14,691 million in 2021 to $20,554 million in 2023 as a result of their increased sales and improved operating efficiency. Up to Q4, there was a significant quarterly increase for FY2024, reaching $9,089 million. In order to maintain financial stability and operational expansion, Broadcom must maintain strong earnings before interest, taxes, depreciation, and amortization.

Broadcom (AVGO) Price Prediction

| Growth Scenario | Fair Value per Share | Firm Value |

| High Growth | $291 | $1.38 Trillion |

| Medium Growth | $196 | $932 Billion |

| Low Growth | $133 | $633 Billion |

These valuations are based on projected revenue growth rates:

- High Growth: Assumes continued AI market expansion with revenue growth exceeding current averages.

- Medium Growth: Assumes revenue growth aligns with the 10-year average of 28%-30%.

- Low Growth: Assumes a decline in revenue growth to approximately 22%.

What is the projected price of Broadcom stock?

Due to growth rates and factors affecting the market environment, it is anticipated that the stock price of Broadcom would fluctuate. It is possible that the stock can reach $291 per share, which would result in the company being valued at $1.38 trillion if the high-growth scenario is maintained. There is a huge demand for semiconductors, software solutions, and cloud infrastructure, which has contributed to the company’s valuation of $932 billion.

It is possible that the stock may be worth $196 per share, and the value of the company would be $932 billion if the medium growth rate is only 22%. The company’s stock price can drop to $133 per share, which would result in a valuation of $633 billion if the low growth rate is lower than the average growth rate over the past ten years. In the event that macroeconomic variables improve, new product creation takes place, and successful application of AI systems occurs, the future of the stock is likely to be positive. The capacity of Broadcom to strengthen its dominant position in strategic markets will be the central factor in determining the valuation.

Did Broadcom raise its dividend?

The quarterly dividend that AVGO pays out has been increased by 11%, which is yet another record that the company has established in its shareholder returns plan. A further increase in the dividend, from $0.53 per share to $0.59 per share, was implemented for the fiscal year 2024. This is evidence of the company’s consistent resolve to grow the value of the shareholders. Broadcom’s confidence in its future cash flow prospects is reflected in this dividend hike, which provides some indication of the company’s strong financial health.

After a solid quarter finish in the fourth quarter of fiscal year 2024, the company was able to generate excellent free cash flow as a result of sales in growth areas such as artificial intelligence (AI), market sectors, and enterprise software. This led to the rise. Over the course of several years, the company has proved its dedication to paying dividends, and it has also continued to invest in growth strategies that are appealing. This decision bridges Broadcom’s dividend announcement, which is scheduled to be paid on December 31, 2024, with an ex-dividend date of December 23, 2024. This decision is made in addition to Broadcom’s steadfast commitment to enrich shareholder value.

Conclusion

Broadcom’s FY2024 results show potential for overcoming technological challenges, with superior revenues, margins, and reasonable FCF. The company focuses on core segments like AI, semiconductors, and enterprise software. Despite fluctuations in profits, Broadcom has a solid financial position and regular dividend growth, demonstrating dedication to shareholders. The forecasted stock price ranges between $133 and $291, making it a good investment for social investors and those interested in innovations and AI applications. Broadcom’s status as a dominant competitor in the technology market supports its ability to adapt to future opportunities and challenges.