Introduction

The Occidental Petroleum stock rose after beating its strong Q1 2025 earnings. Learn why analysts are bullish, what the price targets mean, and whether OXY is the best energy stock to own presently.

Occidental Petroleum’s Q1 2025 earnings exceeded analyst expectations, despite economic instability and fluctuating oil prices. Despite volatile energy prices, the company’s good financials, operational efficiency, and commitment to treating shareholders well have increased investor trust. The stock is positive, with a median price forecast of $48.00 for the next 12 months and high projections of $63.11 for the highest possible price. Berkshire Hathaway’s continued investment in the company contributes to the momentum.

Occidental is a well-established player in the energy industry and a creative and forward-looking entity, positioning itself as a reliable player in the industry. It is possible that Occidental will be the best energy stock to invest in in 2025 for investors seeking stability, value, and growth.

Occidental Petroleum Stock Financial Analysis

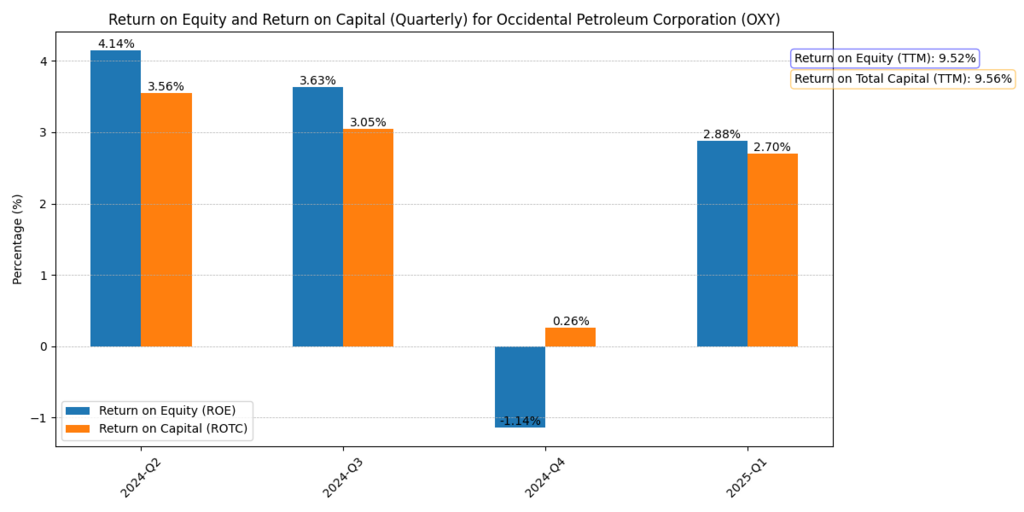

Return on Capital and Equity Analysis

Occidental Petroleum’s excellent return on capital and equity can be attributed to its disciplined capital deployment strategy. Despite having numerous income generators and assets, particularly in the Permian Basin, the company is not overly focused on speculation.

Instead, it has improved its ability to use funds by selling off non-essential assets and focusing on paying off obligations. This has led to improved return metrics and reduced interest expenses.

The company can generate maximum returns from existing investments, resulting in excellent financial performance and long-term investor confidence. This is achieved by focusing management on value rather than volume and streamlining capital expenditures. [1]

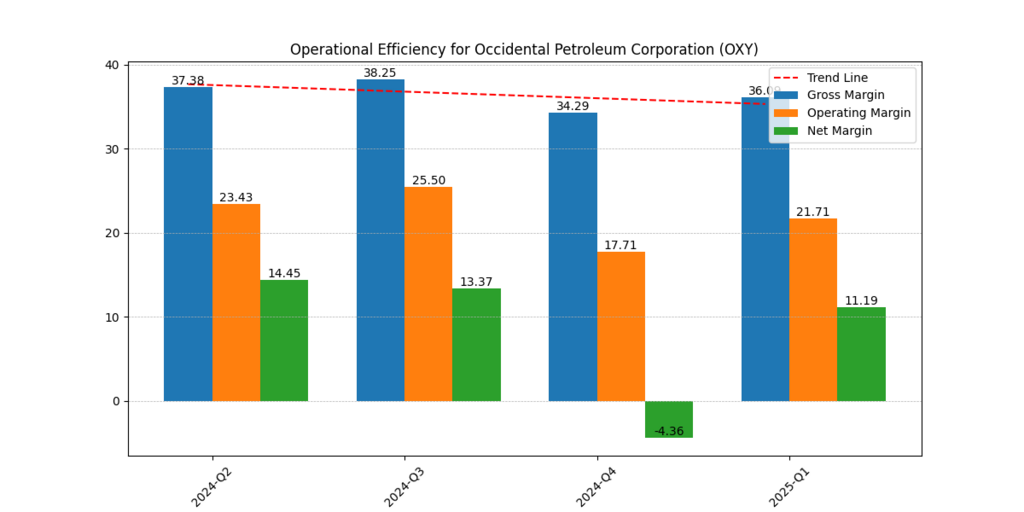

Operational Efficiency Analysis

OXY has successfully implemented a strategy of smoothing and technical merging to increase drilling efficiency and lower costs. The company has been searching for digital tools and automation to achieve economies of scale and simplified logistics. OXY’s operations are located in lucrative basins like the Permian, allowing for economies of scale and simplified logistics.

Cost management in both chemical and upstream divisions ensures margin stability, allowing OXY to generate profits even in low oil prices. These operating qualities also provide resistance against downturns, helping OXY differentiate itself from competitors with less efficient and dispersed operations. OXY is also a good stock for income investors.

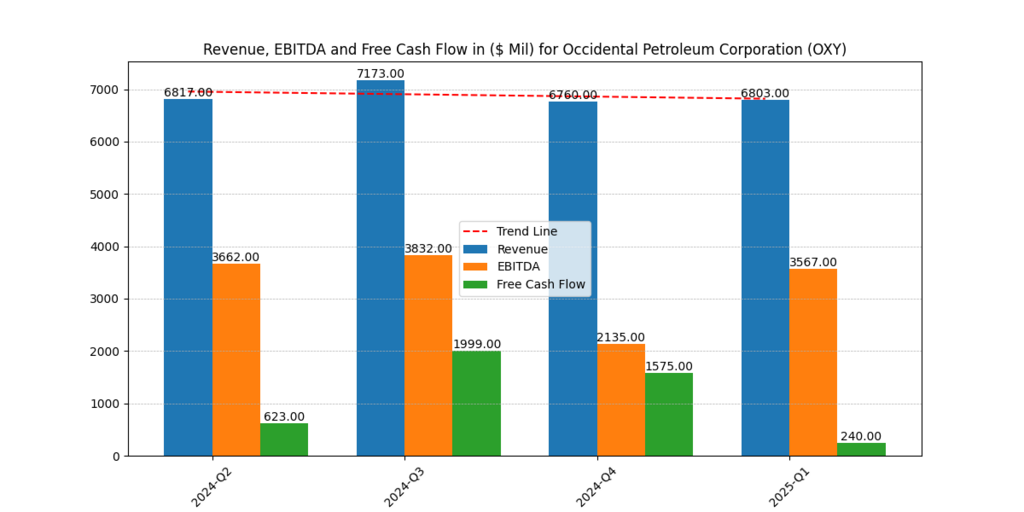

Revenue Analysis

Occidental’s revenue patterns are influenced by its strategic positioning, prioritizing premium barrels and beneficial contracts over predatory expansion. The company’s diversification through OxyChem adds stability and non-cyclicality to its revenue mix. Long-term supply contracts serve as a hedge against commodity price volatility.

Despite market volatility, revenue performance remains consistent due to product range optimization and pricing tactics. Occidental’s robust top-line is achieved through strategic expansion and asset management, ensuring profitability without compromising profitability.

The company’s strategic expansion and asset management have allowed it to maintain a strong top-line without compromising profitability. [2]

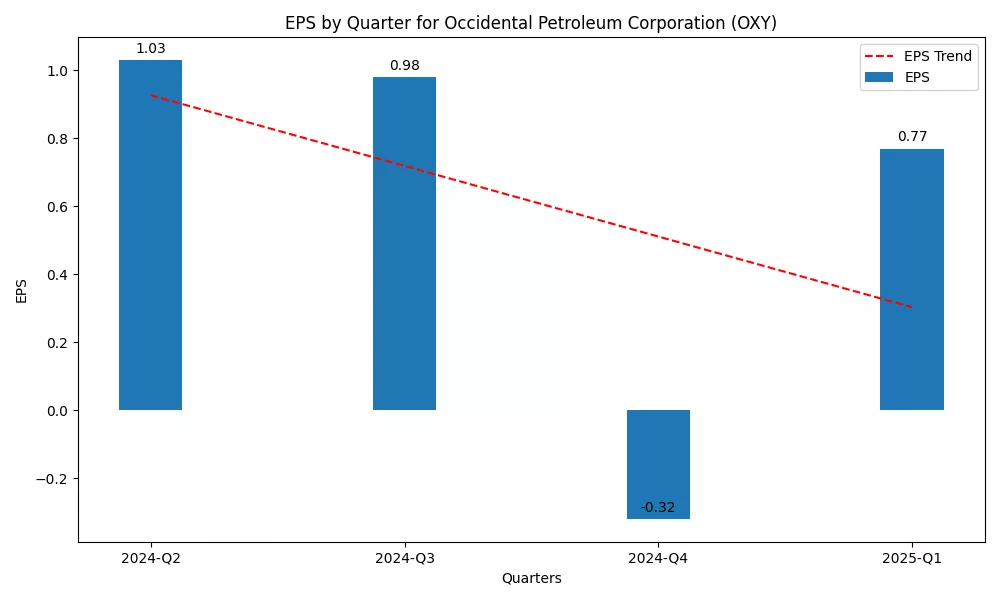

EPS for Occidental Petroleum Corporation

Occidental’s confidence in the company has been strengthened by Berkshire Hathaway’s increasing stake in OXY, indicating institutional investors’ faith in the company’s long-term plan. Share repurchase programs and dividend earnings demonstrate the company’s commitment to shareholders and its recognition of their importance.

Occidental’s initiatives, particularly in carbon capture and low-carbon technology, attract investors concerned about environmental, social, and governance issues. Both growth-oriented and value-oriented investors are drawn to the company due to its efforts to strengthen its balance sheet and adopt financial discipline. The firm’s gains in fundamentals and unambiguous capital return strategy are reorienting the market image from a high-risk investment to a decisive energy long-term investment.

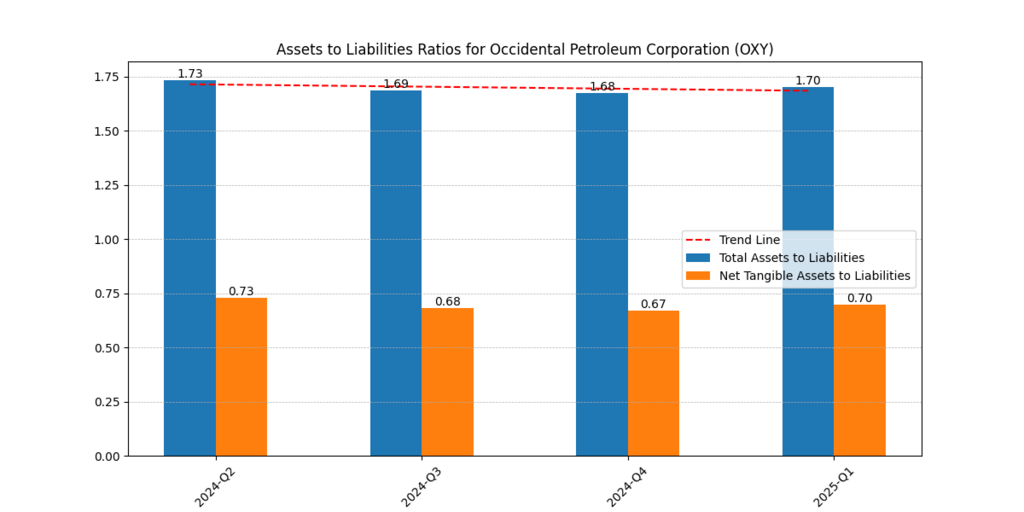

Assets and Liabilities Analysis

Occidental’s asset base includes high-quality upstream assets, carbon capture assets, and enhanced oil recovery assets. The company has improved its asset mix by focusing on cash-rich core properties and diversifying through OxyChem. Occidental accumulated significant debt due to Anadarko’s acquisition, but has been actively repaying it using extra cashflow.

This deleveraging initiative strengthens the company’s balance sheet, improves credit ratings, and lowers borrowing costs in the future. OxyChem provides diversification, while the company’s debt repayment efforts have improved credit ratings and lower borrowing costs.

Occidental Petroleum’s Recent AI and Advanced Technology Initiatives

| Project Name | Date | Description |

| Stratos DAC Facility | Expected 2025 | Occidental is developing the Stratos Direct Air Capture (DAC) facility in West Texas, poised to be the world’s largest upon completion. This project aims to remove CO₂ directly from the atmosphere, providing carbon credits to companies like Microsoft to offset emissions from energy-intensive operations, including AI data centers. |

| Carbon Engineering Acquisition | August 2023 | Occidental acquired Carbon Engineering for $1.1 billion to integrate its DAC technology into Occidental’s operations. This acquisition enhances Occidental’s capabilities in carbon removal, aligning with its strategy to provide scalable solutions for industrial decarbonization. |

| TAE Technologies Partnership | June 2024 | Occidental signed a memorandum of understanding with TAE Technologies to explore the use of nuclear fusion energy to power its DAC projects. This partnership aims to address the high energy demands of DAC by leveraging clean, fusion-based electricity, supporting Occidental’s commitment to sustainable carbon removal. |

Occidental Petroleum is integrating advanced technology into its operations, focusing on environmentally responsible methods and the increasing demand for energy from artificial intelligence and other industries, using innovative carbon management systems.

Conclusion

Occidental Petroleum has achieved a critical juncture in carbon management by combining high operational efficiency with innovative strategies. The company’s strong profits, favorable analysts’ attitudes, and price targets demonstrate its business strength. The incorporation of Direct Air Capture and the acquisition of Carbon Engineering have transformed Occidental into a forward-thinking energy firm, preparing for a world bound by carbon. These initiatives, along with strict capital management and shareholder-friendly attitudes, make the company a top energy play for long-term investors. OXY is well-positioned to capitalize on global trends in artificial intelligence and sustainability, making it a top choice for long-term investors.

Disclaimer

The content provided herein is for informational purposes only and should not be construed as financial, investment, or other professional advice. It does not constitute a recommendation or an offer to buy or sell any financial instruments. The company accepts no responsibility for any loss or damage incurred as a result of reliance on the information provided. We strongly encourage consulting with a qualified financial advisor before making any investment decisions.