Introduction

Let’s talk about the statistics for Salesforce Q3-FY25 Earnings Summary, such as total revenue, EBITDA, operating margin, gross margin, and EPS, as well as an outline of the important stockholders’ data. Read about its earnings, financial standing, and projected trends.

Salesforce (CRM) just released its Q3 FY25 figures, which provide insight into the operational objectives and performance metrics. Salesforce, the industry leader in CRM solutions, continues to be one of the businesses influencing the global digital transformation process. [1]

Although the company’s overall revenue stream as well as consistent operating efficiency was acknowledged, the Q3 EPS disappointment has led to a number of immediate challenges. This article provides a thorough analysis of Salesforce’s many components, including its quarterly total revenues, EBITDA, margins, and EPS result, which investors can use when assessing the company.

Salesforce Q3-FY25 Earnings

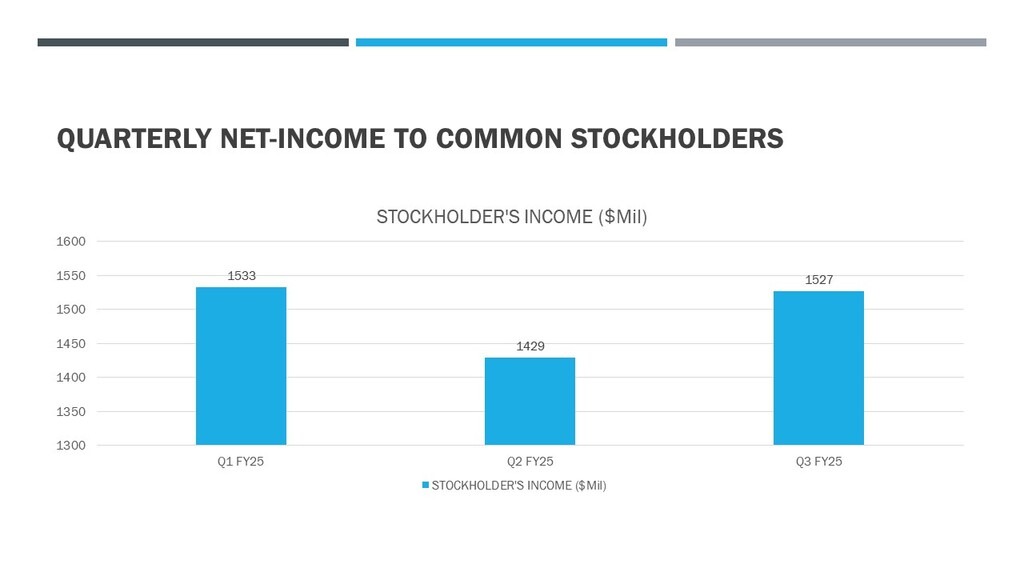

In order to evaluate business achievements, Salesforce CRM Company published the financial figures for the third quarter of the Future Year 2025. A more detailed analysis of stockholder returns in relation to revenue, EBITDA, operating margin, gross margin, and EPS can be found in the table below, which shows data for the Q1, Q2, and Q3 of fiscal year 25. Know if Nvidia is a profitable investment NVIDIA Stock Analysis Post-Q3 FY25 Earnings.

Shareholder’s Metrice for FY25

| Metric | Q1 (April 2024) | Q2 (July 2024) | Q3 (December 2024) |

| Revenue (USD) | 8,247 million | 8,497 million | 8,325 million |

| EBITDA (USD) | 2,728 million | 2,816 million | 2,744 million |

| Operating Margin | 25.2% | 25.8% | 25.1% |

| Gross Margin | 74.0% | 74.2% | 73.8% |

| EPS (Expected) | 1.67 | 1.73 | 1.92 |

| EPS (Actual) | 1.78 | 1.82 | 1.78 |

| EPS Performance | Beat | Beat | Miss |

Highlights of Q3 FY25

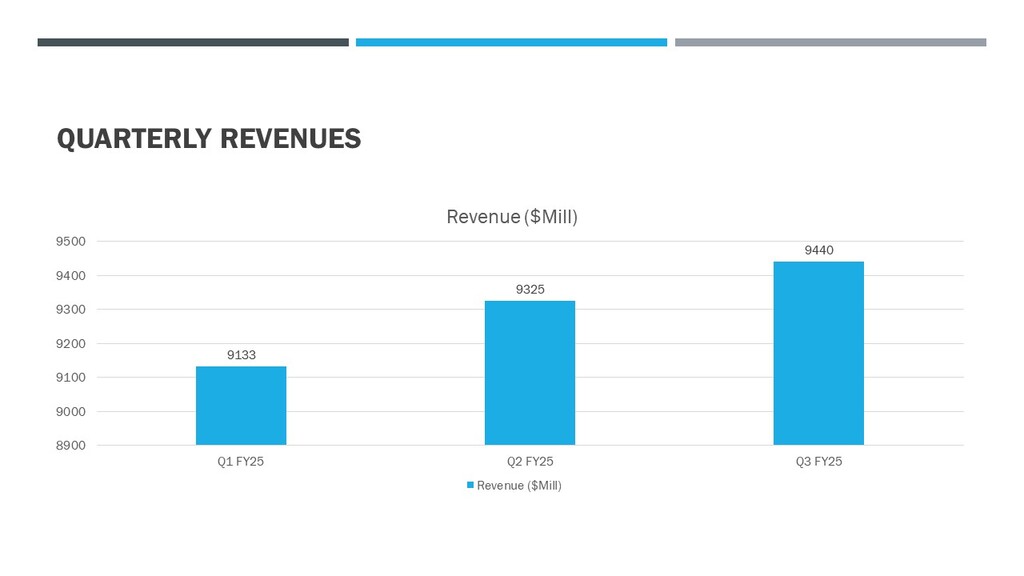

Salesforce’s Q3 FY25 revenue of $9,940 million remained consistent with year-over-year growth trends, even if it was somewhat lower than the prior quarter. This result demonstrates how the company continues to actively focus on the cloud and digital transformation while assisting businesses in managing their digital transformations. Salesforce is one of the major companies in the industry, fulfilling its commitments to offer customer-centric, all-inclusive CRM systems, even in the face of all the changes and the overall decline in revenues. [2]

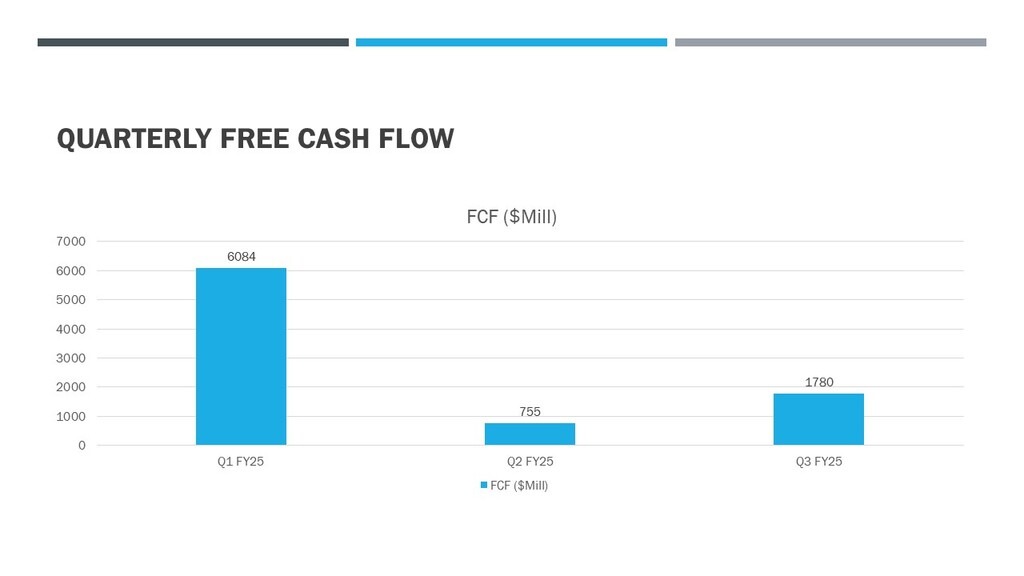

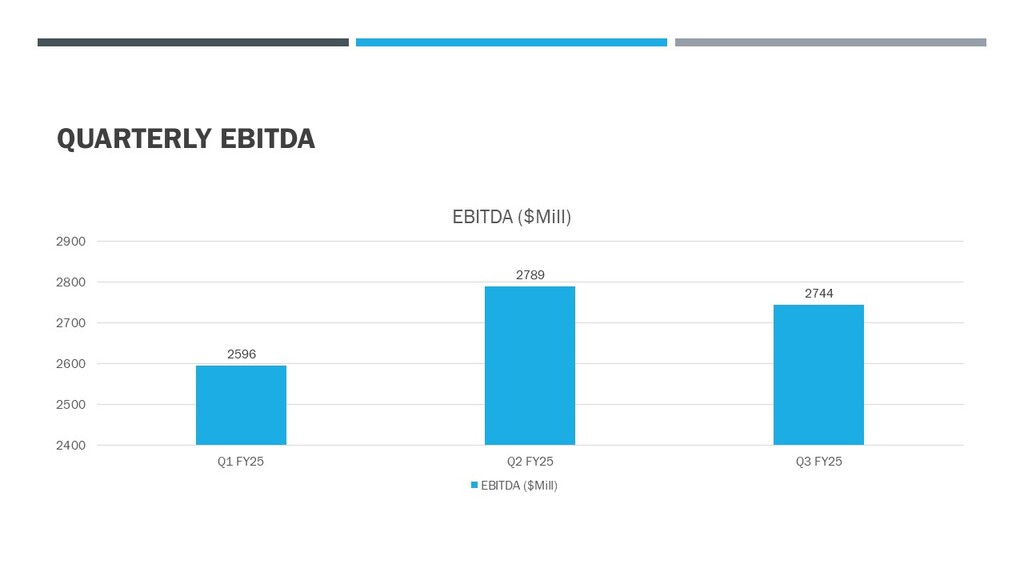

The following are the company’s revenue sources: In Q3 FY25, the company reported EBITDA of $2,744 million, which was lower than the $2,816 reported in Q2 FY25. As it “labs” for strategic growth initiatives, Salesforce has demonstrated a relatively consistent level of operational responsiveness and earnings health, as this figure illustrates. The comparable EBITDA level demonstrates Salesforce’s ability to produce strong revenue while maintaining appropriate cost control.

The operating margin was 24% in Q3 FY25, which was mostly a little lower than it was in Q2 FY25. This expenditure has been increased for strategic acquisitions and growth initiatives, which are essential to maintaining this company’s competitiveness in the rapidly evolving technology market of today. Although the operating margin has somewhat decreased, it still seems strong because operational costs are well under control.

The gross margin for the same time period was 73.8%, and Q2 was 74.2%. This indicator demonstrates that Salesforce has demonstrated its ability to remain effective with constrained resources, despite the company’s challenges with expansion and the need to accommodate expanded operations and further investment in innovation. Salesforce is still achieving economies of scale that enable its profitability, as indicated by the gross margin number. [3]

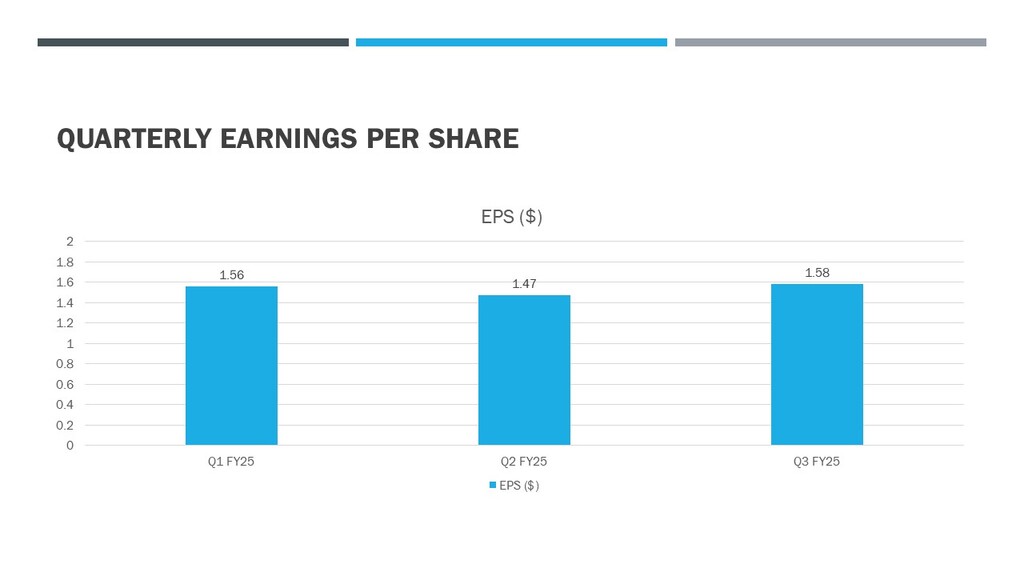

EPS data for Q3 of FY 25 showed both positive and negative revenue trends, which gave conflicting messages. The reported earnings per share (EPS) of $1.58 fell short of the analysts’ expected EPS of $1.92 per share for the quarter. However, EPS was lower in the prior quarter, with Q1 and Q2 of FY25 reporting $1.56 and $1.47, respectively, compared to the predicted $1.67 and $1.73. This is true for previous quarters, which show that Salesforce has been giving shareholders the best value addition even when it occasionally shows indicators of falling short of the forecast.

Future Prospects and Growth

Salesforce has steadfastly maintained its focus on innovation as a business model, a crucial component that is now widely acknowledged to be essential to long-term, sustainable growth. Salesforce integrates AI and automation technology into its CRM systems to produce high-end features that increase customer satisfaction and efficiency for both the employees and the clients.

The company’s recent acquisitions and strategic alliances have left a positive impression that it is proactive in implementing strategies that improve its ability to identify industry trends and develop new markets to satisfy the needs of consumers. In addition to enhancing the Salesforce platform with new features like the newest technology, these initiatives enable enterprises and organizations of all kinds to use a flexible and innovative platform to achieve their full potential. By emphasizing innovation, Salesforce has further solidified its position as a market leader in this area and demonstrated that it can and will adjust to emerging trends in the rapidly expanding cloud computing and CRM markets.

Any investor considering purchasing Salesforce stock should weigh the company’s strong core characteristics against the current indictments. On the one hand, Salesforce has demonstrated a great ability to innovate and dominate the industry in its respective cloud computing and CRM categories, as well as high revenue growth rates and operational success.

These few strategic investments are part of automation, artificial intelligence, and the selection of major acquisitions, which characterize the company’s long-term prospects and incredible thinking. Additionally, Salesforce’s promotion of sustainability and social responsibility is an effective strategy to draw in ethical and environmentally conscious investors. This is a huge benefit for the firm, particularly in the current unpredictable business environment, because it shows that the company’s revenue is fairly predictable due to the variety of sources and customers it attracts.

Nevertheless, the recent glitch in the anticipated reduced EPS for Q3 FY25 presents issues such as worries about how investment spending affects margins and the factors and likelihood of fulfilling high market forecasts. Furthermore, short-term traders may find macro-environmental aspects concerning, such as volatile value in a technology-oriented market. However, Salesforce’s ongoing innovation pipeline, global market development, and operational improvement offer a practical answer for businesses with a longer investment horizon. Ultimately, whether or not to invest in Salesforce is determined by your risk tolerance, your financial goals, and your ability to support this forward-thinking company in a cutthroat market.

Conclusion

The financial report for the third quarter of FY25 shows an inconsistent but promising performance outlook for Salesforce. The 1% decline in revenues, and hence in EBITDA and margins, indicates some short-term hardship. The organization’s effectiveness and emphasis on strategic expansion, however, reveal considerably about its future.

Even while the Q2 EPS loss was significant, it cannot completely mask the R&D service outperformance from the previous quarter. There are still two strategically significant and costly issues to consider. Salesforce is a pioneer in innovation, with a strong focus on automation and artificial intelligence research and development. These fields continue to be crucial for future expansion and market leadership in CRM. Accordingly, the company may continue to overcome its deficiencies and seize chances related to the digital transformation market by developing its salesforce cloud products further, making strategic investments, and using AI-based ways to meet the needs of its clients.

**Please be informed that the content is informational and by no means serve as a buy or sell signal. The company is not responsible for the loss of capital.