Shareholders who want high income and are not willing to invest much capital usually resort to low-cost dividend stocks under $10. The latter are shares of the relatively low-priced companies which pay regular cash dividends to their shareholders. These investment products are also attractive in that they present two ways of earning returns, namely a constant flow of earnings in the form of dividends and a potential for capital gain when the value of the stock rises or increases over some period (Dividend.com, 2025). Retail investors, income-oriented funds, and diversifiers that want to avoid over-concentrating in one issue may also be especially interested in low-priced dividend stocks.

Five companies are analysed in this discussion, chosen by their history of dividends, their yield curve, and their attraction to various businesses: Ellington Credit Company (EARN), Nokia Oyj (NOK), Orchid Island Capital (ORC), VAALCO Energy (EGY) and Western Union (WU). We shall look at their dividend history, payout trend, and other critical financial measures, including Return on Assets (ROA), Return on Sales (ROS), financial leverage and equity ratio. In this way, it will aim at providing income-seeking investors with the information needed to determine which stocks have a balance of yield, stability, and prospective long-term gains in the right proportions (MacroTrends, 2025a).

The first justification as to why most of the dividend stocks under $10 can afford to pay sound dividends is that the share price is not the only factor that defines the dividend policy of a firm. Other companies hold niche markets or cyclical business environments where profits vary; however, the management ensures constant high dividends to attract investors as well as retain them even at low growth rates.

There can be other exceptions, short-term sentiment in the market, market recessions in a specific sector or geographic risk, but with stable cash flows that sustain regular payouts. Such a situation provides opportunities to the shrewder investors to gain higher yields as well as have the chance of enjoying the rise in price in case of improved conditions in the market.

Ellington Credit Company (EARN)

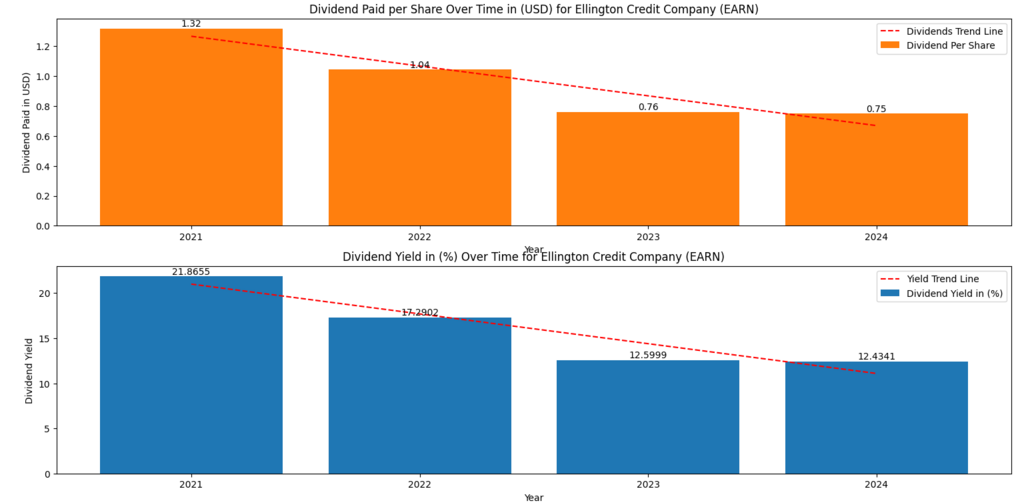

Ellington Credit’s dividend per share fell from $1.32 in 2021 to $0.75 in 2024, while its yield dropped from 21.87% to about 12.43% (MacroTrends, 2025a). This decline, coupled with a recent strategic pivot from REIT status to a CLO-focused model (MarketWatch, 2024), has raised questions about payout sustainability.

Figure 1: Ellington Credit Company (EARN) – Dividend Per Share and Dividend Yield Trends, 2021–2024.

Financially, EARN posted a Return on Assets (ROA) of 0.69% in 2024 (MacroTrends, 2025a) and a debt-to-equity ratio of approximately 3.25:1 (MacroTrends, 2025b). While leverage remains high, the company’s shift in asset strategy could improve margins if successfully executed. However, given its negative historical profitability and fluctuating dividends, EARN remains a high-yield but high-risk play among dividend stocks under $10.

Nokia Oyj (NOK)

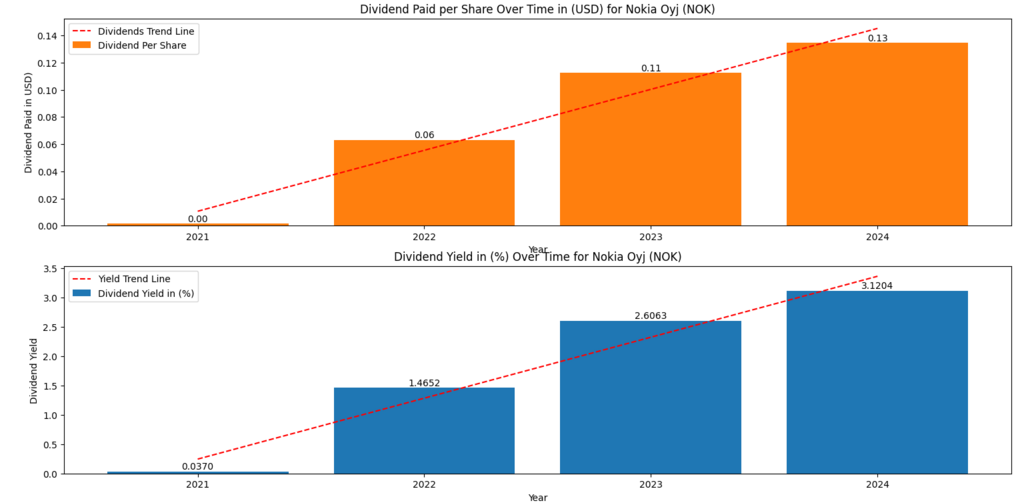

Figure 2: Nokia Oyj (NOK) – Steady Dividend Growth and Yield Improvement, 2021–2024.

Nokia has shown a consistent dividend growth, where its payment broke zero dollars back in 2021, and reached the 0.13 dollars per share in 2024, jumping up its yields to approximately 3.12 per cent (Fidelity, 2025; DividendStocks.Cash, 2025). Its payout ratio is about 83 per cent to properly strike a balance between the returns of its shareholders and earnings to use in its investments in growth (Fidelity, 2025).

Nokia offers a yield of 3.9-4.5 per cent (according to forward estimates), which demonstrates a stable cash flow at the telecom infrastructure featuring company. Nokia is a decent option among dividend stocks below $10 because its affordability and reasonably stable dividend make it a solid choice among investors who do not necessarily have high demands for yield.

Orchid Island Capital, Inc. (ORC)

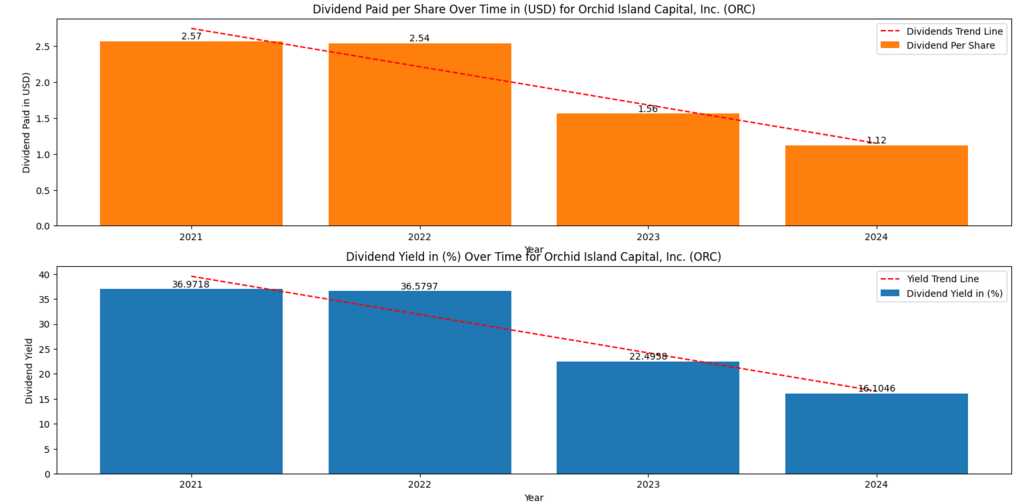

The dividend per share of ORC declined by $2.57 in 2021 to $1.12 in 2024, and the yield decreased by 36.97 per cent and about 16 per cent. Even though it remains high relative to averages in the sector, the negative trend is an indicator that might indicate difficulties in maintaining such payouts in adverse interest rate conditions.

Figure 3: Orchid Island Capital (ORC) – Dividend Per Share and Yield Compression, 2021–2024.

A recent report puts the financial leverage at 8.35 and the equity ratio at 12.04%, suggesting that ORC is less resistant to any change in the cost of funds (MacroTrends, 2025a). To an aggressive income investor, ORC can provide high yields in the short-term; however, it has high long-term risk.

Further Reading : Best Dividend Stocks to Buy Now for a Balanced Portfolio During a Market Crash

VAALCO Energy, Inc. (EGY)

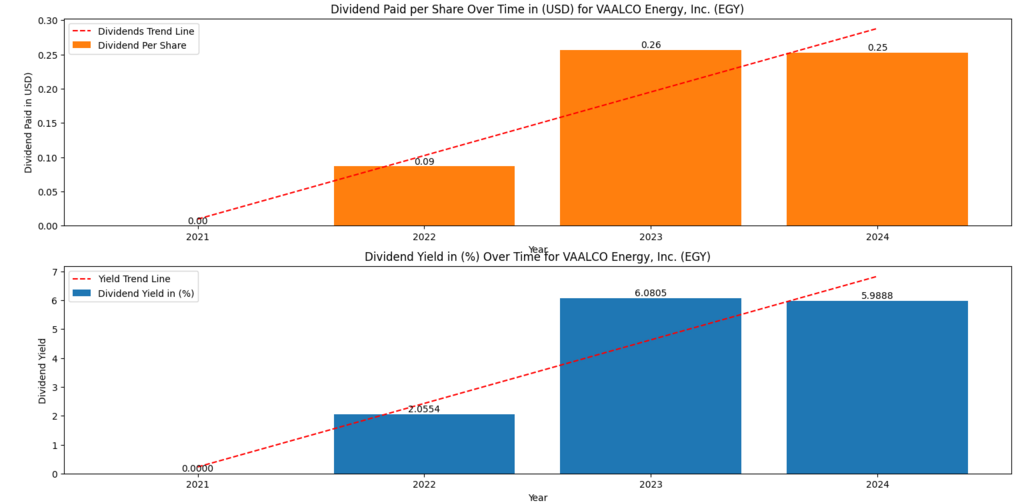

Figure 4: VAALCO Energy (EGY) – Dividend Growth and Yield Expansion, 2022–2024.

After it started paying dividends in 2022 at the rate of 0.09/share, VAALCO has increased payouts to 0.25 in 2024, raising its yield to almost 6% (Dividend.com, 2025). The strong commodity prices and sound cost controls have enabled this.

The high equity ratio of EGY 77.08% indicates the financial strength of the company, whereas its low leverage of 1.89 would allow the company to make further expansions or acquisitions in future (MacroTrends, 2025a). Consequently, EGY becomes one of the best-balanced decisions of the dividend stocks under $10.

The Western Union Company (WU)

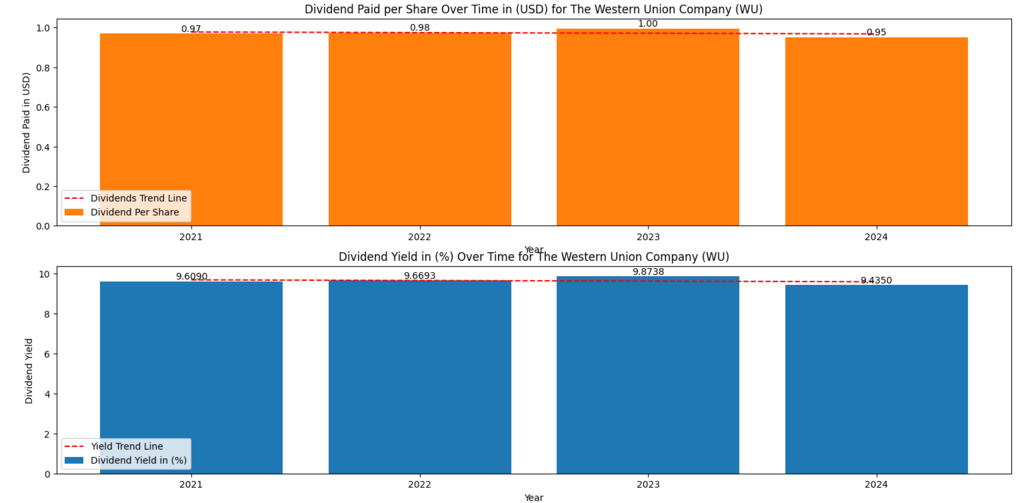

Western Union has been using dividends with a similar level of $0.95 to $1.00 per share since 2021 to 2024, thus keeping the yields at 9-10 percent (Dividend.com, 2025).

Figure 5: Western Union (WU) – Stable Dividend and Yield Maintenance, 2021–2024.

The financial overview indicates a high Return on Sales (21.84%) and high level of ROA (11.22%), but also a high level of leverage (9.04) (MacroTrends, 2025a). Such stability and predictable payout qualify WU as one of the most reliable dividend stocks under $10 that can be relied upon by conservative investors.

Comparison Table: Core Financial Metrics

| Ticker | Return on Sales (%) | ROA (%) | Financial Leverage | Equity Ratio (%) |

| EARN | -111.69 | 0.69 | 3.25 | 30.59 |

| NOK | N/A | N/A | N/A | N/A |

| ORC | 26.42 | 0.08 | 8.35 | 12.04 |

| EGY | 7.73 | 4.02 | 1.89 | 77.08 |

| WU | 21.84 | 11.22 | 9.04 | 24.32 |

Supplemented with MacroTrends (2025a, 2025b).

Investment Insights

Investors need to consider stability in terms of yield, an indicator of the balance sheet, and sector dynamics when screening dividend stocks under $10 (Dividend.com, 2025).

- High yield/high risk combination: EARN and ORC offer 10- to 15-per cent yields with volatility.

- Positive Outlook with growth: NOK and EGY have an equal outlook.

- Consistent revenues: WU provides consistent payments.

A diversified portfolio among these profiles can assist in maximising the revenues and long-term growth prospects (MacroTrends, 2025a).

Conclusion

The analysis of low-priced dividend stocks under $10 shows that low share prices do not always mean low earning potential. All five reviewed companies, such as Ellington Credit Company (EARN), Nokia Oyj (NOK), Orchid Island Capital (ORC), VAALCO Energy (EGY) and Western Union (WU), provide specific combinations of yield, financial health, and risk profile. EARN and ORC look more attractive to folks who can handle greater volatility because they are high-yielding, and NOK and EGY are the most balanced, as their high potential growth is combined with regular dividends. WU, however, can be viewed as a reliable choice for investors who focus on stability and stable cash flows.

However, investors ought to pay constant attention to the sustainability of payouts, leverage and the wider market conditions as these can have a direct impact not only on the regularity of the dividends, but also on share price performance.

Disclaimer

The content provided herein is for informational purposes only and should not be construed as financial, investment, or other professional advice. It does not constitute a recommendation or an offer to buy or sell any financial instruments. The company accepts no responsibility for any loss or damage incurred as a result of reliance on the information provided. We strongly encourage consulting with a qualified financial advisor before making any investment decisions.