Introduction:

Meta Stock for Long-Term Portfolio — Learn how long-term investments in AI, virtual reality, and the Metaverse can help Meta reinvent its growth by 2030. Explore why META might be the best long-term investment idea among the profitability-focused innovators. Meta Platforms, Inc. (NASDAQ: META) remains a strong contender for inclusion in a long-term portfolio, offering a stable and innovative technology portfolio. Previously known as Facebook and Instagram, Meta has re-packaged itself as a diversified technology company with growing interests in artificial intelligence (AI), virtual reality and augmented reality investments and the Metaverse.

These endeavours are in line with the future of digital ecosystems and immersive computing, making Meta a leader in innovation and a profit generator until 2030 (Meta Platforms, Inc., 2025 10K).

Long-term shareholders respect businesses that are financially strong and visionary. The fact that Meta is trying to build its AI infrastructure, including Llama 3, Reels recommendation engines, and immersive tools via Reality Labs, shows that it is laying the background for the future of digital interaction and yet it has its fundamentals. Therefore, the Meta Stock for long-term portfolio is a calculated investment opportunity for patient investors who are aware of the psychology of long-term compounding and innovation cycles.

Financial Foundation: Balance Sheet Strength

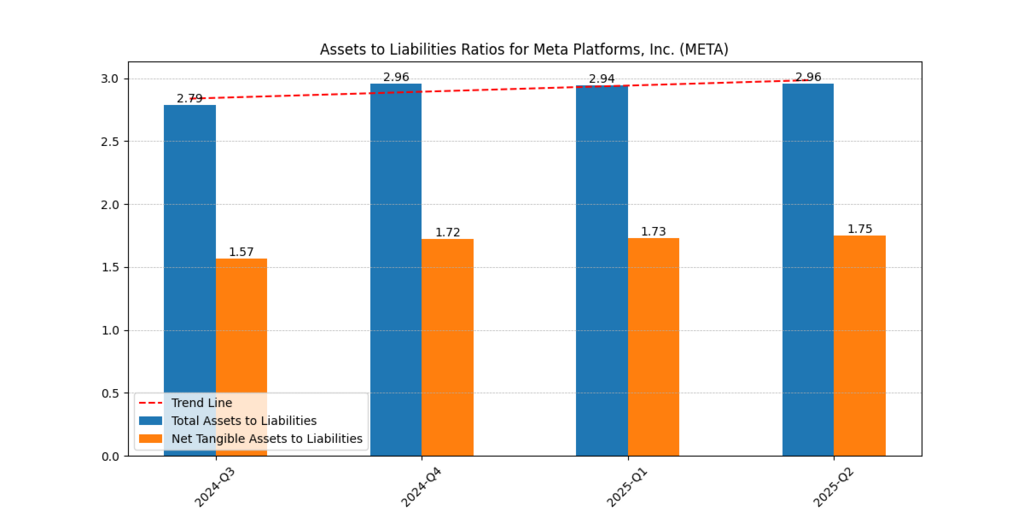

The solidity and liquidity of Meta’s balance sheet are impressive. Its Net Tangible Assets-to-Liabilities ratio increased from 1.57 to 1.75, and its Total Assets-to-Liabilities ratio increased from 2.79 in Q3 2024 to 2.96 by Q2 2025.

Figure 1: Assets-to-Liabilities Ratio (2024–2025)

This pattern emphasises Meta’s low-leverage approach and careful capital management. It has operational freedom and investor confidence because it finances the majority of its projects internally rather than relying on outside financing. According to behavioural finance theory, investors who are risk-averse and want stability but still have access to growth-oriented innovation may find such financial resilience appealing.

Strong liquidity guarantees that Meta can withstand market turbulence, finance AI infrastructure development, and continue share buybacks, all characteristics of a superior long-term investment.

Operational Efficiency and Margin Strength

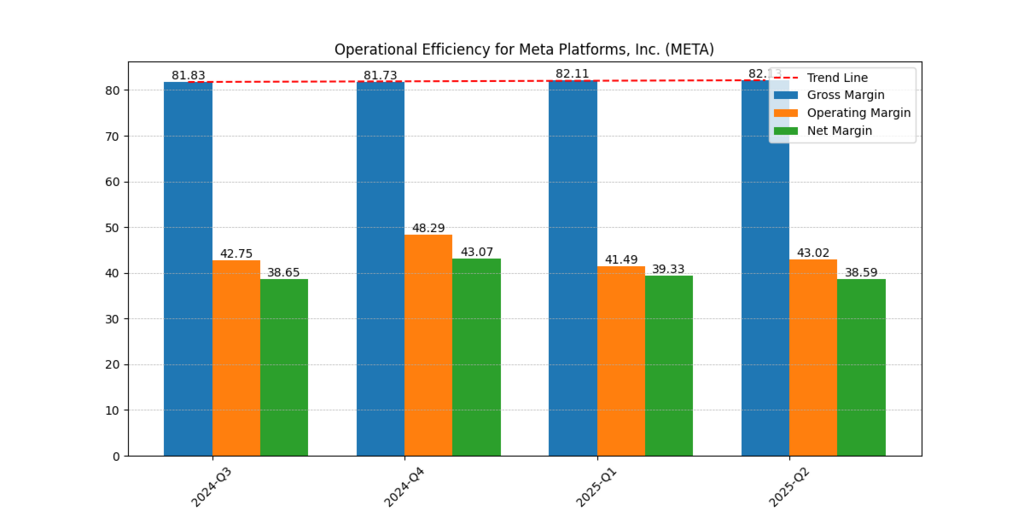

Profitability continues to be a key component of Meta’s operations. Gross margins routinely exceed 81%, operational margins range from 41 to 48%, and net profit margins stay near 39%.

Figure 2: Meta Margins – Gross, Operating, and Net (2024–2025)

These margins demonstrate Meta’s strict cost controls and capacity for effective scaling despite significant R&D expenditures in the creation of AI models and Metaverse technology. Meta continues to maximise campaign accuracy and revenue effectiveness across Facebook parent company Meta, Instagram, and WhatsApp by utilising its AI-driven advertising platforms (Meta Platforms, Inc., 2024 10K).

A protective moat is indicated by such steady profitability since Meta can finance innovation in-house without compromising the calibre of its earnings. This is interpreted by investors as a psychological anchor for trust, particularly in times of tech cycle volatility.

Revenue, EBITDA, and Cash Flow Performance

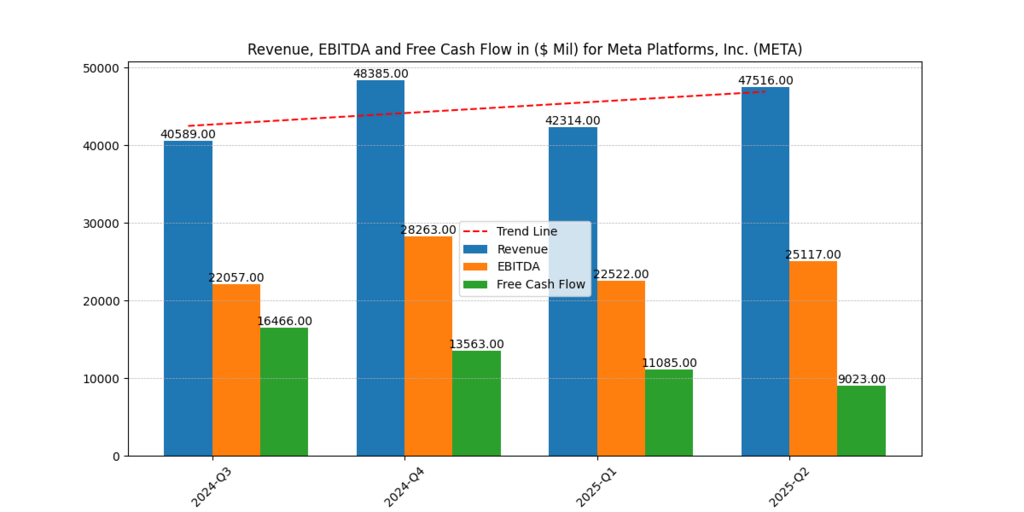

Meta’s investment case is further reinforced by its top-line momentum. EBITDA increased from $22.1 billion to $28.3 billion within the same time period, while revenues increased from $40.6 billion in Q3 2024 to $47.5 billion in Q2 2025. With a range of $9.0 billion to $16.5 billion, Free Cash Flow (FCF) demonstrated a robust internal funding capacity.

Figure 3: Revenue, EBITDA, and Free Cash Flow Growth (2024–2025)

Long-term shareholder value creation is ensured by Meta’s steady FCF generation, which permits capital returns and reinvestment in data centres, AI research, and AR/VR ecosystems. Because regular cash flows reduce short-term volatility, the consistent revenue growth fosters long-term investor confidence and is consistent with the behavioural psychology of “anchoring” and “long-term conviction.”

Profitability: Return on Equity and Capital Efficiency

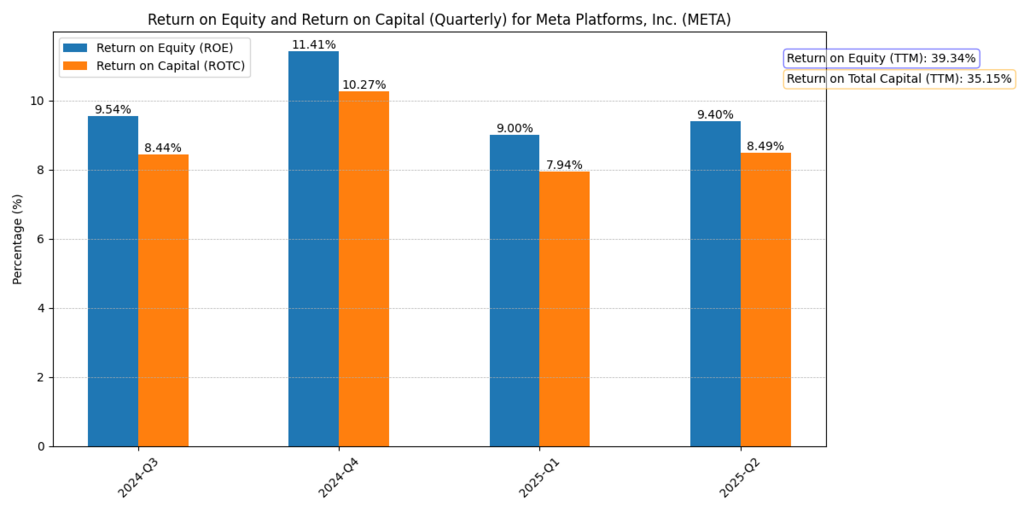

Meta’s operational effectiveness is validated by its Return on Equity (ROE) and Return on Total Capital (ROTC). While ROTC averages 35.1% and the trailing twelve-month (TTM) ROE is 39.3%, Figure 4 shows that ROE averages 9–11% per quarter.

Figure 4: ROE and ROTC Trends (2024–2025)

These strong returns attest to sound profitability in relation to invested capital and effective capital use. Particularly in businesses that prioritise innovation, strong ROE performance frequently indicates a sustained competitive advantage. This constancy strengthens Meta’s reputation as a key portfolio asset and gives long-term investors peace of mind that it can consistently increase shareholder wealth.

Furher Reading : Future Outlook – Meta Stock Price Prediction 2025 and Implications of Q2-2025 Earnings

AI and Metaverse as Long-Term Growth Catalysts

The goal of Meta’s innovation plan is to mature its Metaverse activities while incorporating AI firmly into its ecosystem. While Meta AI business expansion improves user experience and advertising success across platforms, its Reality Labs business continues to lead the way in hardware and mixed-reality experiences.

Meta is a vertically integrated technology powerhouse with investments in AI-driven infrastructure, such as specialised chips and cutting-edge data centres.

Long-term investors see these initiatives as strategic infrastructure plays, much as Amazon’s first logistics expenditures before their enormous returns, notwithstanding the market’s scepticism toward the Metaverse. The company’s VR and AI ecosystems set the stage for Metaverse investment opportunities and AI-driven development in Meta stock, two themes that are predicted to take centre stage by 2030.

Longer-term investors view these projects as call options on future innovation rather than as expenses, rewarding those who can tolerate short-term uncertainty in exchange for long-term gains.

Valuation Analysis: DCF Scenarios

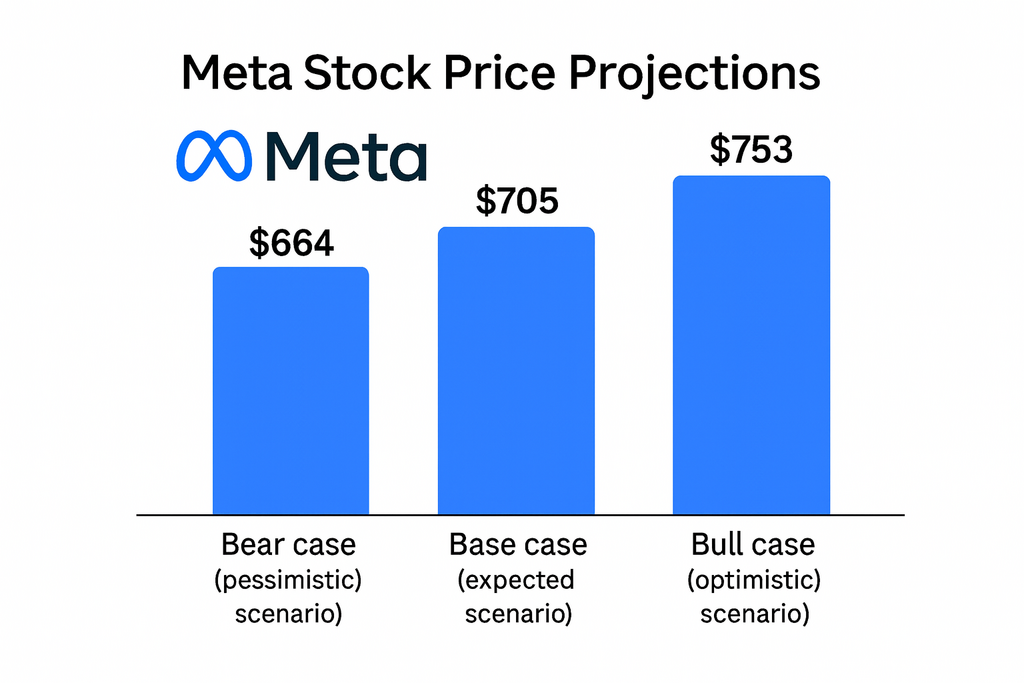

The intrinsic value per share under three growth scenarios—low, mid, and high—is summed up below using the validated Discounted Cash Flow (DCF) models.

| Scenario | Intrinsic Value ($/Share) | Interpretation |

| Low | $664.3 | Conservative case, assuming steady but cautious AI and ad expansion. |

| Mid | $705.1 | Base case reflecting continued ad leadership and measured Metaverse adoption. |

| High | $752.8 | An optimistic scenario where AI and AR/VR synergies are fully realised by 2030. |

These numbers show both substantial long-term potential and downside protection, defining an intrinsic range between $664 and $753 with a midpoint of $705. Even under cautious assumptions, Meta’s intrinsic value is nevertheless well-supported by its fundamentals, as seen by this narrow valuation band.

From the standpoint of investor psychology, well-defined value bands support reason in the face of volatility. Meta Stock Long-term portfolio bases their expectations on intrinsic performance rather than current market emotion by internalising the low-mid-high valuation structure.

Behavioural Viewpoint: Why Meta Fits a Long-Term Portfolio

The justification for including Meta into a long-term portfolio goes beyond financial indicators; it also illustrates a psychological fit with long-term investing ideas. Due to compounding effects and a decrease in emotional trading, behavioural studies highlight that investors who remain engaged over innovation cycles frequently outperform.

Investors can remain devoted to its combination of robust cash flows, profitability, and ongoing innovation. Shareholders are more confident and trusting of the company because of its consistent strategic story, which emphasises AI leadership, immersive social connectivity, and innovation at scale.

Investors looking for the best AI stocks for long-term investors and those who like long-term tech stocks 2025 and beyond will find Meta appealing because it offers both stability and imaginative growth. Thus, owning Meta stock valuation analysis becomes a psychological commitment to patience, self-control, and faith in technological advancement in addition to a financial one.

Conclusion

The two characteristics of a long-term compounder: transformative innovation and operational excellence—are embodied by Meta Platforms. With strong free cash flows, gross margins above 80%, and an asset coverage ratio close to 3× liabilities, Meta exhibits unparalleled financial stability.

Its inherent strength, which comes solely from internal financial modelling, is confirmed by the validated DCF range, which is $664(Low), $705(Mid), and $753 (High). This valuation highlights Meta’s standing as a premier long-term technology investment that provides growth and stability via AI-driven growth in Meta Stock.

In the end, Meta Platforms’ Stock forecast 2030 embodies the contemporary meeting point of innovative vision and financial discipline. Meta provides a strategy for sustainable digital advertising growth trends through 2030 for investors who are prepared to look past quarterly headlines and concentrate on creating intrinsic value.

Frequently Asked Questions (FAQ)

What is the META stock prediction for 2030?

Based on our unlevered methodolgy (focusing mainly on operational performance), we predict the stock price to be between $664 to $753 per share from Bear to Bull scenario.

Will META stock hit $800?

If Meta can maintain higher margins and EPS growth in mid to high teens, it can hit $800. The current AI frenzy and Market run can certainly take the stock even higher, however for us, META has to show higher economic profitability (higher Value Added Earnings) to support higher stock prices.

Is META considered overvalued or undervalued?

The current market price of $734 lies within our estimate (higher end) so we consider the stock fairly valued as well as nearing our higher end estimate of $753.

Usama Ali

Usama Ali is the founder of Financial Beings and a self-taught investor who blends classic valuation study with insights from psychology. Inspired by works from Benjamin Graham, Aswath Damodaran, Stephen Penman, Daniel Kahneman, and Morgan Housel, he shares independent, data-driven research to help readers connect money, mind, and happiness.

Disclaimer

The content provided herein is for informational purposes only and should not be construed as financial, investment, or other professional advice. It does not constitute a recommendation or an offer to buy or sell any financial instruments. The company accepts no responsibility for any loss or damage incurred as a result of reliance on the information provided. We strongly encourage consulting with a qualified financial advisor before making any investment decisions.