Introduction

Here is our NVIDIA Stock Analysis Post-Q3 FY25 Earnings: Investigate revenues, revenue growth and forecasts, new product development and changes in fair value. A detailed professional analyst report.

NVIDIA Corporation has steadily improved its standing in the global artificial intelligence and semiconductor sectors. The company’s Q3 FY25 earnings report demonstrates its outstanding growth in the key industries, such as gaming, data centers, and automotive, making it significant to identify the future trajectory of technology.

This blogpost examines NVIDIA’s remarkable quarterly and annual performance, as well as its smart business innovations, the Blackwell chips, and significant international business transactions in key regions such as the US, Japan, and India. In light of the company’s positive growth forecasts and ongoing market dominance, we additionally evaluate NVIDIA’s revenue growth trajectory, financial ratios, and updated Fair Values.

What is NVIDIA?

NVIDIA Corporation is a technology business that specializes in designing and producing GPUs, SoCs, and AI-based products. Founded in 1993, with its innovative and high-performance GPUs, the company revolutionized the gaming sector. Since then, it has expanded into data centers, self-driving cars, professional graphics, and AI research. NVIDIA is a major player in the global semiconductor and technology sectors owing to its creative solutions, which support cloud computing frameworks, artificial intelligence models, and specialized PC and gaming experiences. [1]

Nvidia Businesses

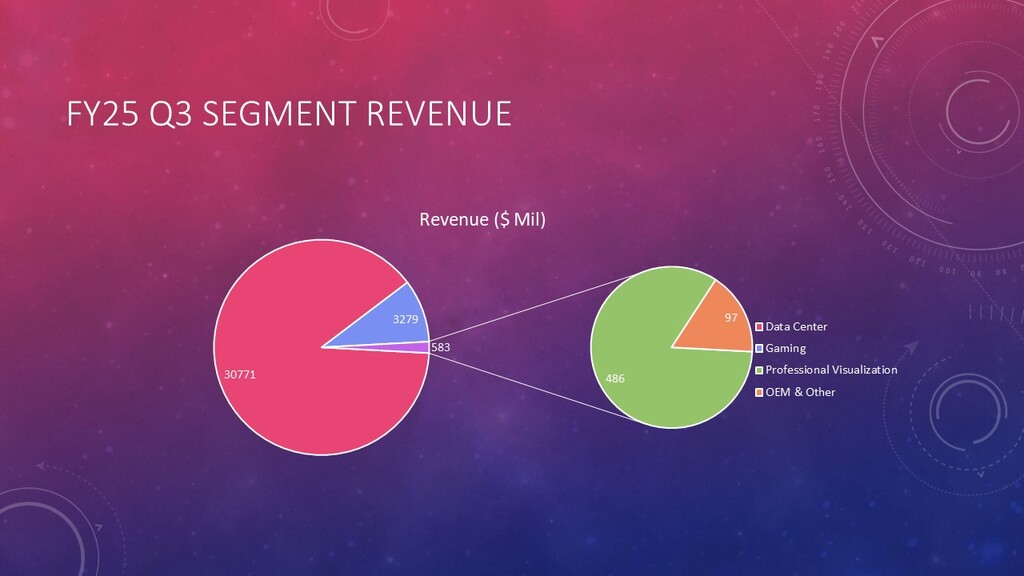

Utilizing its extensive expertise in GPU and AI technology, NVIDIA participates in a variety of business categories:

- Gaming: The GeForce GPUs produced by Nvidia are widely recognized in the gaming industry as strong solutions that can provide high frames per second for both eSports athletes and for the purpose of recreational uses. One of the technologies created by NVIDIA that enhances gaming using cutting-edge artificial intelligence rendering technologies is called DLSS (Deep Learning Super Sampling).

- Data Centers: For use in public and private cloud computing, artificial intelligence computing, large-scale AI model training, and AI enterprises, NVIDIA provides GPUs, AI computer processors, and software systems. The NVIDIA A100 and H100 GPUs are now essential for every industry that depends on carrying out intricate, highly accurate computations.

- Professional Visualization: NVIDIA’s Quadro GPUs and Omniverse platforms enable designers, engineers, and 3D content producers, along with partners, to achieve photorealistic outcomes instantly.

- Automotive: In an effort to revolutionize transportation, NVIDIA, through its NVIDIA DRIVE program, develops AI systems for advanced driver assistance and autonomous driving. It collaborates with manufacturers worldwide to develop these systems.

- OEM & Other: This category comprises GPUs incorporated into additional goods and solutions for various sectors, including manufacturing, robotics, healthcare, edge AI, and the Internet of Things (IoT).

NVIDIA has succeeded in building a broad business portfolio that offers prospective markets ranging from conventional sectors like gaming to newly emerging prospects related to artificial intelligence and computing needs. [2]

Innovative Products of NVIDIA

With more sophisticated and inventive products, particularly in the areas of GPUs and AI hardware, NVIDIA has revolutionized the technology industry throughout the years.

GeForce RTX Series

The RTX 4090 is the top-tier model in NVIDIA’s GeForce RTX series of GPUs, which includes the RTX 4000 series for gaming, video editing, and 3D rendering. These GPUs, which include AI-featured DLSS and ray tracing, restore the realism and efficiency of images for both enthusiasts and experts. Many companies are using NVIDIA’s GPUs, find out more in Dell Stock Forecast 2025.

Tensor Core NVIDIA A100 and H100 GPUs

These GPUs are all designed for high-performance computing, machine learning, and artificial intelligence applications. Based on the Hopper architecture, the H100 is ideal for massive AI inference and training, and it serves as the foundation for sectors including autonomous systems, finance, and health.

Blackwell Architecture GPUs

AI supercomputing and cloud applications are the focus of the upcoming Blackwell chips, which are expected to further innovate computing performance and efficiency scale. Large increases in performance and efficiency could be possible with these GPUs.

NVIDIA DGX Systems

The DGX Station and DGX SuperPOD are NVIDIA DGX Systems, which are made especially for the centralized study and creation of AI solutions for businesses. These systems’ unparalleled computational capacity is a powerful factor that enables data science and deep learning.

Omniverse Platform

NVIDIA Omniverse is an open-source 3D platform enabling teamwork in simulation and virtual world creation. They enable experts, in the fields of architecture, manufacturing, and media, to accurately and precisely model and execute projects in real time.

Biggest Customers

High-end NVIDIA products are used by some of the largest organizations in the world:

- Gaming and Creative Industries: Activision Blizzard, Adobe, and Epic Games are among the companies that use GeForce GPUs and RTX technology in their games and content production.

- AI and Cloud Providers: NVIDIA A100 and H100 GPUs are the foundation of many AWS, Google Cloud, and particularly Microsoft Azure platforms’ AI and data center operations.

- Automotive Leaders: NVIDIA DRIVE has been added by automakers such as Tesla and Mercedes Benz to act as a bridge for advanced driver assistance and self-driving technologies.

- Research and Academia: Outstanding innovations like OpenAI and DeepMind create high-level AI models using NVIDIA’s DGX technologies.

High-end GPUs and AI platforms continue to be NVIDIA’s core competitive advantages, and the company has grown into a technological powerhouse by arming leaders worldwide with new technologies.

NVIDIA’s Metrics for Stockholders

| Metric | Current Value |

| Price-to-Earnings (P/E) Ratio | 54.64 |

| Price-to-Book (P/B) Ratio | 51.4 |

| Market Cap | $3.386 Trillion |

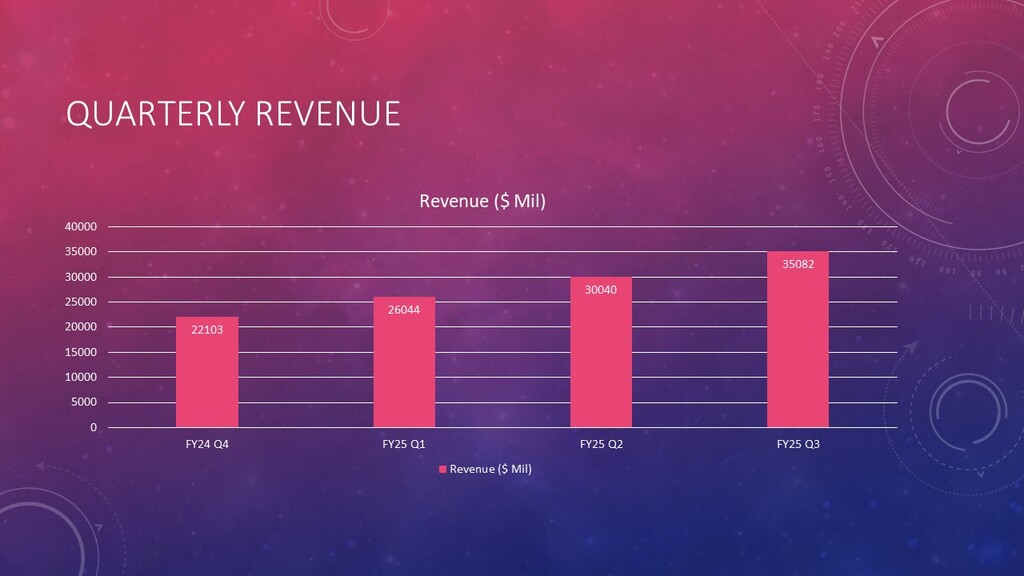

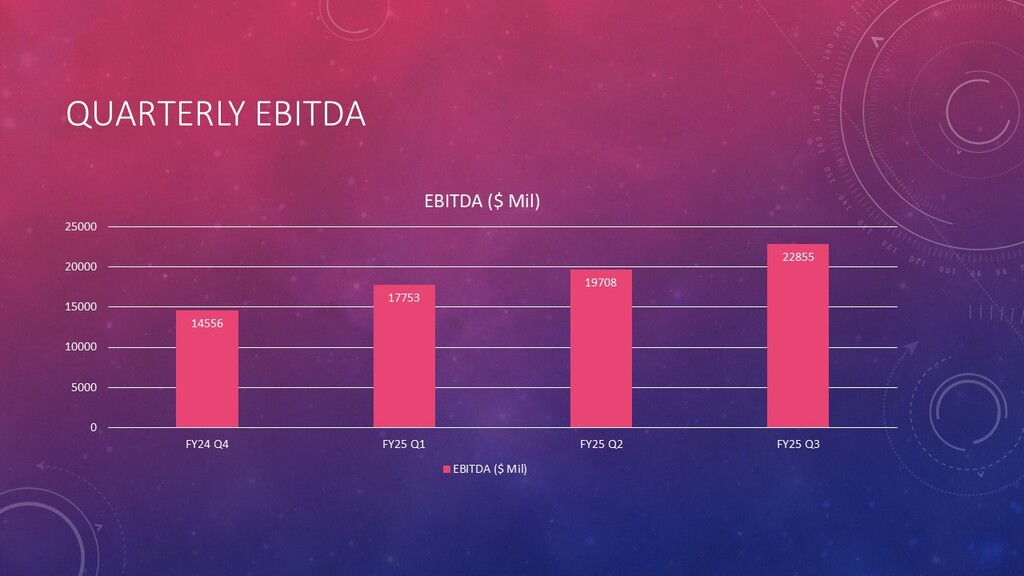

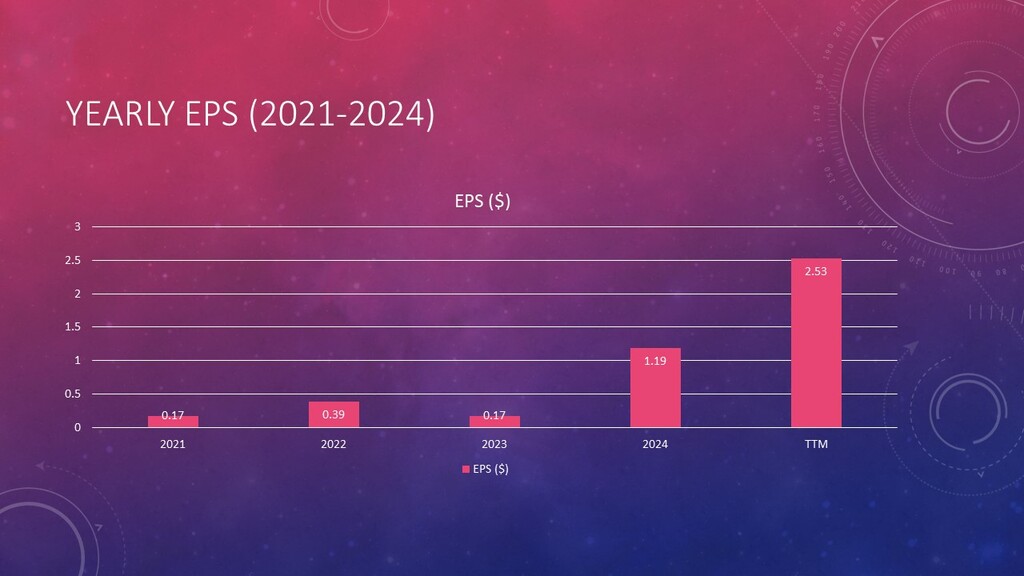

| Revenue YOY Growth | 1/31/2024: 22.103 billion 4/30/2024: 26.044 billion 7/31/2024: 30.040 billion 10/31/2024: 35.082 billion TTM: 113.269 billion Q2 Growth: 17.83% Q3 Growth: 15.35% Q4 Growth: 16.79% |

| EBITDA | $74.872 Billion |

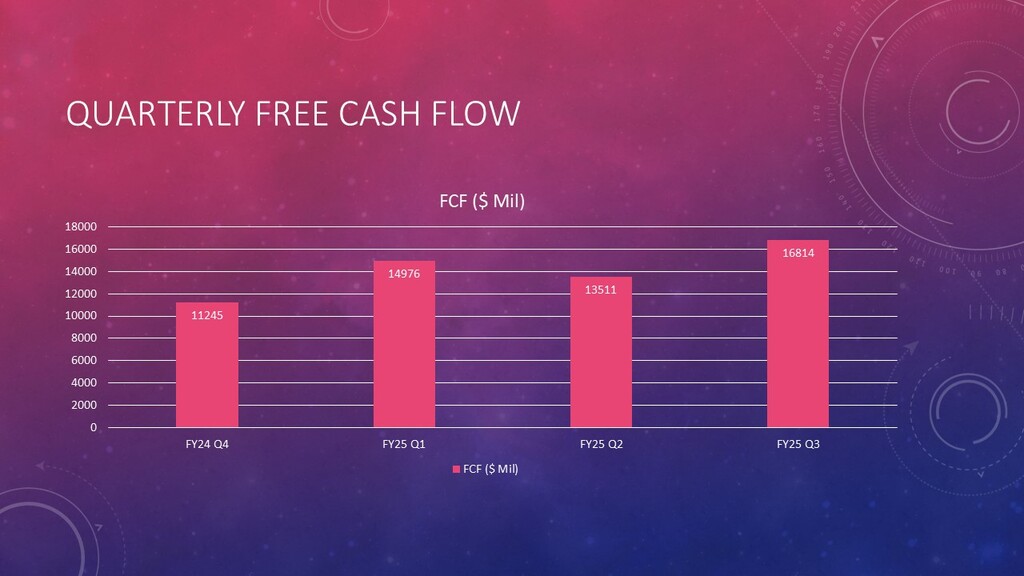

| Cash Flow | 1/31/2024: 11.245 billion 4/30/2024: 14.976 billion 7/31/2024: 13.511 billion 10/31/2024: 16.814 billion TTM: 56.546 billion |

| Gross Margin | 75.86% |

Q3 FY25 Quarterly Revenue Trends

In NVIDIA’s FY25, the Q3 marginal quarterly revenue patterns show an upward tendency in a single quarter with notable growth in each of the following quarters. The company’s revenues were $22.10 billion in the first quarter, but were 17.83% higher in the second quarter, clocking in at $26.04 billion. The organization’s revenue increased by 15.35% to $30.04 billion in the third quarter.

The following quarter witnessed a further growth in the company’s quarterly revenues, which ended the year at $35.08 billion, a 16.79% gain. This steady expansion paints a clear picture of NVIDIA’s robust financial development as a result of growing demand in its key markets, which include gaming, data centers, and artificial intelligence. Additionally, the company’s TTM revenues of $113.27 billion also indicate its potential for future growth. [3]

NVIDIA’s Stock Price Prediction

Projected Revenue Growth

According to NVIDIA Corporation’s annual reports, the company’s revenue growth appears to be on an upbeat trend with room to develop further because of its dominant market positions in the gaming, AI, and data center sectors. NVIDIA is expected to generate $130 billion in revenue in FY25, with substantial increase anticipated in the future years:

- FY26: $201.76 billion

- FY27: $312.72 billion

- FY28: $484.72 billion

Given this impressive growth, we have revised the fair value estimate of NVIDIA’s stock:

- High Growth Scenario: $130 per share

- Medium Growth Scenario: $115 per share

- Low Growth Scenario: $108 per share

The company’s market position, consistent and predictable profit realizations, and NVIDIA’s cost control and management are all taken into consideration in the valuations set for this business. These factors position NVIDIA as a major player in the technology sector with the potential to generate substantial value growth.

NVIDIA’s strong market position in a number of high-growth industries, including gaming, artificial intelligence, and data centers, as well as Secure’s high expected revenue growth, form the basis of the company’s fair value calculations. In fact, NVIDIA anticipates future growth as it is predicted to maintain its revenue increase, with an estimated $130 billion in FY 2025, $201.76 billion in FY 2026 and additional growth in FY 2027, and $312.72 billion in FY 2028 and additional expected growth. Given the growing popularity of AI and supercomputing, these figures highlight NVIDIA’s market share prospects and solidify its position for future growth.

In light of these growth projections, we have modified our estimate of NVIDIA’s stock’s fair value. The fair value is estimated at $130 per share using the same value modeling concept in a high growth scenario that pertains to powerful market and technological forces. Given somewhat less optimistic assumptions, the fair value per share under the Medium Growth Scenario is $115. However, given the relatively sluggish increase in sales and external circumstances, the Low increase Scenario suggests a reasonable value of $108 per share. These scenarios provide the implementing investor with a comprehensive understanding of NVIDIA, allowing them to choose its stock while keeping an eye on different growth rates and market conditions. [4]

Conclusion

With consistently high and increasing revenue and a dominant position in industries like gaming, artificial intelligence, and data centers, NVIDIA is a prime example of innovation success and has a lot of prospects. With estimated revenues of $130 billion in FY25 and additional growth in the years to follow, the company is now well-positioned for consistent development. In order to incorporate a range of growth potential and give investors a thorough picture of the company’s future performance, the new NVDA fair value estimates are between $108 and $130 per share. In the opinion of long-term shareholders, the company is still well-positioned for future success as a supplier of high-performance computing solutions and goods connected to artificial intelligence.

**Please be informed that the content is informational and by no means serve as a buy or sell signal. The company is not responsible for the loss of capital.