Introduction

Netflix (NFLX) Earnings: Analyze fundamental financial metrics such as earnings per share and revenue performance, while providing statistics on subscriber acquisition. Examine the market perspective shaped by Netflix’s alliances and strategic approaches, as well as the challenges facing the sector.

Netflix, Inc. (NASDAQ): As the global leader in streaming entertainment (NFLX), the company has completely changed how people consume media. Before transforming into a massive streaming media company in 2007, which gained a reputation for binge-worthy content, the company began as a DVD rental company in 1997. Netflix has 247 million members and offers its services in more than 190 countries. It is revolutionizing the business with its diverse content options, unique productions, and cutting-edge technological advancements. Netflix, the market leader in streaming, cemented its cultural influence with popular shows like Stranger Things, The Crown, and Squid Game. [1]

Netflix’s fourth-quarter earnings report, which was released at the end of the year, provided insight into the company’s financial situation, corporate expansion plans, and strategic decisions. Echoing strong demand, Netflix has amassed 18.91 million net subscribers after struggling during the height of market diversity and fierce competition. While the subscriber growth rate, earnings per share (EPS), revenue, and free cash flow (FCF) measures all demonstrate steady development, they also point to significant areas that still require attention.

This article explores Netflix’s Q4 2024 revenue and earnings performance by looking at financial data including revenue, EBITDA, and EPS in addition to subscriber growth and new strategic partnerships. Additionally, we will analyze how these measures characterize current performance levels as well as 2025 goals. The blogpost provides investors and followers of the world of entertainment with a comprehensive understanding of Netflix’s revolutionary position in media and its current strategic reactions to industry change.

Key Financial Metrics (TTM)

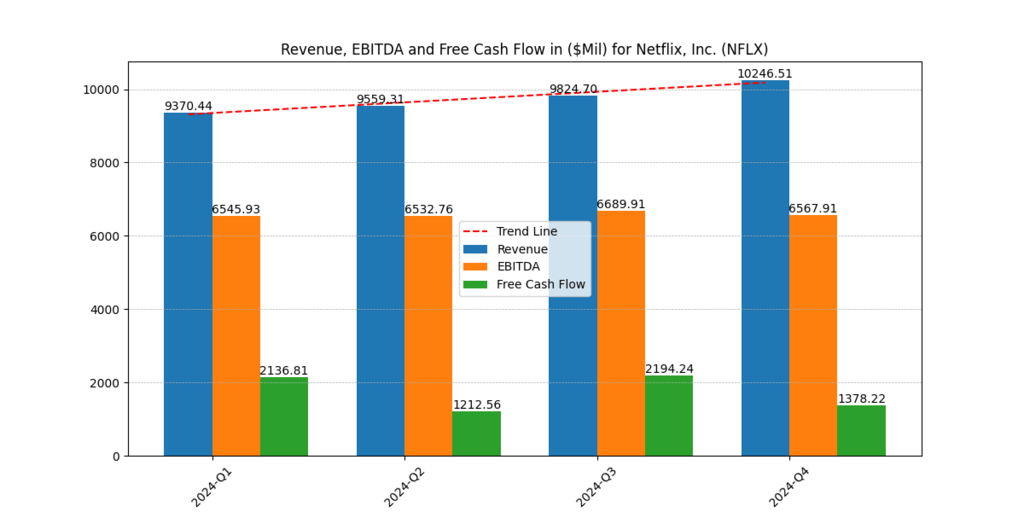

The table below highlights Netflix’s key financial metrics for the trailing twelve months (TTM) of 2024 and includes critical insights for the quarter ended December 2024.

| Metric | TTM Value | Analysis |

| Revenue | $39.00 billion | Strong annual revenue growth fueled by global content and subscriber expansion. |

| EBITDA | $26.31 billion | Healthy EBITDA, though the company faces margin compression due to rising costs. |

| Diluted EPS | $19.83 | Lower EPS reflects reduced profitability driven by declining net margins. |

| Free Cash Flow (FCF) | $6.92 billion | Positive FCF highlights efficient cash management and disciplined content spending. |

| Net Subscriber Gain | 18.91 million (Q4) | Robust subscriber additions exceeded expectations, signaling strong market demand. |

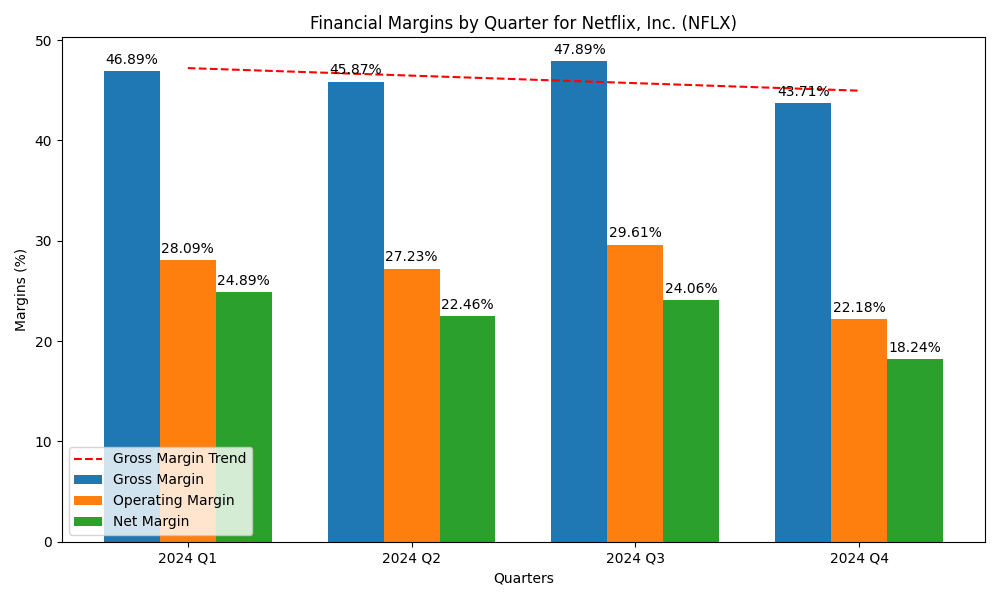

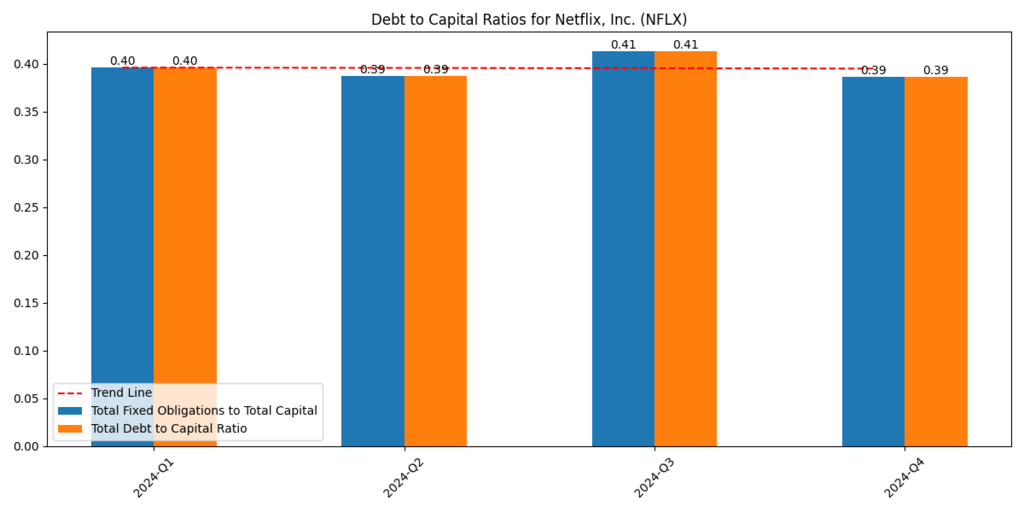

With significant revenue and subscription growth at Netflix, the 2024 trailing twelve months (TTM) financial data demonstrates a robust recovery pattern. With its $37.59 billion yearly revenue, Netflix dominates the market thanks to its robust content diversification and international subscriber growth. Despite growing competition from streaming services, region-specific content enables the business to sustain its continuous success by satisfying a variety of market demands. Through its yearly EBITDA, the company generated $24.96 billion in operational profits. The business is being impacted by stressed margins.

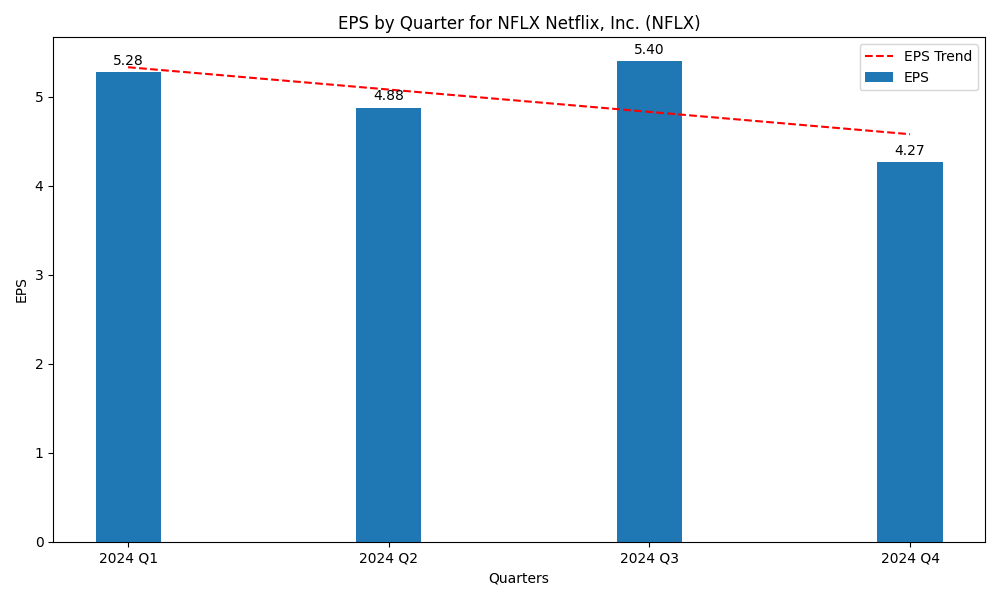

Marginal revenue has decreased across the business as a result of high manufacturing cost increases, rising technology spending, and increased advertising expenses. Netflix’s ongoing successful operations show that maintaining profitability requires careful attention to continually rising costs. The company’s full-year 2024 diluted earnings per share (EPS) was $19.83, however its profits were lower than in previous years. The primary cause of the decline in profitability is shrinking net margins, as the company’s financial statements perform worse due to higher operating expenses and more intense competition.

If Netflix want to keep the confidence of financial investors, it must address its margin issues. Its addition of 18.91 million customers to its network, which exceeded market estimates, was the quarter’s most notable achievement. By creating excellent original material, such as well-liked programs and extensive worldwide releases, the company exhibits a significant ability to acquire new users. The business maintains its dominance in established markets while expanding into emerging ones.

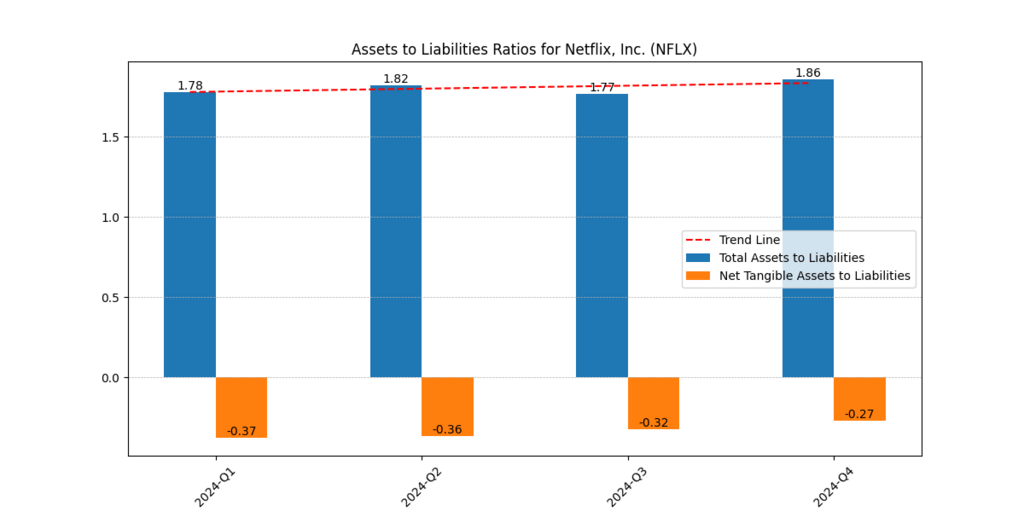

The growing number of subscribers shows how a resilient business can withstand pressure from competitors because it keeps offering customers valuable services that produce positive results. Networks showed effective cash management techniques during the year, generating $6.92 billion in free cash flow (FCF). In order to maintain its positive cash flow generation while increasing its expenditures on technology and content, the company employs disciplined capital allocation. [2]

The effectiveness of the platform gives Netflix funds to spend on content creation, enhances platform capabilities, and offers a solid basis for future growth. The company’s financial data demonstrates robust growth, but it still needs to find answers for rising costs and margin issues. By providing top-notch content and preserving client loyalty through efficient money management techniques, the company remains ready for future market problems. [2]

Subscriber Growth and Market Penetration

The remarkable Q4 2024 growth showed a net subscription rise of 18.91 million because of its effective pricing strategy, sophisticated content selection procedures, and global market expansion. Due to its robust subscriber growth, Netflix was able to surpass its current milestone of 270 million subscribers, solidifying its position as the leading streaming provider globally. The company’s ability to manage market rivalry and provide content formats that cater to the diverse user base of its growing subscriber base is demonstrated by its success. The affordable ad platform that Netflix introduced is largely responsible for the company’s recent subscriber boom. Interested in Hyper growth stocks? We have a list of 5 Best AI Stocks for 2025 with Financial Metrics.

Following the release of its most recent offer, Netflix made its vast library accessible to the cost-conscious countries of Asia-Pacific and Latin America through an inexpensive service. As a sign of its adaptability to the market, Netflix launched ad-supported subscriptions, which led to new subscription growth and advertising income agreements. Due to the availability of localized content for audiences, the number of subscribers significantly rose. In order to gain broad cultural market participation, the business made large investments in non-English material, such as Bollywood productions, Japanese animation, and Korean dramas. For strategic market expansion in developing regions, local content adaption tailored to particular consumer preferences works well.

Netflix has increased its audience engagement powers with their latest forays into live streaming and gaming. After launching live sporting events and improving their selection of mobile games, Netflix increased their product offerings, attracted new users, and improved the user experience for current members. Strategic initiatives show Netflix’s commitment to creative content creation and user involvement in the advancements of the streaming entertainment sector.

Market Sentiment and Stock Performance

Even though profitability and margins were struggling, Netflix’s stock increased by 15% following the release of its Q4 2024 statistics. Due to their emphasis on growth prospects, investors responded favorably despite the current financial difficulties. Market confidence in Netflix as a trailblazer in the sector has been strengthened by the streaming behemoth’s strong 18.91 million net subscriber acquisition and revenue-reinforcement strategy.

The primary driver of investors’ optimism over Netflix’s growth was the company’s growing subscriber base. With its advertising-supported function, the platform successfully adds millions of new users, indicating strong market demand and opening up new business opportunities in price-sensitive industries. Significant growth in subscribers and advertising agreements gave new investors hope that Netflix will be able to expand and turn a profit in the long run.

By venturing into the live streaming and gaming industries, Netflix was able to improve investor perception. With the addition of diverse material, the company’s new endeavors help Netflix establish itself as a market leader capable of spotting new market niches. Real sporting events combined with continuous improvements in gaming features allow this media company to draw in more viewers while retaining users.

Customers benefit greatly from the company’s continued prominence in the global content creation industry. The company’s delivery strategy, which offers top-notch localized content to a variety of audience segments while guaranteeing ongoing consumer appeal, helps it maintain its dominance. The stock price increase shows how Mr. Market responds with rapidly expanding stories in spite of short-term financial constraints. Notwithstanding revenue difficulties, Netflix’s effective implementation of strategic initiatives has bolstered investor confidence, as evidenced by the company’s steadily rising stock price and strong market leadership.

Conclusion

Netflix’s Q4 2024 statistics demonstrate the company’s strength and flexibility as it negotiates a more competitive streaming market. Although the company is facing financial difficulties due to margin compression and EPS decrease, these problems are offset by robust subscriber growth, an inventive ad-supported tier, and a successful worldwide content strategy, all of which point to the company’s potential for long-term, healthy growth. Netflix added 18.91 million new members in Q4 and increased its revenue base by introducing new revenue streams like gaming and live streaming.

The focus on localized content and positive free cash flow, despite lower margins, help the global entertainment leader maintain its top spot. In support of Netflix’s story of sustained growth potential, investor sentiment increased by 15%. The business will be able to handle financial challenges while retaining its market leadership by continuously improving its services and investigating new markets. Netflix serves as an example of how active innovation may lead to transformation.

**Please be informed that the content is informational and by no means serve as a buy or sell signal. The company is not responsible for the loss of capital.