Introduction

ConocoPhillips Stock Forecast 2025 — Find out how COP will perform compared with other oil majors during the fall of oil prices. Find out the valuation, profit trends and price target that will define its future outlook in 2025. The global energy situation in 2025 implies a gradual transition towards normalisation following the oil boom, following the pandemic. With the supply and demand finally forming a balance, oil prices are slowly calming down since their peaks of many years ago, and that has led investors to reevaluate the sustainability of cash flows, dividends, and valuation multiples of the entire energy industry.

ConocoPhillips (NYSE: COP) is one of the best oil stocks to buy 2025 in this changing oil sector outlook that is characterised by adherence to capital allocation, solid liquidity profile and efficiency in operations.

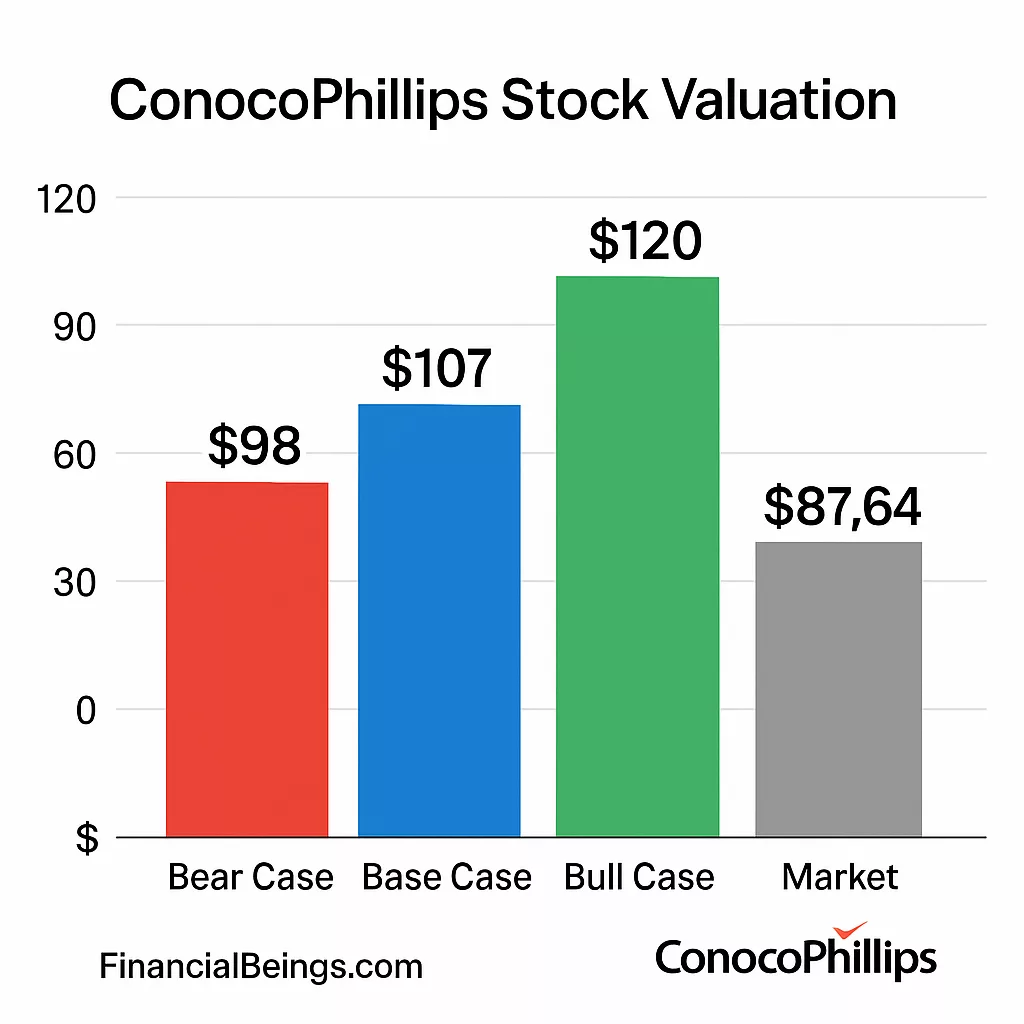

These metrics have been the basis of our ConocoPhillips valuation model that values the three different price performances in 2025: a Bull Case of $120, a Bear Case of $98, and a Base Case of $107. Both of them fit well into the ConocoPhillips price target 2025 range of $ 100-$137, as reported by MarketBeat (2025), to place COP squarely in the range of analyst expectations and have the potential of achieving a full upside at the same time.

In this COP stock forecast analysis report, the researcher probes into the trends in profitability, the sustainable development of dividends, and the market sentiment that will define the future trends of ConocoPhillips. The overall question of the ability of COP to perform in the environment of cooler energy prices is addressed both in quantitative indicators in the valuation and in qualitative drivers in the larger US energy market outlook and energy price trends 2025. The indications indicate that the combination of operational discipline, financial prudence, and strategic foresight in ConocoPhillips continues to provide attractive value to those investors who seek stability and growth in the global oil and gas market.

Profitability and Value Metrics

Return on Sales (TTM): 15.9 %

A 15.9% TTM Return on Sales is an indicator of sustainable profitability in the face of a weaker price. The ratio shows that ConocoPhillips only turns about sixteen cents of every revenue dollar into a profit- excellent in comparison with most of its U.S. E&P competitors. Huge margins contribute to the strength of the firm in the fluctuations of energy prices trends 2025 (Investing.com, 2025).

EV/EBITDA (TTM): 5.2×

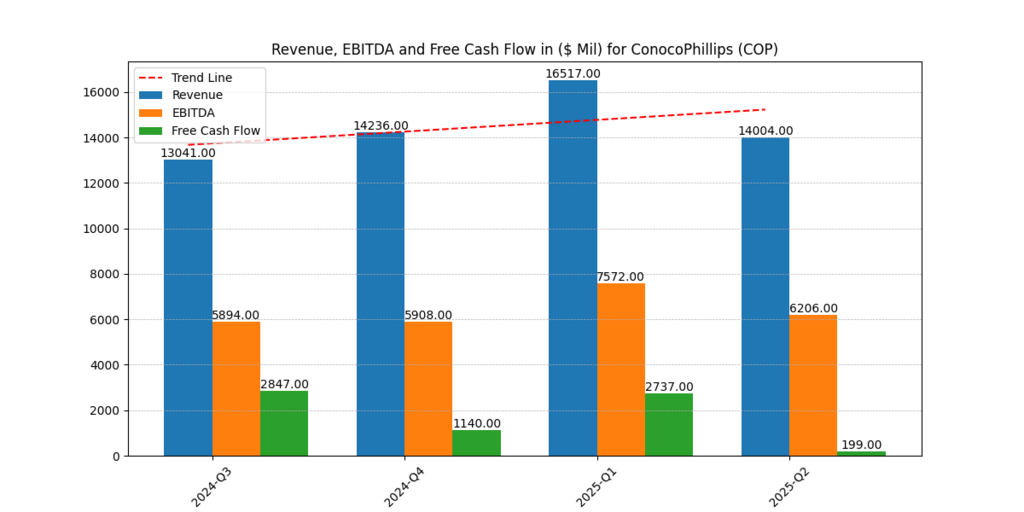

The TTM of EV/EBITDA of 5.2x indicates under-pricing compared to integrated majors. High cash flow and low multiples put COP in a favorable position in the US energy market forecast in 2025 particularly because investors are not concerned with production growth but rather the company with high cash flow yields in free cash flows ( TipRanks, 2025).

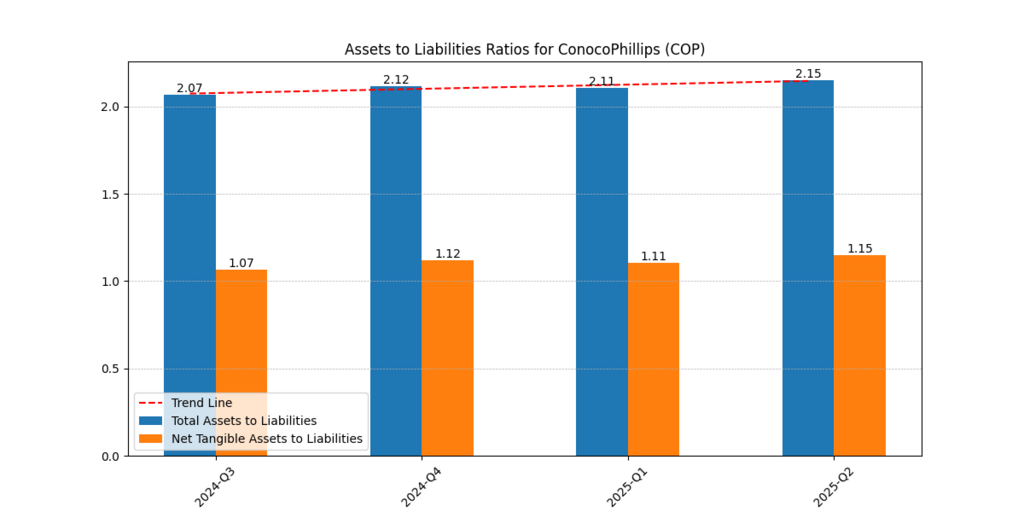

Equity Ratio (TTM): 73.6 %

The conservative capital structure of ConocoPhillips is emphasized by the Equity Ratio of 73.6% TTM. Low leverage also improves the credit quality and judges’ flexibility to future acquisitions or share buybacks without overdepending on debt (Marketscreener, 2025).

FCFE (TTM): ≈ $ 33 Billion

ConocoPhillips has one of the strongest cash-generation profiles in the industry, with Free Cash Flow to Equity (TTM) almost at $ 33 billion. This is a strong FCFE that allows consistent dividends and opportunistic buybacks, which are important components of the ConocoPhillips dividend yield thesis (AlphaSpread, 2025).

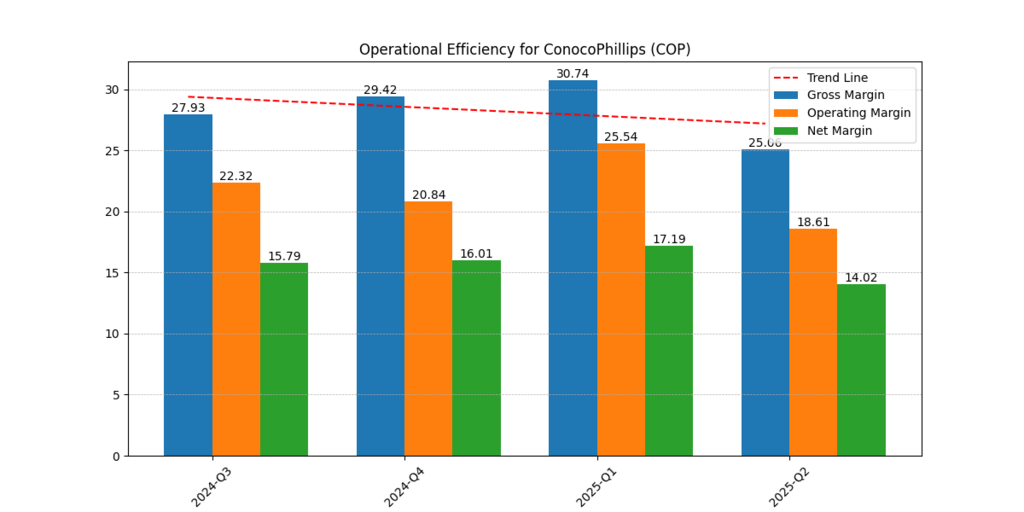

Operational Efficiency and Growth Prospects

The disciplined approach of the company is supported by operational metrics. Despite the rise in the cost of services due to inflation, ConocoPhillips maintained the double-digit margins thanks to the optimisation of the portfolio and integration of technology. Its shale, LNG, and conventional resources in the U.S. have combined forces to provide long-term ConocoPhillips prospects as part of a balanced mix of production.

The company avoids the culture of volumes, but rather returns; the culture of the company is called the efficiency culture, so that the amount of production does not promote and determine performance. Such an orientation is the cornerstone of the COP stock forecast analysis, which is distinguished by ConocoPhillips being a company with a more stable base rather than a leveraged or expansion-oriented company.

Figure 1. ConocoPhillips Profitability Margins (Gross, Operating, and Net Margins %). It depicts stability of the margins and operational efficiency at a Return on Sales (TTM) of 15.9%.

Balance-Sheet Strength and Liquidity

An equity ratio TTM of 73.6 percent represents very high solvency. This financial power allows flexibility to deal with the cycles, fund strategic initiatives, and repurchase the stock when the valuations are favorable. Combined with FCFE≈$33 billion TTM, liquidity is used to cover both dividend and growth expenditures.

This balance-sheet integrity is an increase in investor confidence in a moderating price environment, which is essential in maintaining the positive sentiment in the oil sector outlook 2025.

Figure 2. ConocoPhillips Asset to Liabilities Ratio (2024 Q3- 2025 Q2). The ratio shows that the company is in the strong solvency position and that the equity leverage has been gradually improving within the period covered.

Figure 3. ConocoPhillips Trends in Revenue, EBITDA, and Free Cash Flow (2024 Q3 2025 Q2). The chart shows quarterly revenue and cash-flow changes in favour of the FCFE (TTM) ≈ $ 33 billion analysis.

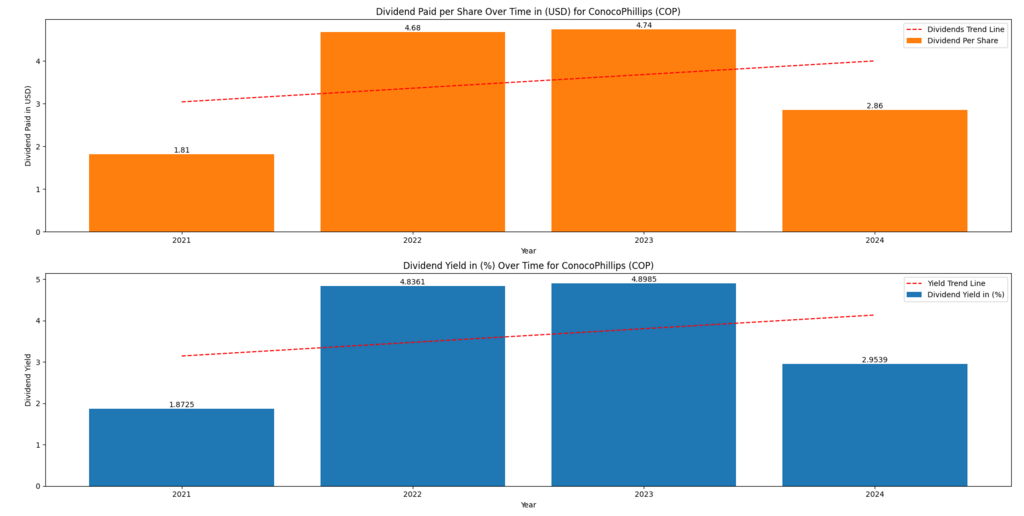

Dividends and Shareholder Returns

The issue of dividend sustainability continues to play a key role in attracting investors. A solid ConocoPhillips dividend yield is based on sufficient free cash flow, which has been higher than peers during good times, and competitive even after normalisation. ConocoPhillips is not expansion-focused, which matches income-oriented investors who want predictability in the entire range of oil and gas investment opportunities (MarketBeat, 2025).

Figure 4. ConocoPhillips Dividends per Share and Dividend Yield (2021 -2024). The graph illustrates the stable dividend policy of the firm and its stability during cycles of oil prices.

The high FCFE makes sure that dividends are not debt-based but internally-funded so that long-term payout credibility is maintained.

Valuation Framework and 2025 Outlook

The ultimate value of a company in the market is a measurement of the cash flows that it is likely to make, its profitability and the feeling that one attaches to the industry that it operates in. In the case of ConocoPhillips, the ConocoPhillips valuation model is a combination of its trailing-twelve-month (TTM) performance ratio, Return on Sales 15.9 % and EV/ EBITDA ratio 5.2× with external market assumptions on the oil prices, discount rates, and peer multiples. This composite system assists in the conversion of operating strength into realistic valuation scales, which would be consistent with analyst forecasts and overall US energy market forecast assumptions.

Analyst Consensus

The independent research companies and investment banks have a moderate positive attitude towards ConocoPhillips. Marketscreener (2025) suggests a median ConocoPhillips price target for 2025 of ≈ $ 115, with a high forecast of $137 and a low forecast of $100, representing the estimates of twenty-six analysts.

Upon superimposing these targets on our own ConocoPhillips valuation model, we find that we are well within the same range, which confirms that the market expectations are aligned with intrinsic-value estimates based on TTM profitability and cash-generation of free-cash-flows. The intersection of the external and internal analysis of valuation adds credence to the COP stock forecast analysis, which gives credence to the best oil stocks to buy 2025, positioning ConocoPhillips in the best position to stand among the best oil stocks to buy 2025 in the current market conditions.

Financial Beings Estimates

| Scenario | Target Price (USD) | Key Assumptions |

| Bear Case | $ 98 | Oil prices remain below $ 70; margin compression; valuation multiple 5×. |

| Base Case | $ 107 | Oil stabilizes around $ 75–80; profitability steady; valuation multiple 6×. |

| Bull Case | $ 120 | Crude recovers above $ 85; investor sentiment improves; multiple 6.5× +. |

The most likely scenario is the Base Case ($ 107). It presupposes that the commodity environment is balanced and the Brent and WTI prices stay between the mid-$70s, the world demand is on course and ConocoPhillips will keep providing good free-cash-flow returns. In this case, valuation multiples would be able to normalize to long-term averages (~6x EV/EBITDA), resulting in a fair-value range that is very close to the median of analysts.

The Bear Case ($ 98) reflects the pessimistic scenario when oil weakens and the attitude towards exploration and production companies worsens, and the Bull Case ($120) is a new optimistic picture of the rise of demand or geopolitical supply disasters. Collectively, these results provide investors with a systematic insight into the prospective risk and reward in the changing oil sector outlook 2025, and despite the conservative scenarios, ConocoPhillips is still bankable and underestimated among the competition.

Further Reading : APA Stock Forecast 2025: Is Apache Undervalued or Overhyped?

Further Reading : APA vs. ConocoPhillips (COP): Which Oil Stock Offers Better Value in 2025?

Investor Psychology and Market Dynamics

Even though the financial indicators of ConocoPhillips remain strong, the movements of the share price are usually influenced by the shifts of the investor instead of solid fundamentals. According to behavioural finance, the sentiment cycles affect energy equities on a large scale: excessive optimism rises fast when prices of oil run high and declines just as fast during a recession. The volatility increases both underpricing and overpricing.

The other behavioural force is confirmation bias, in which investors over-react to the recent news, e.g. quarterly earnings or headlines about oil prices, and under-react to structural strengths, e.g. low leverage and steady FCFE of ConocoPhillips of about 33 billion. This is one reason why a fundamentally sound company may be trading at a level below intrinsic value until some catalyst, like an earnings surprise or dividend increase or an oil-price rebound, compels a mass reconsideration.

Macro Backdrop and Energy Price Trends 2025

The largest number of forecasts in the US energy market forecast predicted that the demand will be moderately growing as the world supply is increasing. Although this puts a limit on near-term upside, volatility prevails as a result of OPEC+ policy and geopolitical risks. Low-cost producers who have high-margins such as ConocoPhillips maintain a competitive advantage in such an environment.

These energy price trends 2025 favour the firms that have robust balance sheets and a low effective cost base. Breakeven at almost $35 per barrel of ConocoPhillips is enough to make the company profitable in almost every conceivable way (Marketscreener, 2025). In this way, the company is still in a position to beat its competitors on risk-adjusted returns despite the global standards levelling off.

Strategic Priorities and Growth Path

The success of ConocoPhillips in the long run will depend on its capacity to balance the returns to the shareholders and strategic reinvestment. Its 2025 road map revolves around four integrated priorities:

- Preserve Capital Discipline: Pursue capital to high-return, low-cost initiatives to maintain the company with a strong free-cash-flow engine. This discipline is what will keep the ConocoPhillips valuation model based on actual cash generation and not on hypothetical growth.

- Increase Shareholder Value: Shareholders Sustain regular dividends and opportunistic share buybacks funded by internal cash flow.

- Advance Low-Carbon and LNG Projects: Selective investment in carbon-capture-and-storage (CCUS), liquefied-natural-gas (LNG), and other transition assets expands the competitive scope of the firm and will be in line with the process of decarbonization throughout the world. These efforts constitute the main pillar of ConocoPhillips growth Prospects in the long run.

- Use digital technologies: Predictive analytics to streamline production, maximise maintenance, and enhance efficiency in the portfolio.

Through its focus on financial strength and innovativeness, COP can prosper in both conventional hydrocarbons and new low-carbon environments: establishing itself as one of the best oil stocks to buy 2025 in a disciplined, future-directed oil sector outlook 2025.

Comprehensive Valuation Summary

| Financial Metric (TTM) | Value | Interpretation |

| Return on Sales | 15.9 % | High profitability for E&P segment |

| EV/EBITDA | 5.2× | Undervalued relative to industry average |

| Equity Ratio | 73.6 % | Low leverage, strong solvency |

| FCFE | ≈ $ 33 Billion | Supports dividends and repurchases |

Our fair-value midpoint (weighted) of $ 108-115 is a statement of positive position in the oil and gas investment opportunities spectrum.

Conclusion

This stock forecast analysis of COP shows that ConocoPhillips is a company with great profitability and a wise management approach to its capital. ConocoPhillips has high margins, low leverage and high free cash flow, which makes it appealing to investors who want to have a balance between income and growth. In a carefully positive outlook of oil industry 2025, COP is among the best oil stocks to buy 2025 with a consistent dividend, optionality in the upside and prudent risk management.

Finally, although the energy price trends 2025 show that the trend will be normalised, the efficiency of ConocoPhillips, its cash generation, and focus on shareholders guarantee the sustainability of its performance in the US energy market forecast. COP also happens to be an excellent investment opportunity among all investment prospects in oil and gas going into 2025, as far as resilience and value creation are concerned, by the investors.

All calculations and valuation estimates are FinancialBeings’ own, based on data sourced from SEC filings and Yahoo Finance.

Frequently Asked Questions (FAQs)

-

What is the price target for COP 2025?

The 2025 price target of ConocoPhillips can be predicted between the values of $98 (Bear), $107 (Base), and $120 (Bull) based on the stability of oil prices, the ability to generate free cash flow, and capital discipline.

-

Is ConocoPhillips a strong buy?

COP is a medium-term investment, as its balance sheet fundamentals are high and shareholder returns are high despite lower oil prices.

-

Is COP a value stock?

Yes. COP is below its intrinsic value estimates, as it is based on stable cash flows and good dividend yield, which made it a compelling value and income investment in the energy sector.

-

What is the future of COP stock?

The future of COP stock is in the recovery of oil demand and efficiency in sustainable production. The perspectives of long-term perspectives are also favourable, which is stimulated by restrained capital expenditure and low-carbon diversification.

Usama Ali

Usama Ali is the founder of Financial Beings and a self-taught investor who blends classic valuation study with insights from psychology. Inspired by works from Benjamin Graham, Aswath Damodaran, Stephen Penman, Daniel Kahneman, and Morgan Housel, he shares independent, data-driven research to help readers connect money, mind, and happiness.

Disclaimer

The content provided herein is for informational purposes only and should not be construed as financial, investment, or other professional advice. It does not constitute a recommendation or an offer to buy or sell any financial instruments. The company accepts no responsibility for any loss or damage incurred as a result of reliance on the information provided. We strongly encourage consulting with a qualified financial advisor before making any investment decisions.