Following its Q2 FY25 earnings release on May 1, 2025, investors are asking the crucial question: Should I Purchase Apple stock? Apple Inc. (AAPL) is still making news. This article examines Apple’s recent performance, prognosis, and investment potential using a combination of graphic financial analysis and reliable market research (Morningstar, 2025).

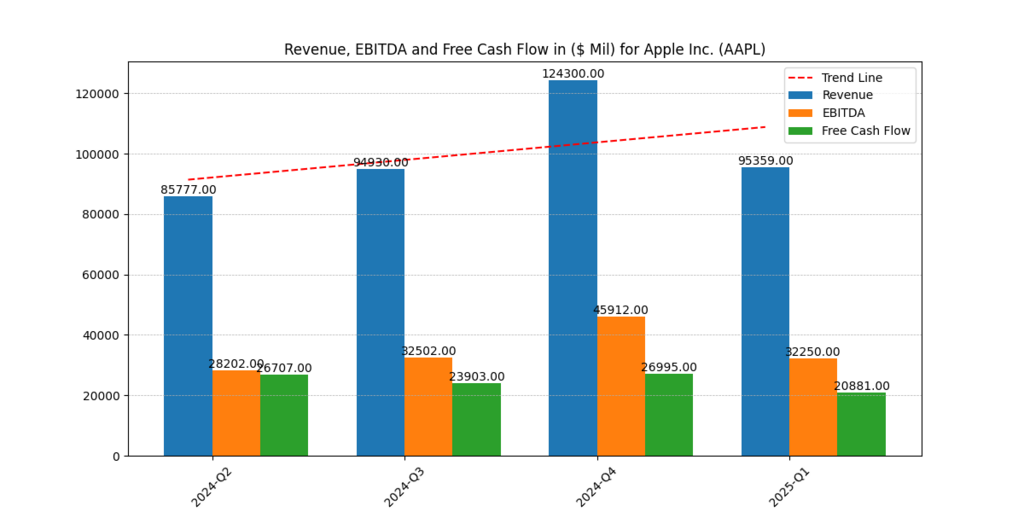

Revenue, EBITDA, and Cash Flow Trends Remain Positive

Apple made $124.3 billion in Q4 FY24 and $95.4 billion in Q1 FY25. The quarterly variations are consistent with Apple’s seasonal sales trend, even if revenue decreased sequentially. The general tendency is still upward (Morningstar, 2025).

Earnings Before Interest, Taxes, Depreciation, and Amortization, or EBITDA, has also been steadily rising, reaching a high of $45.9 billion in Q4 of FY24. In the meantime, free cash flow, a crucial measure of financial flexibility, kept the company over $20 billion over the quarters, demonstrating Apple’s capacity to provide dividends and buybacks to shareholders.

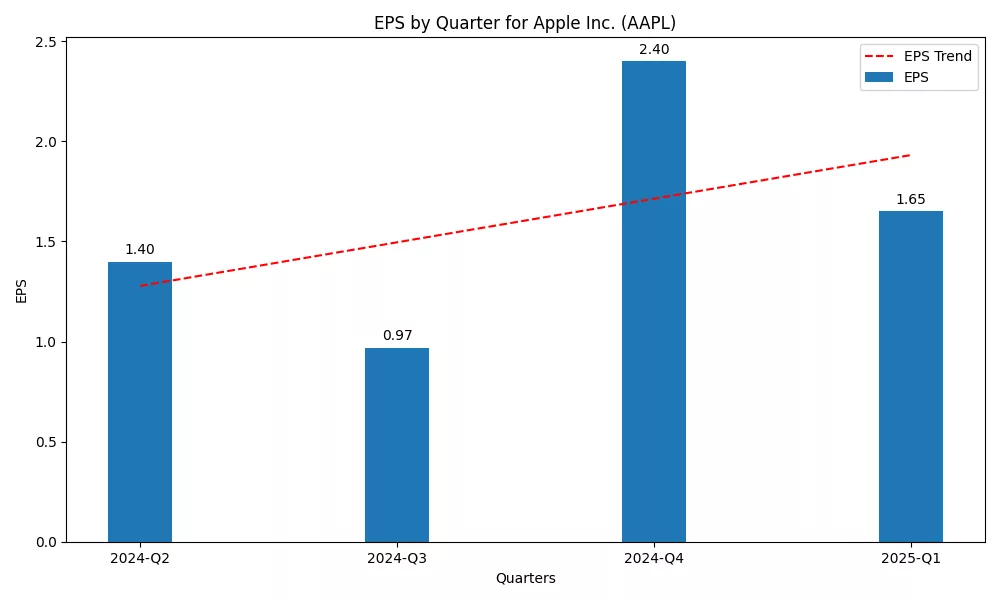

Strong EPS Growth Signals Investor Confidence

Apple’s Q2 FY25 earnings per share (EPS) of $1.65 represented a 7.84% rise over the same quarter the previous year. Interestingly, the outcome was in line with analysts’ consensus projections, suggesting consistency and trust in Apple’s ability to predict outcomes despite fluctuations in the worldwide market.

The larger trend is more fascinating. Apple’s seasonal strength was seen in the Q4 FY24 EPS rise to $2.40. High product releases and high service demand support the company’s earnings momentum, which is confirmed by the increasing EPS trendline. This is a sign of long-term progress, according to analysts. Another AI Giant Microsoft and it’s analysis can be found here!

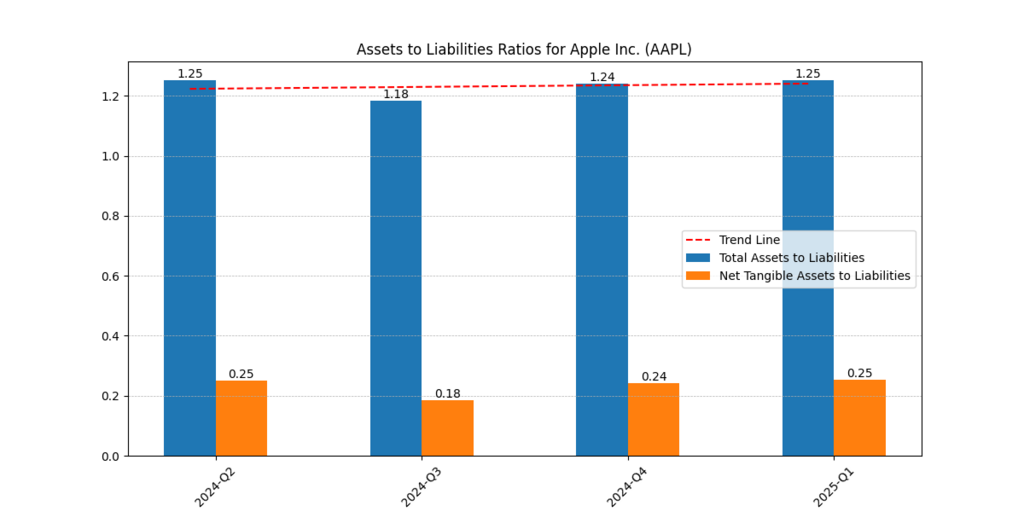

Healthy Financial Structure and Resilience

Above 1.18, Apple’s assets-to-liabilities ratio has stayed steady, reaching a high of 1.25 in both Q2 FY24 and Q1 FY25. This demonstrates Apple’s sound financial standing since it has a comfortable surplus of assets over liabilities.

At about 0.25, the ratio of net tangible assets to liabilities is, nevertheless, quite modest. This illustrates Apple’s substantial investment in intangible assets, such as software and patents, which is characteristic of a tech behemoth. Despite this, the business’s strong balance sheet allows it to continue innovating without taking on too much debt.

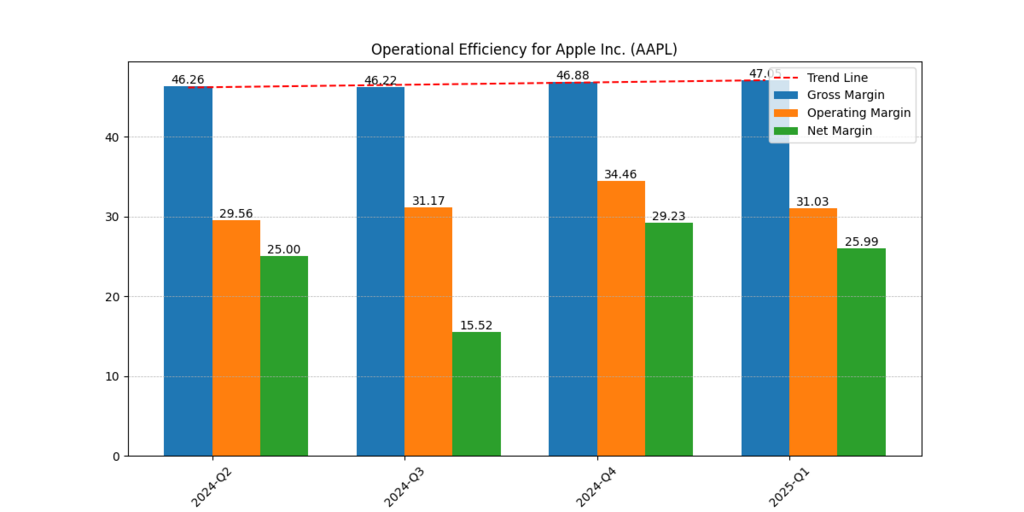

Margin Expansion and Operational Excellence

Apple continues to operate with the highest operational efficiency. Apple reported a gross margin of 47.05% in the first quarter of FY25.

• The operating margin stood at 31.03%.

• The net margin was 25.99%.

These margins, which are better than those of many sector peers, show a strong ability to turn revenue into profit. Apple’s pricing strength and supply chain efficiency are highlighted by the stability of gross margins around the 46–47% mark. In the meantime, net margin recovery following a decline in Q3 FY24 indicates better revenue growth and cost control.

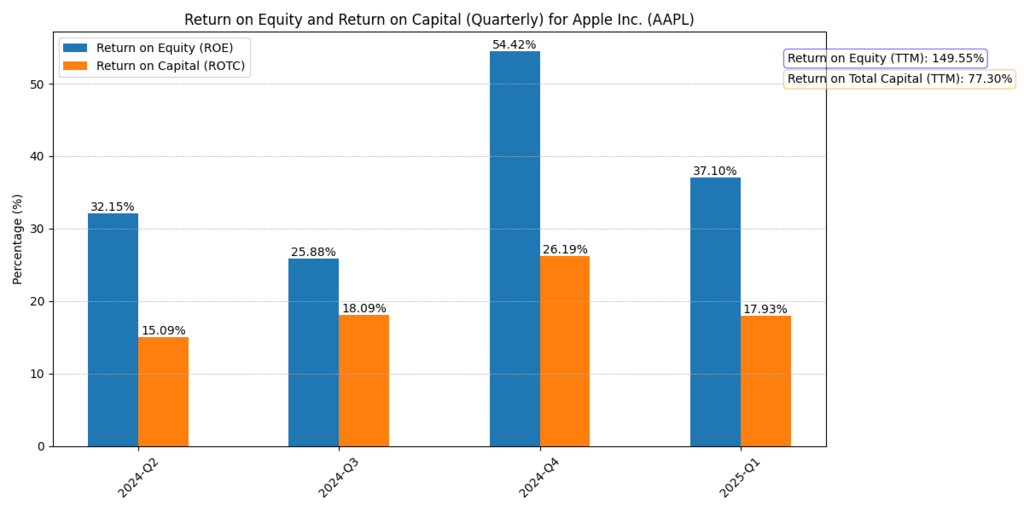

Return on Equity Signals Exceptional Shareholder Value

The return on equity (ROE), a crucial indicator of financial success and shareholder returns, is arguably the strongest argument in favor of buying Apple shares. A remarkable TTM ROE of 149.55%, which reflects effective capital use and shareholder value development, was announced by Apple.

More impressively, analysts predict that ROE would climb to 188.73% in FY25 and 201.29% in FY26 and reach. These numbers highlight Apple’s dominant profitability trend and significantly outperform average ROEs in the tech industry. Strong stock performance is typically correlated with such high ROEs, which makes Apple a great choice.

Analysts’ Forecast: Price Upside Potential

43 analysts have set 12-month price goals for Apple Inc. based on recent forecasts:

- Low Estimate: $141.00.

- High Estimate: $300.00.

- Median Price Target: $235.00.

Strong analyst confidence is confirmed by the median price target, which offers a significant upside from Apple’s current trading range. According to the Financial Times, Apple’s expanding ecosystem, rising services income, and growing investments in AI are probably going to support the company’s ongoing growth.

Final Verdict: Should I Purchase Apple Stock?

Taking into account Apple’s:

- Strong trendline and steadily increasing EPS.

- Sound balance sheet with adequate asset coverage.

- High and increasing return on equity (expected to reach >200% in FY26).

- Strong cash flow and steady margins.

- Optimistic analyst pricing projections and profitability that lead the industry.

The answer seems to be in the affirmative—Apple is still a great long-term investment, particularly for those looking for exposure to tech innovation and steady profits.

Investors should, however, continue to pay attention to market patterns and valuation levels. Even if there is clear upward potential, it might be best to buy during market corrections or on dips.

Conclusion

Apple’s Q2 FY25 results confirm the company’s leadership in both financial performance and technological innovation on a global scale. In an increasingly competitive environment, Apple continues to demonstrate resilience and adaptation with excellent operational margins, steady sales growth, and industry-leading returns on equity.

Apple’s capacity to grow successfully even in established markets is demonstrated by its earnings per share of ~$1.65, which represents a 7.84% growth year over year. With a strong balance sheet and a steady asset-to-liabilities ratio above 1.2, Apple is positioned financially to finance future breakthroughs and withstand macroeconomic turbulence.

Apple’s outstanding return on equity (ROE), which is currently at 149.55% and is expected to surpass 200% by FY26, is what makes the company so alluring. These numbers, which are almost unrivaled in the industry, demonstrate the company’s unrivaled effectiveness in creating value for shareholders (Financial Times, 2025).

Furthermore, a median price prediction of $235 set by analysts indicates widespread market confidence, with bullish projections reaching $300. These projections show hope for Apple’s capacity to propel growth via new service offerings, technological advancements, and sustained ecosystem leadership.

In conclusion, Apple’s financials show that the company is not only steady but also doing well. The answer to the question, “Should I buy Apple stock?” is a resolute and well-supported yes for long-term investors seeking a premium stock underpinned by strong fundamentals, superior operational performance, and credible growth prospects.

Disclaimer

The content provided herein is for informational purposes only and should not be construed as financial, investment, or other professional advice. It does not constitute a recommendation or an offer to buy or sell any financial instruments. The company accepts no responsibility for any loss or damage incurred as a result of reliance on the information provided. We strongly encourage consulting with a qualified financial advisor before making any investment decisions.